Fill Your Netspend Dispute Form

Different PDF Templates

What Is a P45 Form Uk - The employee should be aware of the importance of the information on the P45.

The Employment Verification Form is a crucial document that confirms an individual's employment history, job title, and salary from previous employers. This form serves as a vital tool for prospective employers, providing them with credible information to help in their hiring decisions. To ensure a smooth hiring process, consider filling out the verification form by clicking the button below, or you can Fill PDF Forms for easy access.

Employee Availability Template - Indicate your scheduling preferences using this availability form.

Similar forms

The Netspend Dispute form shares similarities with the Chargeback Request form commonly used by credit card companies. Both documents serve the purpose of disputing unauthorized transactions. They require the cardholder to provide details about the disputed transaction, including the date, amount, and merchant involved. Additionally, both forms emphasize the importance of submitting the dispute within a specified timeframe, typically 60 days, to ensure the cardholder's rights are protected. Supporting documentation is also encouraged to bolster the claim, highlighting the need for thoroughness in both processes.

Another document that resembles the Netspend Dispute form is the Fraud Report form used by banks and financial institutions. This form is designed for customers to report instances of fraud, including unauthorized access to accounts. Like the Netspend form, it necessitates detailed information about the fraudulent activity and may require a police report. Both documents aim to provide a structured approach for consumers to communicate their issues and seek resolution in a timely manner.

The Identity Theft Affidavit is another relevant document. This affidavit is utilized when individuals believe their personal information has been compromised. Similar to the Netspend Dispute form, it requires the victim to outline the circumstances surrounding the theft, including any unauthorized transactions. Both documents focus on protecting the consumer's interests and facilitating a response from the financial institution to address the issue at hand.

The Unauthorized Transaction Claim form is another document that aligns closely with the Netspend Dispute form. This form is often used by consumers to formally claim that a transaction was made without their consent. It requires similar information, such as transaction details and supporting evidence. The emphasis on timely submission and the provision of documentation to substantiate the claim is a shared characteristic between these two forms.

To ensure compliance with local regulations, it is advisable to utilize a "thorough Missouri Lease Agreement template" when renting property. This simplifies the leasing process by clarifying the terms of the arrangement and protecting the interests of both landlords and tenants. For more information on this important document, visit the Lease Agreement page.

Additionally, the Electronic Funds Transfer (EFT) Error Resolution Notice is comparable to the Netspend Dispute form. This notice is used when a consumer believes there has been an error in an electronic funds transfer, such as an unauthorized debit. Both documents require the consumer to provide specific transaction details and assert their rights to dispute the charges. The urgency in addressing these errors is a common theme, ensuring that consumers can quickly rectify any discrepancies.

The Billing Dispute Letter also shares similarities with the Netspend Dispute form. This letter is typically sent to a creditor when a consumer disagrees with a charge on their bill. Like the Netspend form, it requires clear details about the disputed amount and the reasons for the dispute. Both documents aim to initiate a formal review process, allowing the consumer to seek a resolution to their billing issues in a structured manner.

Lastly, the Consumer Complaint Form utilized by various consumer protection agencies bears resemblance to the Netspend Dispute form. This form allows individuals to report grievances related to financial services, including unauthorized transactions. Both documents require detailed descriptions of the issues faced and may involve similar timelines for submission. The goal of both forms is to provide a clear pathway for consumers to voice their concerns and seek appropriate remedies.

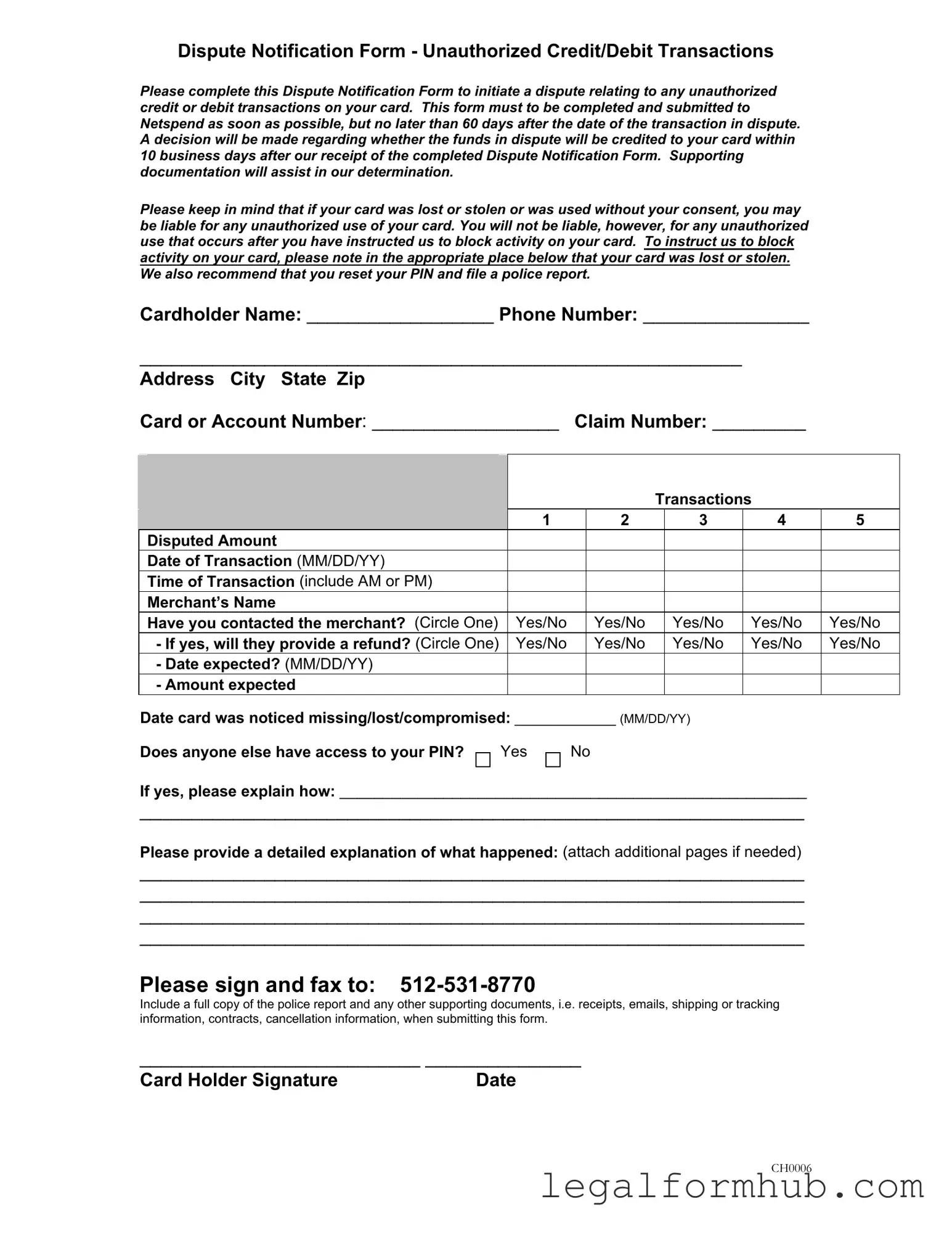

Instructions on Writing Netspend Dispute

Once the Netspend Dispute Notification Form is completed, it should be submitted promptly to initiate a review of the disputed transactions. This process will help determine if the disputed funds can be credited back to your account. Following the outlined steps will ensure that all necessary information is provided for an efficient resolution.

- Begin by entering your Cardholder Name at the top of the form.

- Provide your Phone Number in the designated space.

- Fill in your Address, including the City, State, and Zip Code.

- Write your Card or Account Number in the appropriate field.

- Enter the Claim Number if you have one.

- List the transactions you are disputing. You can submit up to five transactions on one form. For each transaction, fill out the following:

- Disputed Amount

- Date of Transaction (MM/DD/YY)

- Time of Transaction (include AM or PM)

- Merchant’s Name

- Indicate if you have contacted the merchant by circling Yes or No.

- If yes, circle whether they will provide a refund and note the expected date and amount.

- Record the Date card was noticed missing/lost/compromised (MM/DD/YY).

- Answer whether anyone else has access to your PIN by circling Yes or No. If yes, provide an explanation.

- Write a detailed explanation of what happened. Attach additional pages if necessary.

- Sign and date the form at the bottom.

- Fax the completed form to 512-531-8770.

- Include a full copy of the police report and any supporting documents, such as receipts or emails, when submitting the form.

Misconceptions

Here are some common misconceptions about the Netspend Dispute form:

- Misconception 1: The form can be submitted anytime after the transaction.

- Misconception 2: You don't need to provide supporting documentation.

- Misconception 3: You are always liable for unauthorized transactions.

- Misconception 4: You can dispute more than five transactions on one form.

- Misconception 5: The decision on your dispute will take a long time.

- Misconception 6: You don't need to contact the merchant before submitting the form.

- Misconception 7: You can submit the form without your signature.

The form must be submitted within 60 days of the disputed transaction. Delaying beyond this period may result in the inability to resolve the dispute.

While it's possible to submit the form without additional documents, providing supporting evidence can significantly aid in resolving your dispute more quickly.

If you report your card as lost or stolen, you won't be liable for unauthorized transactions that occur after your report.

The form allows you to dispute up to five transactions at a time. If you have more than that, you will need to submit additional forms.

Netspend aims to make a decision within 10 business days after receiving the completed form, so you won’t have to wait indefinitely.

While it's not mandatory, contacting the merchant first can sometimes resolve the issue more quickly and may be required for certain disputes.

A signature is required on the form to validate your request. Ensure you sign it before submission to avoid delays.

Key takeaways

When dealing with unauthorized transactions on your Netspend card, filling out the Dispute Notification Form is an essential step. Here are some key takeaways to keep in mind:

- Timeliness is crucial. You must submit the form within 60 days of the disputed transaction to ensure your dispute is considered.

- Documentation matters. Providing supporting documents can significantly aid in the resolution of your dispute.

- Keep your information secure. If your card is lost or stolen, report it immediately to limit your liability for unauthorized transactions.

- Blocking your card is important. Indicate on the form if your card was lost or stolen so that Netspend can block further activity.

- Reset your PIN. After reporting a lost or stolen card, changing your PIN adds an extra layer of security.

- Contacting the merchant is advisable. If you’ve reached out to the merchant about the transaction, note this on the form.

- Multiple disputes can be filed. You can submit up to five disputed transactions on a single form, streamlining the process.

- Be thorough in your explanation. Provide a detailed account of the situation to help Netspend understand your case better.

- Fax your submission. Ensure that you send the completed form and any supporting documents to the designated fax number for prompt processing.

By following these guidelines, you can navigate the dispute process more effectively and increase your chances of a favorable outcome.

File Information

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used to report unauthorized credit or debit transactions on a Netspend card. |

| Submission Deadline | Cardholders must submit the form within 60 days of the disputed transaction date. |

| Decision Timeline | Netspend will decide on the dispute and notify the cardholder within 10 business days after receiving the form. |

| Liability Information | If a card is lost or stolen, the cardholder may be liable for unauthorized use unless they reported it and requested to block the card. |

| Supporting Documents | It is advisable to include supporting documents, such as a police report and receipts, to strengthen the dispute claim. |