Printable Motor Vehicle Bill of Sale Document

Common Motor Vehicle Bill of Sale Documents:

Free Horse Bill of Sale - This form supports transparency in equine transactions by detailing agreed-upon conditions.

To facilitate your transaction further, make sure to obtain a proper document for your records, such as a Sales Receipt, which acts as confirmation of the sale and outlines the details of the transfer between the parties involved.

Jet Ski Bill of Sale - Crucial for ensuring both parties understand their rights and obligations.

Motor Vehicle Bill of Sale - Tailored for Each State

Similar forms

The Motor Vehicle Bill of Sale is similar to a Real Estate Purchase Agreement. Both documents serve as legal proof of a transaction involving the transfer of ownership. Just as a Bill of Sale outlines the details of a vehicle sale, a Real Estate Purchase Agreement specifies the terms under which a property is sold, including price, conditions, and the identities of the buyer and seller. Each document protects the interests of both parties and can be used in court if any disputes arise.

In navigating the complexities of financial transactions, utilizing a reliable and efficient form can make a significant difference. The Free And Invoice PDF form is a straightforward document designed to help individuals and businesses create invoices easily and efficiently. This form provides a clear structure for detailing services or products sold, making it essential for proper record-keeping and payment tracking. Take the first step towards hassle-free invoicing by filling out the Fill PDF Forms today!

Another document akin to the Motor Vehicle Bill of Sale is the Boat Bill of Sale. This form is used when selling or buying a boat, and it includes similar elements such as the description of the boat, the purchase price, and the signatures of both the buyer and seller. Just like with vehicles, having a Bill of Sale for a boat provides legal evidence of ownership transfer and can help avoid future disputes regarding the vessel.

The Motorcycle Bill of Sale shares similarities with the Motor Vehicle Bill of Sale as well. This document records the sale of a motorcycle, detailing the specifics of the bike, including its make, model, and Vehicle Identification Number (VIN). Both forms serve the same purpose of establishing ownership and protecting the rights of both parties involved in the transaction.

A Lease Agreement can also be compared to the Motor Vehicle Bill of Sale. While the Bill of Sale transfers ownership, a Lease Agreement establishes the terms under which one party rents property from another. Both documents outline responsibilities and rights, ensuring that both parties are clear on the terms of their arrangement, whether it’s for a vehicle or a rental property.

The Equipment Bill of Sale is another document that parallels the Motor Vehicle Bill of Sale. This form is used for the sale of heavy machinery or equipment, such as construction tools or agricultural machinery. Like the vehicle bill of sale, it includes details about the equipment, the sale price, and the parties involved, providing a clear record of the transaction.

A Franchise Agreement is somewhat similar in that it outlines the terms of a business relationship, much like a Bill of Sale outlines a sale. While it does not involve the transfer of ownership in the same way, it does define the rights and responsibilities of the franchisor and franchisee. Both documents aim to protect the interests of the parties involved and provide a legal framework for the relationship.

The Warranty Deed is another document that shares characteristics with the Motor Vehicle Bill of Sale. While primarily used in real estate transactions, a Warranty Deed guarantees that the seller has the right to transfer ownership and that the property is free from claims. Similarly, a Bill of Sale guarantees that the seller has the right to sell the vehicle and that it is free of liens, ensuring a smooth transfer of ownership.

The Personal Property Bill of Sale is closely related to the Motor Vehicle Bill of Sale as well. This form is used for the sale of personal items, such as furniture or collectibles. Both documents serve to document the transfer of ownership and include important details about the item being sold, providing legal protection for both the buyer and the seller.

The Assignment of Contract is another document that can be likened to the Motor Vehicle Bill of Sale. This document allows one party to transfer their rights and obligations under a contract to another party. While it does not involve the sale of a physical item like a vehicle, it serves a similar purpose in terms of transferring ownership or rights, ensuring that all parties are aware of the changes.

Lastly, a Gift Receipt can be compared to the Motor Vehicle Bill of Sale in that it documents the transfer of an item, typically without payment. While a Bill of Sale indicates a sale, a Gift Receipt serves to acknowledge that an item has been given as a gift. Both documents provide proof of the transaction and can be important for tax purposes or in case of disputes.

Instructions on Writing Motor Vehicle Bill of Sale

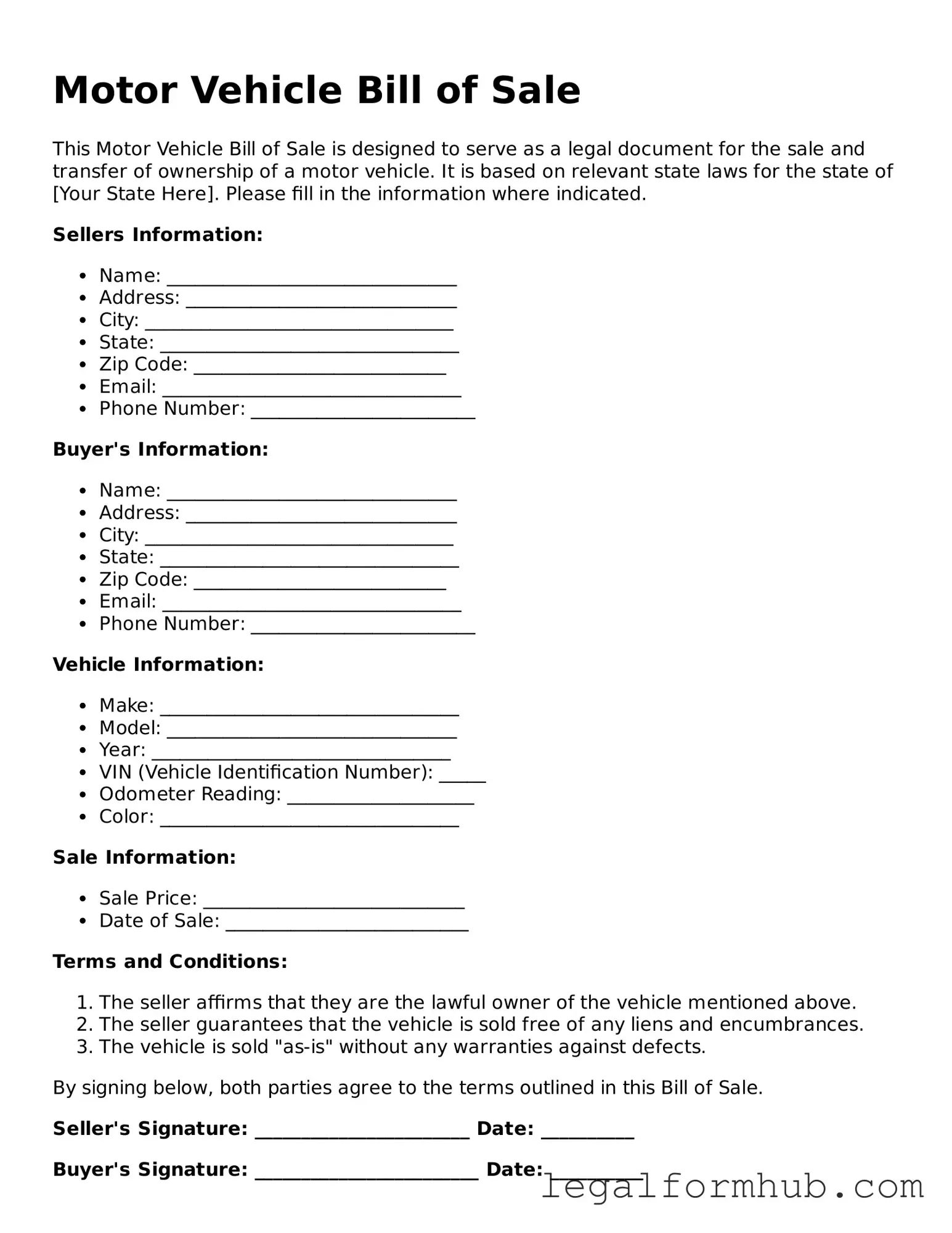

After obtaining the Motor Vehicle Bill of Sale form, you are ready to complete it. This form will facilitate the transfer of ownership of a vehicle from the seller to the buyer. Ensuring that all information is accurate and complete is crucial for a smooth transaction.

- Begin by entering the date of the sale at the top of the form.

- Fill in the full name and address of the seller. Make sure to include any necessary contact information.

- Next, provide the buyer's full name and address, ensuring that this information is also accurate.

- Enter the details of the vehicle being sold. This includes the make, model, year, and Vehicle Identification Number (VIN).

- Specify the sale price of the vehicle. This should reflect the agreed-upon amount between the seller and buyer.

- Both the seller and buyer should sign the form. This indicates that both parties agree to the terms outlined in the document.

- Finally, ensure that you make copies of the completed form for both parties' records.

Misconceptions

The Motor Vehicle Bill of Sale form is an essential document for anyone buying or selling a vehicle. However, several misconceptions surround it. Here are seven common misunderstandings:

- It is not legally required to have a Bill of Sale. Many people believe that a Bill of Sale is optional. In reality, while it may not be mandated in every state, having one protects both the buyer and seller by providing proof of the transaction.

- A verbal agreement is sufficient. Some individuals think that a simple handshake or verbal agreement suffices. However, without written documentation, disputes can arise, making it difficult to prove the terms of the sale.

- The Bill of Sale is only for used vehicles. This misconception suggests that only used cars require a Bill of Sale. In fact, new vehicle purchases also benefit from this document, ensuring clarity in the transaction.

- Only the seller needs to sign the Bill of Sale. It is often assumed that only the seller's signature is necessary. In truth, both parties should sign the document to validate the sale and confirm agreement on the terms.

- Once the Bill of Sale is completed, it is no longer needed. Some believe that after signing, the document can be discarded. Instead, it is wise to keep a copy for future reference, especially for registration and title transfer purposes.

- All states have the same requirements for a Bill of Sale. There is a common belief that one standard form exists for all states. However, each state has its own regulations and requirements, so it’s crucial to check local laws.

- The Bill of Sale does not affect ownership. Many think that a Bill of Sale is merely a receipt. In reality, it serves as a critical document that can establish ownership and protect the rights of both parties involved.

Understanding these misconceptions can help ensure that both buyers and sellers navigate the vehicle transaction process more smoothly and with greater confidence.

Key takeaways

When filling out and using the Motor Vehicle Bill of Sale form, several important points should be considered to ensure a smooth transaction.

- Accurate Information: Ensure that all details regarding the vehicle, including make, model, year, and VIN, are filled out accurately. This information is crucial for identification and legal purposes.

- Seller and Buyer Details: Include complete names and addresses for both the seller and the buyer. This establishes a clear record of the transaction.

- Sale Price: Clearly state the agreed-upon sale price. This amount should reflect the actual sale and can affect tax obligations.

- Odometer Reading: Record the vehicle's odometer reading at the time of sale. This information is often required by law and helps prevent fraud.

- Signatures: Both the seller and buyer must sign the document. This confirms that both parties agree to the terms outlined in the bill of sale.

- Notarization: Although not always required, having the bill of sale notarized can add an extra layer of authenticity and protection for both parties.

- Keep Copies: After the bill of sale is completed and signed, both parties should retain copies for their records. This documentation can be important for future reference or in case of disputes.

By following these key takeaways, individuals can facilitate a more effective and secure vehicle sale process.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The Motor Vehicle Bill of Sale form serves as a legal document that records the sale of a vehicle between a buyer and a seller. |

| Identification | The form typically includes details such as the vehicle's make, model, year, VIN (Vehicle Identification Number), and odometer reading. |

| Signatures Required | Both the buyer and seller must sign the form to validate the transaction and confirm the transfer of ownership. |

| State-Specific Forms | Some states have their own specific Bill of Sale forms that must be used, governed by local laws. For example, California requires specific wording as per California Vehicle Code Section 5901. |

| Consideration | The form should state the purchase price or consideration exchanged for the vehicle, which is important for tax purposes. |

| Notarization | In some states, notarization of the Bill of Sale may be required to ensure authenticity and prevent fraud. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records, as it may be needed for future reference or legal matters. |

| Tax Implications | The Bill of Sale can be used to determine sales tax owed during the registration of the vehicle with the state. |