Fill Your Mortgage Statement Form

Different PDF Templates

How to Check How Many College Credits You Have - Provide both primary and alternate telephone numbers for contact purposes.

For those looking to formalize their transaction, utilizing a reliable resource like the Missouri Mobile Home Bill of Sale document template can streamline the process and ensure all necessary information is properly recorded.

Tax Form 2553 - This form can transform corporate tax responsibilities for many businesses.

Similar forms

The first document similar to a Mortgage Statement is the Loan Statement. Like a Mortgage Statement, a Loan Statement provides a detailed summary of the outstanding balance, payment history, and any fees associated with the loan. It typically includes information about the principal amount, interest rates, and due dates. Both documents serve as a communication tool from the lender to the borrower, ensuring that the borrower is informed about their financial obligations and any changes in their loan terms.

Another comparable document is the Billing Statement. A Billing Statement outlines the amounts owed for various services, including utilities or credit card payments. Similar to a Mortgage Statement, it specifies the total amount due, payment due date, and any late fees that may apply. Both documents aim to keep the recipient aware of their financial responsibilities and encourage timely payments to avoid penalties.

The Employment Verification Form is an essential document used by prospective employers to verify an individual's employment history, job title, and salary from previous employers. By confirming this information, employers can make more informed hiring decisions, ultimately contributing to a smoother recruitment process. If you need to complete this verification, you can easily get started by visiting Fill PDF Forms.

The Account Statement is also akin to a Mortgage Statement. This document provides an overview of transactions related to a specific account, whether it's a bank account or a loan account. It includes details such as deposits, withdrawals, and current balances. Like the Mortgage Statement, the Account Statement helps individuals track their financial activities and understand their current standing with the lender or financial institution.

Lastly, a Payment Reminder is similar to a Mortgage Statement in that it serves to notify borrowers of upcoming payments. This document typically includes the amount due, payment due date, and any relevant account information. Both the Payment Reminder and the Mortgage Statement aim to prompt the borrower to make timely payments, thereby preventing late fees and maintaining good standing with the lender.

Instructions on Writing Mortgage Statement

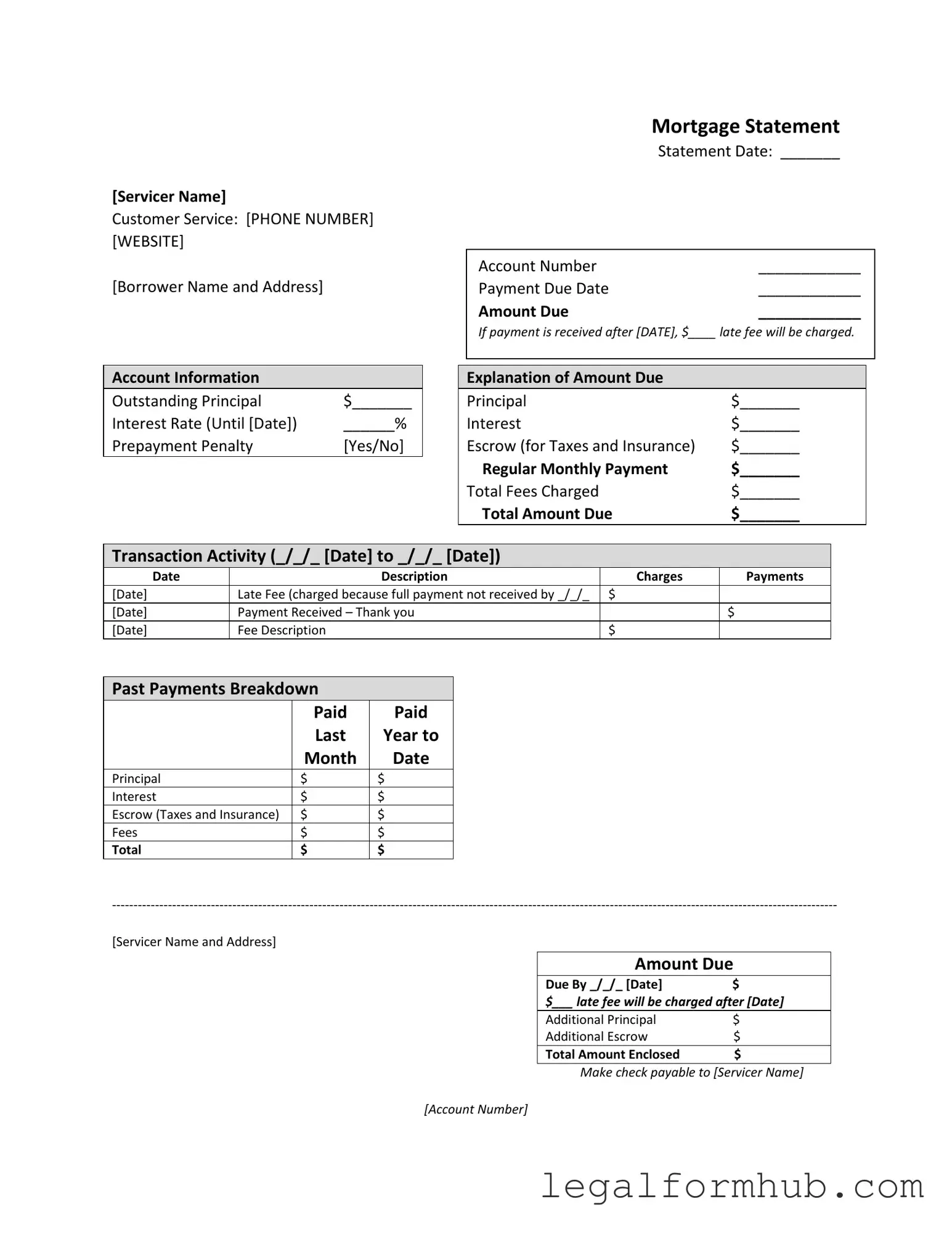

Filling out your Mortgage Statement form is an important step in managing your mortgage. This form contains key information about your account, payment history, and any amounts due. Completing it accurately will help ensure that your mortgage payments are processed correctly.

- Begin by entering the Servicer Name at the top of the form.

- Fill in the Customer Service Phone Number and Website provided by your mortgage servicer.

- Write your Borrower Name and Address in the designated area.

- In the Statement Date field, enter the date of the statement.

- Provide your Account Number in the corresponding space.

- Fill in the Payment Due Date and the Amount Due for your mortgage payment.

- If applicable, indicate the late fee that will be charged if payment is received after the specified date.

- For the Outstanding Principal, enter the total amount still owed on your mortgage.

- Input the Interest Rate and the date until which this rate is applicable.

- Specify if there is a Prepayment Penalty by marking Yes or No.

- Break down the Amount Due by filling in the amounts for Principal, Interest, Escrow (for Taxes and Insurance), Regular Monthly Payment, Total Fees Charged, and Total Amount Due.

- Review the Transaction Activity section and list the date, description, charges, and payments for the relevant period.

- Complete the Past Payments Breakdown by entering the amounts paid for Principal, Interest, Escrow, and Fees for the last year.

- At the bottom, enter the Amount Due and the Due By date.

- Note any additional amounts for Additional Principal and Additional Escrow.

- Calculate the Total Amount Enclosed and ensure to make your check payable to the Servicer Name along with your Account Number.

- Read the important messages regarding partial payments and delinquency notices to understand your obligations.

Misconceptions

Understanding your mortgage statement can be tricky. Here are some common misconceptions that many borrowers have:

- All payments are applied immediately. Many believe that any payment made goes straight to their mortgage balance. In reality, partial payments are often held in a suspense account until the full amount is received.

- Late fees are charged automatically. Some think that late fees apply immediately after the due date. However, fees are only charged if the payment is not received by a specified date.

- The amount due is the only amount I owe. Borrowers may assume that the total amount due on the statement is their only obligation. It's important to check for any outstanding fees or charges that may not be included in the total.

- My interest rate is fixed for the life of the loan. Many homeowners believe their interest rate will never change. If your loan has an adjustable rate, it can fluctuate based on market conditions.

- Escrow is optional. Some think they can opt out of escrow for taxes and insurance. However, many lenders require escrow accounts to ensure these payments are made on time.

- My payment history does not affect my credit score. Some believe that as long as they make their payments, their credit score remains unaffected. In fact, late payments can significantly impact your credit score.

- Foreclosure happens overnight. Many assume that if they miss a payment, foreclosure will happen quickly. The foreclosure process can take months, but it is crucial to address any missed payments as soon as possible.

- All mortgage counseling services are the same. Some borrowers think that all assistance programs offer the same help. In reality, services can vary widely, so it’s important to research and find one that fits your needs.

Key takeaways

When filling out and using the Mortgage Statement form, it is crucial to pay attention to several key aspects. Here are some important takeaways to consider:

- Understand Your Payment Details: Review the payment due date and the total amount due. Ensure that you are aware of any late fees that may apply if the payment is not made on time.

- Review Your Account Information: Check the outstanding principal, interest rate, and any prepayment penalties. This information is essential for understanding your mortgage obligations.

- Monitor Transaction Activity: Keep track of your transaction history, including any late fees or payments received. This will help you maintain an accurate record of your mortgage payments.

- Seek Assistance if Needed: If you find yourself experiencing financial difficulty, do not hesitate to reach out for mortgage counseling or assistance. Resources are available to help you navigate challenging times.

By keeping these points in mind, you can better manage your mortgage and avoid potential pitfalls.

File Information

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website, ensuring borrowers have access to assistance and information regarding their mortgage. |

| Payment Details | Key payment information is provided, including the payment due date, amount due, and any late fees that may be charged if payment is not received by a specified date. |

| Outstanding Account Information | Borrowers can find detailed information about their outstanding principal, interest rate, and any applicable prepayment penalties, which helps in understanding their financial obligations. |

| Delinquency Notice | The statement includes a notice if the borrower is late on payments, outlining the potential consequences of continued delinquency, including fees and the risk of foreclosure. |