Printable Mobile Home Purchase Agreement Document

More Forms:

What Are Constating Documents - Establish guidelines for executive compensation.

Aircraft Bill of Sale Example - The bill of sale should be dated to reflect the day of the transaction.

The importance of having a Medical Power of Attorney cannot be overstated, as it provides peace of mind knowing that a trusted individual can make critical healthcare decisions when needed. For those seeking a reliable template to ensure their wishes are legally documented, resources like arizonapdfs.com/medical-power-of-attorney-template/ can be invaluable in navigating this important process.

Jet Ski Bill of Sale - Commonly used across private sales and dealerships alike.

Similar forms

The Mobile Home Purchase Agreement form is similar to a Residential Purchase Agreement. Both documents outline the terms and conditions under which a buyer agrees to purchase a property. They detail essential information such as the purchase price, closing date, and any contingencies that must be met before the sale can be finalized. Just like the Mobile Home Purchase Agreement, the Residential Purchase Agreement also serves to protect the interests of both the buyer and the seller, ensuring that each party understands their rights and obligations in the transaction.

Another similar document is the Lease Agreement. While a Mobile Home Purchase Agreement is focused on the sale of the mobile home, a Lease Agreement governs the rental of a property. Both documents specify the terms of occupancy, including payment amounts, duration of the agreement, and responsibilities for maintenance. They ensure that both landlords and tenants are clear on their rights and duties, providing a framework for resolving disputes should they arise.

The Bill of Sale is another document that shares similarities with the Mobile Home Purchase Agreement. A Bill of Sale serves as proof of transfer of ownership for personal property, including mobile homes. It typically includes details such as the buyer's and seller's names, a description of the property, and the sale price. Like the Mobile Home Purchase Agreement, the Bill of Sale formalizes the transaction and protects both parties by documenting the sale.

For those looking to create a clear and effective legal document for transactions, the General Bill of Sale is an invaluable resource. This form ensures that all specific details of the transfer are captured, thereby safeguarding both parties involved. To further assist in this process, you can obtain the necessary documentation from PDF Documents Hub, ensuring the smooth completion of your sale.

Lastly, the Title Transfer Document is akin to the Mobile Home Purchase Agreement in that it facilitates the transfer of ownership. This document is essential in establishing legal ownership of the mobile home once the sale is completed. It provides necessary information about the mobile home, including the Vehicle Identification Number (VIN) and the names of the new and previous owners. Both documents work together to ensure a smooth transition of ownership and to safeguard the rights of the buyer.

Instructions on Writing Mobile Home Purchase Agreement

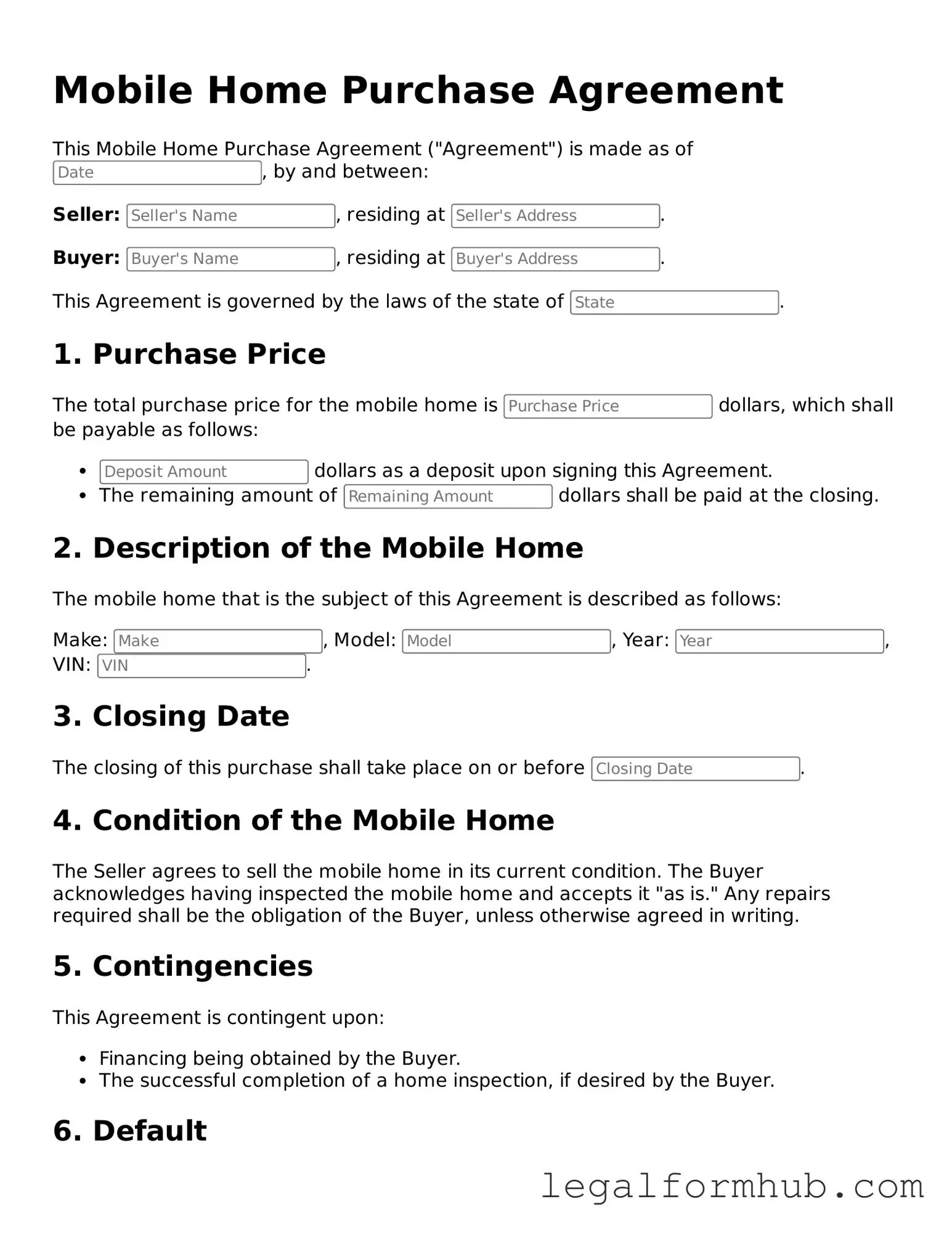

After obtaining the Mobile Home Purchase Agreement form, the next step is to fill it out accurately to ensure a smooth transaction. Each section of the form must be completed with the required information. Follow these steps to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide the full names of the buyer(s) in the designated section.

- List the seller's full name as it appears on the title.

- Fill in the address of the mobile home, including the city, state, and zip code.

- Specify the purchase price of the mobile home.

- Indicate the amount of the deposit, if applicable.

- Complete the financing section by noting how the buyer plans to pay for the mobile home.

- Fill out the terms of sale, including any contingencies or conditions that apply.

- Sign and date the form at the bottom. Ensure all parties involved have signed the agreement.

Once the form is completed, it should be reviewed for accuracy before submission. Proper documentation will help facilitate the purchase process.

Misconceptions

Understanding the Mobile Home Purchase Agreement form is essential for anyone looking to buy a mobile home. However, several misconceptions can lead to confusion. Here are six common misconceptions:

- It is the same as a traditional home purchase agreement. Many believe that a mobile home purchase agreement functions like a standard real estate contract. While there are similarities, mobile home agreements often include specific terms related to the unique nature of mobile homes.

- It is not legally binding. Some think that because mobile homes are personal property, the agreement lacks legal weight. In reality, a properly executed mobile home purchase agreement is legally binding and enforceable.

- Only the seller needs to sign. A common misconception is that only the seller's signature is necessary. Both the buyer and the seller must sign the agreement to make it valid.

- It covers financing terms. Many assume that the purchase agreement includes financing details. However, financing terms are typically outlined in a separate document and should be addressed separately.

- It is not necessary to have it reviewed. Some buyers think they can sign the agreement without professional review. Having a legal expert review the document can help avoid potential pitfalls and ensure all terms are clear.

- It only protects the seller. Buyers may feel that the agreement is designed solely to protect the seller's interests. In fact, a well-drafted agreement protects both parties and outlines their rights and responsibilities.

Being informed about these misconceptions can help you navigate the mobile home purchasing process more effectively. Always consider seeking guidance to ensure a smooth transaction.

Key takeaways

When engaging in the purchase of a mobile home, it is essential to understand the Mobile Home Purchase Agreement form. Here are five key takeaways to consider:

- Clear Identification of Parties: The agreement should clearly identify the buyer and the seller, including their full names and contact information. This ensures that both parties are aware of their roles and responsibilities.

- Detailed Description of the Mobile Home: A comprehensive description of the mobile home is crucial. This includes the make, model, year, and any unique features. Such details help avoid disputes later on.

- Purchase Price and Payment Terms: Clearly state the purchase price and outline the payment terms. Specify whether the payment will be made in full upfront or if there will be financing involved, including any down payment and installment details.

- Contingencies and Conditions: It is important to include any contingencies that must be met for the sale to proceed. This may involve inspections, financing approvals, or other conditions that protect the buyer.

- Signatures and Date: Both parties must sign and date the agreement to make it legally binding. Ensure that all signatures are obtained before any exchange of funds or possession of the mobile home occurs.

Understanding these elements can facilitate a smoother transaction and protect the interests of both the buyer and the seller.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Mobile Home Purchase Agreement is a legal document outlining the terms of sale between the buyer and seller of a mobile home. |

| Parties Involved | The agreement typically involves two parties: the seller (current owner) and the buyer (prospective owner). |

| Governing Law | The agreement is subject to state laws. For example, in California, it is governed by the California Civil Code. |

| Key Components | Important elements include the purchase price, payment terms, and any contingencies related to the sale. |

| Disclosure Requirements | Sellers may be required to disclose any known defects or issues with the mobile home prior to the sale. |

| Financing Options | The agreement may outline financing arrangements, including loans or cash payments. |

| Signatures Required | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

| Legal Recourse | If disputes arise, the agreement may specify how they will be resolved, such as through mediation or arbitration. |