Free Transfer-on-Death Deed Template for Michigan

Create Other Popular Transfer-on-Death Deed Forms for Different States

Tod in California - Creating this deed may involve minimal costs, making it an economical choice.

Obtaining an Emotional Support Animal Letter can significantly improve your quality of life, as these letters assist in validating your need for an emotional support animal, making it easier to navigate housing and travel situations. If you're considering this path, you can begin the process by visiting Fill PDF Forms to fill out the necessary paperwork.

Free Printable Transfer on Death Deed Form Georgia - Ensure that you meet all local legal requirements to avoid any challenges in the transfer process.

What Are the Disadvantages of a Transfer on Death Deed? - Clear instructions should accompany the deed to ensure that beneficiaries know how to claim the property.

Similar forms

The Michigan Transfer-on-Death Deed (TODD) allows property owners to transfer real estate to beneficiaries without the need for probate. Similar to a will, the TODD serves as a legal document that specifies how property should be distributed upon the owner’s death. However, unlike a will, which takes effect only after the individual passes away and may require court validation, the TODD allows the transfer to occur automatically upon death, simplifying the process and minimizing potential legal complications. This streamlined approach can be particularly beneficial for individuals seeking to ensure their loved ones receive property without the burden of probate proceedings.

A revocable living trust is another document that shares similarities with the Transfer-on-Death Deed. Like the TODD, a revocable living trust allows individuals to designate beneficiaries for their assets while avoiding probate. The key difference lies in the management of the trust during the grantor’s lifetime. With a revocable living trust, the grantor retains control over the assets and can make changes or revoke the trust entirely. In contrast, the TODD becomes effective only upon the owner’s death, and the property is transferred directly to the beneficiaries without the need for a trustee to manage the assets during the grantor’s lifetime.

The Employment Application PDF form plays a vital role in the job application process by enabling candidates to succinctly present their qualifications and experiences. It is important for applicants to furnish accurate details regarding their work history and education, as this document serves as a reflection of their professional identity and capabilities. For more information on how to fill out this essential form, you can visit https://pdftemplates.info/, which provides guidance and resources tailored to assist job seekers in their application journey.

A durable power of attorney (DPOA) is another important legal document that can complement the Transfer-on-Death Deed. While the TODD deals specifically with the transfer of real estate upon death, a DPOA allows an individual to appoint someone to manage their financial and legal affairs while they are still alive but unable to do so themselves. This document can be crucial for ensuring that property and other assets are handled according to the owner’s wishes, particularly in cases of illness or incapacitation. Though they serve different purposes, both documents emphasize the importance of planning ahead to protect one’s interests and facilitate the transfer of assets.

Life insurance policies also bear some resemblance to the Transfer-on-Death Deed, particularly in the context of beneficiary designations. When a policyholder passes away, the death benefit is paid directly to the named beneficiaries, avoiding probate. This direct transfer of funds mirrors the TODD’s intent to facilitate the seamless transition of property ownership. Both documents underscore the significance of naming beneficiaries and ensuring that assets are distributed according to the policyholder's wishes, thereby providing peace of mind for individuals planning for the future.

Lastly, a joint tenancy agreement is another document that shares similarities with the Michigan Transfer-on-Death Deed. In a joint tenancy arrangement, two or more individuals own property together, with the right of survivorship. This means that when one owner dies, their share automatically passes to the surviving owner(s), avoiding probate. Like the TODD, a joint tenancy agreement simplifies the transfer process and ensures that property remains within the family or designated individuals. However, joint tenancy can also introduce complexities, such as potential disputes among co-owners or implications for tax liabilities, which are not present with a straightforward TODD.

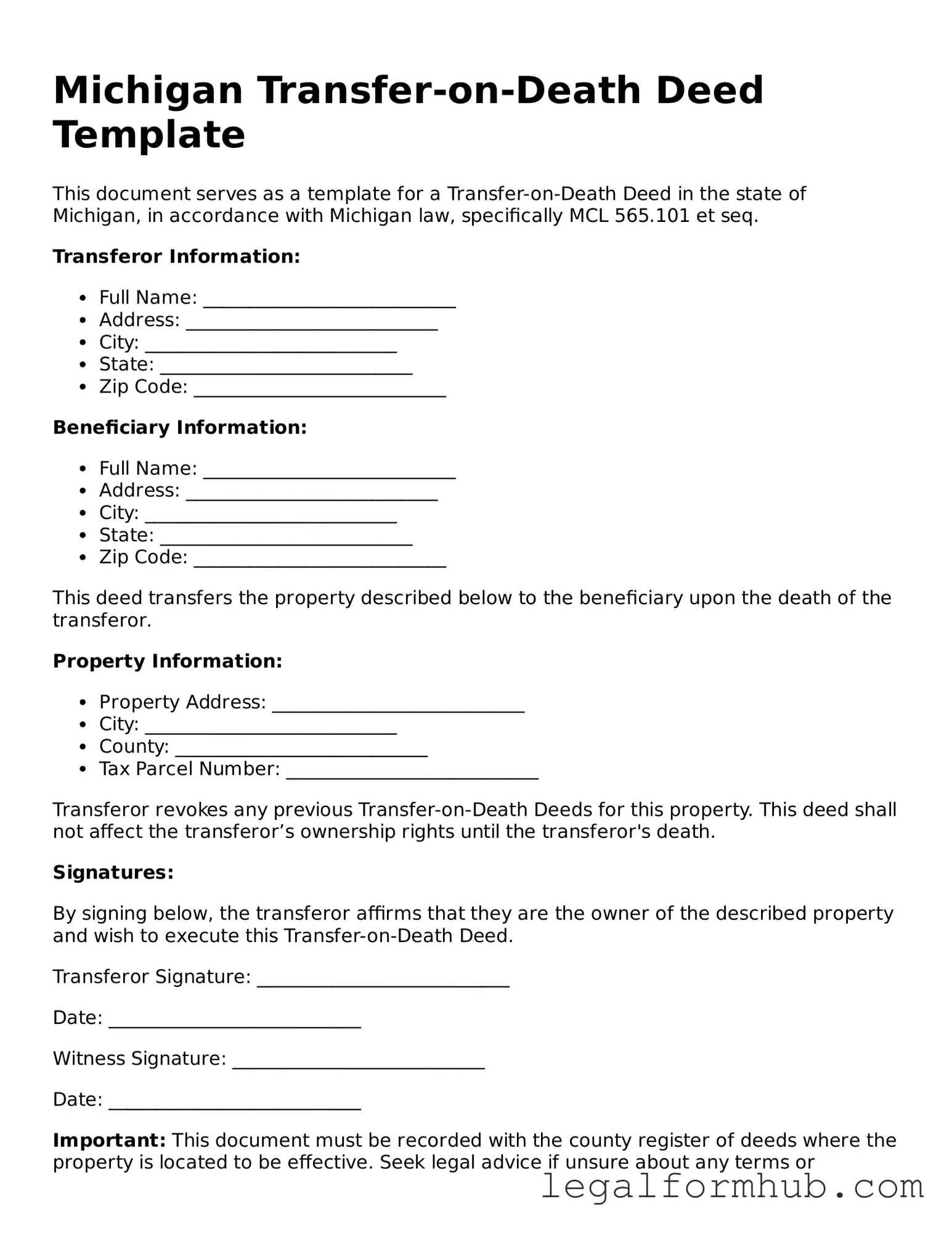

Instructions on Writing Michigan Transfer-on-Death Deed

After completing the Michigan Transfer-on-Death Deed form, you will need to ensure it is properly signed and recorded. This will help facilitate the transfer of property upon the owner's passing without going through probate.

- Obtain the Michigan Transfer-on-Death Deed form. This can be found online or through local government offices.

- Fill in the name of the property owner(s) at the top of the form. Make sure to include all legal names as they appear on property records.

- Provide the legal description of the property. This information can typically be found on your property tax statement or deed.

- Identify the beneficiary or beneficiaries. Include their full names and addresses. Ensure that the names are spelled correctly.

- Specify whether the transfer is to be made to multiple beneficiaries and how the property will be divided among them.

- Sign the form in the presence of a notary public. All property owners must sign, and the notary will verify the signatures.

- Record the completed deed with the county register of deeds in the county where the property is located. There may be a recording fee.

Misconceptions

When it comes to estate planning, the Michigan Transfer-on-Death Deed (TODD) can be a valuable tool. However, several misconceptions surround this form that can lead to confusion. Here are seven common myths debunked:

- It automatically transfers property upon signing. Many people believe that simply signing a TODD means the property is immediately transferred to the beneficiary. In reality, the transfer only occurs upon the death of the owner.

- All properties can be transferred using a TODD. While the TODD can be used for many types of real estate, it cannot be applied to all properties. For example, it cannot be used for properties held in a trust or for properties that are part of a business entity.

- Once filed, the deed cannot be changed. Some think that once a TODD is recorded, it is set in stone. However, the owner can revoke or modify the deed at any time before their death, as long as they follow the proper legal procedures.

- Beneficiaries have immediate rights to the property. A common misunderstanding is that beneficiaries can access the property before the owner's death. In fact, beneficiaries have no rights until the owner passes away and the deed is executed.

- Using a TODD avoids all taxes. While a TODD can help avoid probate, it does not exempt the property from taxes. Beneficiaries may still be responsible for property taxes and capital gains taxes upon sale.

- It replaces a will. Some people mistakenly believe that a TODD can take the place of a will. In truth, a TODD only addresses the transfer of specific real estate and does not cover other assets or wishes outlined in a will.

- It's only for married couples. The misconception exists that only married couples can use a TODD. In fact, any individual owner of real estate can utilize this deed, regardless of marital status.

Understanding these misconceptions can empower individuals to make informed decisions about their estate planning. Always consult with a legal professional to navigate the complexities of property transfer and ensure your wishes are honored.

Key takeaways

When considering the Michigan Transfer-on-Death Deed (TODD), it's important to understand its implications and requirements. Here are key takeaways to keep in mind:

- Purpose of the TODD: The Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries without going through probate.

- Eligibility: Any individual who owns real estate in Michigan can create a TODD, provided they are of sound mind and at least 18 years old.

- Form Requirements: The TODD must be filled out accurately, including the property description and the names of the beneficiaries.

- Signature: The deed must be signed by the property owner in the presence of a notary public to be legally valid.

- Filing: After signing, the TODD must be recorded with the county register of deeds where the property is located.

- Revocation: A property owner can revoke the TODD at any time before their death by recording a revocation form.

- Beneficiary Rights: Beneficiaries do not have rights to the property until the owner passes away, ensuring the owner retains full control during their lifetime.

- Tax Implications: Transferring property via a TODD generally does not trigger gift taxes, but it is advisable to consult a tax professional.

- Limitations: The TODD cannot be used for all types of property, such as personal property or property held in a trust.

- Legal Advice: It is often beneficial to seek legal guidance to ensure that the TODD is filled out correctly and aligns with the owner’s estate planning goals.

Understanding these points can help ensure that the Transfer-on-Death Deed is used effectively and in accordance with Michigan law.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Michigan to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by Michigan Compiled Laws, Section 565.25. |

| Eligibility | Only individuals who own real property in Michigan can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property upon their death. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner through a written document. |

| Filing Requirements | The deed must be recorded with the county register of deeds to be effective. |

| Tax Implications | There are no immediate tax implications for the transfer; however, beneficiaries may be subject to taxes upon the property’s sale. |