Free Real Estate Purchase Agreement Template for Michigan

Create Other Popular Real Estate Purchase Agreement Forms for Different States

Contract of Sale Real Estate - Specifies property description and any included fixtures or appliances.

When engaging in the sale or purchase of a motor vehicle in Arizona, it is crucial to utilize the Motor Vehicle Bill of Sale form, as it details the transaction between the buyer and seller. This form not only safeguards the interests of both parties but also serves as vital proof of ownership transfer. For those looking for a reliable template, you can find one at arizonapdfs.com/motor-vehicle-bill-of-sale-template/.

Texas Real Estate Contract - Notes protections in place for the buyer in case of seller insolvency prior to closing.

Similar forms

The Michigan Residential Purchase Agreement is similar to the California Residential Purchase Agreement. Both documents serve as legally binding contracts between buyers and sellers in real estate transactions. They outline the terms of sale, including the purchase price, contingencies, and closing dates. Each agreement is designed to protect the interests of both parties while ensuring compliance with state-specific real estate laws. The format and structure of these agreements are also comparable, featuring sections that detail property descriptions, financing arrangements, and any included fixtures or personal property.

Another document that resembles the Michigan Residential Purchase Agreement is the Texas Real Estate Sales Contract. This contract is used in Texas for residential property transactions and contains similar components such as the offer, acceptance, and conditions for the sale. Both agreements require disclosures related to property conditions and legal obligations, ensuring that buyers are fully informed before proceeding. The Texas contract also includes provisions for earnest money and title insurance, mirroring the protective measures found in the Michigan agreement.

The Florida Purchase and Sale Agreement is another document that shares similarities with the Michigan form. Like the Michigan agreement, the Florida version outlines the terms of the sale, including the price and closing timeline. Both documents require the identification of the property and the parties involved. Additionally, they address contingencies, such as financing and inspections, providing a framework that helps manage the transaction process effectively.

The New York Residential Real Estate Purchase Agreement also bears resemblance to the Michigan form. This agreement includes essential elements such as the purchase price, deposit requirements, and conditions for closing. Both documents emphasize the importance of disclosures and contingencies to protect buyers and sellers. The New York agreement may include specific clauses related to attorney review, which is a common practice in that state, adding another layer of legal oversight similar to what is found in Michigan.

In addition to these documents, individuals engaging in various property-related activities should also be aware of the importance of the California Release of Liability form. This form serves as a critical tool to protect both parties by waiving the right to sue for any potential injuries or damages that may occur during the process. For those looking to engage in activities that require such protections, it’s essential to understand its implications and to properly complete the form by visiting Fill PDF Forms.

The Illinois Residential Real Estate Purchase Contract is another comparable document. This agreement outlines the terms of the sale, including the buyer's offer and seller's acceptance. Both the Illinois and Michigan agreements require the identification of the property and detail the responsibilities of each party. They also include provisions for inspections and financing, ensuring that both parties have a clear understanding of their obligations throughout the transaction.

Finally, the Ohio Purchase Agreement is similar in nature to the Michigan Residential Purchase Agreement. This document serves as a binding contract between the buyer and seller, detailing the purchase price, closing date, and any contingencies. Both agreements emphasize the importance of disclosures regarding the property's condition and legal status. They also provide a structured approach to managing the transaction, ensuring that all necessary information is clearly communicated and documented.

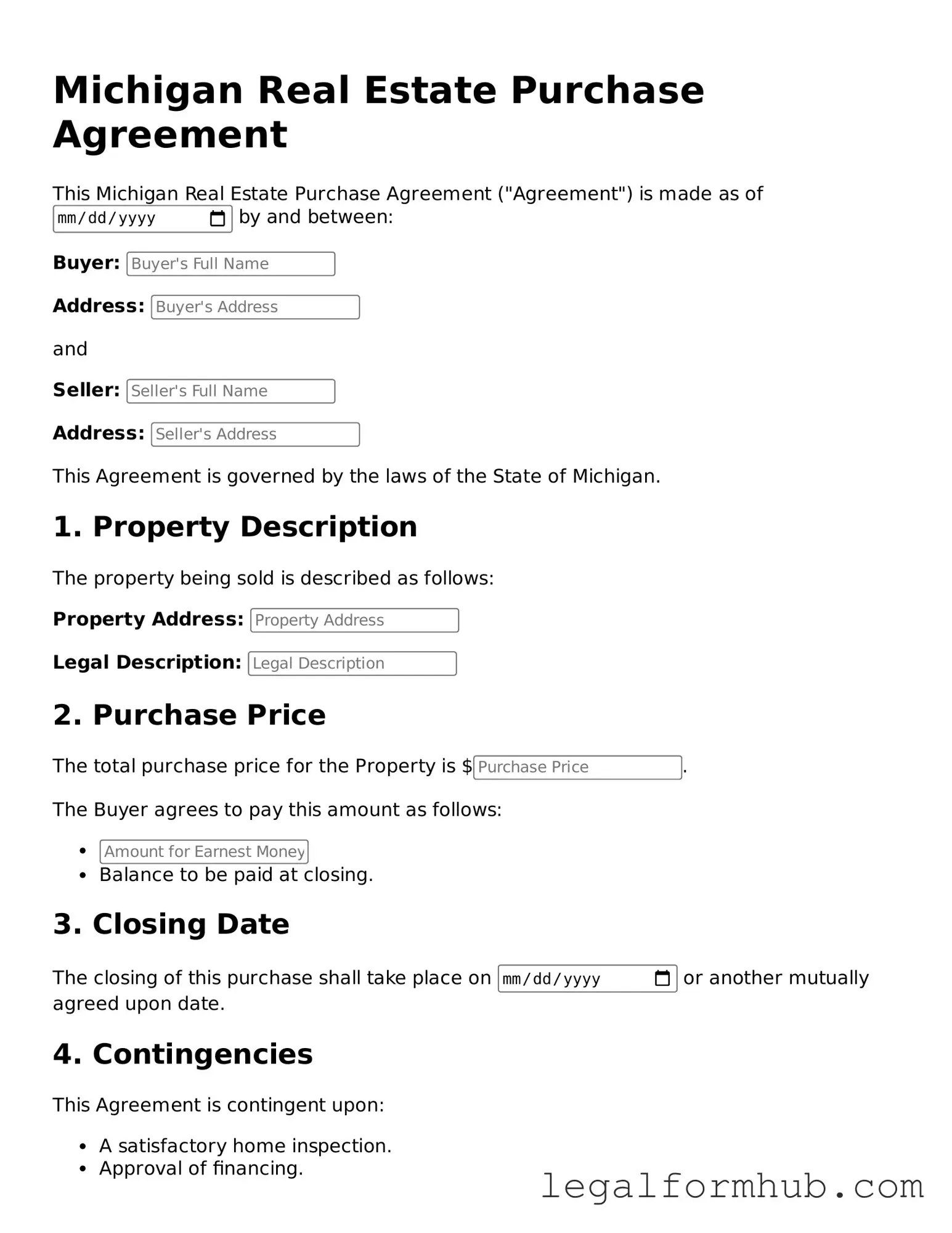

Instructions on Writing Michigan Real Estate Purchase Agreement

Filling out the Michigan Real Estate Purchase Agreement form is a crucial step in the home buying process. Once completed, this form will facilitate the negotiation and finalization of the property transaction. It’s important to ensure that all information is accurate and complete to avoid any complications later on.

- Begin by entering the date at the top of the form. This date marks when the agreement is being created.

- Fill in the names of the buyers and sellers. Make sure to include full legal names as they appear on identification documents.

- Provide the property address. This should include the street number, street name, city, and zip code to ensure clarity.

- Specify the purchase price of the property. This is the amount the buyer agrees to pay the seller.

- Indicate the amount of earnest money. This is a deposit made to demonstrate the buyer’s serious intent to purchase.

- Outline the terms of financing. Mention whether the buyer will be obtaining a mortgage, paying cash, or using another method.

- Include any contingencies. Common contingencies might include inspections, financing, or the sale of another property.

- Detail the closing date. This is the date when the transaction will be finalized and ownership will be transferred.

- Sign and date the agreement. Both parties must sign to indicate their acceptance of the terms outlined in the agreement.

After completing the form, both parties should review it carefully to ensure all details are correct. It may be wise to consult with a real estate professional or attorney to address any questions or concerns before moving forward with the transaction.

Misconceptions

When it comes to buying or selling a home in Michigan, the Real Estate Purchase Agreement (REPA) is a crucial document. However, there are several misconceptions surrounding this form that can lead to confusion. Here’s a breakdown of ten common myths and the truths behind them.

-

Misconception 1: The REPA is only for residential properties.

In reality, the REPA can be used for various types of real estate transactions, including commercial properties, as long as both parties agree to its terms.

-

Misconception 2: A verbal agreement is sufficient.

While discussions can happen verbally, a written REPA is essential for legal protection and clarity. Without it, misunderstandings can arise.

-

Misconception 3: The REPA is a binding contract immediately upon signing.

Although signing the REPA indicates intent, it often includes contingencies that must be satisfied before it becomes fully binding.

-

Misconception 4: All terms are negotiable.

While many terms can be negotiated, some aspects, such as state laws and regulations, must be adhered to and cannot be altered.

-

Misconception 5: The seller is responsible for all repairs before closing.

This is not always the case. The REPA may specify which repairs, if any, the seller must complete prior to closing.

-

Misconception 6: The REPA does not require a deposit.

A deposit, often called earnest money, is typically included in the REPA to show the buyer’s commitment. This amount is usually held in escrow until closing.

-

Misconception 7: Once signed, the REPA cannot be changed.

Amendments can be made to the REPA if both parties agree. It’s important to document any changes in writing.

-

Misconception 8: The REPA is the only document needed for a real estate transaction.

Other documents, such as disclosures and closing statements, are also required to complete the transaction legally.

-

Misconception 9: The REPA is the same as the listing agreement.

The REPA is different from the listing agreement, which is a contract between a seller and a real estate agent. The REPA specifically outlines the terms of the sale.

-

Misconception 10: You don’t need legal advice to fill out the REPA.

While it’s possible to complete the REPA without legal help, consulting a real estate attorney or agent can provide valuable guidance and ensure all necessary terms are included.

Understanding these misconceptions can help buyers and sellers navigate the real estate process more effectively. Clarity in the REPA leads to smoother transactions and fewer surprises down the road.

Key takeaways

When filling out and using the Michigan Real Estate Purchase Agreement form, keep these key takeaways in mind:

- Accuracy is Crucial: Ensure that all information, including names, addresses, and property details, is filled out correctly to avoid any disputes later.

- Understand the Terms: Familiarize yourself with the terms of the agreement, including contingencies, closing dates, and earnest money requirements.

- Consult a Professional: It’s advisable to have a real estate agent or attorney review the agreement before signing to ensure your interests are protected.

- Keep Copies: After completing the form, retain copies for your records. This documentation is important for future reference and any potential legal issues.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Real Estate Purchase Agreement is designed to outline the terms of a property sale between a buyer and a seller. |

| Governing Law | This agreement is governed by the laws of the State of Michigan. |

| Parties Involved | The agreement involves at least two parties: the buyer and the seller. |

| Property Description | A detailed description of the property being sold must be included in the agreement. |

| Purchase Price | The total purchase price for the property is clearly stated in the agreement. |

| Earnest Money | The agreement typically requires an earnest money deposit to demonstrate the buyer's commitment. |

| Contingencies | Common contingencies may include financing, inspections, and appraisal conditions. |

| Closing Date | The agreement specifies a closing date when the transaction will be finalized. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |