Free Quitclaim Deed Template for Michigan

Create Other Popular Quitclaim Deed Forms for Different States

Quit Claim Deed Form Free - A Quitclaim Deed may be required in certain legal situations, like establishing clear title in estate claims.

The Arizona Notice to Quit form is a legal document that a landlord uses to inform a tenant that they must vacate the rental property. This notice outlines the reasons for eviction and provides a timeline for the tenant to leave. For more information and to access a template for this important document, visit arizonapdfs.com/notice-to-quit-template/. Understanding this form is essential for both landlords and tenants navigating the eviction process in Arizona.

Quick Claim Deed Ohio - Not a method for resolving title disputes.

Quit Claim Deed Form Texas - Property owners can use Quitclaim Deeds to change names on the title easily.

Similar forms

The Warranty Deed is a common document used in property transactions, similar to a Quitclaim Deed. However, while a Quitclaim Deed transfers ownership without any guarantees about the title, a Warranty Deed provides a strong assurance that the grantor holds a clear title to the property. This means that if any issues arise regarding ownership, the grantor is legally obligated to resolve them. Buyers often prefer Warranty Deeds when purchasing property because they offer greater protection against potential claims from third parties.

The Bargain and Sale Deed is another document that shares similarities with the Quitclaim Deed. This type of deed conveys property ownership but does not include warranties about the title, similar to a Quitclaim Deed. However, it implies that the seller has the right to sell the property. Buyers may find this type of deed appealing, especially in transactions involving foreclosures or tax sales, where the seller may not be able to provide a full warranty.

A Special Purpose Deed is also comparable to a Quitclaim Deed, particularly in specific situations like transferring property into a trust or to a family member. This type of deed may not offer full title assurances, similar to a Quitclaim Deed, but is often used for specific legal purposes. It allows for a straightforward transfer while meeting particular legal requirements, making it a useful tool for estate planning or asset protection.

When dealing with various types of deeds, it is essential to understand the nuances that differentiate them from one another. For instance, the warranty deed offers comprehensive guarantees regarding property ownership, while the quitclaim deed provides no such assurances. If you find yourself needing to complete related paperwork, such as the EDD DE 2501 form for disability benefits, you can seek guidance on how to proceed by visiting Fill PDF Forms.

The Deed of Trust is another document related to property transactions, although it serves a different purpose. It is used to secure a loan by transferring the property title to a trustee until the borrower repays the loan. While it doesn’t transfer ownership outright like a Quitclaim Deed, it does involve the transfer of title and can be an essential part of real estate financing. Understanding how these documents interrelate can help in navigating property transactions effectively.

The Grant Deed is similar to a Quitclaim Deed in that it transfers ownership of real property. However, a Grant Deed provides certain guarantees, such as the assurance that the property has not been sold to anyone else and that there are no undisclosed encumbrances. This makes it a more secure option for buyers who want some level of protection, unlike the more straightforward Quitclaim Deed.

A Life Estate Deed, while serving a different purpose, shares the essence of transferring property rights. This deed allows a person to transfer ownership of a property while retaining the right to live in it for the rest of their life. Like a Quitclaim Deed, it can simplify the transfer process, but it also creates specific rights and responsibilities for both the grantor and the grantee, making it a unique option in estate planning.

Lastly, a Mortgage Deed, though primarily a security instrument, has similarities to a Quitclaim Deed in that it involves the transfer of an interest in property. When a borrower takes out a mortgage, they grant the lender a security interest in the property. This deed does not transfer full ownership but does convey rights to the lender until the loan is paid off. Understanding these nuances can aid individuals in making informed decisions during property transactions.

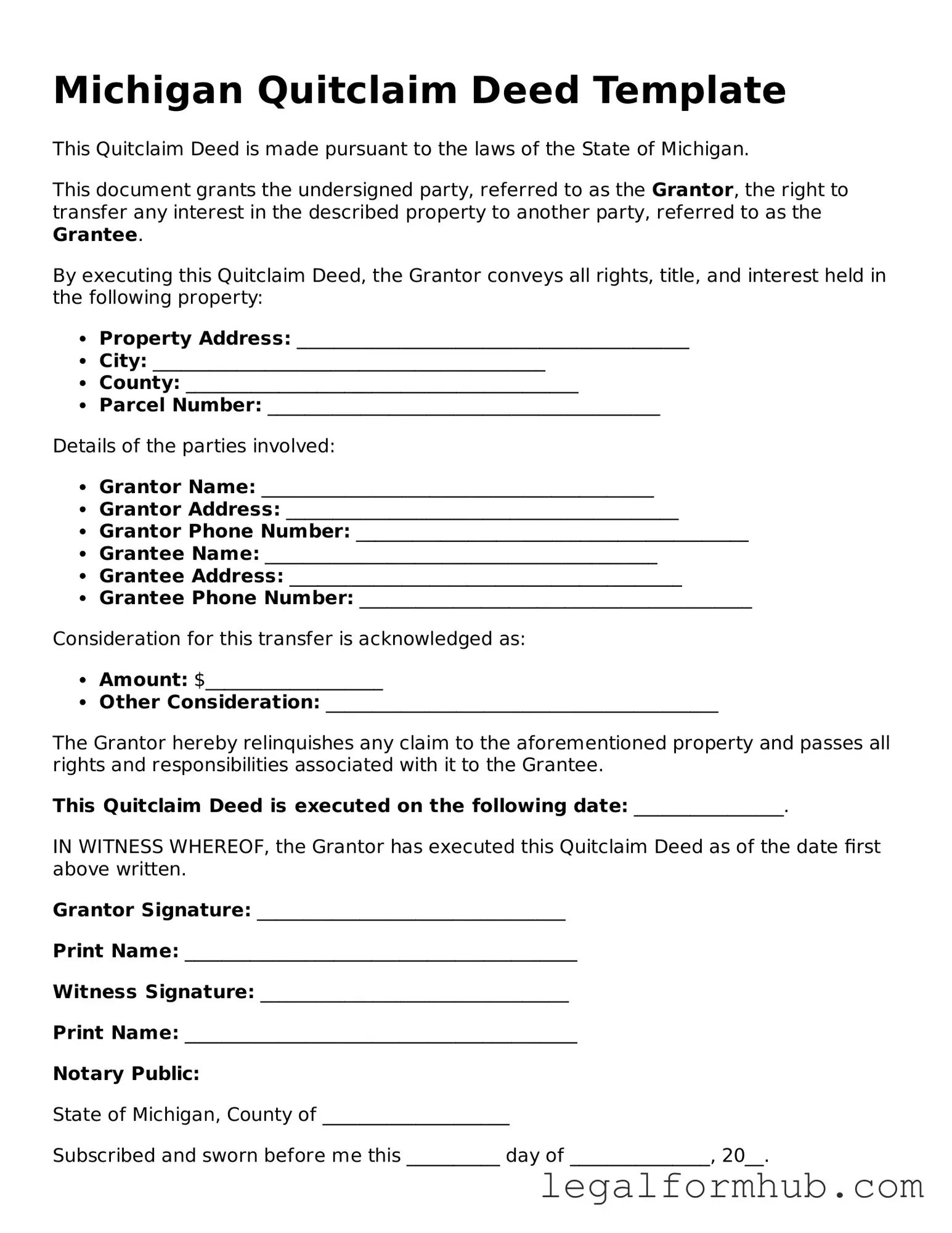

Instructions on Writing Michigan Quitclaim Deed

Once you have the Michigan Quitclaim Deed form in hand, it is essential to fill it out accurately to ensure the transfer of property rights is legally recognized. After completing the form, it must be signed in front of a notary public and then filed with the appropriate county register of deeds. This process is crucial for the deed to take effect and to protect the interests of all parties involved.

- Begin by entering the name of the grantor (the person transferring the property) at the top of the form.

- Next, provide the name of the grantee (the person receiving the property) below the grantor's name.

- Fill in the address of the grantee to ensure proper identification.

- Include a legal description of the property being transferred. This can typically be found in the property’s existing deed or tax records.

- Indicate the consideration, or the amount paid for the property, if applicable. If the transfer is a gift, you may note that as well.

- Sign the form as the grantor. Ensure that your signature matches the name provided earlier.

- Have your signature notarized by a notary public. The notary will verify your identity and witness the signing.

- Finally, submit the completed and notarized Quitclaim Deed to the county register of deeds in the county where the property is located.

Misconceptions

- Misconception 1: A quitclaim deed transfers ownership without any warranties.

- Misconception 2: A quitclaim deed is only used between family members.

- Misconception 3: Using a quitclaim deed means you can avoid taxes.

- Misconception 4: A quitclaim deed is the same as a warranty deed.

- Misconception 5: Once a quitclaim deed is signed, it cannot be revoked.

This is true. A quitclaim deed does not guarantee that the property title is clear or free of claims. It simply transfers whatever interest the grantor has in the property, if any.

This is incorrect. While quitclaim deeds are often used for family transfers, they can also be used in various situations, such as in divorce settlements or between business partners.

This is misleading. While some transfers may be exempt from certain taxes, a quitclaim deed does not inherently provide tax benefits. It's important to check local laws and regulations.

This is false. A warranty deed offers guarantees about the title and protects the buyer from claims. In contrast, a quitclaim deed offers no such protections.

This is not entirely accurate. While a quitclaim deed is generally final, it may be possible to revoke it under certain circumstances, such as mutual agreement or legal action.

Key takeaways

When filling out and using the Michigan Quitclaim Deed form, keep these key takeaways in mind:

- Understand the Purpose: A Quitclaim Deed transfers ownership of property without guaranteeing that the title is clear. It's often used between family members or in divorce settlements.

- Gather Necessary Information: You will need the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property), along with the legal description of the property.

- Complete the Form Accurately: Fill out all required fields carefully. Mistakes can lead to delays or complications in the transfer process.

- Sign in Front of a Notary: The Quitclaim Deed must be signed by the grantor in front of a notary public to be legally valid.

- Consider Recording the Deed: After signing, you should record the Quitclaim Deed with the county register of deeds. This provides public notice of the ownership change.

- Check for Local Requirements: Some counties may have specific requirements or forms. Always verify local rules to ensure compliance.

- Consult a Professional if Needed: If you're unsure about any part of the process, consider seeking legal advice. It can save you time and prevent future issues.

- Keep Copies for Your Records: After completing and recording the deed, retain copies for your personal records. This documentation is important for future reference.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real property without any warranties. |

| Governing Law | The Michigan Quitclaim Deed is governed by the Michigan Compiled Laws, specifically MCL 565.25. |

| Purpose | This type of deed is often used between family members or in divorce settlements, where trust exists. |

| Warranties | Unlike other deeds, a quitclaim deed offers no guarantees regarding the title's validity. |

| Form Requirements | The deed must be in writing, signed by the grantor, and must include a legal description of the property. |

| Recording | To protect the interests of the new owner, it is advisable to record the quitclaim deed with the county register of deeds. |

| Tax Implications | Transfer taxes may apply, and it is important to check local regulations regarding property transfers. |

| Effectiveness | The transfer of ownership occurs immediately upon execution of the deed, provided it is properly executed and delivered. |

| Limitations | Since it provides no warranties, buyers should conduct thorough title searches before accepting a quitclaim deed. |