Free Promissory Note Template for Michigan

Create Other Popular Promissory Note Forms for Different States

Ohio Promissory Note Requirements - This document can come in handy for tax purposes down the line.

The Arizona Notice to Quit form is a legal document that a landlord uses to inform a tenant that they must vacate the rental property. This notice outlines the reasons for eviction and provides a timeline for the tenant to leave. For more information and to access a template, you can visit arizonapdfs.com/notice-to-quit-template/. Understanding this form is essential for both landlords and tenants navigating the eviction process in Arizona.

Simple Promissory Note Template California - Interest rates can be fixed or variable, depending on the agreement made.

Georgia Promissory Note - In some cases, promissory notes can include a grace period for repayments.

Loan Agreement Template Texas - Repayment can be structured in various ways, including lump-sum payments or installment plans.

Similar forms

The Michigan Promissory Note form bears similarities to the Loan Agreement, which outlines the terms and conditions under which a borrower receives funds from a lender. Like the promissory note, a loan agreement specifies the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement often includes additional details, such as collateral requirements and the rights of both parties in the event of a default. This comprehensive nature makes it suitable for larger loans or more complex financial arrangements.

Another document that shares characteristics with the Michigan Promissory Note is the IOU, or informal acknowledgment of debt. An IOU is a simple, straightforward document indicating that one party owes money to another. While it does not typically include the same level of detail as a promissory note, such as interest rates or repayment terms, it serves a similar purpose by establishing a record of the debt. Both documents create a sense of obligation, although the IOU is generally less formal and may not be enforceable in a court of law.

The Secured Promissory Note is also akin to the Michigan Promissory Note, with one key distinction: it is backed by collateral. In this case, the borrower pledges an asset, such as property or equipment, to secure the loan. If the borrower defaults, the lender has the right to claim the collateral. This added layer of security can make lenders more willing to extend credit. Both documents outline the terms of repayment and the borrower's promise to repay, but the secured note provides additional protection for the lender.

The Mortgage Note shares similarities with the Michigan Promissory Note, particularly in the context of real estate transactions. A mortgage note serves as a written promise to repay a loan used to purchase property. Like a promissory note, it specifies the loan amount, interest rate, and repayment terms. However, the mortgage note is tied directly to the property itself, allowing the lender to foreclose on the property if the borrower defaults. Both documents create a legal obligation, but the mortgage note is specifically designed for real estate financing.

When it comes to navigating the financial landscape, many individuals may encounter various forms and agreements, and understanding them is crucial. For instance, the EDD DE 2501 form is specifically designed for those in California seeking disability benefits. To successfully complete this essential document, you can refer to resources like Fill PDF Forms for guidance, ensuring that all necessary information is provided and that you can access the financial support you need during challenging times.

Lastly, the Personal Guarantee is another document that resembles the Michigan Promissory Note. A personal guarantee involves an individual agreeing to be personally liable for a debt incurred by a business or another party. This document is often used when a lender requires additional assurance that the loan will be repaid. Similar to a promissory note, a personal guarantee outlines the obligation to repay the debt. However, it shifts the responsibility from the business to the individual, providing an extra layer of security for the lender.

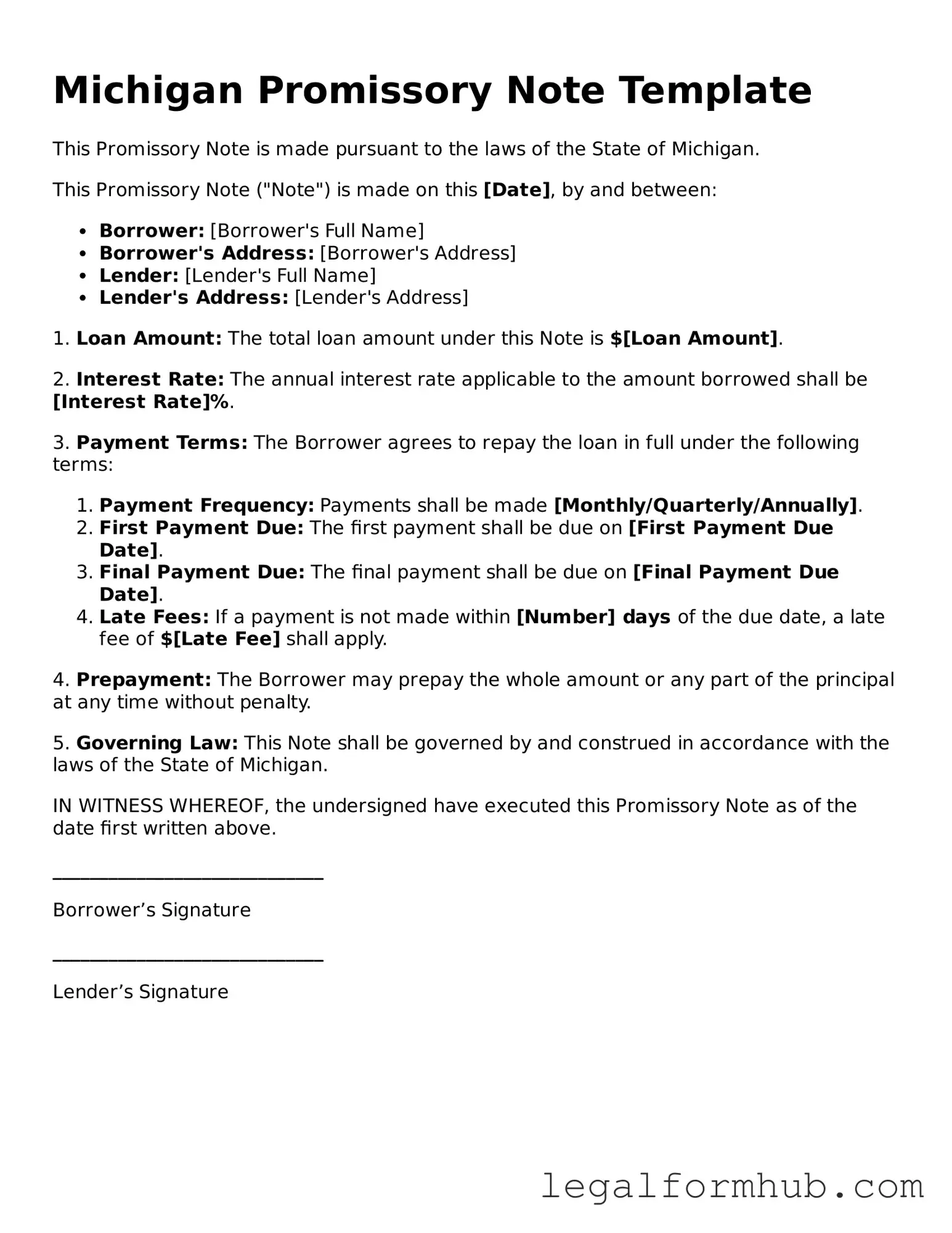

Instructions on Writing Michigan Promissory Note

Once you have the Michigan Promissory Note form in front of you, it’s time to fill it out carefully. Completing this form correctly is important for ensuring that the terms of the loan are clear and enforceable. Follow these steps to fill out the form accurately.

- Enter the date: Write the date on which the note is being created at the top of the form.

- Borrower’s information: Fill in the full name and address of the borrower. This is the person who will be repaying the loan.

- Lender’s information: Provide the full name and address of the lender. This is the person or entity providing the loan.

- Loan amount: Clearly state the total amount of money being borrowed.

- Interest rate: Specify the interest rate that will be applied to the loan. Make sure to indicate whether it is fixed or variable.

- Payment terms: Outline the repayment schedule, including the frequency of payments (monthly, quarterly, etc.) and the due date for each payment.

- Late fees: If applicable, include any fees that will be charged for late payments.

- Signatures: Both the borrower and lender must sign and date the form to make it legally binding.

After completing the form, keep a copy for your records. It’s also a good idea to provide a copy to the borrower. This ensures both parties have the same understanding of the agreement moving forward.

Misconceptions

Understanding the Michigan Promissory Note form can be challenging due to various misconceptions. Here are seven common misunderstandings that people often have:

- All promissory notes must be notarized. Many believe that notarization is a requirement for all promissory notes. However, while notarization can add an extra layer of authenticity, it is not legally required for a promissory note to be enforceable in Michigan.

- Promissory notes are only for loans. Some think that promissory notes are exclusively used for loan agreements. In reality, they can also be used in various transactions where one party promises to pay another, such as for services rendered or goods purchased.

- A promissory note must be in writing. There is a misconception that oral agreements cannot be considered promissory notes. While written notes are strongly recommended for clarity and enforceability, oral promises can also be legally binding, although they are harder to prove.

- Interest rates must be specified. Many assume that a promissory note must include an interest rate. While it is common to specify an interest rate, it is not mandatory. A note can simply state that the amount is to be repaid without interest.

- Only banks can issue promissory notes. Some people believe that only financial institutions have the authority to create promissory notes. In fact, any individual or business can draft a promissory note, provided it meets the legal requirements.

- All promissory notes are the same. There is a misconception that all promissory notes follow a standard format. However, the terms and conditions can vary widely based on the agreement between the parties involved. Customization is often necessary to reflect specific circumstances.

- Promissory notes are not legally binding. Some individuals think that promissory notes lack legal weight. On the contrary, when properly executed, they are legally binding contracts that can be enforced in a court of law.

By dispelling these misconceptions, individuals can better navigate the complexities of the Michigan Promissory Note form and ensure their agreements are clear and enforceable.

Key takeaways

Ensure all parties' names and addresses are accurately filled out. This includes the borrower and lender to avoid any confusion or legal issues.

Clearly state the loan amount. The principal sum should be specified in both numerical and written form to prevent discrepancies.

Include the interest rate, if applicable. Specify whether it is fixed or variable, and ensure it complies with Michigan’s usury laws.

Define the repayment terms. Outline the payment schedule, including the frequency of payments and the due date for the final payment.

Consider including a default clause. This should explain the consequences if the borrower fails to make payments as agreed.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a specified time or on demand. |

| Governing Law | The Michigan Promissory Note is governed by the Uniform Commercial Code (UCC), specifically Article 3, which deals with negotiable instruments. |

| Parties Involved | The document involves two primary parties: the borrower (maker) who promises to pay, and the lender (payee) who receives the payment. |

| Interest Rate | The interest rate can be specified in the note. If not stated, Michigan law allows for a default rate of 5% per annum. |

| Payment Terms | Payment terms should be clearly outlined, including the due date, payment schedule, and any applicable late fees. |

| Signatures | The note must be signed by the borrower to be legally binding. A witness or notary is not required but can enhance validity. |

| Enforceability | If properly executed, a promissory note is enforceable in court. The lender can take legal action if the borrower defaults. |

| Modification | Any changes to the terms of the promissory note must be agreed upon by both parties and documented in writing. |