Free Last Will and Testament Template for Michigan

Create Other Popular Last Will and Testament Forms for Different States

Illinois Last Will and Testament - Can be tailored to accommodate unique family situations or traditions.

To ensure a smooth transaction when transferring ownership of a trailer, it's essential to complete the necessary documentation, particularly the California Trailer Bill of Sale. This form serves as proof of the sale and includes important details about the trailer. For those who need to fill out this form correctly, you can access it through Fill PDF Forms.

Free Ohio Last Will and Testament Form Pdf - A means to leave a legacy in alignment with your personal beliefs.

Last Will and Testament North Carolina - Offers a platform to express final thoughts or messages to loved ones.

Last Will and Testament Template Georgia - Can include instructions for personal property not covered by titles, like heirlooms.

Similar forms

The Michigan Last Will and Testament form shares similarities with a Living Will, which is a document that outlines an individual's preferences regarding medical treatment in situations where they may be unable to communicate their wishes. Both documents serve to express personal intentions, but while a Last Will deals with the distribution of assets after death, a Living Will focuses on healthcare decisions during one’s lifetime. This distinction highlights the importance of planning for both the end of life and the management of one’s estate.

Another related document is the Durable Power of Attorney. This legal form allows a person to designate someone else to make financial or medical decisions on their behalf if they become incapacitated. Like a Last Will, it provides clarity about an individual’s wishes and ensures that their affairs are handled according to their preferences. However, the Durable Power of Attorney is effective during the person's lifetime, whereas a Last Will only takes effect after death.

For individuals engaged in buying or selling property, understanding the importance of a bill of sale is crucial. This document provides legal validation during transactions and ensures that both parties have clarity. To explore various options available for creating a bill of sale, check out this comprehensive guide on the Missouri Bill of Sale.

A Revocable Living Trust is also similar to the Last Will and Testament. This document allows individuals to place their assets into a trust during their lifetime, which can then be managed by a trustee. Upon the individual's death, the assets in the trust are distributed according to the terms set forth in the trust document. Both instruments aim to facilitate the transfer of assets, but a Revocable Living Trust can help avoid probate, which is a process that a Last Will typically must go through.

The Appointment of Guardian form is another document that aligns closely with a Last Will. This form allows parents to designate a guardian for their minor children in the event of their death or incapacity. While a Last Will outlines how assets should be distributed, the Appointment of Guardian ensures that children are cared for by someone the parents trust. This document is crucial for parents who want to have a say in their children's future, reinforcing the protective intent behind both documents.

A Codicil is a legal document that modifies an existing Last Will and Testament. It allows individuals to make changes, such as updating beneficiaries or altering asset distribution, without having to create an entirely new will. This flexibility is important as life circumstances change. Both a Codicil and a Last Will serve to reflect a person's final wishes, ensuring that their intentions are accurately captured and honored.

Lastly, a Declaration of Trust is similar in that it outlines how an individual's assets will be managed and distributed. This document can specify the terms of asset management while the individual is alive and how those assets should be handled after death. While a Last Will typically focuses on asset distribution after death, a Declaration of Trust can address both lifetime management and posthumous distribution, providing a comprehensive approach to estate planning.

Instructions on Writing Michigan Last Will and Testament

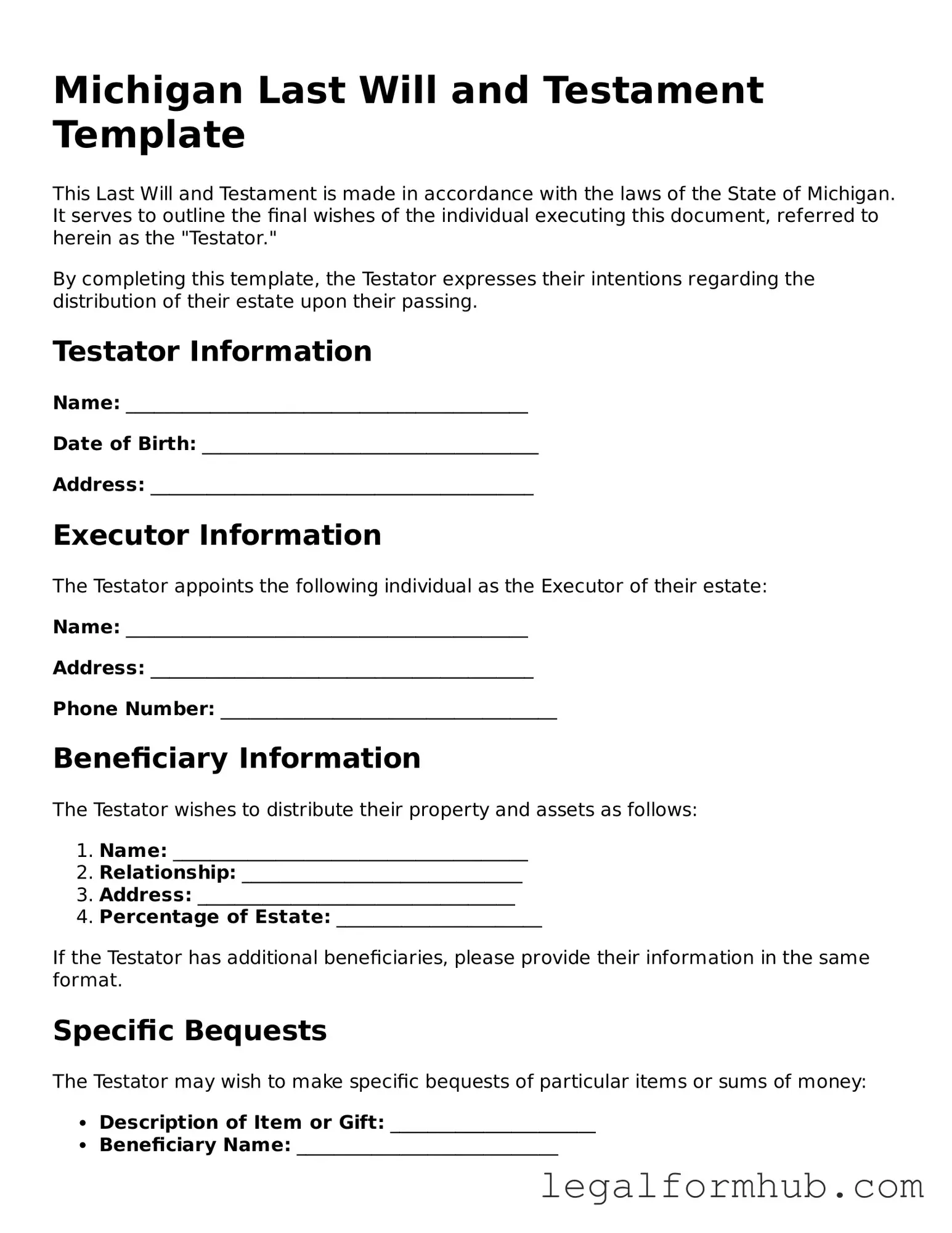

Filling out the Michigan Last Will and Testament form is an important step in ensuring your wishes are honored after your passing. This process can feel overwhelming, but breaking it down into manageable steps can make it easier. Follow the instructions carefully to complete the form accurately.

- Begin by obtaining the Michigan Last Will and Testament form. You can find it online or at legal supply stores.

- Read through the entire form before starting to fill it out. Familiarize yourself with the sections and requirements.

- In the first section, provide your full legal name and address. Make sure this information is accurate.

- Next, specify the date of your will. This is important for legal purposes and helps clarify which version of your will is valid.

- Identify your beneficiaries. List the names and relationships of the individuals or organizations you wish to inherit your assets.

- Designate an executor. This person will be responsible for ensuring your wishes are carried out. Provide their name and contact information.

- Detail any specific bequests. If you want to leave particular items or amounts of money to specific people, list them clearly.

- Include a residuary clause. This outlines what happens to any remaining assets after specific bequests have been made.

- Sign the document in the presence of at least two witnesses. They must also sign the form to validate it.

- Store the completed will in a safe place, and inform your executor of its location. Consider making copies for your beneficiaries if appropriate.

Once you have filled out the form, it is advisable to review it periodically, especially after major life changes. Keeping your will updated ensures that it reflects your current wishes and circumstances.

Misconceptions

Misconceptions about the Michigan Last Will and Testament form can lead to confusion and potentially impact the distribution of one's estate. Here are four common misunderstandings:

-

All wills must be notarized to be valid. Many people believe that a will must be notarized to be legally binding. In Michigan, while notarization can add an extra layer of authenticity, it is not a requirement. A will is valid as long as it is signed by the testator and witnessed by at least two individuals who are not beneficiaries.

-

Only lawyers can create a valid will. Some individuals think that a will must be drafted by a lawyer to be valid. While legal assistance can ensure that all necessary provisions are included, individuals can create their own will as long as they follow Michigan's legal requirements.

-

Handwritten wills are not valid. There is a belief that handwritten wills, also known as holographic wills, are not recognized in Michigan. In fact, Michigan does allow handwritten wills, provided they are signed by the testator and express the testator's intent.

-

A will can control all assets after death. Many people assume that a will governs all assets, including those with designated beneficiaries. However, certain assets, such as life insurance policies and retirement accounts, pass directly to named beneficiaries and do not go through the probate process governed by a will.

Key takeaways

When it comes to preparing a Last Will and Testament in Michigan, understanding the process is crucial. Here are some key takeaways to help guide you:

- Legal Age Requirement: You must be at least 18 years old to create a valid will in Michigan.

- Written Document: The will must be in writing. Oral wills are not recognized in Michigan.

- Signature Requirement: You must sign the will, or someone else can sign it on your behalf in your presence.

- Witnesses: At least two witnesses are required to sign the will. They should not be beneficiaries to avoid any potential conflicts.

- Revocation of Previous Wills: Creating a new will automatically revokes any prior wills, so be sure to destroy old versions.

- Executor Appointment: Designate an executor who will ensure your wishes are carried out after your passing.

- Clarity is Key: Be clear and specific about your wishes regarding asset distribution to avoid confusion among heirs.

- Storage and Accessibility: Store the will in a safe place and inform your executor and family members where it can be found.

Taking the time to understand these key points can make a significant difference in ensuring your wishes are honored. Don’t delay; get your will in order today!

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed upon their death. |

| Governing Law | The Michigan Last Will and Testament is governed by the Michigan Estates and Protected Individuals Code (EPIC), specifically MCL 700.2501 et seq. |

| Requirements | In Michigan, a will must be signed by the testator and witnessed by at least two individuals who are not beneficiaries. |

| Revocation | A Last Will and Testament can be revoked by the testator at any time, typically through a subsequent will or by destroying the original document. |

| Holographic Wills | Michigan recognizes holographic wills, which are handwritten and do not require witnesses, provided the testator's intent is clear. |

| Probate Process | After death, the will must be submitted to probate court to ensure its validity and to facilitate the distribution of the estate. |