Free Lady Bird Deed Template for Michigan

Create Other Popular Lady Bird Deed Forms for Different States

Texas Transfer on Death Deed Form - It allows for the property to be sold without needing beneficiary input before the owner's death.

The EDD DE 2501 form is a vital document used in California for claiming Disability Insurance benefits. This form allows individuals who are unable to work due to a non-work-related illness or injury to receive financial support during their recovery. Ensuring it is filled out correctly is essential for a smooth application process, so click the button below to start. For more information, visit https://pdftemplates.info/.

Ladybird Deed North Carolina - A Lady Bird Deed can provide significant tax benefits under certain circumstances.

Similar forms

The Michigan Lady Bird Deed is similar to a traditional life estate deed. Both documents allow a property owner to retain certain rights during their lifetime while transferring the remainder interest to a beneficiary. However, a life estate deed typically restricts the owner's ability to sell or mortgage the property without the consent of the remainderman. In contrast, the Lady Bird Deed provides greater flexibility, allowing the owner to sell or change the beneficiaries without needing permission, which can be particularly beneficial for estate planning purposes.

Another document comparable to the Lady Bird Deed is the quitclaim deed. A quitclaim deed transfers ownership of property without any warranties or guarantees regarding the title. While both deeds can be used to transfer property, the quitclaim deed does not offer the same level of control to the original owner. Once a quitclaim deed is executed, the original owner relinquishes all rights to the property, making it a less favorable option for those who wish to retain certain rights during their lifetime.

The warranty deed is also similar to the Lady Bird Deed, as it transfers ownership of property. However, a warranty deed provides a guarantee that the title is clear and free of any liens or encumbrances. In contrast, the Lady Bird Deed allows the original owner to retain rights while still transferring the property upon their death. This distinction makes the Lady Bird Deed a more flexible option for those concerned about future ownership and control over the property.

A revocable living trust shares similarities with the Lady Bird Deed in that both are used for estate planning. A revocable living trust allows the property owner to place their assets into a trust, which can be managed during their lifetime and distributed upon their death. While both documents avoid probate, the Lady Bird Deed allows for a simpler transfer of property without the need for ongoing management or oversight, making it an appealing choice for many individuals.

The transfer-on-death deed (TOD) is another document that aligns with the Lady Bird Deed. A TOD deed allows the property owner to designate a beneficiary who will automatically receive the property upon the owner’s death, bypassing probate. Like the Lady Bird Deed, the TOD deed enables the owner to retain full control of the property during their lifetime. However, the Lady Bird Deed offers more flexibility in terms of selling or transferring the property without losing the right to change beneficiaries.

In the realm of property transfers, understanding the various types of deeds is essential for smooth transactions. For motorcycle owners in Arizona, utilizing a specific template can ensure proper documentation of sales. For further details, visit arizonapdfs.com/motorcycle-bill-of-sale-template, which provides resources for creating a clear and legal motorcycle bill of sale.

The general power of attorney (POA) is also relevant when discussing the Lady Bird Deed. A general POA allows an individual to appoint someone else to manage their financial and legal affairs. While a Lady Bird Deed specifically addresses property transfer and retains rights for the original owner, a POA can be more comprehensive, covering various aspects of decision-making. Both documents provide a means of control, but they serve different purposes in managing assets and rights.

Another document that resembles the Lady Bird Deed is the enhanced life estate deed. This type of deed allows the property owner to retain the right to live in the property for their lifetime while transferring the remainder interest to a beneficiary. The key difference is that the enhanced life estate deed typically does not provide the same level of flexibility as the Lady Bird Deed, particularly regarding the ability to sell or change beneficiaries without consent.

Lastly, a joint tenancy deed is similar to the Lady Bird Deed in that it allows for shared ownership of property. In a joint tenancy arrangement, two or more individuals own the property together, and upon the death of one owner, the property automatically passes to the surviving owner(s). While this arrangement provides a straightforward transfer of ownership, it does not offer the same control over the property during the owner's lifetime as the Lady Bird Deed does, which can be crucial for estate planning.

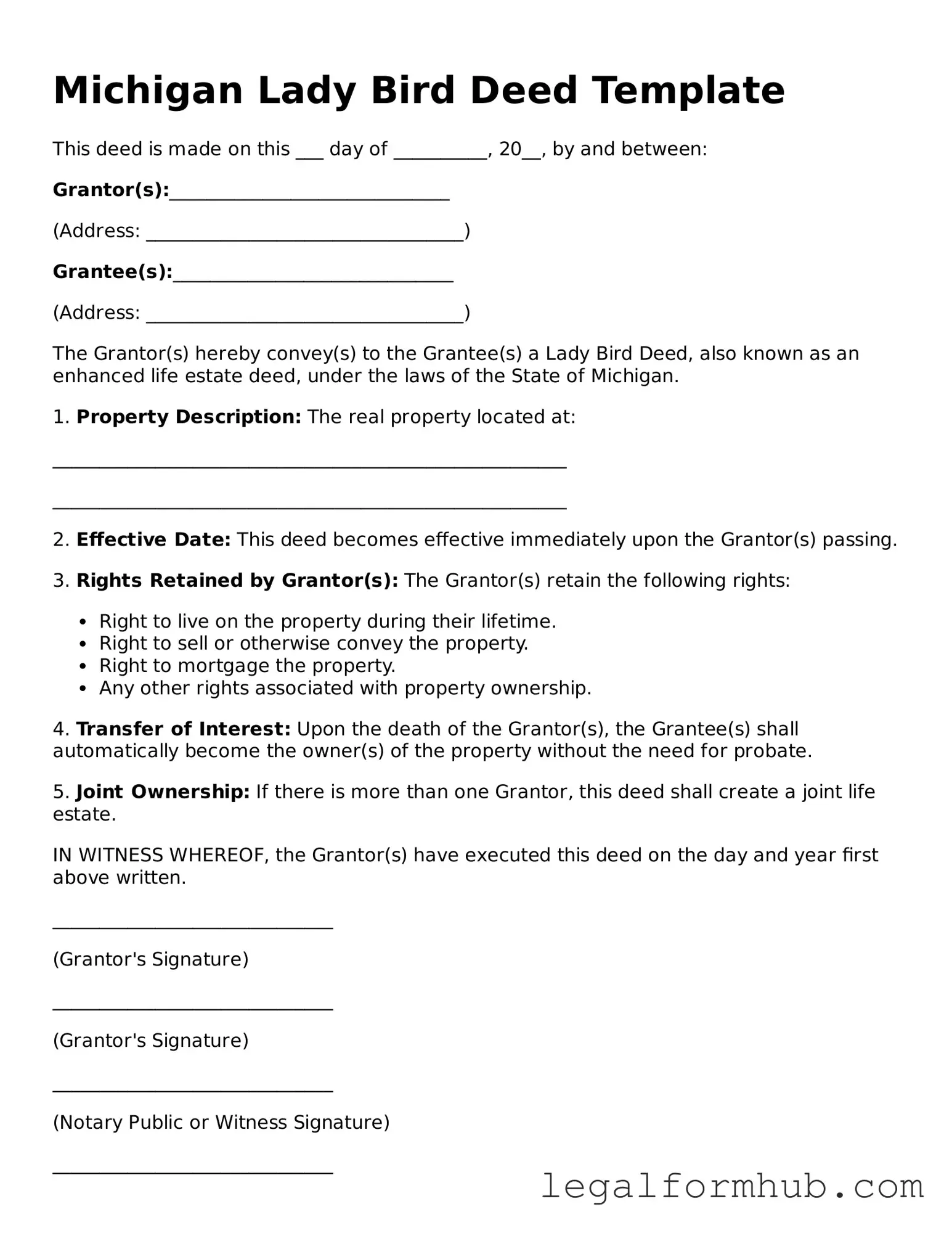

Instructions on Writing Michigan Lady Bird Deed

Completing the Michigan Lady Bird Deed form is a straightforward process that requires careful attention to detail. Once you have filled out the form, you will need to have it signed and notarized before filing it with the appropriate county register of deeds.

- Obtain the Michigan Lady Bird Deed form. You can find it online or at your local county clerk's office.

- Enter the name of the property owner in the designated section. Make sure to use the full legal name.

- Provide the address of the property being transferred. This should include the street number, street name, city, and zip code.

- List the names of the beneficiaries who will receive the property upon the owner's passing. Ensure that the names are accurate and spelled correctly.

- Include the legal description of the property. This may be found on the property deed or tax assessment records.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- Make copies of the completed and notarized form for your records.

- File the original form with the county register of deeds in the county where the property is located. There may be a filing fee, so check in advance.

Misconceptions

When it comes to the Michigan Lady Bird Deed, there are several misconceptions that can lead to confusion. Here’s a breakdown of some common misunderstandings:

- It’s only for wealthy individuals. Many people think that Lady Bird Deeds are only for those with significant assets. In reality, they can be beneficial for anyone looking to transfer property while retaining control.

- It avoids all taxes. While a Lady Bird Deed can help avoid probate, it doesn’t necessarily eliminate all taxes. Property taxes and potential capital gains taxes may still apply.

- It’s the same as a regular quitclaim deed. A Lady Bird Deed is not the same as a quitclaim deed. It allows the property owner to retain certain rights, like the ability to sell or change the property during their lifetime.

- It can only be used for primary residences. Some believe that Lady Bird Deeds are limited to primary homes. However, they can also be used for other types of real estate, including vacation homes and rental properties.

- Once signed, it cannot be changed. People often think that a Lady Bird Deed is set in stone once it’s executed. In fact, the property owner can revoke or change the deed at any time during their lifetime.

- It eliminates the need for a will. While a Lady Bird Deed can simplify the transfer of property, it does not replace the need for a comprehensive estate plan, which may still include a will.

- It’s only useful for avoiding probate. While one of the main advantages is avoiding probate, Lady Bird Deeds also allow for flexibility in property management and can help with Medicaid planning.

- Anyone can draft a Lady Bird Deed. While it might seem straightforward, it’s advisable to consult with a legal professional to ensure that the deed is properly drafted and meets all legal requirements.

- It provides no protection against creditors. Some may think that a Lady Bird Deed protects the property from creditors. However, this is not entirely true; creditors may still have claims against the property.

Understanding these misconceptions can help individuals make informed decisions about property transfer and estate planning in Michigan.

Key takeaways

When filling out and using the Michigan Lady Bird Deed form, keep these key takeaways in mind:

- The Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime.

- This type of deed avoids probate, which can save time and money for your heirs.

- It is important to clearly identify the property being transferred in the deed.

- Beneficiaries can be individuals or entities, such as trusts or organizations.

- Ensure that the deed is signed and notarized to make it legally valid.

- Be aware that the property will be included in your estate for tax purposes until your passing.

- Consult with a legal expert if you have questions about how this deed fits into your overall estate plan.

- Remember to keep a copy of the completed deed with your important documents for easy access.

File Overview

| Fact Name | Description |

|---|---|

| Definition | The Michigan Lady Bird Deed is a legal document that allows property owners to transfer their real estate to a beneficiary while retaining control during their lifetime. |

| Governing Law | This deed is governed by Michigan Compiled Laws, specifically MCL 565.1 et seq. |

| Retained Rights | Property owners can retain the right to sell, mortgage, or change the property without the beneficiary's consent. |

| Transfer Upon Death | Upon the owner's death, the property automatically transfers to the named beneficiary without going through probate. |

| Tax Implications | The Lady Bird Deed can help avoid gift tax issues since the transfer occurs at death, not during the owner's lifetime. |

| Eligibility | Any individual who owns real estate in Michigan can create a Lady Bird Deed, provided they meet the legal requirements for property ownership. |

| Revocability | The deed can be revoked or amended at any time by the property owner, ensuring flexibility in estate planning. |