Fill Your Louisiana act of donation Form

Different PDF Templates

How to Make a Payroll Check - The form can be issued weekly, bi-weekly, or monthly as per company policy.

The California Lease Agreement form provides a comprehensive framework for the relationship between landlord and tenant, ensuring both parties are aligned on rental terms. For clarity and effectiveness in the leasing process, it's crucial to have this document properly completed; to assist with this, you can visit Fill PDF Forms to get started.

What Is a P45 Form Uk - If the employee worked only in a weekly or monthly period, this must be indicated.

Similar forms

The Louisiana Act of Donation form is similar to a Quitclaim Deed. Both documents facilitate the transfer of property rights from one party to another. A Quitclaim Deed is often used to transfer property without any warranties or guarantees regarding the title. This means that the donor in both cases is relinquishing their interest in the property without assuming any responsibility for potential claims or encumbrances. This makes both documents straightforward and useful for quick transfers, especially among family members or friends.

Another document akin to the Louisiana Act of Donation is the Warranty Deed. While both serve to transfer property, a Warranty Deed provides more security to the recipient. It guarantees that the property is free from liens and encumbrances, and the seller is responsible for any issues that arise. In contrast, the Louisiana Act of Donation does not offer such assurances, making it a less formal option for transferring ownership.

A Bill of Sale is also comparable to the Louisiana Act of Donation. While the Act of Donation pertains specifically to real estate, a Bill of Sale is used for the transfer of personal property. Both documents serve to establish a legal record of the transfer, ensuring that the new owner has proof of their acquisition. This is particularly important for items of value, as it helps to clarify ownership and protect the rights of the new owner.

The Power of Attorney is another document that shares similarities with the Louisiana Act of Donation. Both can be used to facilitate the transfer of assets, although they serve different purposes. A Power of Attorney grants someone the authority to act on behalf of another, which can include transferring property. This can be particularly useful in situations where the donor is unable to complete the transfer themselves due to health issues or other circumstances.

The Revocable Living Trust is also relevant in this context. Like the Louisiana Act of Donation, a Revocable Living Trust allows for the transfer of assets without going through probate. This can streamline the process and provide privacy regarding the distribution of assets. However, a Revocable Living Trust is typically more comprehensive, as it can manage a variety of assets and provide for their distribution upon the grantor's death.

A Deed of Gift is closely related to the Louisiana Act of Donation. Both documents formalize the act of giving property without expecting anything in return. A Deed of Gift is often used for personal property, while the Louisiana Act of Donation is specifically for real estate. Both documents require the donor's intent to give and may involve tax implications, making them important legal instruments for transferring ownership.

The Affidavit of Heirship is another document that can be associated with the Louisiana Act of Donation. While it does not transfer property directly, it establishes the rightful heirs to a deceased person's estate, which can include property that may have been informally gifted during their lifetime. This affidavit can help clarify ownership and facilitate the transfer of assets, similar to how the Louisiana Act of Donation formalizes a gift of property.

When considering educational options, parents may also need to understand the importance of the Arizona Homeschool Letter of Intent, which they can find more information about at arizonapdfs.com/homeschool-letter-of-intent-template/. This formal document is essential for notifying the state about their decision to homeschool, and it outlines their commitment to provide an education that falls outside traditional schooling.

Lastly, the Lease Agreement can be viewed as somewhat similar. Although primarily used for rental arrangements, a Lease Agreement can grant temporary rights to use property, similar to how the Louisiana Act of Donation transfers ownership. Both documents create legal obligations and rights regarding property, highlighting the importance of clear agreements in any property-related transaction.

Instructions on Writing Louisiana act of donation

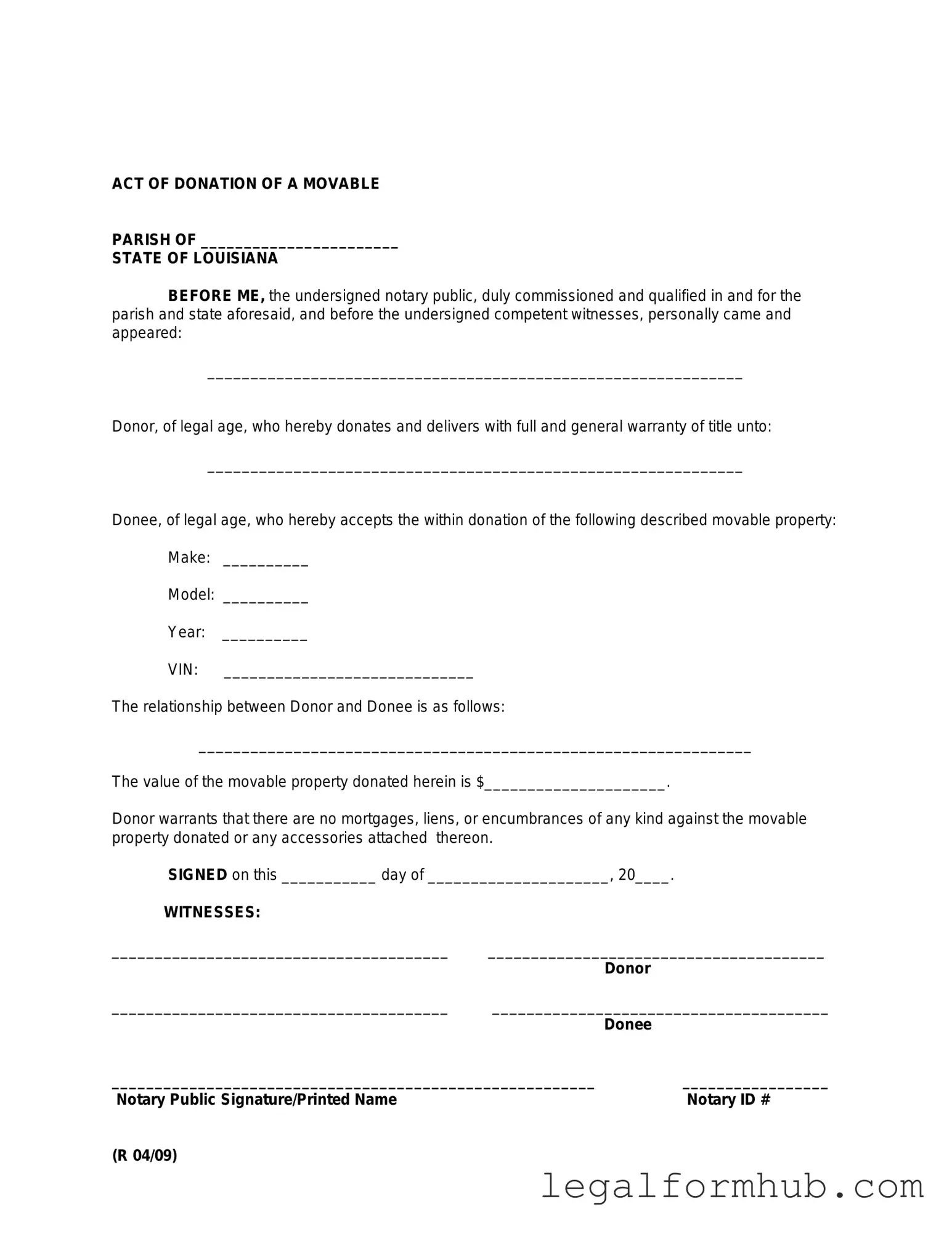

Filling out the Louisiana Act of Donation form requires careful attention to detail. This process involves providing specific information about the donor, the recipient, and the property being donated. Once completed, the form will need to be signed and may require notarization to ensure its validity.

- Obtain the Louisiana Act of Donation form from a reliable source, such as a legal website or local government office.

- Begin by entering the full name and address of the donor in the designated section.

- Next, provide the full name and address of the recipient, ensuring all information is accurate.

- Clearly describe the property being donated. Include details such as the type of property, its location, and any relevant identification numbers.

- Specify any conditions or restrictions related to the donation, if applicable.

- Sign the form in the designated area to indicate your consent and intention to donate the property.

- If required, have the form notarized by a licensed notary public to validate the document.

- Make copies of the completed form for your records and for the recipient.

After filling out the form, the next step involves ensuring that all parties involved understand the terms of the donation. It is advisable to consult with a legal professional if there are any uncertainties regarding the implications of the donation.

Misconceptions

Understanding the Louisiana act of donation form is crucial for anyone involved in property transfer or donation in the state. However, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- It is only for real estate donations. Many believe the act of donation form applies solely to real estate. In reality, it can also be used for personal property, such as vehicles or valuable items.

- Only a lawyer can fill out the form. While legal assistance can be helpful, individuals can complete the form themselves as long as they follow the guidelines provided by the state.

- The form must be notarized to be valid. Notarization is not always required. It depends on the type of property being donated and the specific circumstances surrounding the donation.

- Donations are tax-free for the donor. Donors may still face tax implications, depending on the value of the property and their overall financial situation.

- Once signed, the donation cannot be revoked. This is not entirely true. Under certain conditions, a donor may have the right to revoke the donation before it is accepted by the recipient.

- All donations must be reported to the state. Not every donation requires state reporting. It often depends on the value of the donation and the specific type of property.

- The recipient has no responsibilities. Recipients may have obligations, such as maintaining the property or paying taxes associated with it, depending on the terms of the donation.

- Only individuals can donate property. Organizations and businesses can also use the act of donation form to transfer property to individuals or other entities.

- The act of donation is the same as a will. These are distinct legal documents. A will outlines how a person’s assets will be distributed after death, while an act of donation transfers ownership during the donor's lifetime.

Clarifying these misconceptions can help individuals navigate the donation process more effectively and make informed decisions.

Key takeaways

Here are some key takeaways about filling out and using the Louisiana act of donation form:

- The form is used to legally transfer ownership of property or assets from one person to another without compensation.

- It is important to provide accurate information about both the donor and the recipient to avoid any disputes later.

- The act of donation must be notarized to be legally binding, ensuring that all parties understand the terms.

- Consider including a detailed description of the donated property to prevent any confusion regarding what is being transferred.

- Both parties should retain copies of the signed form for their records, as this serves as proof of the donation.

- Consulting with a legal professional can help clarify any questions about the process and ensure compliance with state laws.

- The act of donation can have tax implications, so it may be beneficial to seek advice from a tax professional.

File Information

| Fact Name | Description |

|---|---|

| Definition | The Louisiana Act of Donation form is a legal document used to transfer ownership of property from one person to another without compensation. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1468 through 1474. |

| Types of Donations | Donations can be made for movable or immovable property, including real estate and personal items. |

| Requirements | The form must be signed by both the donor and the donee, and it may require notarization for validity. |

| Revocability | Donations are generally irrevocable unless specified otherwise in the document. |

| Tax Implications | Donations may have tax implications for both the donor and the donee, depending on the value of the property transferred. |