Printable Loan Agreement Document

More Forms:

Letter of Intent to Sue - It can be an opportunity to express your willingness to settle outside of court.

Form 6059B Customs Declaration - This form promotes fair trade practices at the border.

Before finalizing your vehicle sale, it's essential to ensure all necessary documentation is complete. The Florida Motor Vehicle Bill of Sale is an important part of this process, as it not only represents the transfer of ownership but also details important information regarding the vehicle and the involved parties. To streamline this step, you can easily create your document online with the help of services like Fill PDF Forms, ensuring that your transaction is smooth and compliant with state regulations.

How Can I Get a Free Copy of My Birth Certificate - This document systematizes and formalizes personal information regarding birth.

Loan Agreement - Tailored for Each State

Loan Agreement Form Subtypes

Similar forms

A promissory note is a financial document that outlines a promise to pay a specified amount of money to a lender at a designated time. Similar to a Loan Agreement, it includes essential details such as the loan amount, interest rate, and repayment schedule. However, while a Loan Agreement may cover broader terms and conditions, a promissory note is often more straightforward and focuses primarily on the borrower's commitment to repay the loan. Both documents serve to protect the lender's interests, but the promissory note is typically shorter and less detailed.

A mortgage agreement is another document closely related to a Loan Agreement, particularly in real estate transactions. This type of agreement secures a loan with the property being purchased as collateral. Like a Loan Agreement, it details the terms of the loan, including the amount borrowed, interest rate, and repayment terms. However, a mortgage agreement specifically addresses the rights and responsibilities of both the borrower and lender concerning the property. If the borrower defaults, the lender has the right to foreclose on the property, which is a significant distinction from a standard Loan Agreement.

A credit agreement, often used in business financing, shares similarities with a Loan Agreement in that it outlines the terms under which a borrower can access funds from a lender. It specifies the credit limit, interest rates, and repayment terms. While a Loan Agreement typically involves a specific loan amount with a fixed repayment schedule, a credit agreement may allow for ongoing borrowing and repayment, making it more flexible. Both documents aim to establish clear expectations for repayment and protect the interests of the lender.

An installment agreement is another document that bears resemblance to a Loan Agreement. This type of agreement outlines the terms under which a borrower agrees to repay a loan in regular installments over a specified period. Like a Loan Agreement, it includes the loan amount, interest rate, and payment schedule. The key difference lies in the structure of repayment; an installment agreement often breaks down payments into smaller, more manageable amounts, making it easier for borrowers to budget their finances.

In addition to the legal agreements that facilitate financial transactions, it is essential to consider other critical documents, such as a Colorado Power of Attorney form, which provides the principal the ability to authorize someone to act on their behalf. This important legal document allows for decision-making in financial or health-related matters when the principal is unable to communicate directly. For more information, you can refer to the POA.

A lease agreement can also be compared to a Loan Agreement, particularly when it comes to financing equipment or property. While a Loan Agreement involves borrowing money, a lease agreement allows a borrower to use an asset for a specified period in exchange for regular payments. Both documents outline the terms of the financial arrangement, including payment amounts and durations. However, a lease agreement typically does not transfer ownership of the asset to the lessee, whereas a Loan Agreement usually culminates in ownership of the financed item upon repayment.

Finally, a partnership agreement may resemble a Loan Agreement in the context of financing a business venture. This document outlines the terms of a partnership, including the contributions of each partner and how profits and losses will be shared. Similar to a Loan Agreement, it establishes clear expectations and responsibilities among the parties involved. However, while a Loan Agreement focuses on borrowing and repayment, a partnership agreement emphasizes collaboration and the sharing of resources, making it distinct in its purpose and structure.

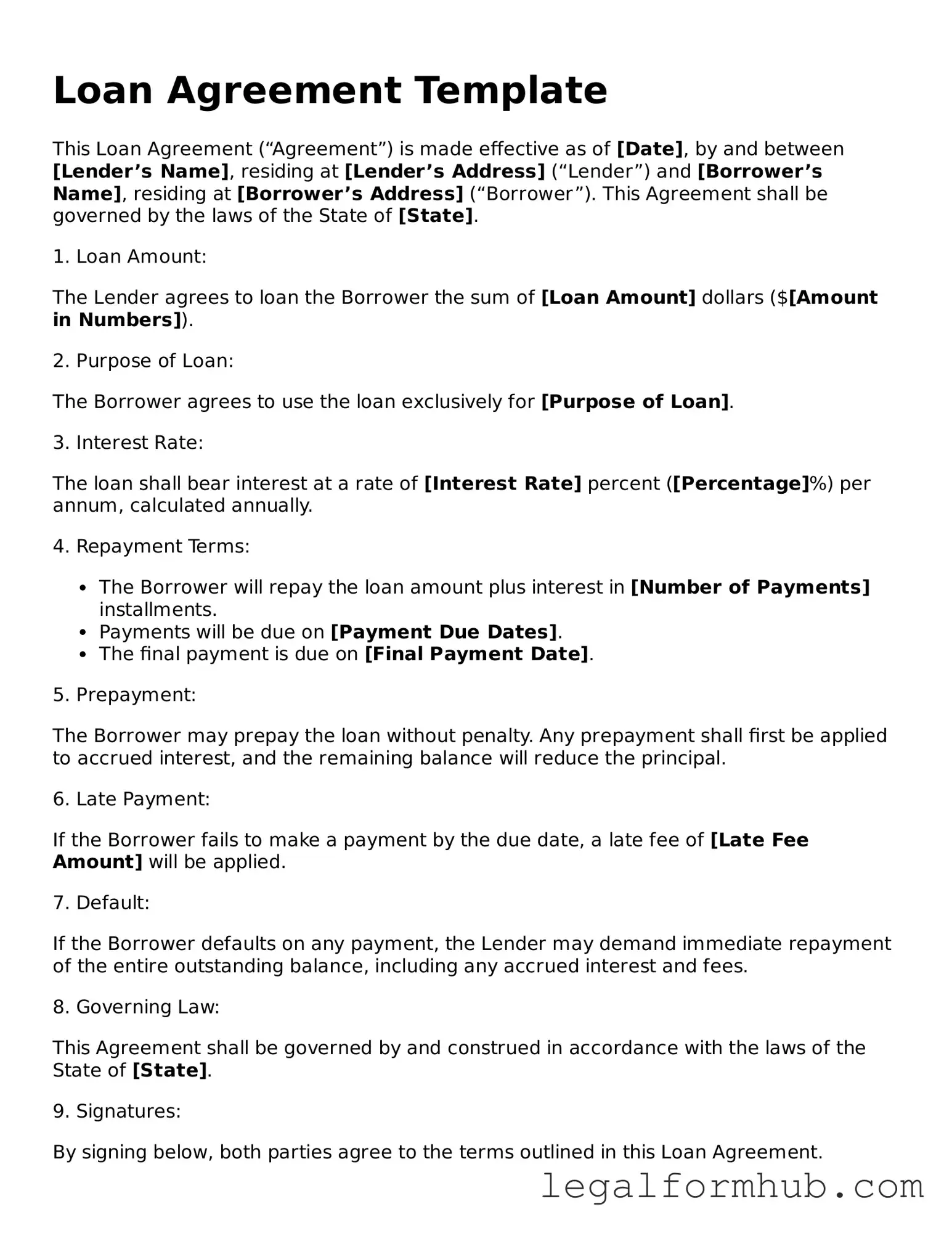

Instructions on Writing Loan Agreement

Completing a Loan Agreement form is an important step in securing a loan. By following the instructions carefully, you can ensure that all necessary information is accurately provided. This will help facilitate the loan process and protect the interests of all parties involved.

- Begin by entering the date at the top of the form. This date should reflect when the agreement is being completed.

- Fill in the names and contact information of both the lender and the borrower. Make sure to include addresses and phone numbers for clarity.

- Specify the total loan amount being requested. This should be clearly stated in both numerical and written form.

- Indicate the interest rate applicable to the loan. This can be a fixed or variable rate; specify which one applies.

- Outline the repayment terms, including the duration of the loan and the frequency of payments (monthly, quarterly, etc.).

- Provide details about any collateral offered, if applicable. This can help secure the loan and protect the lender's interests.

- Include any additional terms or conditions that may apply to the loan. This can cover late fees, prepayment options, or other relevant details.

- Both parties should sign and date the form at the bottom. This signifies agreement to the terms outlined in the document.

After completing the form, review all entries for accuracy. Once confirmed, ensure that both parties retain a copy for their records. This will help maintain clarity and accountability throughout the loan period.

Misconceptions

Understanding the Loan Agreement form is crucial for anyone involved in borrowing or lending money. However, several misconceptions can lead to confusion. Here are nine common misconceptions:

- Loan Agreements are only for large amounts. Many believe that loan agreements are only necessary for significant loans. In reality, even small loans can benefit from a written agreement to clarify terms and protect both parties.

- Verbal agreements are sufficient. Some think that a verbal agreement is enough to secure a loan. However, without a written document, it can be challenging to enforce the terms if disputes arise.

- All Loan Agreements are the same. Not all loan agreements are identical. Each agreement should be tailored to fit the specific terms and conditions agreed upon by the parties involved.

- Loan Agreements are only for banks. While banks often use loan agreements, they are also essential for personal loans, peer-to-peer lending, and business transactions.

- Once signed, a Loan Agreement cannot be changed. Many believe that a signed agreement is set in stone. In fact, parties can negotiate changes, but it should be documented in writing to avoid misunderstandings.

- Loan Agreements are only necessary for formal lenders. Even informal loans between friends or family can benefit from a written agreement to prevent potential conflicts and misunderstandings.

- Interest rates are fixed and cannot be negotiated. Some people think that interest rates in loan agreements are non-negotiable. However, borrowers can often negotiate rates based on their creditworthiness and other factors.

- Loan Agreements protect only the lender. A common misconception is that these agreements only serve the lender's interests. In reality, they protect both parties by clearly outlining obligations and expectations.

- Loan Agreements are not legally binding. Some believe that a loan agreement has no legal standing. However, a properly drafted agreement is enforceable in court, provided it meets the necessary legal requirements.

Addressing these misconceptions can help individuals navigate the borrowing and lending process more effectively. Understanding the importance of a Loan Agreement is key to ensuring a smooth transaction.

Key takeaways

Filling out a Loan Agreement form is an important step in securing a loan. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Loan Agreement outlines the terms of the loan, including the amount borrowed, interest rate, and repayment schedule.

- Provide Accurate Information: Ensure that all personal and financial information is accurate. Mistakes can lead to delays or complications.

- Review the Terms: Carefully read the terms and conditions. Understand your obligations and rights as a borrower.

- Interest Rates Matter: Pay attention to the interest rates. They can significantly affect the total amount you will repay.

- Repayment Schedule: Know when payments are due. Missing a payment can result in penalties or damage to your credit score.

- Seek Clarification: If any terms are unclear, ask questions. It’s important to fully understand what you are agreeing to.

- Keep a Copy: After signing, keep a copy of the Loan Agreement for your records. This can help in case of disputes or misunderstandings.

By following these guidelines, you can navigate the Loan Agreement process more confidently and effectively.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | A Loan Agreement outlines the terms and conditions under which a borrower receives funds from a lender. |

| Parties Involved | The agreement typically includes the lender and the borrower, clearly identifying each party. |

| Governing Law | The agreement is subject to the laws of the state where it is executed. For example, in California, it follows California Civil Code. |

| Repayment Terms | Details about how and when the borrower will repay the loan are specified, including interest rates and payment schedules. |

| Default Clauses | It outlines what happens if the borrower fails to repay the loan, including possible penalties or legal actions. |