Printable Letter of Intent to Purchase Business Document

Common Letter of Intent to Purchase Business Documents:

Sample Letter of Intent to Homeschool - Using this form, you can outline your educational objectives for the year ahead.

Completing the Alabama Homeschool Letter of Intent accurately is crucial for parents embarking on their homeschooling journey, as it informs the local school system of their educational choice. For additional guidance on filling out this essential form, visit homeschoolintent.com/editable-alabama-homeschool-letter-of-intent to ensure all requirements are met effectively.

Letter of Intent Grant Template - Explain how your project aligns with funder priorities.

How to Write a Letter of Intent for Commercial Lease - This letter can highlight the importance of lease flexibility for business growth.

Similar forms

A Memorandum of Understanding (MOU) is often used in business transactions to outline the intentions of the parties involved. Similar to a Letter of Intent, an MOU establishes a framework for negotiations and clarifies the key terms of a potential agreement. While an MOU may not be legally binding, it serves as a useful tool for ensuring that all parties are on the same page before moving forward. This document often includes details about the scope of the project, responsibilities, and timelines, making it a valuable precursor to more formal agreements.

An Offer to Purchase is another document closely related to a Letter of Intent. This offer is typically more formal and is presented by a buyer to a seller, outlining the terms under which the buyer is willing to purchase a business. It includes specifics such as the purchase price, payment terms, and any contingencies that must be met. Unlike a Letter of Intent, which is more exploratory, an Offer to Purchase indicates a serious intent to buy and can lead directly to a binding contract if accepted.

A Term Sheet serves a similar purpose by summarizing the main points of a proposed agreement. It outlines the key terms and conditions that both parties agree to discuss further. While it is not a legally binding document, a Term Sheet provides clarity and direction for negotiations, much like a Letter of Intent. It often includes details about pricing, timelines, and any necessary conditions that must be met before finalizing the deal.

A Non-Disclosure Agreement (NDA) can also be compared to a Letter of Intent, especially when confidentiality is crucial in the negotiation process. An NDA protects sensitive information shared between parties during discussions. While the Letter of Intent expresses intent to engage in a transaction, the NDA ensures that proprietary information remains confidential. This allows both parties to freely share information without fear of it being disclosed to outside parties.

A Purchase Agreement is a more formal and comprehensive document that follows a Letter of Intent. It serves as the final contract that outlines the terms and conditions of the sale. This document includes all details necessary for the transaction, such as price, payment methods, and the obligations of both parties. While a Letter of Intent expresses preliminary interest, the Purchase Agreement solidifies the deal and is legally binding.

A Business Plan may also share similarities with a Letter of Intent, particularly in how it outlines the vision and strategy for a business transaction. While a Letter of Intent focuses on the intent to purchase, a Business Plan provides a detailed roadmap for how the business will operate post-acquisition. It includes market analysis, financial projections, and operational plans, making it a crucial document for both buyers and sellers to consider during negotiations.

Parents considering homeschooling in California may find it essential to familiarize themselves with the necessary documentation, including the California Homeschool Letter of Intent form, which can be found at OnlineLawDocs.com. This form is integral in notifying the school district of a child's homeschooling status, ensuring compliance with state educational requirements.

Finally, a Due Diligence Checklist is an important document that often follows a Letter of Intent. It outlines the information and documentation required to evaluate the business being purchased. This checklist helps buyers ensure they have all necessary data to make an informed decision. While a Letter of Intent indicates a willingness to proceed, the Due Diligence Checklist serves as a practical tool to assess the viability of the transaction before finalizing any agreements.

Instructions on Writing Letter of Intent to Purchase Business

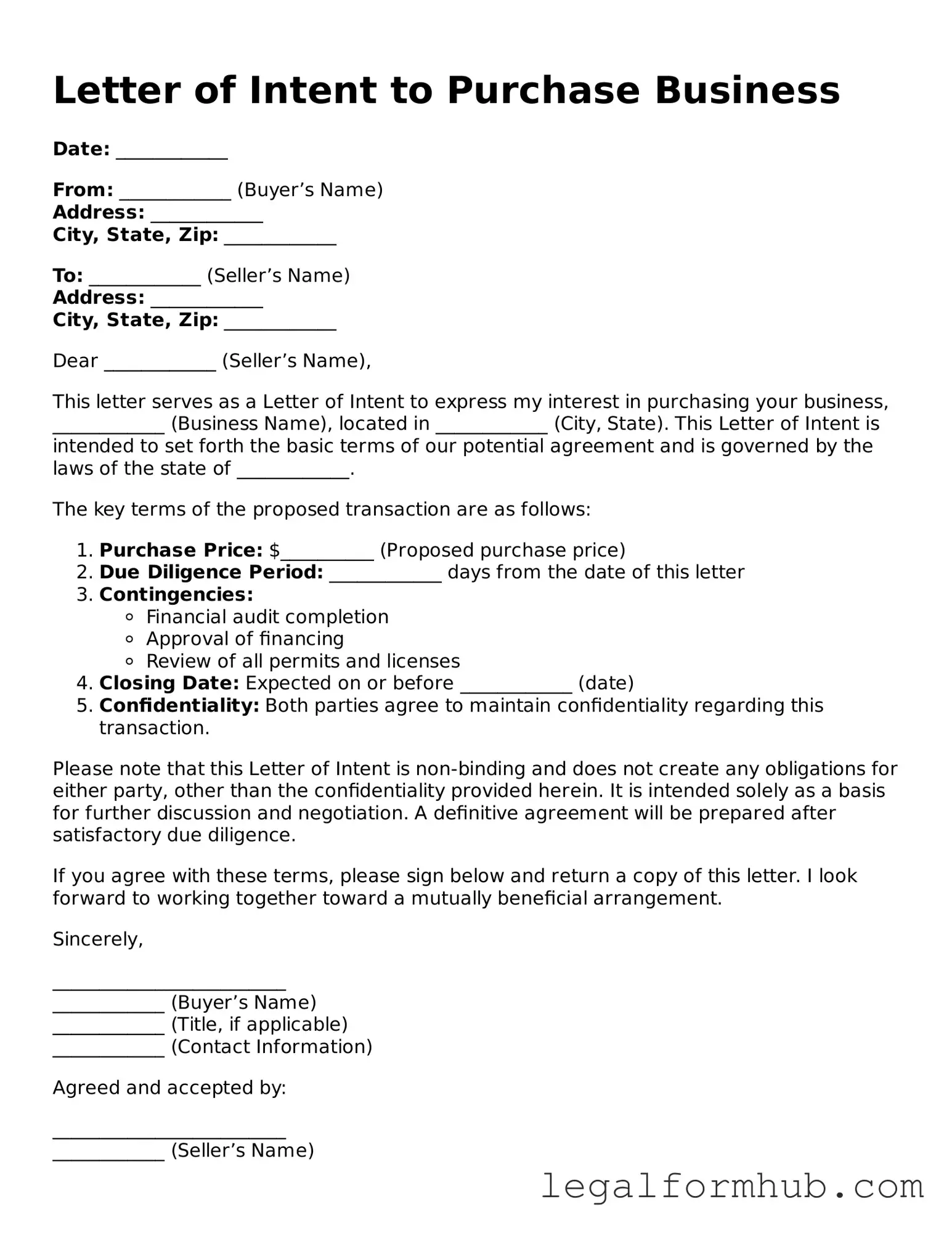

Once you have decided to move forward with purchasing a business, filling out the Letter of Intent to Purchase Business form is a crucial step. This document outlines your intentions and sets the stage for negotiations. It’s important to be thorough and precise to ensure clarity for both parties involved.

- Begin with Your Information: At the top of the form, enter your full name, address, phone number, and email. This establishes your identity as the buyer.

- Seller’s Information: Next, fill in the details of the seller. Include their name, address, and contact information. This identifies the party you are negotiating with.

- Business Details: Provide the name of the business you wish to purchase. Include any relevant identifiers, such as the business address and any registration numbers.

- Purchase Price: Clearly state your proposed purchase price for the business. If there are contingencies or conditions affecting the price, note those as well.

- Terms and Conditions: Outline any specific terms you wish to include. This could involve payment terms, financing arrangements, or conditions that must be met before the sale can proceed.

- Due Diligence Period: Specify the time frame you require to conduct due diligence. This is the period during which you will assess the business’s financial health and operational status.

- Confidentiality Clause: If you want to ensure that sensitive information remains private, include a confidentiality clause. This protects both parties during negotiations.

- Signature Line: Finally, sign and date the form. This signifies your agreement to the terms outlined and your intention to move forward with the purchase.

After completing the form, you will typically present it to the seller. This document serves as a foundation for further discussions and negotiations. Be prepared to engage in dialogue about the details, as both parties will likely have questions and may wish to adjust terms before finalizing any agreements.

Misconceptions

Understanding the Letter of Intent (LOI) to Purchase a Business is crucial for anyone involved in a business transaction. However, several misconceptions can cloud judgment and lead to confusion. Here’s a breakdown of ten common misconceptions:

-

An LOI is a legally binding contract.

Many believe that an LOI is a formal contract. In reality, it usually outlines intentions and is often non-binding, except for specific clauses like confidentiality.

-

An LOI guarantees the sale will happen.

Some think that signing an LOI means the sale is guaranteed. However, it merely expresses interest and outlines terms for further negotiation.

-

The LOI can’t be changed once signed.

This is not true. Parties can negotiate terms and amend the LOI before finalizing the sale agreement.

-

An LOI is only necessary for large transactions.

While often used in significant deals, an LOI can be beneficial for transactions of any size to clarify intentions.

-

All LOIs are the same.

Each LOI can differ significantly based on the specifics of the transaction, the parties involved, and the business context.

-

LOIs are only for buyers.

Sellers can also benefit from an LOI as it helps outline their expectations and conditions for the sale.

-

LOIs are unnecessary if a buyer and seller have already agreed on a price.

Even with an agreed price, an LOI can help clarify other essential terms and conditions before drafting a formal contract.

-

Legal advice is not needed for an LOI.

While it may not be a formal contract, seeking legal advice can help ensure that the LOI accurately reflects the intentions of both parties.

-

Once an LOI is signed, the buyer has exclusive rights to the business.

This misconception can lead to disappointment. An LOI does not typically grant exclusive negotiation rights unless specifically stated.

-

LOIs are only for business purchases.

LOIs can be used in various transactions, including real estate and partnerships, not just business acquisitions.

By addressing these misconceptions, individuals can approach the Letter of Intent with a clearer understanding, making the process smoother and more effective.

Key takeaways

When considering the Letter of Intent to Purchase Business form, there are several important points to keep in mind. This document serves as a preliminary agreement between a buyer and a seller, outlining the basic terms of a potential transaction.

- Clarity is Key: Clearly outline the terms and conditions of the proposed sale. This includes the purchase price, payment terms, and any contingencies that may apply.

- Confidentiality Matters: Include a confidentiality clause to protect sensitive information. This ensures that both parties keep the details of the transaction private.

- Intent to Proceed: The letter signifies the buyer's serious intent to move forward with the purchase. It sets the stage for further negotiations and due diligence.

- Non-Binding Nature: Understand that while the letter expresses intent, it is typically non-binding. This means that either party can withdraw from negotiations without legal repercussions, unless otherwise specified.

Using this form effectively can streamline the purchasing process and help both parties align their expectations.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A Letter of Intent to Purchase Business outlines the preliminary agreement between a buyer and seller regarding the sale of a business. |

| Purpose | This document serves to express interest and outline the basic terms of the proposed transaction. |

| Non-Binding Nature | Typically, the letter is non-binding, meaning it does not legally obligate either party to complete the sale. |

| Key Components | Common components include purchase price, payment terms, and a timeline for due diligence. |

| Confidentiality Clause | Many letters include a confidentiality clause to protect sensitive information during negotiations. |

| State-Specific Forms | Some states may have specific forms or requirements. For example, California governs such agreements under the California Civil Code. |

| Due Diligence | The letter often outlines a period for due diligence, allowing the buyer to investigate the business before finalizing the purchase. |

| Expiration Date | It is common for the letter to include an expiration date, after which the terms may no longer be valid. |

| Negotiation Tool | The letter can serve as a tool for negotiation, helping both parties clarify expectations before entering a formal agreement. |

| Legal Review | It is advisable for both parties to have the letter reviewed by legal counsel to ensure clarity and compliance with applicable laws. |