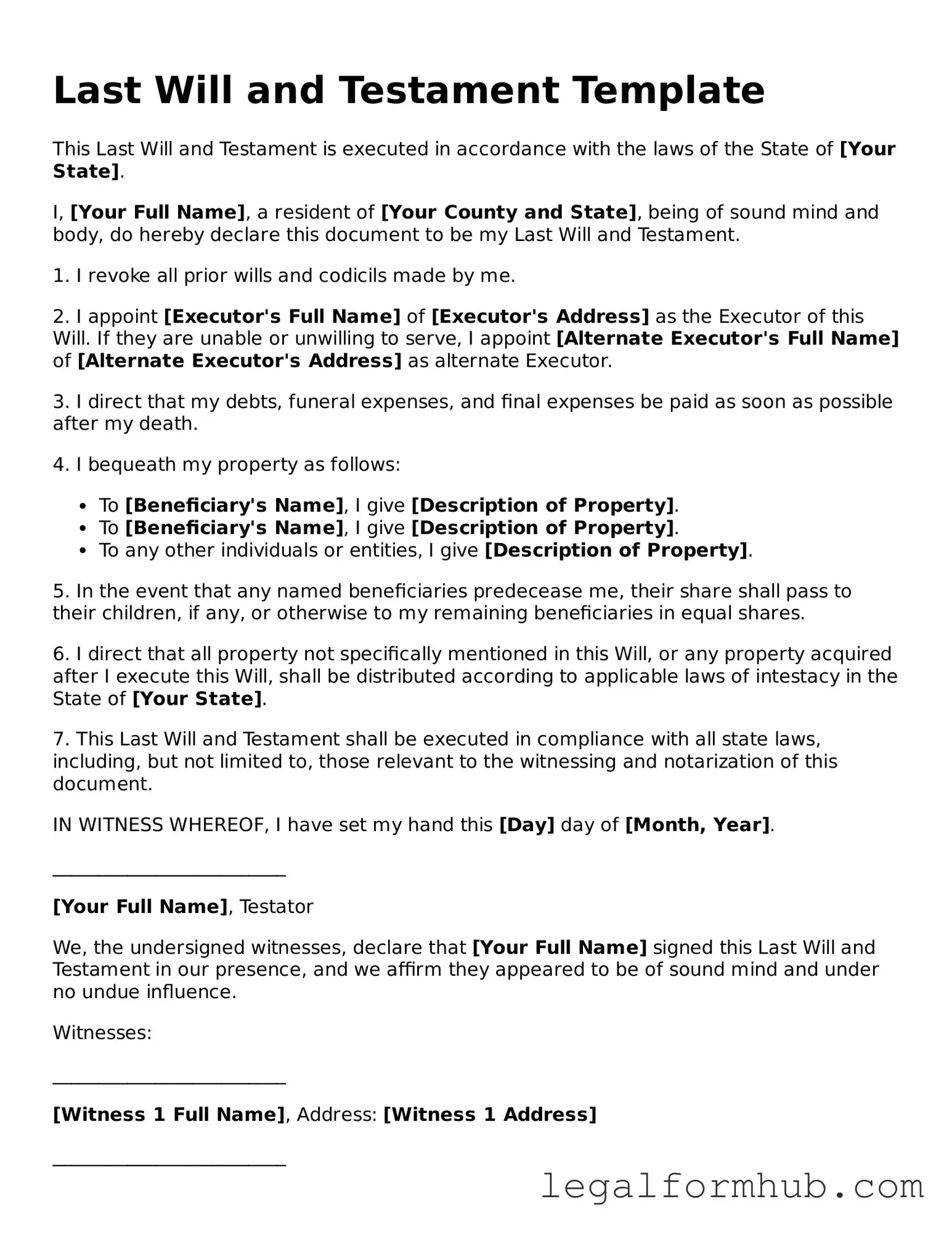

Printable Last Will and Testament Document

More Forms:

Aircraft Bill of Sale Example - The AC 8050-2 assists in ensuring compliance with federal regulations.

When engaging in a transaction, it is crucial to have a complete understanding of the associated documents; for example, you can reference a Sales Receipt to clearly confirm the details of your purchase or sale, ensuring all parties are aware of their rights and responsibilities.

Trader Joes Application - Committed to sustainable practices and promoting environmentally-friendly products.

How to Write a Daily Report to Your Boss - Include specific days of the week to track shifts accurately.

Last Will and Testament - Tailored for Each State

Last Will and Testament Form Subtypes

Similar forms

A Living Will is a crucial document that, like a Last Will and Testament, expresses an individual's wishes. However, while a Last Will outlines how assets should be distributed after death, a Living Will focuses on healthcare decisions during a person's lifetime. It specifies what medical treatments a person does or does not want if they become unable to communicate their preferences. Both documents serve to protect individual rights and ensure that personal wishes are respected, but they operate in different contexts—one for after death and the other for medical care while living.

A Power of Attorney (POA) is another important legal document that shares similarities with a Last Will and Testament. Both documents allow individuals to express their intentions regarding their affairs. A Last Will directs how assets will be managed and distributed after death, while a Power of Attorney designates someone to make decisions on your behalf during your lifetime, especially if you become incapacitated. This could include financial decisions, legal matters, or healthcare choices. Both documents empower individuals to take control of their future, albeit in different ways.

To streamline your vehicle transaction process, it's essential to have the necessary documentation ready, ensuring all requirements are met. One such important document is the Florida Motor Vehicle Bill of Sale, which acts as proof of ownership transfer between buyer and seller. This form includes vital information about both the vehicle and the parties involved, helping to avoid misunderstandings during the transaction. To facilitate this process, you can easily access and complete the form through Fill PDF Forms, ensuring a smooth and compliant vehicle exchange.

Trusts, particularly revocable living trusts, are similar to Last Wills in that they both facilitate the transfer of assets upon death. A Last Will goes through probate, which can be a lengthy process, while a trust allows for a more private and often quicker distribution of assets. With a trust, individuals can specify how and when their assets will be distributed to beneficiaries, which can help avoid family disputes. Both documents serve to manage an individual's estate but do so through different mechanisms.

Advance Healthcare Directives are closely related to Living Wills but can encompass broader healthcare preferences. Like a Last Will, which outlines how one's estate should be handled, an Advance Healthcare Directive provides instructions regarding medical treatment and appoints someone to make decisions if the individual cannot. This document ensures that a person's healthcare wishes are honored, similar to how a Last Will ensures that their financial wishes are respected after death. Both documents emphasize the importance of personal choice in critical situations.

Beneficiary Designations are also akin to a Last Will and Testament, as they dictate how certain assets are distributed upon death. Many financial accounts, such as life insurance policies and retirement accounts, allow individuals to name beneficiaries directly. This means that those assets can bypass probate, similar to how assets in a trust are handled. While a Last Will covers all assets, beneficiary designations specifically target certain accounts, ensuring that specific individuals receive those assets directly. Both serve to clarify intentions and streamline the transfer of property after death.

Instructions on Writing Last Will and Testament

Completing a Last Will and Testament form is an important step in ensuring that your wishes regarding the distribution of your assets are clearly articulated. After filling out the form, it is advisable to review the document carefully and seek any necessary legal advice to ensure that it meets state requirements.

- Begin by obtaining a blank Last Will and Testament form. Ensure that it is the correct version for your state.

- At the top of the form, write your full legal name and current address.

- Clearly state that this document is your Last Will and Testament.

- Designate an executor by naming the person you trust to carry out your wishes. Include their full name and address.

- List your beneficiaries. Include their names, addresses, and the specific assets or percentages of your estate they will receive.

- Identify any guardians for your minor children, if applicable. Provide their names and addresses.

- Include any specific bequests. These are items or amounts you wish to leave to particular individuals or organizations.

- Sign and date the document in the presence of witnesses. Most states require at least two witnesses.

- Have your witnesses sign the form, including their names and addresses. Ensure they are not beneficiaries of the will.

- Store the signed document in a safe place and inform your executor and family members of its location.

Misconceptions

Many people have misunderstandings about the Last Will and Testament form. Here are seven common misconceptions:

- A will only takes effect after death. While it is true that a will is executed upon death, it also serves as a legal document that outlines a person's wishes regarding their estate. It provides clarity and direction for loved ones during a difficult time.

- Only wealthy individuals need a will. This is not accurate. Everyone can benefit from having a will, regardless of their financial situation. A will helps ensure that your assets, no matter how modest, are distributed according to your wishes.

- Oral wills are just as valid as written ones. In most states, a written will is required for it to be legally binding. Oral wills, also known as nuncupative wills, are recognized in very limited circumstances and can lead to disputes.

- Once a will is made, it cannot be changed. This is a common myth. A will can be amended or revoked at any time, as long as the person is of sound mind. Updating a will is often necessary to reflect life changes.

- All debts must be paid before any inheritance is distributed. While debts are typically settled from the estate before distribution, some assets may pass directly to beneficiaries, depending on how they are titled. It's important to understand how this works in your state.

- Having a will avoids probate. A will does not avoid probate; it actually must go through the probate process to be validated. However, there are other estate planning tools that can help minimize or avoid probate.

- Wills are only for distributing property. A will can do much more than just distribute property. It can also appoint guardians for minor children, specify funeral arrangements, and provide instructions for managing your estate.

Key takeaways

When preparing a Last Will and Testament, it is essential to understand several key points. The following list outlines important takeaways to consider:

- Clearly identify yourself at the beginning of the document. Include your full name and address to avoid any confusion.

- Designate an executor. This person will be responsible for ensuring that your wishes are carried out after your passing.

- Be specific about your assets. Clearly list all significant assets, including real estate, bank accounts, and personal belongings.

- Include beneficiaries. Specify who will receive your assets and in what proportions.

- Consider guardianship for minor children. If applicable, name a guardian to care for your children in the event of your death.

- Sign the document in the presence of witnesses. Most states require at least two witnesses to validate the will.

- Check state laws. Requirements for wills can vary by state, so ensure compliance with local regulations.

- Review and update your will regularly. Life changes, such as marriage, divorce, or the birth of children, may necessitate updates.

- Store the will safely. Keep the document in a secure location, such as a safe or with your attorney, and inform your executor of its location.

- Consider consulting a legal professional. While it is possible to create a will independently, seeking legal advice can provide peace of mind.

By keeping these points in mind, you can create a Last Will and Testament that accurately reflects your wishes and provides clarity for your loved ones.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| Governing Law | Each state has its own laws governing wills. For example, in California, the Probate Code regulates wills. |

| Requirements | Most states require the testator (the person making the will) to be at least 18 years old and of sound mind. |

| Witnesses | Typically, a will must be signed in the presence of at least two witnesses who are not beneficiaries. |

| Revocation | A Last Will can be revoked or amended at any time before the testator's death, provided the legal requirements are met. |

| Probate Process | After death, the will usually goes through probate, a legal process to validate the will and distribute assets accordingly. |