Printable Lady Bird Deed Document

Common Lady Bird Deed Documents:

Corrective Deed California - A Corrective Deed is effective for amending past transactions.

Problems With Transfer on Death Deeds California - This legal tool is recognized in many states, promoting thoughtful estate planning.

To facilitate the smooth transfer of motorcycle ownership, it is important to complete all necessary documentation, including the California Motorcycle Bill of Sale form, which outlines key information about the motorcycle and the parties involved. You can easily obtain the form and begin the process by visiting Fill PDF Forms, ensuring a hassle-free transaction.

What Is a Gift Deed in Real Estate - It is recommended to notarize the Gift Deed for added legal credibility.

Lady Bird Deed - Tailored for Each State

Similar forms

The Lady Bird Deed, often known as an enhanced life estate deed, is similar to a traditional life estate deed. Both documents allow the property owner to retain the right to live in and use the property during their lifetime. However, the key difference lies in the ability to sell or mortgage the property without the consent of the remaindermen. In a traditional life estate deed, the remaindermen have a vested interest in the property, which can complicate the owner's ability to manage the asset. The Lady Bird Deed offers greater flexibility and control to the property owner, making it a preferred choice for many.

A quitclaim deed also shares similarities with the Lady Bird Deed, particularly in its function of transferring property rights. A quitclaim deed allows an individual to transfer whatever interest they have in a property without making any guarantees about the title. While it does not provide the same life estate benefits as the Lady Bird Deed, it is often used to clear up title issues or transfer property between family members. The simplicity of a quitclaim deed can make it a quick solution for property transfers, but it lacks the protective features that a Lady Bird Deed offers.

If you are considering buying or selling an all-terrain vehicle, it is crucial to understand the significance of the necessary documents involved in the process. For comprehensive guidance on completing the ATV Bill of Sale, visit our detailed ATV Bill of Sale form overview.

Another document that aligns with the Lady Bird Deed is the transfer-on-death (TOD) deed. A TOD deed allows property owners to designate a beneficiary who will automatically receive the property upon the owner's death, bypassing probate. While both the Lady Bird Deed and the TOD deed aim to simplify the transfer of property and avoid probate, the Lady Bird Deed allows the owner to maintain control and use of the property during their lifetime. This control can be crucial for individuals who wish to manage their assets actively until death.

The revocable living trust also shares some characteristics with the Lady Bird Deed. Both are estate planning tools designed to facilitate the transfer of property while avoiding probate. A revocable living trust allows the property owner to place their assets into a trust, which can be managed during their lifetime and distributed according to their wishes after death. However, unlike the Lady Bird Deed, a living trust requires the property to be retitled in the name of the trust, which can involve more administrative steps and costs.

Lastly, the special warranty deed is similar to the Lady Bird Deed in that it provides some level of protection to the grantee regarding the title. A special warranty deed guarantees that the grantor has not encumbered the property during their ownership but does not cover issues that may have arisen before that time. While it does not offer the same lifetime control as the Lady Bird Deed, it does provide a degree of assurance to the new owner that the property is free from claims made during the grantor's ownership period.

Instructions on Writing Lady Bird Deed

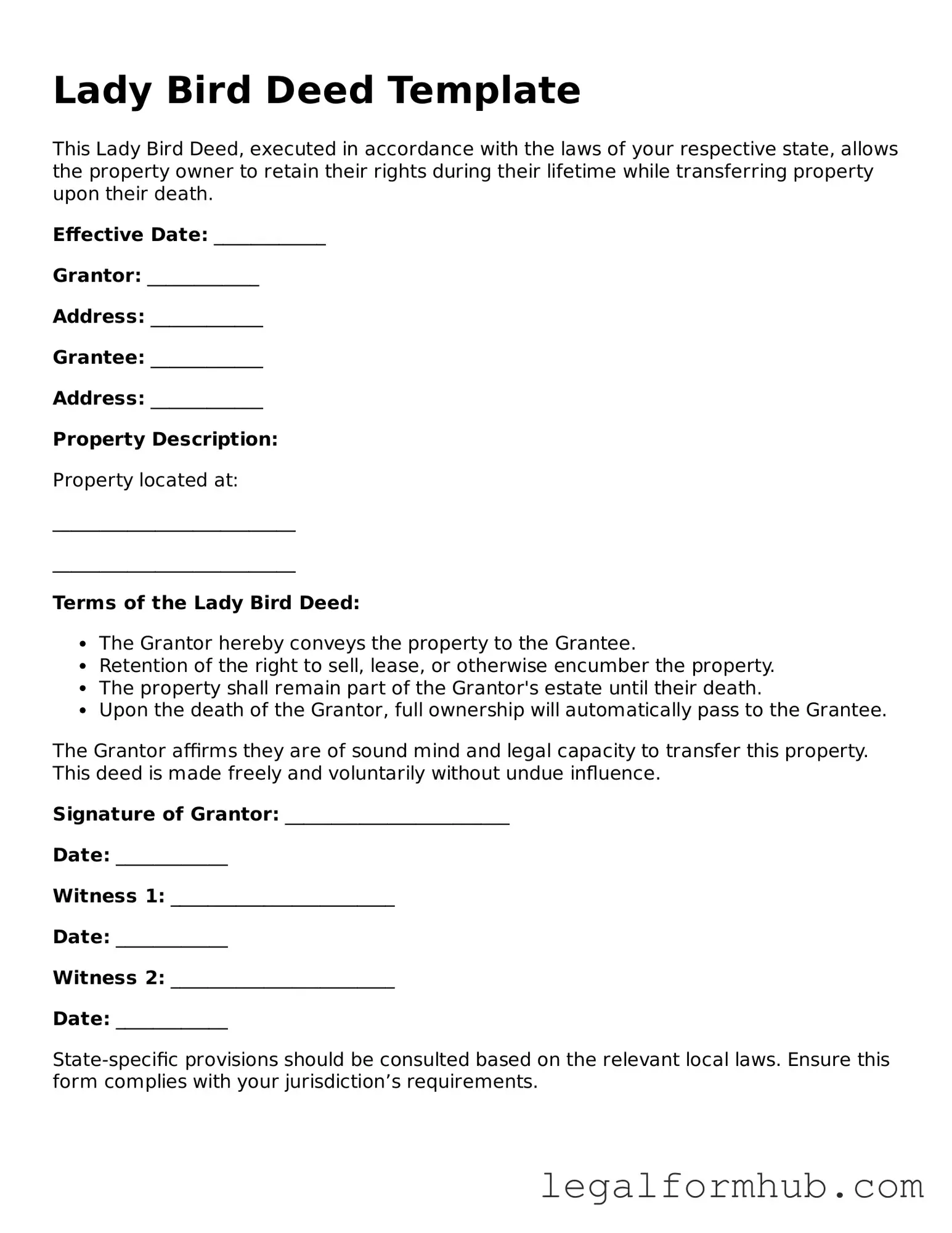

Filling out a Lady Bird Deed form requires careful attention to detail. This document allows property owners to transfer their property to beneficiaries while retaining certain rights. Completing the form accurately is essential for ensuring that the transfer is valid and recognized by the relevant authorities.

- Obtain the Lady Bird Deed form from a reliable source, such as a legal website or your local county clerk's office.

- Begin by entering the name and address of the property owner at the top of the form.

- Provide a clear legal description of the property. This may include the parcel number, lot number, or a description from the property deed.

- List the names of the beneficiaries who will receive the property upon the owner's passing. Include their addresses to ensure clarity.

- Indicate any conditions or restrictions regarding the property transfer, if applicable. This may include rights to live in the property or manage it during the owner’s lifetime.

- Sign and date the form in the designated area. The signature must be that of the property owner.

- Have the form notarized. This step is crucial for the document to be legally binding.

- File the completed and notarized form with the appropriate county office. This ensures the deed is recorded and recognized.

Misconceptions

The Lady Bird Deed, also known as an enhanced life estate deed, is a useful tool for estate planning, but there are several misconceptions surrounding it. Here’s a list of common misunderstandings and clarifications to help you better understand this important legal document.

-

It only applies to married couples.

This is false. A Lady Bird Deed can be used by any individual, regardless of marital status, to transfer property to one or more beneficiaries.

-

It avoids probate completely.

While a Lady Bird Deed can help avoid probate for the property it covers, it does not eliminate the need for probate for other assets not included in the deed.

-

It is the same as a regular life estate deed.

A Lady Bird Deed provides more flexibility than a traditional life estate deed, allowing the grantor to retain control over the property during their lifetime.

-

Once executed, the grantor cannot change it.

This is incorrect. The grantor can revoke or change the Lady Bird Deed at any time before their death, maintaining control over the property.

-

It is only beneficial for tax purposes.

While there can be tax benefits, the primary advantage of a Lady Bird Deed is the ability to transfer property without going through probate.

-

All states recognize the Lady Bird Deed.

This is not true. The Lady Bird Deed is recognized in some states, but not all. It’s essential to check your state’s laws regarding this type of deed.

-

It automatically transfers property upon the grantor's death.

The transfer does occur automatically, but it’s important to ensure that the deed is properly executed to avoid complications.

-

It can only be used for residential properties.

This misconception is misleading. A Lady Bird Deed can be used for various types of real estate, not just residential properties.

-

Beneficiaries can take possession of the property before the grantor's death.

This is false. Beneficiaries do not have the right to occupy or control the property until the grantor passes away.

-

Legal assistance is not necessary to create a Lady Bird Deed.

While it is possible to create one without legal help, consulting an attorney is highly recommended to ensure that the deed is valid and meets your specific needs.

Understanding these misconceptions can help you make informed decisions regarding your estate planning. Always consider seeking professional advice to navigate the complexities of property transfer and estate management.

Key takeaways

The Lady Bird Deed is a useful estate planning tool that allows property owners to transfer their property to beneficiaries while retaining certain rights. Here are some key takeaways about filling out and using the Lady Bird Deed form:

- Retain Control: The property owner can continue to live in and manage the property during their lifetime.

- Automatic Transfer: Upon the owner's death, the property automatically transfers to the designated beneficiaries without going through probate.

- Revocable: The deed can be revoked or altered at any time before the owner's death, providing flexibility.

- Tax Benefits: The property may receive a stepped-up basis for tax purposes, potentially reducing capital gains taxes for heirs.

- Medicaid Planning: The Lady Bird Deed can help protect the property from being counted as an asset for Medicaid eligibility, depending on state laws.

- Simple Process: Filling out the form is generally straightforward, but it must be executed correctly to be valid.

- State-Specific Rules: Laws regarding Lady Bird Deeds vary by state, so it’s important to understand local regulations.

- Legal Guidance: Consulting with an attorney can ensure that the deed meets all legal requirements and aligns with your estate planning goals.

- Beneficiary Designation: Clearly identifying beneficiaries is crucial to avoid disputes and ensure the property goes to the intended individuals.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed allows property owners to transfer their real estate to beneficiaries while retaining the right to use the property during their lifetime. |

| State Usage | Commonly used in states like Florida, Texas, and Michigan, where the deed is recognized under state law. |

| Governing Law | In Texas, the Lady Bird Deed is governed by Texas Property Code § 5.041. |

| Avoiding Probate | One significant benefit is that it allows the property to pass directly to beneficiaries, avoiding probate proceedings. |

| Retained Rights | The property owner retains the right to sell, mortgage, or alter the property without the beneficiaries' consent. |

| Tax Implications | Property transferred through a Lady Bird Deed may receive a step-up in basis, which can reduce capital gains taxes for beneficiaries. |

| Revocability | The deed can be revoked or modified at any time by the property owner, providing flexibility in estate planning. |

| Medicaid Protection | In some states, a Lady Bird Deed can help protect the property from Medicaid estate recovery after the owner's death. |

| Form Requirements | The deed must be executed, notarized, and recorded with the county clerk to be valid. |

| Limitations | Not all states recognize Lady Bird Deeds, and their effectiveness can vary based on local laws and regulations. |