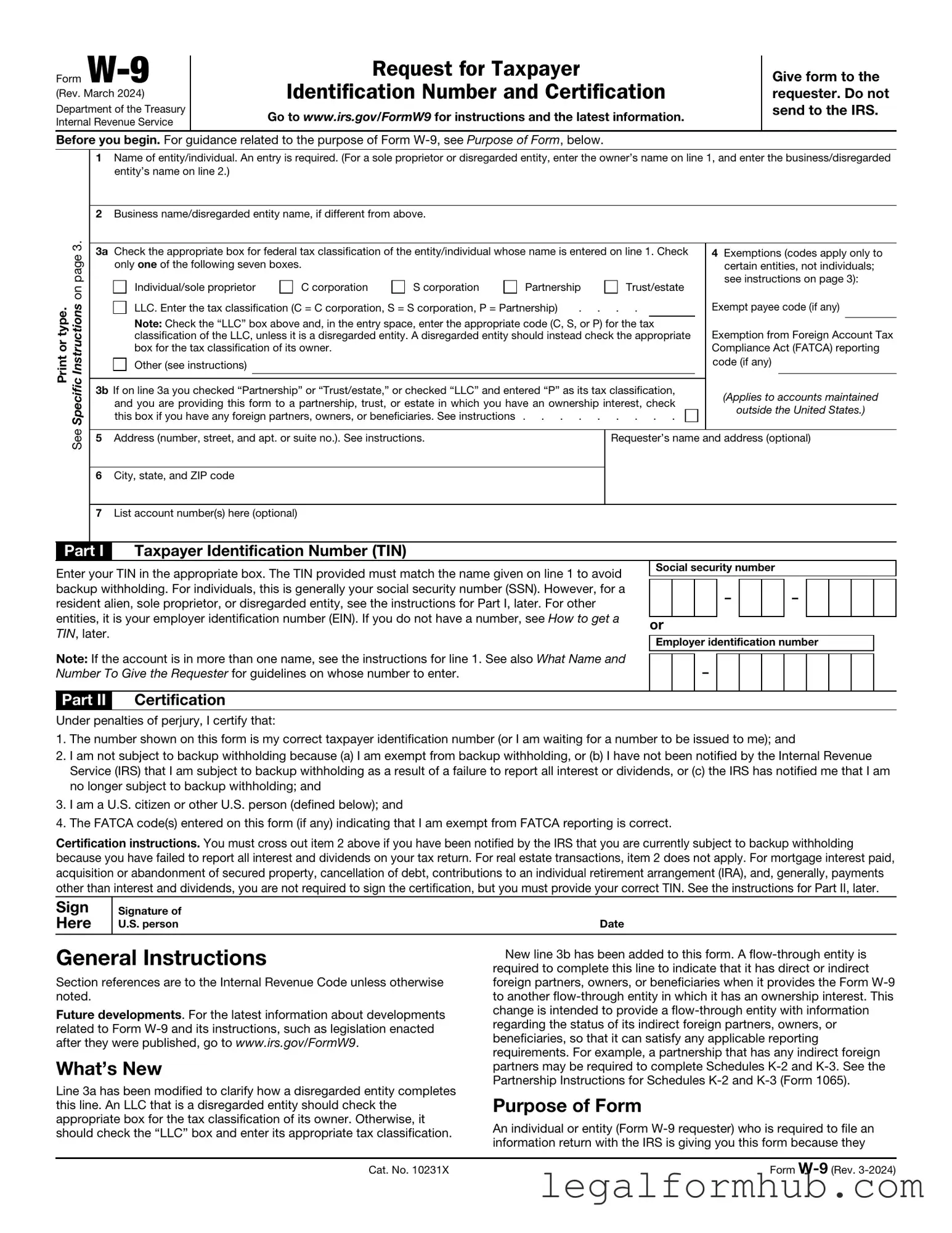

Fill Your IRS W-9 Form

Different PDF Templates

Filing a Lien in Florida - A timely response can prevent further legal complications for the property owner.

To ensure a smooth renting experience, complete your essential lease agreement documentation by utilizing our user-friendly Lease Agreement template.

Dvla Form - If your name or address has changed since your last licence was issued, indicate that on the form.

Free Printable 5 Wishes Form - Five Wishes is legally recognized in most U.S. states, making it a reliable option for planning ahead.

Similar forms

The IRS W-4 form is similar to the W-9 in that both are used to provide information to the IRS for tax purposes. The W-4 is specifically for employees to indicate their tax withholding preferences, while the W-9 is used by independent contractors and freelancers to provide their taxpayer identification information. Both forms help ensure that the correct amount of taxes is withheld or reported, promoting compliance with tax regulations.

For anyone looking to facilitate a transaction, using a well-crafted bill of sale form is crucial. This document ensures both parties are protected and have clear records of the sale details. To learn more about the necessary steps to create this document, visit the resource on the comprehensive bill of sale form.

The 1099 form serves as another related document. It is used to report income received by non-employees, such as independent contractors, freelancers, and other service providers. When a business pays an independent contractor, it typically requires a W-9 to obtain the contractor's taxpayer information. Later, the business uses that information to complete the 1099 form, which reports the payments made to the contractor to the IRS.

The IRS Form 4506-T is also relevant. This form allows taxpayers to request a transcript of their tax return from the IRS. While the W-9 is used to provide taxpayer information, the 4506-T is utilized to verify that information when needed, such as during loan applications or audits. Both forms play a role in ensuring that accurate tax information is available to the IRS and other entities.

The Form SS-4, used to apply for an Employer Identification Number (EIN), is another document that shares similarities with the W-9. While the W-9 collects information from individuals or entities that are already established, the SS-4 is for those who need to obtain a unique identifier for their business. Both forms are essential for tax reporting and compliance purposes.

The Form 1040 is a personal income tax return that individuals file annually. While the W-9 is used to collect taxpayer information, the 1040 is where individuals report their income, deductions, and credits. The information from the W-9 may ultimately be included in the 1040 when independent contractors report their earnings, linking the two forms in the tax reporting process.

Lastly, the Form 1096 is relevant as it serves as a summary of information returns, including 1099 forms. When a business files multiple 1099s, it must also submit a 1096 to the IRS. Like the W-9, which provides taxpayer identification, the 1096 consolidates that information for reporting purposes. Both documents facilitate the accurate reporting of income to the IRS, ensuring compliance with tax laws.

Instructions on Writing IRS W-9

Once you have your IRS W-9 form ready, it’s time to fill it out accurately. Completing this form is essential for providing your taxpayer information to the requester, ensuring that they can report any payments made to you correctly. Below are the steps to guide you through the process of filling out the W-9 form.

- Begin by downloading the IRS W-9 form from the official IRS website or obtaining a physical copy.

- In the first section, enter your name as it appears on your tax return. If you are using a business name, include it in the appropriate section.

- Next, check the box that corresponds to your tax classification. Options include individual, corporation, partnership, or other entities.

- If applicable, provide your business name or disregarded entity name in the designated area.

- Enter your address, including street, city, state, and ZIP code. Make sure this is the address where you receive tax documents.

- Provide your taxpayer identification number (TIN). This can be your Social Security Number (SSN) or Employer Identification Number (EIN).

- If you are exempt from backup withholding, indicate this in the relevant section. If not, you can leave it blank.

- Sign and date the form at the bottom. Your signature certifies that the information provided is accurate.

After completing the form, it’s important to send it to the requester, not the IRS. Ensure that you keep a copy for your records, as it may be needed for future reference.

Misconceptions

The IRS W-9 form is often misunderstood, leading to confusion for many individuals and businesses. Here are ten common misconceptions about the W-9 form, along with clarifications to help you navigate this important document.

- Only freelancers need to fill out a W-9. Many people believe that only independent contractors or freelancers need to complete this form. In reality, anyone who receives certain types of income, including businesses and individuals, may be required to submit a W-9.

- The W-9 form is only for tax purposes. While the primary use of the W-9 is for tax reporting, it also serves to confirm your taxpayer identification number (TIN) and can be used for other financial transactions that require verification of identity.

- Submitting a W-9 means I will be audited. Providing a W-9 does not trigger an audit. It simply allows the payer to report payments made to you to the IRS accurately.

- I don’t need to submit a W-9 if I’m a small business. Small businesses often overlook the need for a W-9. If your business receives payments that require reporting, you must complete and submit the form.

- The W-9 form is the same as a W-4 form. These forms serve different purposes. The W-4 is used by employees to determine withholding allowances, while the W-9 is for independent contractors and others to provide their TIN to payers.

- Once I submit a W-9, it’s permanent. This is not true. If your information changes, such as your name or TIN, you need to submit a new W-9 to ensure accurate reporting.

- I can fill out the W-9 form online and submit it electronically. While you can complete the form digitally, be aware that some payers may require a physical signature or a printed copy. Always check with the requesting party for their submission preferences.

- All payments require a W-9. Not every payment requires a W-9. For example, payments made to corporations typically do not require a W-9, as corporations are generally not subject to 1099 reporting.

- There’s a deadline for submitting a W-9. There is no specific deadline for submitting a W-9 form itself. However, it should be provided to the payer before they issue a 1099 at the end of the tax year.

- Filling out a W-9 guarantees payment. Completing the form does not guarantee that you will receive payment. It simply provides the necessary information for the payer to report payments correctly.

Understanding these misconceptions can help you handle your tax responsibilities more effectively and avoid potential pitfalls. Always ensure that you provide accurate and up-to-date information on your W-9 form.

Key takeaways

The IRS W-9 form is an essential document for individuals and businesses in the United States. It is primarily used for tax purposes. Here are some key takeaways about filling out and using the W-9 form:

- The W-9 form is used to provide your taxpayer identification information to another party, typically a business or individual that will pay you.

- It is important to fill out the form accurately to avoid issues with tax reporting.

- You must provide your name, business name (if applicable), and address on the form.

- For individuals, the taxpayer identification number is usually your Social Security number (SSN).

- Businesses may use an Employer Identification Number (EIN) instead of an SSN.

- Once completed, the W-9 form should be submitted to the requester, not the IRS.

- Keep a copy of the W-9 for your records, as it can be useful for tax filing purposes.

- Requesters use the W-9 information to prepare 1099 forms, which report income to the IRS.

- Failure to provide a W-9 when requested can result in backup withholding on your payments.

- It is advisable to update the W-9 form if your personal or business information changes.

Understanding these key points can help ensure compliance and smooth transactions in your financial dealings.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The IRS W-9 form is used to provide taxpayer information to businesses and individuals for reporting income paid to you. |

| Who Uses It? | Independent contractors, freelancers, and other self-employed individuals commonly use the W-9 form. |

| Tax Identification Number | When filling out the W-9, you must provide your Tax Identification Number (TIN), which can be your Social Security Number (SSN) or Employer Identification Number (EIN). |

| Submission | You do not send the W-9 form to the IRS. Instead, you give it to the person or business requesting it. |

| State-Specific Forms | Some states may have their own versions of the W-9 for local tax reporting. Check your state’s tax authority for specific requirements. |

| Validity | The W-9 form does not expire. However, if your information changes, you should submit a new form. |

| Backup Withholding | If you do not provide a W-9, the payer may withhold a percentage of your payments for taxes, known as backup withholding. |

| Signature Requirement | You must sign and date the form to certify that the information provided is accurate. |