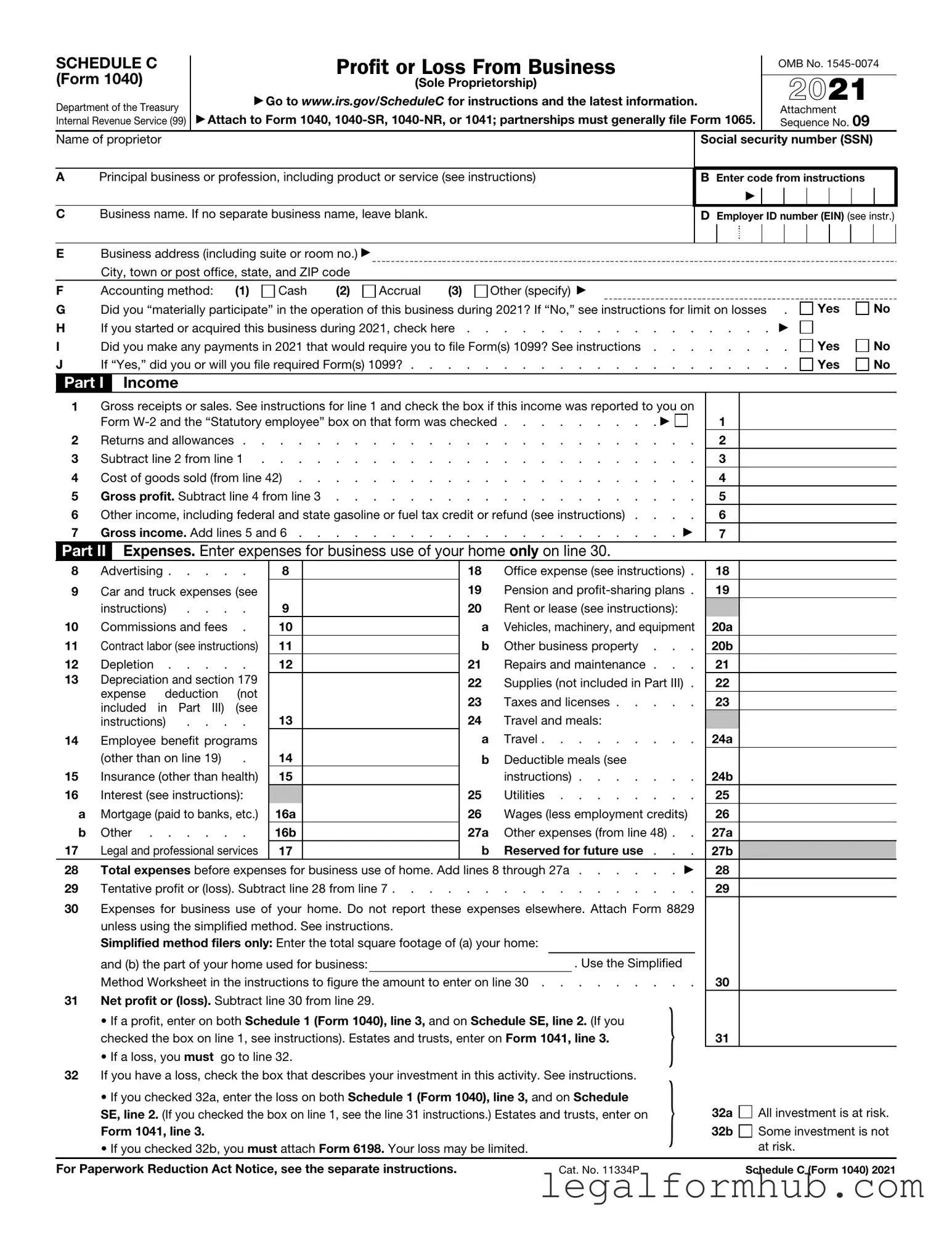

Fill Your IRS Schedule C 1040 Form

Different PDF Templates

Bdsm Form - Identifying and respecting limits promotes well-being.

Editable Dnd Character Sheet - Spell list, detailing the character’s known and prepared spells.

To facilitate the ownership transfer process, it is advisable to use the Fill PDF Forms resource, which provides an easy way to complete the California Boat Bill of Sale form accurately, ensuring all required details are properly captured for both the buyer and seller.

Blank Invoice Template Word - Designed to meet various business needs.

Similar forms

The IRS Schedule C (Form 1040) is similar to the Form 1065, which is used by partnerships to report income, deductions, and profits. Both forms require detailed reporting of business income and expenses. However, while Schedule C is for sole proprietors, Form 1065 is specifically designed for partnerships, reflecting the different business structures and tax implications involved.

Another document that shares similarities with Schedule C is Form 1120, which is used by corporations to report their income and expenses. Like Schedule C, Form 1120 requires a comprehensive breakdown of revenue and deductible expenses. However, the primary distinction lies in the fact that Schedule C is for individual business owners, while Form 1120 is intended for corporate entities, which are taxed separately from their owners.

Form 1040 itself serves as a foundational document for individual tax returns, including income from various sources. Schedule C is an attachment to Form 1040, specifically designed for reporting self-employment income. Both forms require taxpayers to summarize their financial activities for the year, but Schedule C focuses exclusively on business-related income and expenses.

Form 4835 is another document that bears resemblance to Schedule C. It is utilized by individuals who receive rental income from non-owner-occupied property. Both forms require detailed reporting of income and expenses, but Form 4835 is tailored for landlords rather than business owners, reflecting the nuances of rental income taxation.

If you're looking for a reliable way to transfer ownership, consider using a comprehensive Illinois Trailer Bill of Sale form. This will ensure that all necessary details are correctly documented during the transaction. For further guidance, visit the official Trailer Bill of Sale resources.

Form 941, the Employer's Quarterly Federal Tax Return, is related to Schedule C in that it deals with employment taxes. While Schedule C focuses on business income and expenses for sole proprietors, Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Both forms require accurate reporting of financial information, but they serve different purposes in the tax reporting process.

Form 1099-MISC is another document that has similarities with Schedule C, particularly for self-employed individuals. This form is used to report miscellaneous income, including payments made to independent contractors. Individuals who receive 1099-MISC forms may need to report this income on Schedule C, as both documents involve the reporting of income earned outside of traditional employment.

Form 8829 is used to calculate expenses for business use of a home, which can be reported on Schedule C. Both forms require detailed documentation of expenses related to business activities. While Schedule C summarizes overall business income and expenses, Form 8829 specifically addresses the home office deduction, allowing taxpayers to claim a portion of their home expenses as business-related.

Form 4562 is used to report depreciation and amortization of business assets. This form can be relevant for those completing Schedule C, as it allows for the deduction of asset depreciation related to business use. Both forms require careful record-keeping and accurate reporting of financial information, but they focus on different aspects of business expenses.

Form 1040-SR is designed for seniors and is similar to Form 1040, including the Schedule C attachment for self-employed individuals. Both forms provide a means for reporting income and deductions, but Form 1040-SR has a simplified format and larger print to accommodate older taxpayers. The inclusion of Schedule C allows seniors who are self-employed to report their business income in a manner consistent with their overall tax return.

Lastly, Schedule E is relevant for individuals who report income from rental real estate, royalties, partnerships, S corporations, estates, and trusts. While Schedule C is focused on business income from sole proprietorships, Schedule E allows for reporting of income from various other sources. Both schedules require detailed reporting of income and expenses, but they cater to different types of income earners.

Instructions on Writing IRS Schedule C 1040

Filling out the IRS Schedule C (Form 1040) can seem daunting, but with a clear plan, you can complete it with confidence. This form is essential for reporting income or loss from a business you operated or a profession you practiced as a sole proprietor. Below are the steps to guide you through the process.

- Gather all necessary documents, including your income records, expense receipts, and any other relevant financial information.

- Start by entering your name and Social Security number at the top of the form.

- In Part I, report your business income. List your gross receipts or sales, and subtract any returns or allowances to calculate your total income.

- Proceed to Part II, where you will detail your business expenses. Categorize your expenses, such as advertising, car and truck expenses, and supplies, and enter the total for each category.

- Calculate your net profit or loss by subtracting your total expenses from your total income. This figure will be entered at the bottom of Part II.

- If applicable, complete Part III, which pertains to cost of goods sold. This section is relevant if you sell products as part of your business.

- Review the information for accuracy, ensuring that all figures are correctly entered and that you have included all necessary documentation.

- Sign and date the form. If you are filing jointly, your spouse must also sign.

- Make a copy of the completed Schedule C for your records before submitting it with your Form 1040.

Once you have filled out Schedule C, you will attach it to your Form 1040 and file it with the IRS. Ensure that you meet the filing deadlines to avoid penalties. If you have any questions or uncertainties, consider reaching out to a tax professional for assistance.

Misconceptions

Understanding the IRS Schedule C (Form 1040) can be challenging, and several misconceptions often arise. Here are eight common misunderstandings:

- Only self-employed individuals need to file Schedule C. Many people believe that only sole proprietors file this form. However, anyone who earns income from a business, including freelancers and independent contractors, must report their earnings using Schedule C.

- All business expenses are deductible. While many expenses can be deducted, not all are eligible. Personal expenses or those that do not directly relate to the business cannot be deducted. It’s essential to distinguish between personal and business-related expenses.

- Filing Schedule C guarantees a tax refund. Some assume that filing this form will automatically result in a refund. Refunds depend on various factors, including total income, tax withheld, and overall tax liability.

- Schedule C is only for businesses that make a profit. Even if a business incurs a loss, it still needs to file Schedule C. Reporting losses can help offset income from other sources, potentially reducing overall tax liability.

- All income must be reported on Schedule C. While most business income is reported here, some income types, like certain investment income, are reported elsewhere. It’s crucial to understand where different income types belong.

- Once you file Schedule C, you cannot change it. If you discover an error or need to make adjustments after filing, you can amend your return. Filing an amended return allows you to correct mistakes or update information.

- Record-keeping isn’t necessary if you file Schedule C. Good record-keeping is vital, regardless of whether you file Schedule C. Accurate records support your income and expenses, making it easier to file and defend your return if questioned.

- Schedule C is only for U.S. citizens. Non-resident aliens who operate a business in the U.S. may also need to file Schedule C. Understanding your residency status and tax obligations is essential.

By clarifying these misconceptions, individuals can better navigate the complexities of filing their taxes and ensure compliance with IRS regulations.

Key takeaways

Filling out the IRS Schedule C (Form 1040) is essential for self-employed individuals to report income and expenses. Here are six key takeaways to keep in mind:

- Accurate Income Reporting: Ensure that all income from your business is reported. This includes cash, checks, and credit card payments.

- Deductible Expenses: Familiarize yourself with the types of expenses that can be deducted. Common deductions include supplies, utilities, and business-related travel.

- Record Keeping: Maintain organized records of income and expenses. This will simplify the process of filling out the form and support your claims in case of an audit.

- Self-Employment Tax: Be aware that self-employed individuals must pay self-employment tax in addition to income tax. This is calculated on Schedule SE.

- Filing Deadlines: Pay attention to filing deadlines. Schedule C is typically due on April 15, alongside your personal tax return.

- Consult a Professional: If your business finances are complex, consider consulting a tax professional. They can provide guidance tailored to your specific situation.

File Information

| Fact Name | Description |

|---|---|

| Purpose | Schedule C is used by sole proprietors to report income or loss from a business. |

| Filing Requirement | Taxpayers must file Schedule C if they have net earnings of $400 or more from self-employment. |

| Due Date | Schedule C must be filed by April 15, unless an extension is requested. |

| Net Profit or Loss | The form calculates net profit or loss, which is then reported on Form 1040. |

| Business Expenses | Taxpayers can deduct ordinary and necessary business expenses on Schedule C. |

| Record Keeping | Accurate records of income and expenses are essential for completing Schedule C. |

| Self-Employment Tax | Net earnings reported on Schedule C may be subject to self-employment tax. |

| State-Specific Forms | Some states require additional forms for business income; check state laws for specifics. |

| Estimated Taxes | Taxpayers may need to make estimated tax payments based on Schedule C income. |

| Amendments | If errors are found after filing, taxpayers can amend their return, including Schedule C. |