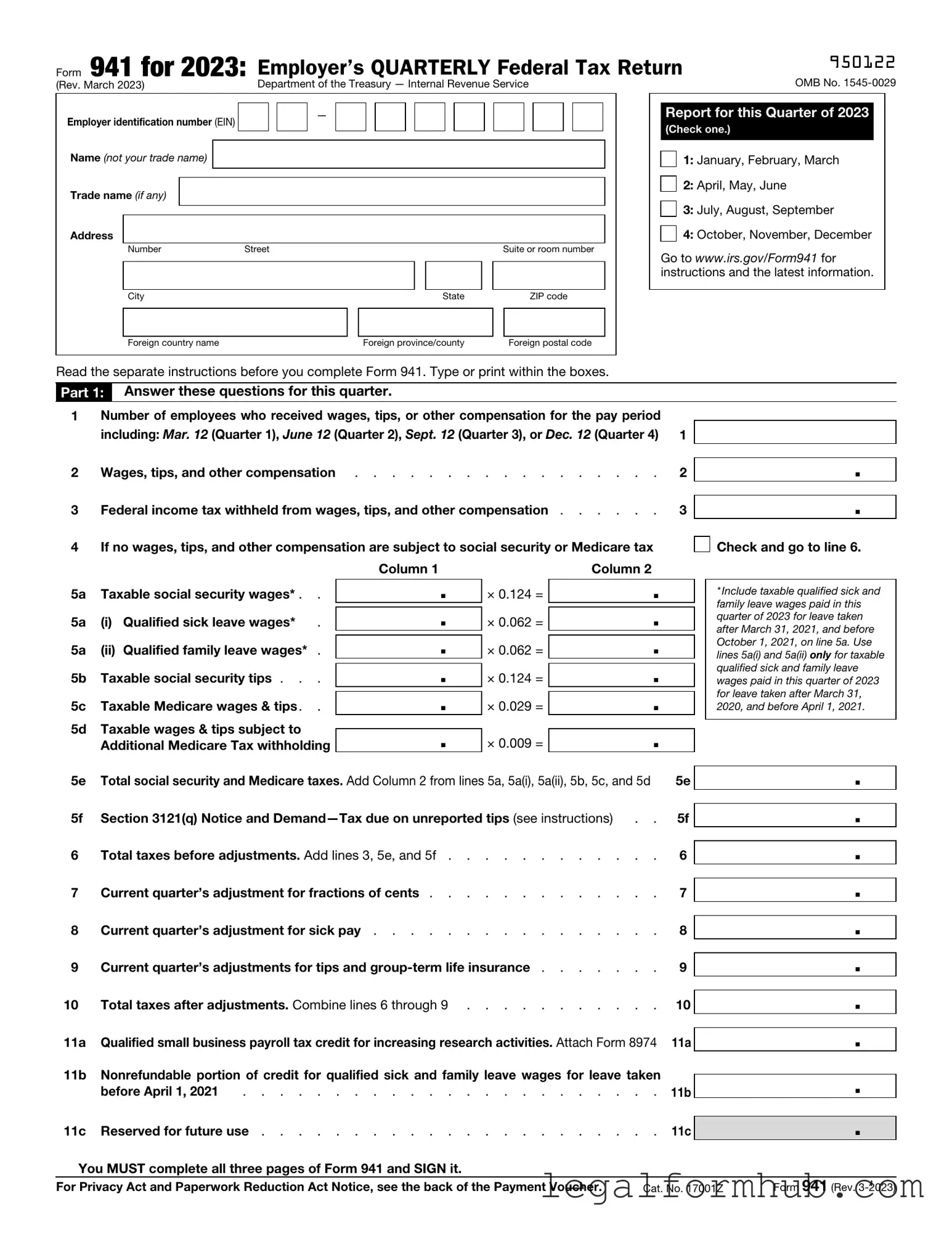

Fill Your IRS 941 Form

Different PDF Templates

Form 6059B Customs Declaration - This form supports customs in doing their job effectively.

In addition to the vital information required for the California Boat Bill of Sale, it's advisable to utilize resources that can streamline the process; for instance, you can Fill PDF Forms to efficiently complete the necessary documentation.

Waiver of Lein - The format aids in protecting the rights of all parties involved in a construction project.

Similar forms

The IRS Form 944 is similar to Form 941 in that both are used by employers to report payroll taxes. However, Form 944 is designed for smaller businesses with an annual payroll tax liability of $1,000 or less. While Form 941 is filed quarterly, Form 944 is filed annually. This difference in frequency and eligibility makes Form 944 a simpler option for qualifying employers, allowing them to streamline their tax reporting process.

Form 943 serves a similar purpose as Form 941 but is specifically for agricultural employers. It is used to report income taxes withheld and FICA taxes for farmworkers. Like Form 941, Form 943 is filed quarterly. This form caters to the unique payroll needs of the agricultural industry, ensuring that farmers meet their tax obligations while accounting for the seasonal nature of their workforce.

Form 945 is another related document, used to report federal income tax withheld from nonpayroll payments. This includes payments made to independent contractors and other non-employees. While Form 941 focuses on payroll taxes for employees, Form 945 covers a different aspect of tax withholding. Both forms require accurate reporting to ensure compliance with IRS regulations, but they serve distinct purposes based on the type of payments made.

Form W-2 is also relevant as it summarizes an employee's annual earnings and the taxes withheld from their paycheck. Employers must provide a W-2 to each employee by January 31 of the following year. While Form 941 reports quarterly tax liabilities, Form W-2 provides a year-end summary. Both documents are crucial for accurate tax reporting and ensuring that employees have the necessary information for their individual tax returns.

In legal matters, understanding the importance of liability protection is crucial, which is where documents like the Hold Harmless Agreement come into play. This form can provide peace of mind for parties entering into agreements, as the arizonapdfs.com/hold-harmless-agreement-template illustrates the essential clauses required to safeguard interests and clarify responsibilities in various situations.

Form W-3, the transmittal form for W-2s, accompanies the W-2 when submitted to the IRS. It summarizes the total earnings and taxes withheld for all employees for the year. Similar to Form 941, which reports quarterly totals, Form W-3 aggregates annual data. This form helps the IRS verify that the information reported on individual W-2s aligns with the employer's total payroll tax obligations.

Lastly, Form 1099-MISC is comparable to Form 941 in that it reports payments made to independent contractors and other non-employees. While Form 941 is for employee wages, Form 1099-MISC captures payments outside of traditional employment. Both forms are essential for accurate tax reporting, but they cater to different categories of workers, ensuring that all income is reported to the IRS appropriately.

Instructions on Writing IRS 941

After gathering the necessary information, you can proceed to fill out the IRS Form 941. This form is used to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. Follow these steps to complete the form accurately.

- Obtain a copy of IRS Form 941 from the IRS website or your tax professional.

- Fill in your employer identification information at the top of the form, including your name, address, and Employer Identification Number (EIN).

- Enter the quarter for which you are filing. The form will have sections for each quarter of the year.

- In Part 1, report the number of employees who received wages during the quarter.

- Calculate the total wages, tips, and other compensation paid to employees and enter this amount in the appropriate box.

- Determine the total federal income tax withheld from employees' paychecks and record this figure.

- Calculate the total Social Security and Medicare taxes owed based on the wages reported and fill in these amounts.

- Complete any adjustments needed for sick pay or group-term life insurance in the designated sections.

- In Part 2, report any deposit schedule and payments made during the quarter.

- Ensure that all calculations are accurate and that all required fields are filled out completely.

- Sign and date the form at the bottom. If you are using a paid preparer, they must also sign the form.

- Submit the completed form to the IRS by the due date, either by mail or electronically.

Misconceptions

The IRS Form 941 is an essential document for employers, but several misconceptions surround it. Here are five common misunderstandings:

- Form 941 is only for large businesses. Many people believe that only large employers need to file Form 941. In reality, any business that pays wages to employees must file this form, regardless of size.

- Form 941 is filed annually. Some think that Form 941 is an annual requirement. However, it is actually filed quarterly. Employers must submit it four times a year to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks.

- All employers must file Form 941. Not every employer is required to file this form. For instance, if a business has no employees during a quarter, it does not need to submit Form 941 for that period.

- Form 941 is the same as Form 944. There is confusion between Form 941 and Form 944. While both are used for reporting payroll taxes, Form 944 is designed for smaller employers who file annually instead of quarterly.

- Filing Form 941 is optional. Some may think that filing Form 941 is optional if they have already paid their payroll taxes. This is a misconception; filing the form is a requirement, even if taxes are paid on time.

Understanding these misconceptions can help employers stay compliant and avoid penalties. Properly filing Form 941 ensures that businesses meet their tax obligations and contribute to social programs.

Key takeaways

When dealing with the IRS 941 form, it’s essential to understand its purpose and how to fill it out correctly. Here are some key takeaways to keep in mind:

- Purpose of the Form: The IRS 941 form is used to report employment taxes, including federal income tax withheld and Social Security and Medicare taxes.

- Filing Frequency: Employers must file this form quarterly. Ensure that you submit it by the last day of the month following the end of each quarter.

- Accurate Information: Provide accurate information regarding wages paid and taxes withheld. Errors can lead to penalties or delays in processing.

- Payment of Taxes: If you owe taxes, make sure to pay them by the due date to avoid interest and penalties.

- Signature Requirement: The form must be signed by an authorized person, which can include the owner, a partner, or an officer of the business.

- Record Keeping: Keep copies of the filed forms and any supporting documentation for at least four years. This will help in case of audits or discrepancies.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. |

| Filing Frequency | Employers must file Form 941 quarterly, with due dates typically falling on the last day of the month following the end of each quarter. |

| Employer Identification Number | Each employer must have an Employer Identification Number (EIN) to complete Form 941 accurately. |

| Penalties | Failure to file Form 941 on time may result in penalties, which can increase over time if the form remains unfiled. |

| State-Specific Forms | Some states require additional forms or filings that align with state laws regarding payroll taxes. For example, California has its own payroll tax reporting requirements under the California Revenue and Taxation Code. |

| Changes in Tax Rates | Employers must stay informed about any changes in federal tax rates, as these can affect the amounts reported on Form 941. |

| Record Keeping | Employers are required to keep records of employment taxes for at least four years after the date the tax becomes due or is paid. |