Fill Your IRS 2553 Form

Different PDF Templates

Broward County Animal Care and Adoption - Veterinarians play a vital role in ensuring pets are vaccinated properly.

For those engaging in activities that involve risk, a well-drafted effective Release of Liability document can safeguard you from potential claims. This legal form ensures that participants acknowledge the risks and waive their right to initiate litigation for any unforeseen incidents. It is essential to consider utilizing this form to protect your interests in various scenarios.

Goodwill Receipt - Contributions documented on this form support community development initiatives.

Roofing Estimate Template Pdf - Don’t leave budgeting to chance; use this form for direction.

Similar forms

The IRS Form 8832, also known as the Entity Classification Election, is similar to Form 2553 in that both are used by businesses to choose their tax classification. While Form 2553 is specifically for S corporations, Form 8832 allows entities to elect to be classified as either a corporation or a partnership for federal tax purposes. This flexibility in classification can significantly impact how a business is taxed and how profits are distributed among owners. Both forms require timely submission and adherence to specific guidelines to ensure the desired tax status is achieved.

Understanding the various IRS forms is essential for business compliance, and for those considering the addition of an emotional support animal as part of their mental health treatment, the Emotional Support Animal Letter form can be an important document to obtain. This letter supports individuals in ensuring access to housing and travel accommodations while maintaining tax responsibilities with various forms like 1065, 2553, and others that serve specific reporting needs for partnerships and corporations.

The IRS Form 1065 is another document that shares similarities with Form 2553. Form 1065 is used by partnerships to report income, deductions, gains, and losses. While Form 2553 is about electing S corporation status, Form 1065 is the actual reporting mechanism for partnerships. Both forms are crucial for ensuring that the IRS receives accurate information about a business's financial activities. Additionally, both require the submission of K-1 forms to report each partner's share of income, highlighting the importance of proper classification in tax reporting.

The IRS Form 1120 is relevant when discussing corporate tax filings. This form is used by C corporations to report their income and calculate their tax liability. While Form 2553 is focused on the election of S corporation status, understanding Form 1120 is essential for those who may opt not to elect S status. Both forms require detailed financial information and adherence to IRS regulations. Choosing between S and C corporation status can have significant tax implications, making it crucial for business owners to understand the differences and requirements of each form.

The IRS Form 941 is similar in that it is a reporting form, but it focuses on employment taxes. Businesses that have employees must file Form 941 quarterly to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. While Form 2553 deals with the tax classification of the business itself, Form 941 is about ongoing compliance with payroll tax obligations. Both forms require careful attention to detail and timely submission to avoid penalties, emphasizing the importance of maintaining accurate records in business operations.

The IRS Form 1065-B, which is used for electing to be treated as a qualified electing fund, bears some resemblance to Form 2553. Both forms involve elections that affect how entities are taxed. Form 1065-B is specifically for electing to be taxed under the partnership rules but allows for special treatment of certain types of income. Like Form 2553, it requires careful consideration and timely filing to ensure that the entity receives the desired tax treatment. Understanding these forms is vital for business owners who wish to optimize their tax positions and comply with IRS regulations.

Instructions on Writing IRS 2553

Filling out the IRS Form 2553 is an important step for businesses looking to elect S corporation status. This form must be completed accurately to ensure compliance with IRS regulations and to take advantage of the benefits associated with this election. Below are the steps you need to follow to successfully fill out the form.

- Begin by downloading the IRS Form 2553 from the IRS website or obtaining a physical copy.

- At the top of the form, provide the name of your corporation as it appears in your articles of incorporation.

- Enter the corporation's address, including the city, state, and zip code.

- Fill in the date of incorporation and the state where your corporation was formed.

- Indicate the tax year your corporation will follow, typically January 1 to December 31.

- In the section for shareholders, list each shareholder's name, address, and the number of shares owned.

- Make sure to include the date each shareholder acquired their shares.

- Sign and date the form in the designated area. This signature must be from an officer of the corporation.

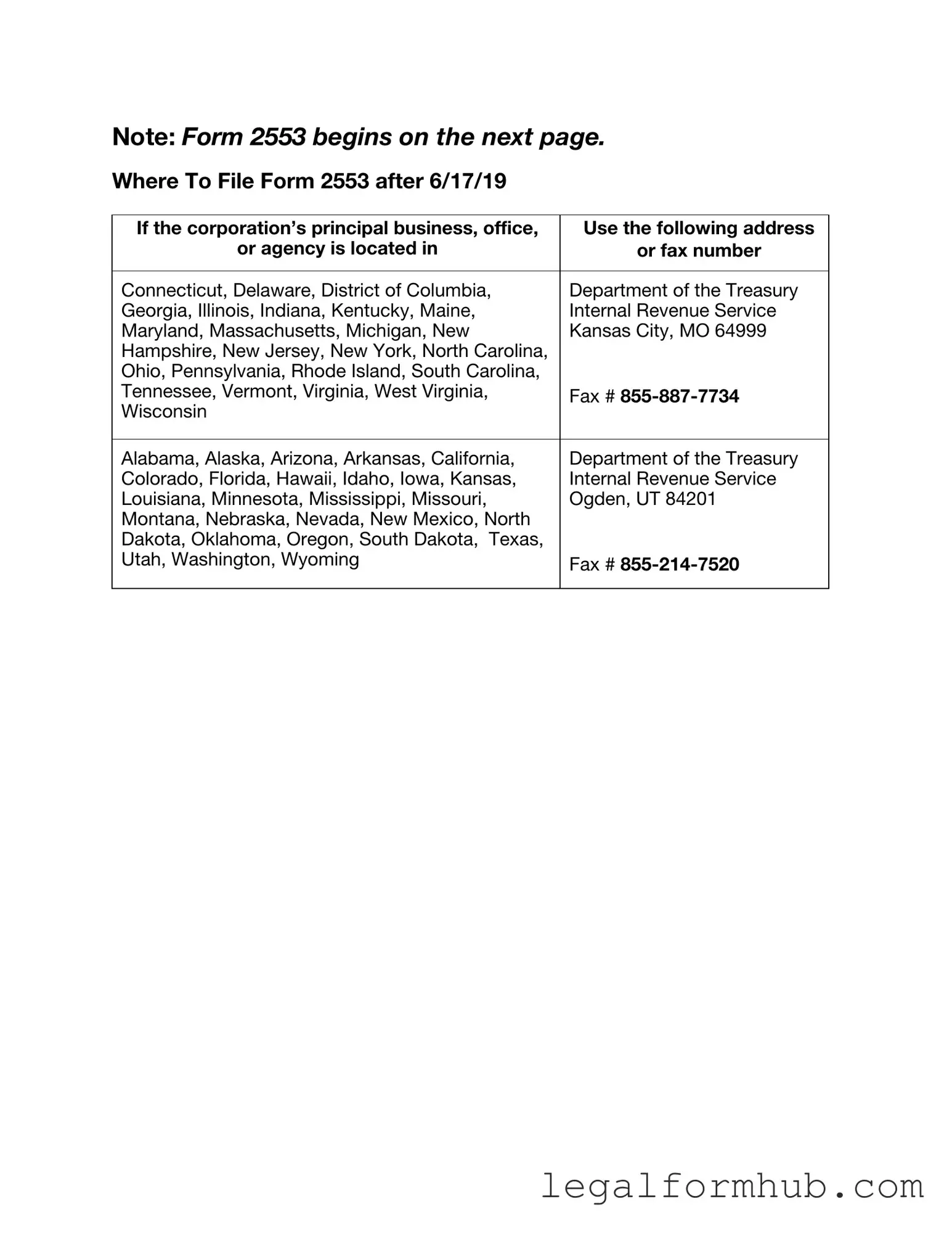

- Submit the completed form to the IRS by mailing it to the address provided in the form instructions.

- Keep a copy of the submitted form for your records.

Once you have submitted the form, the IRS will process your application. It’s important to monitor for any correspondence from them regarding your election status. If approved, you can enjoy the benefits that come with being classified as an S corporation.

Misconceptions

The IRS Form 2553 is used by small businesses to elect to be taxed as an S corporation. However, several misconceptions surround this form. Here are eight common misunderstandings:

- Misconception 1: Only corporations can file Form 2553.

- Misconception 2: Filing Form 2553 is optional for all businesses.

- Misconception 3: The deadline to file is the same for all businesses.

- Misconception 4: All shareholders must be U.S. citizens.

- Misconception 5: Filing Form 2553 guarantees S corporation status.

- Misconception 6: Once elected, S corporation status cannot be revoked.

- Misconception 7: All income is passed through to shareholders.

- Misconception 8: The IRS Form 2553 is only for tax purposes.

Many believe that only corporations can use this form. In reality, limited liability companies (LLCs) can also elect S corporation status by filing Form 2553.

While it's true that not all businesses must file this form, those that want to be taxed as an S corporation must do so. Failure to file can result in default tax treatment as a C corporation.

The deadline to file Form 2553 is generally 75 days after the beginning of the tax year. However, if a business is newly formed, it can file at any time within the first year of operation.

While it is true that S corporations cannot have non-resident alien shareholders, they can have certain types of trusts and estates as shareholders, which is often overlooked.

Completing the form does not automatically grant S corporation status. The IRS must approve the election, and the business must meet all eligibility requirements.

Businesses can revoke their S corporation election by filing a statement with the IRS. However, there are specific procedures and timeframes that must be followed.

While S corporations generally pass income, losses, and deductions to shareholders, certain types of income, like passive investment income, can be subject to different rules.

Though primarily a tax form, filing Form 2553 can also affect a business's legal structure and operational framework, impacting how it conducts business.

Key takeaways

Filling out the IRS Form 2553 is an important step for small business owners who wish to elect S Corporation status. Here are some key takeaways to keep in mind:

- Eligibility Requirements: Not every business can file Form 2553. To qualify, your business must be a domestic corporation with no more than 100 shareholders, and all shareholders must be U.S. citizens or residents.

- Filing Deadline: Timing is crucial. You must file Form 2553 within 75 days of the start of the tax year you want the S Corporation status to take effect. Missing this deadline can lead to significant tax implications.

- Shareholder Consent: All shareholders must consent to the S Corporation election. This means that each shareholder needs to sign the form, indicating their agreement to the status change.

- Tax Benefits: Electing S Corporation status can provide tax advantages, such as avoiding double taxation on corporate income. However, it's essential to understand how this status will impact your overall tax situation.

Understanding these points can help ensure a smoother process when electing S Corporation status for your business.

File Information

| Fact Name | Details |

|---|---|

| Purpose | The IRS Form 2553 is used by small businesses to elect S corporation status for tax purposes. |

| Eligibility | To qualify, the business must be a domestic corporation with no more than 100 shareholders. |

| Filing Deadline | The form must be filed within 75 days of the beginning of the tax year for which the election is to take effect. |

| Shareholder Restrictions | Shareholders must be individuals, certain trusts, or estates; corporations and partnerships cannot be shareholders. |

| Tax Benefits | Electing S corporation status allows income to pass through to shareholders, avoiding double taxation at the corporate level. |

| State Forms | Some states require additional forms to elect S corporation status, governed by state-specific laws. |

| Revocation | Once elected, S corporation status can be revoked by the shareholders or the IRS under certain conditions. |

| IRS Processing Time | Processing times for Form 2553 can vary, but it typically takes several weeks for the IRS to respond. |

| Late Election | If the form is filed late, the business may still qualify for S corporation status under certain circumstances. |

| Form Updates | The IRS periodically updates Form 2553, so it is important to use the most current version available. |