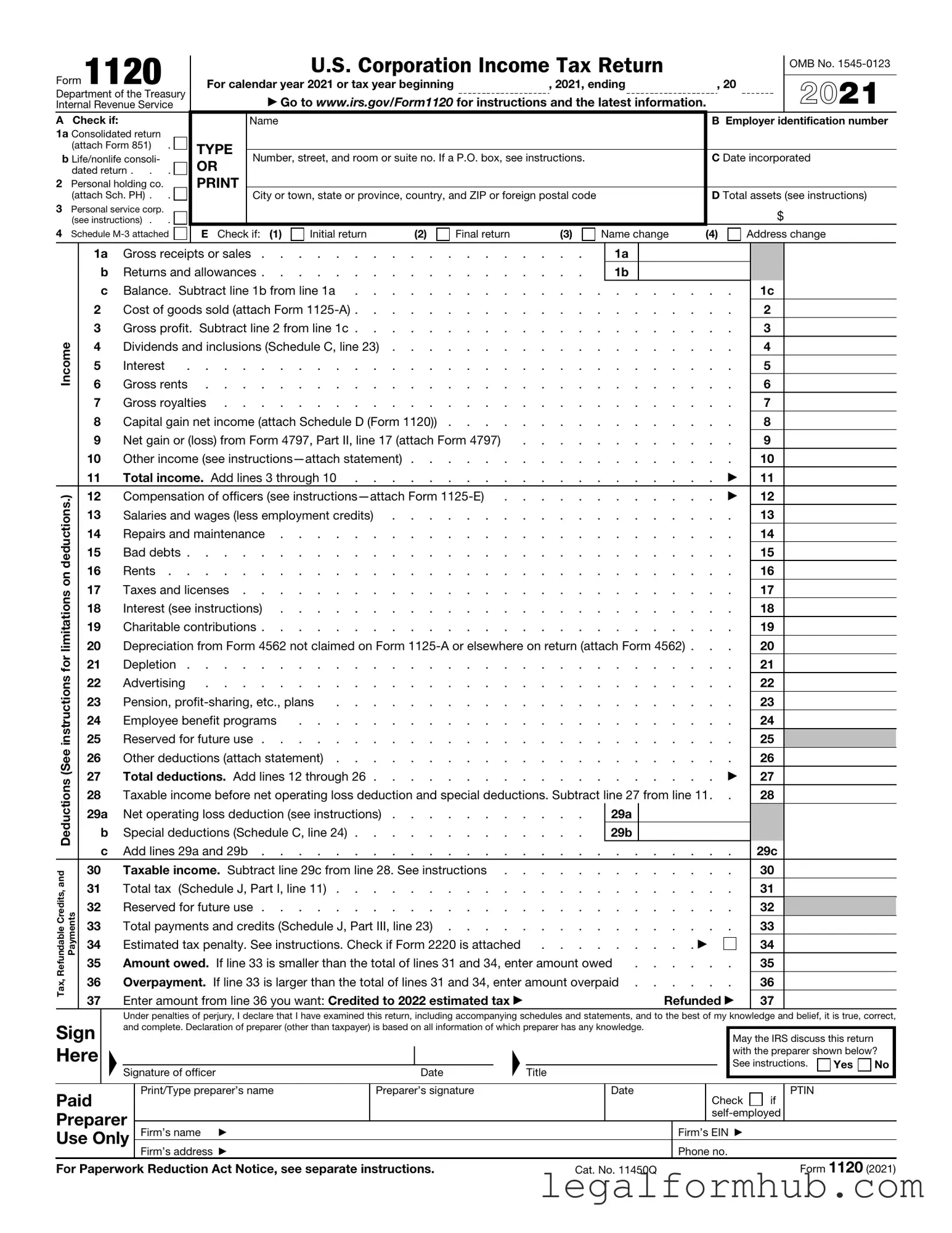

Fill Your IRS 1120 Form

Different PDF Templates

Uscis Affidavit of Support - The I-864 must comply with the latest poverty guidelines set by the government.

For those looking to prepare a legal safeguard for themselves or a loved one, utilizing the California Power of Attorney form can be a prudent choice. It allows you to select a trusted individual to handle your affairs, ensuring your interests are protected. To learn more and access the necessary documentation, visit https://pdftemplates.info.

Counting Till - This sheet provides a structured approach for cash drawer reconciliation.

Progressive Insurance Logo - Collect information from all parties involved in an accident for your records.

Similar forms

The IRS Form 1065 is similar to Form 1120 in that both are used for reporting income, deductions, and other financial information to the Internal Revenue Service. However, while Form 1120 is specifically designed for corporations, Form 1065 is intended for partnerships. Partnerships do not pay income tax at the entity level; instead, they pass through profits and losses to their partners. The information on Form 1065 helps the IRS track income that will ultimately be reported on the partners' individual tax returns.

Another document that shares similarities with Form 1120 is the IRS Form 1120-S. This form is used by S corporations, which are a specific type of corporation that elects to pass corporate income, losses, deductions, and credits through to their shareholders. Like Form 1120, Form 1120-S requires reporting of financial activities, but it is tailored for S corporations, which have different tax implications. Both forms require detailed financial information, but the tax treatment differs significantly based on the entity type.

For those dealing with the intricacies of tax documentation, understanding various forms is essential. Whether you’re managing a corporation, partnership, or nonprofit organization, navigating through forms like IRS Form 1120, Form 1065, and Form 990 can be overwhelming. Resources are available to simplify these processes, and for those looking to streamline their paperwork, you can rely on Fill PDF Forms for assistance in filling out necessary documents efficiently.

The IRS Form 990 is another document that has similarities with Form 1120, particularly in the context of financial reporting. Form 990 is used by tax-exempt organizations to provide the IRS with information about their activities, governance, and financial status. While Form 1120 is focused on for-profit entities, Form 990 serves non-profit organizations. Both forms require transparency in financial reporting, but they cater to different types of organizations and have different tax obligations.

Lastly, the IRS Form 1040 is relevant when discussing individual tax returns, as it is the standard form used by individuals to report their income. While Form 1120 is for corporations, both forms ultimately serve the purpose of reporting income and calculating tax liabilities. Form 1040 includes various schedules that allow individuals to detail their income sources, deductions, and credits, similar to how corporations use Form 1120 to report their financial activities. The key difference lies in the entity type and the tax structure applicable to each form.

Instructions on Writing IRS 1120

Completing the IRS Form 1120 is an important step for corporations filing their federal income tax returns. Once you have gathered all necessary financial information, you can proceed with filling out the form. Below are the steps to help guide you through the process.

- Begin by downloading the IRS Form 1120 from the IRS website or obtain a physical copy from a local IRS office.

- At the top of the form, enter your corporation's name, address, and Employer Identification Number (EIN).

- In the section labeled "Income," report all sources of income. This includes gross receipts and any other income earned during the tax year.

- Next, move to the "Deductions" section. Here, list all allowable business expenses, such as salaries, rent, and utilities.

- After calculating total income and total deductions, determine the corporation's taxable income by subtracting total deductions from total income.

- Proceed to the "Tax and Payments" section. Calculate the tax owed based on the taxable income and enter the amount.

- If applicable, include any credits that your corporation may qualify for and deduct them from the tax owed.

- Finally, sign and date the form. Ensure that the person signing has the authority to do so on behalf of the corporation.

After completing the form, review it carefully for accuracy. Make sure all calculations are correct and that all necessary information has been provided. Once satisfied, submit the form to the IRS by the due date to avoid any penalties.

Misconceptions

The IRS Form 1120 is essential for corporations to report their income, gains, losses, deductions, and credits. However, several misconceptions surround this form. Here are ten common misunderstandings:

- Only large corporations need to file Form 1120. Many small businesses and corporations, regardless of size, must file this form if they are classified as C corporations.

- Form 1120 is only for profit-making companies. Even if a corporation incurs losses, it must still file Form 1120 to report its financial activities.

- Filing Form 1120 guarantees a tax refund. Filing does not automatically result in a refund. The outcome depends on the corporation's tax situation.

- Form 1120 is the same as personal tax forms. Form 1120 is specifically designed for corporations, while personal tax forms, like the 1040, cater to individual taxpayers.

- Corporations can ignore Form 1120 if they have no income. All corporations must file Form 1120, even with zero income, to maintain compliance.

- Filing deadlines are flexible. The IRS has strict deadlines for submitting Form 1120, typically the 15th day of the fourth month after the end of the corporation's tax year.

- Only accountants can prepare Form 1120. While accountants can help, any business owner can prepare the form if they understand their financial situation.

- Form 1120 is too complex for small businesses. Although it requires attention to detail, many small businesses successfully complete it with the right resources.

- Once filed, Form 1120 cannot be amended. If errors are found, corporations can file an amended return using Form 1120-X.

- Filing Form 1120 is optional for corporations. Filing is mandatory for C corporations, and failure to do so can result in penalties.

Understanding these misconceptions can help corporations navigate their tax responsibilities more effectively.

Key takeaways

Filing the IRS 1120 form is an essential step for corporations in the United States. Understanding the key aspects of this form can help ensure compliance and potentially minimize tax liabilities.

- Eligibility: Only C corporations are required to file Form 1120. If your business is structured as an S corporation or another type of entity, different forms apply.

- Filing Deadline: The form is due on the 15th day of the fourth month after the end of your corporation's tax year. For most corporations, this means April 15th for a calendar year-end.

- Accurate Reporting: Ensure all income, deductions, and credits are reported accurately. Mistakes can lead to audits or penalties.

- Tax Rates: Be aware of the current corporate tax rates, as these can change. Understanding the tax structure can help in planning your finances.

- Extensions: If more time is needed to file, you can apply for an extension using Form 7004. This grants an additional six months, but taxes owed must still be paid by the original deadline.

- Documentation: Keep thorough records of all financial transactions. Supporting documentation is crucial if the IRS requests further information.

- Consult Professionals: Consider working with a tax professional or accountant. Their expertise can help navigate complex tax laws and ensure compliance.

Understanding these key points about the IRS 1120 form can alleviate some of the stress associated with corporate tax filing. By being informed and prepared, you can take steps to protect your business and ensure compliance with federal regulations.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 1120 is used by corporations to report their income, gains, losses, deductions, and credits, as well as to calculate their federal income tax liability. |

| Filing Deadline | Corporations must file Form 1120 by the 15th day of the fourth month after the end of their tax year, with extensions available under certain conditions. |

| State-Specific Forms | Many states require additional forms, such as California's Form 100, governed by the California Revenue and Taxation Code. |

| Estimated Payments | Corporations may need to make estimated tax payments throughout the year to avoid penalties, based on expected tax liability. |