Fill Your IRS 1040 Form

Different PDF Templates

Annual Physical Exam Template - Indicate if the medical history summary has been reviewed during the visit.

The Employment Application PDF form is a standardized document used by employers to gather essential information about job applicants. This form typically includes sections for personal details, work history, and educational background, facilitating a streamlined hiring process. To get started, Fill PDF Forms by clicking the button below.

1099 Nec Fillable Form - The 1099-NEC is particularly important for reporting payments of $600 or more to independent contractors.

Similar forms

The IRS Form 1040 is similar to the W-2 form, which reports an employee's annual wages and the taxes withheld from their paycheck. While the 1040 is used to file an individual's income tax return, the W-2 provides the necessary information for completing that return. Both forms are crucial for determining tax liability and ensuring compliance with federal tax laws. They work together to provide a complete picture of an individual's earnings and tax obligations for the year.

Another document that resembles the 1040 is the 1099 form. This form is used to report various types of income other than wages, salaries, or tips. Freelancers and independent contractors often receive 1099 forms from clients, detailing the income earned. Like the 1040, the information from the 1099 is essential for accurately reporting total income on the tax return, allowing individuals to declare all sources of income.

The Employment Verification Form serves as a crucial document that confirms an individual's job history and employment details. Typically used by employers and financial institutions, this form aids in ensuring the accuracy of information provided by potential employees or borrowers. To expedite the process of verifying employment, consider filling out the form by clicking the button below, or visit pdftemplates.info for more resources.

The Schedule C form is also similar to the 1040. It is used by sole proprietors to report income and expenses from their business activities. When filing a 1040, individuals who run their own businesses will attach Schedule C to provide a detailed account of their business income and deductions. This connection helps the IRS understand the financial situation of self-employed individuals.

Form 1040 is akin to the Schedule A form, which is used for itemizing deductions. Taxpayers who choose not to take the standard deduction can use Schedule A to list eligible expenses such as medical costs, mortgage interest, and charitable contributions. The information from Schedule A is then transferred to the 1040, influencing the overall tax liability.

The 1040 is also similar to the Form 8889, which is used for reporting Health Savings Account (HSA) contributions and distributions. Taxpayers who have HSAs must report their contributions and any withdrawals on this form. The totals from Form 8889 are then included on the 1040, affecting the taxpayer's overall taxable income and potential deductions.

The Form 8862 is another document that relates to the 1040. This form is used to claim the Earned Income Tax Credit (EITC) after a previous claim was denied. If a taxpayer's eligibility for the EITC has been questioned in the past, they must submit Form 8862 along with their 1040 to demonstrate their eligibility for the credit in the current tax year.

Form 4506-T is similar in that it allows taxpayers to request a transcript of their tax return. This form can be helpful for individuals who need to verify their income for loans or other financial applications. While it does not directly relate to the filing process, it can assist taxpayers in gathering the necessary information to complete their 1040 accurately.

The IRS Form 1040 is also comparable to the Form 941, which is used by employers to report payroll taxes. Although primarily for businesses, the 941 form provides insight into the taxes withheld from employees' paychecks, which ultimately affects the information reported on the 1040. Understanding payroll taxes is essential for employees when filing their individual tax returns.

Lastly, the Form 1040-X is similar as it is used to amend a previously filed tax return. If an error was made on the original 1040, taxpayers can file a 1040-X to correct it. This form ensures that any adjustments are documented and that the IRS has the most accurate information regarding a taxpayer’s financial situation.

Instructions on Writing IRS 1040

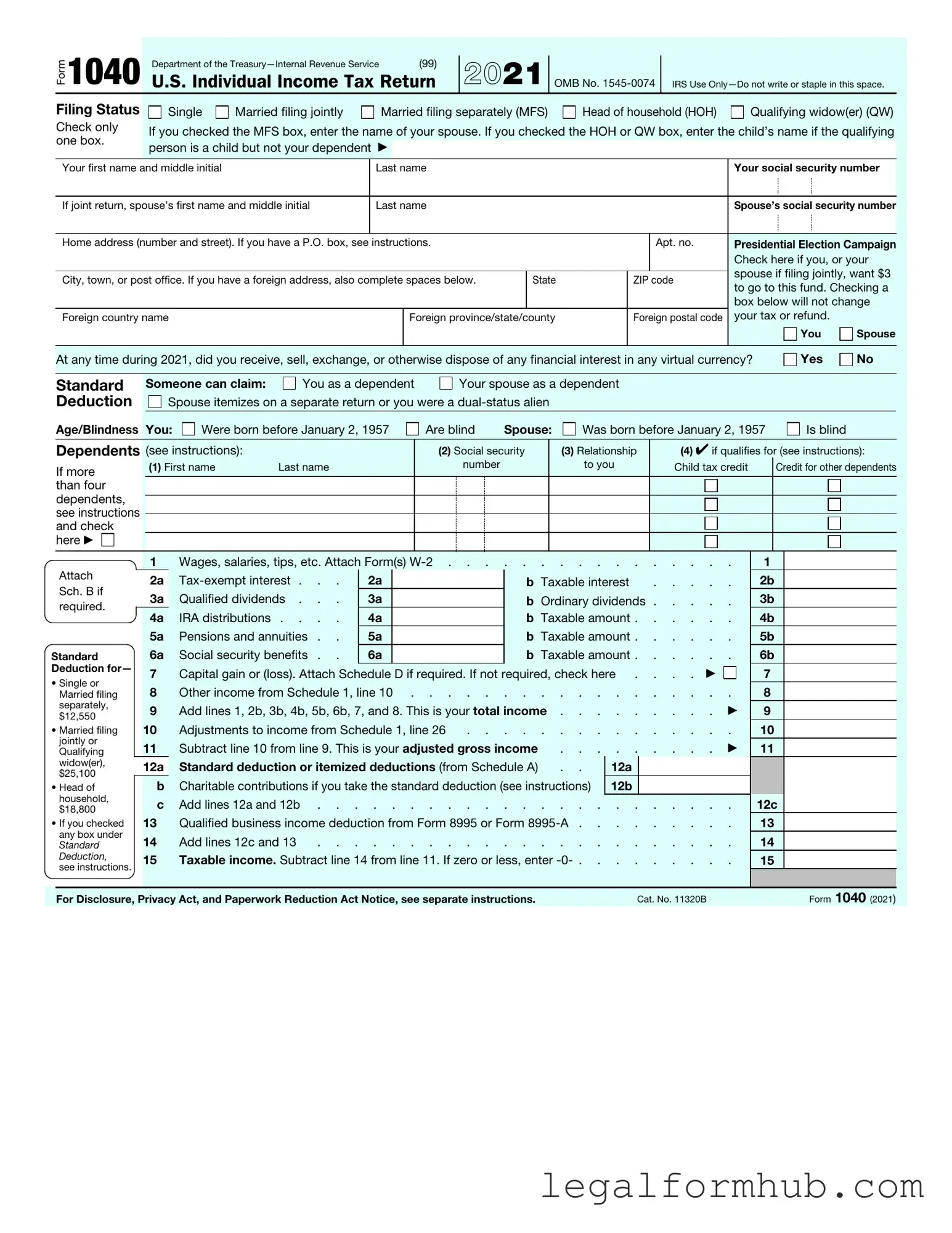

Filling out the IRS 1040 form is an essential step in preparing your annual tax return. This process involves gathering your financial information, calculating your income, and reporting any deductions or credits you may qualify for. Follow these steps to ensure a smooth completion of the form.

- Gather necessary documents, such as W-2s, 1099s, and any other income statements.

- Start with your personal information at the top of the form. Include your name, address, and Social Security number.

- Indicate your filing status by checking the appropriate box. Options include single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Report your income. Use the lines provided to enter wages, salaries, and any other income sources. Add them up to find your total income.

- Calculate your adjusted gross income (AGI). This involves subtracting specific deductions from your total income. These deductions can include contributions to retirement accounts or student loan interest.

- Determine your taxable income by subtracting standard or itemized deductions from your AGI. Choose the option that gives you the largest deduction.

- Calculate your tax liability using the tax tables provided in the form's instructions. This will help you determine how much tax you owe.

- Account for any tax credits you may qualify for. Enter these amounts on the appropriate lines to reduce your tax liability.

- Determine whether you owe additional taxes or if you are due a refund. This will depend on your total tax liability compared to the taxes you have already paid throughout the year.

- Complete the payment section if you owe taxes. If you are due a refund, indicate how you would like to receive it, either by check or direct deposit.

- Sign and date the form. If you are filing jointly, your spouse must also sign.

- Make a copy of the completed form for your records before mailing it to the appropriate IRS address.

Misconceptions

The IRS 1040 form is a crucial document for individual taxpayers in the United States, but several misconceptions surround its use and requirements. Understanding these misconceptions can help taxpayers navigate their tax obligations more effectively.

- Misconception 1: Everyone must file a 1040 form.

- Misconception 2: Filing a 1040 form guarantees a tax refund.

- Misconception 3: The 1040 form is the same for everyone.

- Misconception 4: You can only file the 1040 form during tax season.

Not every individual is required to file a 1040 form. Some people may fall below the income threshold set by the IRS, making them exempt from filing. Additionally, certain individuals may qualify for other forms, like the 1040EZ or 1040A, which are simpler options.

Filing a 1040 does not automatically mean a taxpayer will receive a refund. A refund depends on various factors, including the amount of tax withheld from paychecks, tax credits, and overall tax liability. Some individuals may end up owing money instead.

The 1040 form can vary significantly based on individual circumstances. Taxpayers may have different schedules and attachments depending on their sources of income, deductions, and credits. Each taxpayer should ensure they are using the correct version of the form for their situation.

While most individuals file their 1040 forms during the designated tax season, extensions are available. Taxpayers can request an extension, allowing them additional time to file their returns. However, it is important to note that an extension to file is not an extension to pay any taxes owed.

Key takeaways

Filling out the IRS 1040 form is a crucial step in ensuring that your tax obligations are met accurately and timely. Here are some key takeaways to keep in mind:

- Understanding your filing status is essential. Your status affects your tax rates and eligibility for certain deductions and credits.

- Accurate reporting of income is vital. All sources of income, including wages, dividends, and self-employment earnings, must be reported to avoid issues with the IRS.

- Take advantage of deductions and credits. Familiarize yourself with available deductions, such as those for mortgage interest or education expenses, as they can significantly reduce your taxable income.

- Double-check your calculations. Errors in math or missed entries can lead to delays in processing your return or even audits. Always review your form carefully before submission.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The IRS 1040 form is used by individuals to file their annual income tax returns. |

| Filing Status | Taxpayers must select their filing status, which affects their tax rate and eligibility for deductions. |

| Income Reporting | All sources of income, including wages, interest, and dividends, must be reported on the form. |

| Deductions | Taxpayers can choose between standard deductions and itemized deductions, depending on their situation. |

| Tax Credits | Various tax credits can reduce the amount of tax owed, such as the Earned Income Tax Credit. |

| Filing Deadline | The standard deadline for filing the IRS 1040 form is April 15th of each year, unless it falls on a weekend or holiday. |

| State Forms | In addition to the federal 1040, many states require their own tax forms, governed by state tax laws. |

| Electronic Filing | The IRS encourages electronic filing for faster processing and refunds, offering various e-filing options. |

| Amendments | If errors are found after filing, taxpayers can amend their return using Form 1040-X. |