Printable Investment Letter of Intent Document

Common Investment Letter of Intent Documents:

Letter of Intent to Sue - The sender should keep a copy for personal records.

Letter of Intent Grant Template - State your commitment to transparency throughout the project lifecycle.

Similar forms

The Investment Letter of Intent (LOI) serves as a preliminary agreement between parties looking to enter into a business relationship. Similar to a Memorandum of Understanding (MOU), an LOI outlines the general terms and conditions that the parties have discussed. While an MOU is often non-binding and emphasizes the intent to cooperate, an LOI can sometimes include binding clauses, particularly regarding confidentiality or exclusivity. Both documents aim to clarify expectations and set the stage for further negotiations.

Another document akin to the Investment Letter of Intent is the Term Sheet. A Term Sheet provides a summary of the key terms and conditions of an investment or acquisition deal. It is typically more detailed than an LOI and often includes specific financial terms, valuation, and other critical aspects of the deal. While both documents serve to outline the intentions of the parties involved, a Term Sheet is generally more structured and may lead directly to the drafting of a formal agreement.

A Letter of Intent in real estate transactions shares similarities with the Investment LOI. In real estate, this document outlines the buyer's intentions to purchase a property, detailing the terms of the potential sale. Like the Investment LOI, it can include contingencies and other conditions that must be met before the deal is finalized. Both documents help set expectations and provide a framework for negotiation, although the specifics may vary based on the nature of the transaction.

The Non-Binding Agreement is another document that resembles the Investment Letter of Intent. This type of agreement outlines the general understanding between parties without creating a legally enforceable commitment. It often includes terms for confidentiality and may serve as a precursor to more detailed negotiations. While the LOI can include binding elements, the Non-Binding Agreement is explicitly designed to avoid legal obligations, focusing instead on mutual understanding.

A Business Proposal often parallels the Investment Letter of Intent in terms of purpose. A business proposal outlines a plan for a project or partnership, detailing objectives, strategies, and expected outcomes. While an LOI indicates intent to negotiate, a business proposal presents a more formalized plan that can persuade the other party to consider the proposed terms. Both documents are essential for initiating discussions and laying the groundwork for future agreements.

The Joint Venture Agreement also shares common ground with the Investment Letter of Intent. This document formalizes the terms under which two or more parties will collaborate on a specific project or business endeavor. While the LOI expresses intent and outlines preliminary terms, a Joint Venture Agreement provides a comprehensive framework for the partnership, including contributions, profit-sharing, and responsibilities of each party. Thus, the LOI often serves as the first step toward a more binding joint venture arrangement.

The Confidentiality Agreement, or Non-Disclosure Agreement (NDA), can also be seen as related to the Investment Letter of Intent. While the LOI may include confidentiality provisions, an NDA is a standalone document that specifically protects sensitive information shared between parties. Both documents aim to foster trust and protect proprietary information during negotiations, ensuring that parties can discuss their intentions openly without fear of disclosure.

Finally, the Purchase Agreement bears resemblance to the Investment Letter of Intent in that both documents are crucial in the transaction process. A Purchase Agreement is a legally binding contract that outlines the terms of a sale, including price, payment terms, and other conditions. The LOI typically precedes this document, serving as an initial expression of interest that sets the stage for more detailed negotiations leading to the final Purchase Agreement.

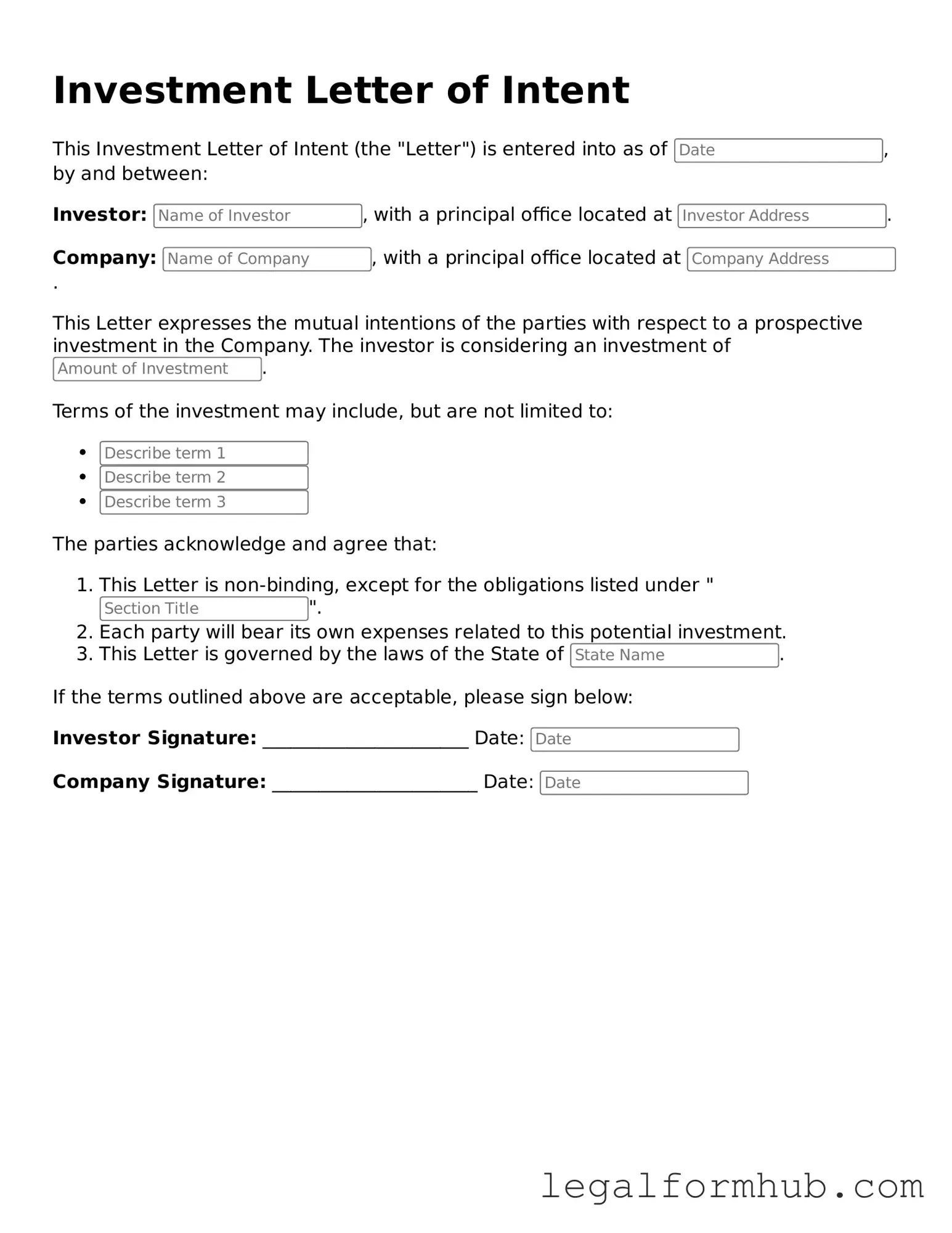

Instructions on Writing Investment Letter of Intent

Once you have the Investment Letter of Intent form, it's important to fill it out accurately to ensure your intentions are clearly communicated. Follow the steps below to complete the form effectively.

- Start by entering your full name in the designated field.

- Provide your current address, including city, state, and zip code.

- List your contact information, including phone number and email address.

- Indicate the name of the investment opportunity you are interested in.

- Specify the amount you intend to invest.

- Include any relevant details about your investment preferences or conditions.

- Review the information you have entered for accuracy.

- Sign and date the form at the bottom.

After completing the form, ensure that you keep a copy for your records. Submit the original to the appropriate party as instructed in your investment process.

Misconceptions

When it comes to the Investment Letter of Intent (LOI) form, many people hold misconceptions that can lead to confusion. Understanding these misconceptions can help clarify the purpose and function of this important document.

- Misconception 1: The Investment LOI is a legally binding contract.

- Misconception 2: An LOI guarantees that the investment will happen.

- Misconception 3: All LOIs are the same and can be used interchangeably.

- Misconception 4: The LOI process is quick and requires minimal effort.

While an LOI outlines the intentions of the parties involved, it is typically not a legally binding agreement. Instead, it serves as a preliminary document that expresses interest and outlines the basic terms of a potential investment.

Signing an LOI does not guarantee that the investment will be finalized. It simply indicates that both parties are interested in moving forward. Due diligence and further negotiations are still necessary before any formal agreement is reached.

Not all LOIs are created equal. Each LOI should be tailored to fit the specific investment opportunity and the needs of the parties involved. Generic forms may not capture the unique aspects of a particular deal.

Drafting an effective LOI can take time and careful consideration. It involves discussions about terms, expectations, and the interests of both parties. Rushing through this process may lead to misunderstandings later on.

Key takeaways

When filling out and using the Investment Letter of Intent form, keep these key takeaways in mind:

- Understand the Purpose: The Investment Letter of Intent outlines your intent to invest in a business or project. It serves as a preliminary agreement before finalizing any terms.

- Provide Accurate Information: Ensure all details are correct. This includes your name, contact information, and the specifics of the investment.

- Clarify Investment Terms: Clearly define the amount you intend to invest and any conditions that apply. This helps set expectations for both parties.

- Review Before Submitting: Double-check the form for completeness and accuracy. An error can lead to misunderstandings or delays.

- Keep a Copy: After submission, retain a copy for your records. This can be useful for future reference or in case of disputes.

- Follow Up: After sending the form, follow up with the recipient to confirm receipt and discuss any next steps. Communication is key to a smooth process.

File Overview

| Fact Name | Description |

|---|---|

| Definition | An Investment Letter of Intent (LOI) outlines the preliminary terms of a potential investment agreement between parties. |

| Purpose | The LOI serves to express the intent of the parties to negotiate a formal agreement in good faith. |

| Non-Binding Nature | Typically, an LOI is non-binding, meaning it does not create a legal obligation to complete the investment. |

| Key Components | Common elements include investment amount, valuation, and timeline for closing the deal. |

| Confidentiality Clause | Many LOIs include a confidentiality clause to protect sensitive information shared during negotiations. |

| Governing Law | The governing law may vary by state; for example, California law often governs LOIs executed in California. |

| Expiration Date | LOIs often have an expiration date, after which the terms may no longer be valid. |

| Negotiation Tool | The LOI acts as a negotiation tool, helping parties clarify expectations and responsibilities. |

| Potential for Formal Agreement | While an LOI is not a contract, it can lead to a formal investment agreement if both parties reach consensus. |