Fill Your Intent To Lien Florida Form

Different PDF Templates

Which of These Items Is Checked in a Pre-trip Inspection - Record any unusual noises or vehicle behavior during inspection.

To effectively manage your affairs when you are unable to do so, it’s crucial to have a California Power of Attorney form in place, which allows you to designate someone trustworthy to act on your behalf; for assistance in completing this form, you can Fill PDF Forms to ensure all necessary decisions align with your wishes.

How to Write a Contract for Rental Property - The structure of the lease promotes a mutual understanding of rights and responsibilities.

Bdsm Form - Understanding the psychological aspects enriches engagement.

Similar forms

The Notice of Commencement is a document that serves a similar purpose to the Intent to Lien form. It is filed by property owners to officially notify the public that construction is about to begin on a property. This notice provides essential information, including the property description, the contractor’s name, and the nature of the work. Just like the Intent to Lien, it aims to protect the rights of contractors and subcontractors by establishing a clear timeline for when work will commence, thus preventing potential disputes over payment and lien rights.

The Notice of Non-Payment is another document closely related to the Intent to Lien. This notice is issued when a contractor or supplier has not received payment for work completed or materials provided. It informs the property owner of the outstanding balance and serves as a warning that failure to settle the debt could lead to the filing of a lien. Both documents are proactive measures taken to secure payment and protect the rights of those who have contributed to a property’s improvement.

The Claim of Lien is a critical document that follows the Intent to Lien. Once the required notice period has passed without payment, a contractor or supplier can file this formal claim against the property. The Claim of Lien establishes a legal right to the property until the debt is satisfied. Similar to the Intent to Lien, it serves to alert property owners of potential legal actions and emphasizes the importance of resolving payment issues promptly.

The Release of Lien is another important document in this context. Once payment has been made, the contractor or supplier can file a Release of Lien to formally relinquish their claim against the property. This document clears the title and confirms that the debt has been settled. Like the Intent to Lien, it plays a significant role in the overall lien process, ensuring that property owners can regain peace of mind once their obligations have been fulfilled.

For those interested in purchasing or selling an all-terrain vehicle, understanding the specific requirements of an ATV Bill of Sale form is key. This document not only formalizes the transaction but also protects both parties involved in the sale. To learn more about this important form, visit the page on the necessary ATV Bill of Sale documentation.

The Notice of Termination is a document that can be issued when a contractor or subcontractor ceases work on a project. This notice serves to inform the property owner and any other interested parties that the work has been halted, which may also affect any existing liens. Similar to the Intent to Lien, it helps keep all parties informed about the status of the project and the implications of unpaid debts or unresolved disputes.

The Affidavit of Non-Payment is another document that may be used in conjunction with the Intent to Lien. This affidavit is typically filed by a contractor to affirm that they have not received payment for services rendered. It can serve as supporting documentation when pursuing a lien. Both documents highlight the importance of communication regarding payment and the necessity of taking action when debts remain unpaid.

Lastly, the Notice of Intent to File a Lawsuit is a document that may be issued when a contractor or supplier decides to take legal action for unpaid debts. This notice informs the property owner of the intention to pursue legal remedies, similar to the Intent to Lien, which serves as a warning before more serious actions are taken. Both documents aim to prompt resolution and encourage payment before escalating to litigation.

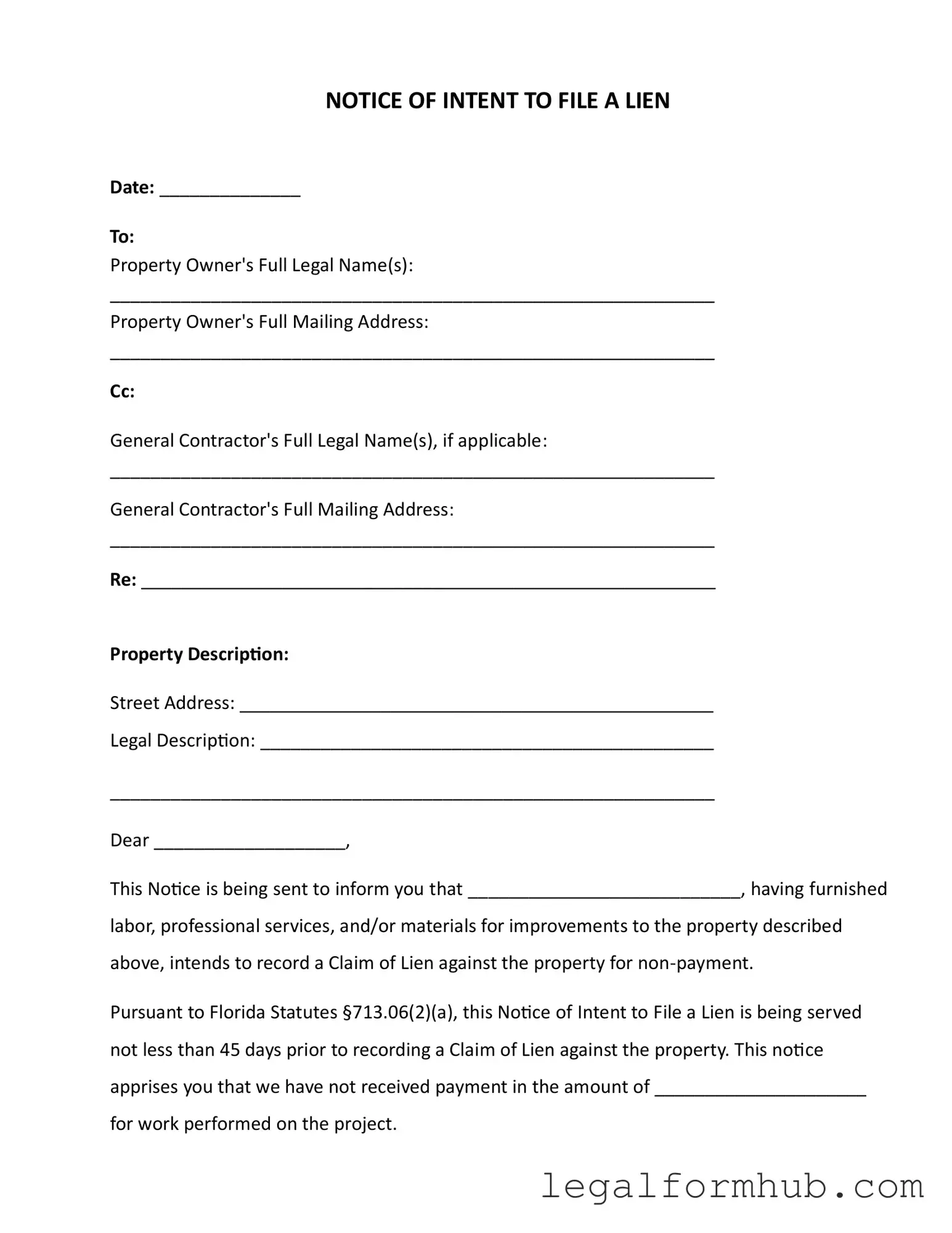

Instructions on Writing Intent To Lien Florida

After completing the Intent to Lien Florida form, you will need to ensure it is properly served to the property owner and any relevant parties. This is crucial for the enforcement of your rights regarding the lien. Follow the steps below to fill out the form accurately.

- Date: Write the current date at the top of the form.

- Property Owner's Full Legal Name(s): Enter the full legal name of the property owner.

- Property Owner's Full Mailing Address: Provide the complete mailing address of the property owner.

- General Contractor's Full Legal Name(s): If applicable, include the full legal name of the general contractor.

- General Contractor's Full Mailing Address: Enter the mailing address of the general contractor, if applicable.

- Property Description: Specify the street address of the property.

- Legal Description: Provide the legal description of the property.

- Dear [Property Owner's Name]: Address the letter to the property owner using their name.

- Intention Statement: Fill in your name and state your intention to file a lien for non-payment.

- Amount Due: Indicate the amount that has not been paid for the work performed.

- Signature: Sign the form and include your name, title, phone number, and email address.

- Certificate of Service: Complete this section by noting how the notice was served and to whom it was sent.

Once the form is completed, ensure you serve it according to the methods indicated. Keep a copy for your records. This step is essential for protecting your rights and interests in the property.

Misconceptions

Below is a list of misconceptions regarding the Intent To Lien Florida form, along with explanations for each.

- Misconception 1: The Intent To Lien form is only for contractors.

- Misconception 2: Sending the Intent To Lien guarantees payment.

- Misconception 3: The form must be filed with the court.

- Misconception 4: There is no deadline for sending the Intent To Lien.

- Misconception 5: The property owner can ignore the Intent To Lien.

- Misconception 6: The Intent To Lien is the same as a Claim of Lien.

- Misconception 7: Sending the Intent To Lien is optional.

- Misconception 8: A response to the Intent To Lien is not necessary.

This form can be used by various parties, including subcontractors and suppliers, not just general contractors.

While the form serves as a notice, it does not guarantee that payment will be received. It is a formal notification of intent.

The Intent To Lien is a notice sent to the property owner, not a document that is filed with the court. It precedes the actual lien filing.

Florida law requires that this notice be sent at least 45 days before filing a Claim of Lien.

Ignoring this notice may lead to the recording of a lien, which could result in foreclosure proceedings.

The Intent To Lien is a preliminary notice, while a Claim of Lien is a formal legal document that is recorded against the property.

For certain parties seeking payment, sending this notice is a legal requirement under Florida statutes.

A property owner should respond within 30 days to avoid potential lien recording and associated legal consequences.

Key takeaways

- Timeliness is crucial. The Intent to Lien form must be sent at least 45 days before filing a Claim of Lien. This timeframe is essential to comply with Florida law.

- Clear communication is key. Ensure that the property owner's full legal name and mailing address are accurately filled out to avoid any delivery issues.

- Include specific details. Clearly state the amount owed for the labor, materials, or services provided. This transparency helps the property owner understand the basis of the claim.

- Understand the consequences. Failure to respond within 30 days can lead to a lien being recorded, which may result in foreclosure and additional costs for the property owner.

- Document your efforts. Keep a record of how and when the Intent to Lien was served. This could be critical in case of any disputes later on.

- Maintain professionalism. Use a respectful tone in the letter. A professional approach may encourage the property owner to resolve the payment issue amicably.

- Seek resolution. Encourage the property owner to contact you to arrange payment. A proactive approach can often prevent the need for further legal action.

File Information

| Fact Name | Details |

|---|---|

| Purpose of the Form | This form serves to notify property owners of an intent to file a lien due to non-payment for services rendered or materials supplied. |

| Governing Law | The form is governed by Florida Statutes §713.06, which outlines the requirements for filing a lien in Florida. |

| Notice Period | According to Florida law, the notice must be served at least 45 days before the actual lien is recorded. |

| Response Time | Property owners have 30 days to respond to the notice. Failure to do so may lead to a lien being recorded. |

| Consequences of Non-Payment | If a lien is filed, the property may be subject to foreclosure, and the owner could incur additional costs, including attorney fees. |

| Certificate of Service | The form includes a section for certifying that the notice was properly served to the property owner, ensuring legal compliance. |