Fill Your Independent Contractor Pay Stub Form

Different PDF Templates

Puppy Health Record - Ensures important health information is consolidated in one place.

In order to ensure compliance with Arizona rental laws, it is important for landlords to familiarize themselves with the Arizona Notice to Quit form, which serves as a formal notification to tenants to vacate the property. For more detailed information and templates, you can visit arizonapdfs.com/notice-to-quit-template, where helpful resources are available to assist in understanding the eviction process.

How to Create a Job Application - Past interactions with the company may influence current employment decisions.

Letter Authorizing Child to Travel - The form can include emergency contact information for the minor.

Similar forms

The Independent Contractor Pay Stub is similar to a W-2 form, which employers use to report wages paid to employees. Both documents provide a summary of earnings over a specific period. However, while a W-2 reflects employee wages and tax withholdings, the Independent Contractor Pay Stub details payments made to independent contractors, who are not subject to the same tax withholding requirements. This distinction is crucial for tax reporting and compliance.

Another document that resembles the Independent Contractor Pay Stub is the 1099-MISC form. This form is used to report income paid to independent contractors and freelancers. Like the pay stub, the 1099-MISC summarizes earnings for the year, but it serves a different purpose. The pay stub provides a breakdown of payments within a specific pay period, while the 1099-MISC reports total annual earnings, making it essential for tax filing.

The Payroll Summary Report is also akin to the Independent Contractor Pay Stub. This report summarizes all payments made to employees and contractors within a given timeframe. Both documents provide detailed information about payments, including dates and amounts. However, the Payroll Summary Report typically includes employee information and tax withholdings, while the Independent Contractor Pay Stub focuses solely on contractor payments without any withholding details.

Similarly, an Invoice is another document that shares characteristics with the Independent Contractor Pay Stub. Contractors often issue invoices to request payment for services rendered. Both documents outline payment details, including amounts and services provided. However, invoices are generated by the contractor, while pay stubs are issued by the payer. This difference highlights the roles of each party in the payment process.

The Payment Receipt is comparable to the Independent Contractor Pay Stub as well. When a contractor receives payment, they may provide a receipt confirming the transaction. Both documents serve as proof of payment, detailing the amount paid and the date of the transaction. However, the pay stub typically includes more detailed information about the payment period and the contractor’s earnings, making it more comprehensive.

For those who require specialized support, understanding the importance of documentation is essential, and the Emotional Support Animal Letter form plays a vital role in that process. It serves as a formal acknowledgment of the need for an emotional support animal, which can greatly contribute to one's mental health. To get started on this important journey, you can Fill PDF Forms and ensure you have the necessary resources for your emotional well-being.

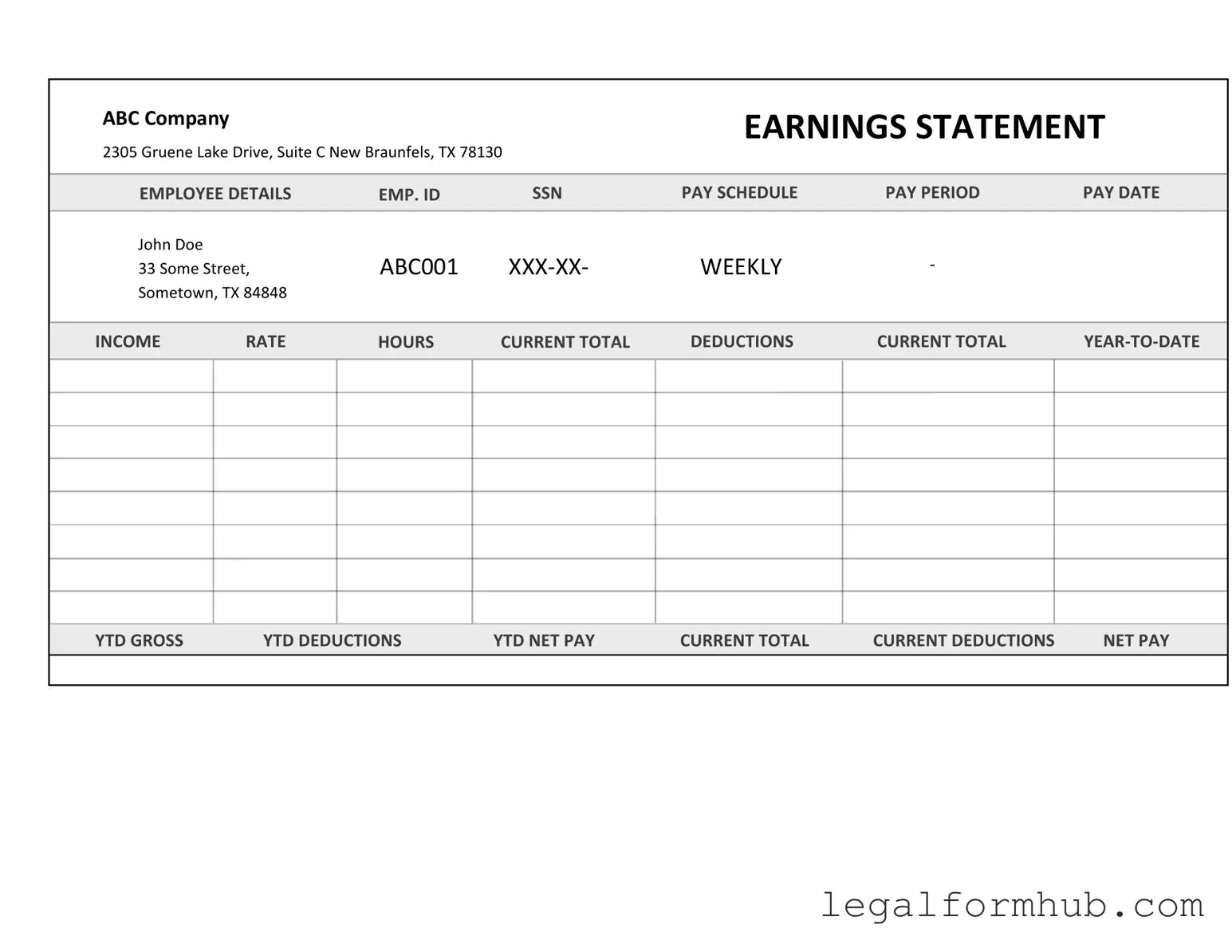

Lastly, the Earnings Statement can be seen as similar to the Independent Contractor Pay Stub. This document provides a summary of earnings, deductions, and net pay for a specific period. While earnings statements are primarily used for employees, they share the same purpose of informing individuals about their earnings. The key difference lies in the context: the Independent Contractor Pay Stub focuses on payments to contractors, while the Earnings Statement is geared towards employees and includes tax deductions.

Instructions on Writing Independent Contractor Pay Stub

Filling out the Independent Contractor Pay Stub form is an essential task that ensures accurate record-keeping for payments made to independent contractors. Following these steps will help you complete the form correctly, facilitating clear communication regarding compensation.

- Begin by entering the contractor's name at the top of the form.

- Next, provide the contractor's address, including the street, city, state, and ZIP code.

- Fill in the date on which the payment is being made.

- Indicate the payment period for which the services were rendered, specifying the start and end dates.

- List the amount paid for the services in the designated field.

- If applicable, include any deductions that have been taken from the payment.

- Provide a brief description of services rendered, detailing the work completed during the payment period.

- Finally, sign and date the form to confirm the accuracy of the information provided.

Misconceptions

- Misconception 1: Independent contractors do not need pay stubs.

- Misconception 2: Pay stubs are only for employees.

- Misconception 3: All pay stubs must include the same information.

- Misconception 4: Independent contractors do not have to report income from pay stubs.

- Misconception 5: Pay stubs are not necessary for tax purposes.

- Misconception 6: Independent contractors cannot request pay stubs.

- Misconception 7: Pay stubs are only useful for tracking hourly wages.

Many believe that independent contractors are exempt from providing pay stubs. In reality, while they are not required by law to issue them, providing a pay stub can help maintain clear records for both the contractor and the client.

This is incorrect. Pay stubs can also be beneficial for independent contractors. They serve as a record of income and can assist in tax preparation and financial planning.

Pay stubs can vary in content. While they typically include earnings and deductions, independent contractors can customize them to fit their specific needs and services provided.

Independent contractors must report all income received, including that reflected on pay stubs. Failure to report income can lead to tax penalties.

While not mandatory, pay stubs can simplify the tax filing process. They provide a clear summary of income and any deductions taken, which can be helpful when preparing tax returns.

Independent contractors have the right to request pay stubs from their clients. This request can help ensure accurate record-keeping and transparency in financial transactions.

This is misleading. Pay stubs can also be used to document project-based payments, retainers, or commission-based earnings, making them versatile tools for various payment structures.

Key takeaways

Filling out and using the Independent Contractor Pay Stub form is essential for both contractors and businesses. Here are some key takeaways to keep in mind:

- Accurate Information: Ensure that all information entered on the pay stub is accurate, including the contractor's name, address, and tax identification number.

- Payment Details: Clearly outline the payment amount, the date of payment, and the period for which the payment is made. This helps in maintaining transparency.

- Tax Deductions: If applicable, indicate any tax deductions that have been withheld from the payment. This is important for the contractor's tax reporting.

- Clear Breakdown: Provide a detailed breakdown of the services rendered, including hours worked or projects completed. This information is useful for both parties.

- Record Keeping: Both the contractor and the business should keep copies of the pay stubs for their records. This can aid in future tax filings or disputes.

- Compliance: Ensure that the pay stub complies with any relevant local or federal regulations regarding independent contractor payments.

File Information

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub is a document that outlines the payment details for independent contractors, including earnings, deductions, and payment dates. |

| Purpose | The pay stub serves as a record for both the contractor and the hiring entity, ensuring transparency in financial transactions and aiding in tax preparation. |

| State-Specific Requirements | In some states, such as California, the governing law requires that pay stubs include specific information, like hours worked and rate of pay. |

| Importance for Tax Reporting | Independent contractors use pay stubs to accurately report income to the IRS, making it essential for financial record-keeping and compliance. |