Free Transfer-on-Death Deed Template for Illinois

Create Other Popular Transfer-on-Death Deed Forms for Different States

Texas Transfer on Death Deed Form - It may also be beneficial for those with minor children to designate guardianship without complicating property transfer.

In order to create a comprehensive understanding of the leasing terms, the California Lease Agreement form must be meticulously filled out. By doing so, both the landlord and tenant can avoid potential misunderstandings and establish a solid foundation for their rental arrangement. For a seamless experience, you can easily access the necessary documents by visiting Fill PDF Forms to begin the process.

Free Printable Transfer on Death Deed Form Georgia - It can contribute to minimizing family challenges related to asset distribution after death.

Similar forms

The Illinois Transfer-on-Death Deed (TODD) allows individuals to transfer real estate to beneficiaries upon their death without the need for probate. This document shares similarities with the Last Will and Testament. Both serve to outline how an individual's assets will be distributed after their passing. However, while a will must go through probate, a TODD allows for a more streamlined transfer of property directly to the named beneficiaries, making it an appealing option for many property owners.

The Beneficiary Deed is another document that parallels the Transfer-on-Death Deed. Like the TODD, a Beneficiary Deed allows property owners to designate beneficiaries who will receive the property upon their death. The key difference lies in the terminology and the specific laws governing them in various states. In Illinois, the Transfer-on-Death Deed is the preferred method, while other states may use the Beneficiary Deed terminology.

The Durable Power of Attorney for Property is another related document. While the TODD deals specifically with real estate transfer upon death, a Durable Power of Attorney allows an individual to appoint someone to manage their financial affairs while they are alive, especially if they become incapacitated. Both documents emphasize the importance of planning for the future, but they serve different purposes in asset management.

Understanding the importance of various estate planning documents, including the Illinois Transfer-on-Death Deed (TODD), is crucial for individuals looking to manage their legacies. The process of organizing these legal instruments can be simplified by utilizing resources such as the arizonapdfs.com/homeschool-letter-of-intent-template, which aid in ensuring all necessary documentation is correctly filed and submitted. By being informed about these essential documents, individuals can make better decisions for their families and future generations.

A Revocable Living Trust is similar in function to the Transfer-on-Death Deed but offers more comprehensive estate planning options. Like the TODD, a revocable trust allows for the transfer of assets without probate. However, it can also provide for the management of assets during the grantor's lifetime and after death, making it a more flexible option for those with complex estates.

The Joint Tenancy with Right of Survivorship is another legal arrangement that resembles the TODD. This form of property ownership allows two or more individuals to hold title to a property together. Upon the death of one owner, the surviving owner(s) automatically inherit the deceased owner's share. While both methods facilitate a transfer of property outside of probate, joint tenancy requires ongoing co-ownership, whereas a TODD allows for a single owner to designate beneficiaries.

The Life Estate Deed is a document that also shares some characteristics with the Transfer-on-Death Deed. A Life Estate Deed grants an individual the right to use and benefit from a property during their lifetime, with the property passing to designated beneficiaries upon their death. While both documents avoid probate, the Life Estate Deed creates a vested interest for the beneficiaries during the grantor's life, which is not the case with a TODD.

The Assignment of Beneficial Interest in a Trust is another document that can be compared to the Transfer-on-Death Deed. This document allows individuals to assign their interest in a trust to a beneficiary. While the TODD directly transfers property upon death, the assignment of beneficial interest allows for the transfer of benefits from a trust, offering flexibility in how assets are managed and distributed.

The Will Substitute is a broader category that includes various documents designed to transfer assets outside of probate. The Transfer-on-Death Deed falls within this category, as it allows for the direct transfer of property upon death without the lengthy probate process. Other will substitutes might include pay-on-death accounts or transfer-on-death securities, which serve similar functions in ensuring that assets are passed on efficiently.

Lastly, the Family Limited Partnership (FLP) can also be likened to the Transfer-on-Death Deed. An FLP allows family members to pool their resources and manage assets collectively, with the ability to transfer interests to beneficiaries. While the TODD focuses specifically on real estate and avoids probate, the FLP offers a way to manage and transfer various types of assets, providing a comprehensive approach to family wealth management.

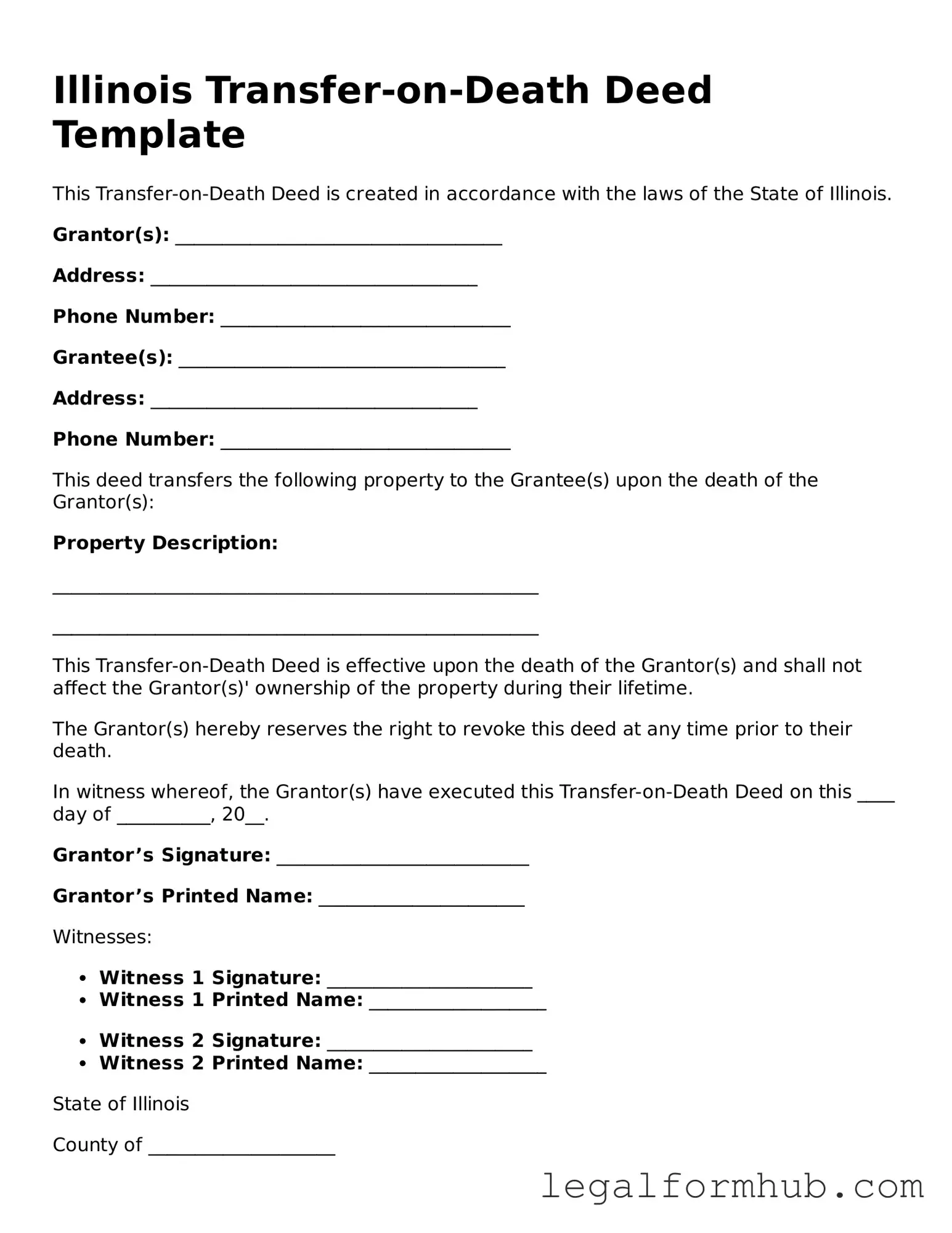

Instructions on Writing Illinois Transfer-on-Death Deed

Filling out the Illinois Transfer-on-Death Deed form is a straightforward process, but it requires careful attention to detail. After completing the form, you will need to file it with the appropriate county office to ensure it is legally recognized. This step is crucial for the transfer of property upon your passing.

- Obtain the Form: Start by downloading the Illinois Transfer-on-Death Deed form from the official state website or acquiring a physical copy from your local county clerk's office.

- Identify the Property: Clearly describe the property you wish to transfer. Include the address, legal description, and any other identifying details.

- Provide Your Information: Fill in your name as the current owner of the property. Ensure that your name is spelled correctly and matches the title of the property.

- Designate Beneficiaries: List the names of the individuals or entities who will receive the property upon your death. Be specific and include their full names.

- Include Additional Details: If you have multiple beneficiaries, indicate how the property will be divided among them. Specify if it will be equally divided or if certain percentages apply.

- Sign the Form: As the property owner, sign the form in the designated area. Your signature must be dated.

- Notarization: Have the form notarized. This step is essential to validate the document legally.

- File the Form: Submit the completed and notarized form to the county recorder’s office where the property is located. Keep a copy for your records.

Misconceptions

The Illinois Transfer-on-Death Deed form is a valuable tool for estate planning, yet several misconceptions surround its use and implications. Understanding these misconceptions can help individuals make informed decisions about their property and estate. Below are six common misconceptions:

- It automatically transfers property upon death. Many people believe that once the deed is executed, the property is immediately transferred to the beneficiary upon the owner's death. In reality, the transfer only occurs after the owner's passing and does not take effect until that time.

- It eliminates the need for a will. Some assume that by using a Transfer-on-Death Deed, they no longer need a will. However, a will is still essential for addressing other assets and matters not covered by the deed.

- All property can be transferred using this deed. It is a common misconception that any type of property can be transferred using a Transfer-on-Death Deed. In Illinois, this deed is only applicable to residential real estate, excluding other types of property such as personal belongings or business assets.

- Beneficiaries cannot be changed. Some individuals think that once a beneficiary is named on the deed, it cannot be altered. In fact, property owners can revoke or change the beneficiary designation at any time before their death.

- It avoids probate entirely. While a Transfer-on-Death Deed allows for the transfer of property outside of probate, it does not completely eliminate the probate process for other assets or debts associated with the estate.

- It is only for married couples. There is a belief that only married couples can utilize the Transfer-on-Death Deed. In truth, anyone who owns residential real estate in Illinois can execute this deed, regardless of marital status.

Understanding these misconceptions can empower individuals to make better estate planning decisions. Proper use of the Transfer-on-Death Deed can simplify the transfer of property and ensure that wishes are honored after one's passing.

Key takeaways

Filling out and using the Illinois Transfer-on-Death Deed form can be a straightforward process if you keep a few key points in mind. Here are some important takeaways to consider:

- Eligibility: Ensure that the property you wish to transfer is eligible for a Transfer-on-Death Deed. This typically includes residential real estate.

- Form Completion: Fill out the form accurately. Include all required information, such as the names of the current owners and the beneficiaries.

- Signature Requirement: The deed must be signed by the property owner(s) in the presence of a notary public. This step is crucial for the deed to be valid.

- Recording the Deed: After completing the form, it must be recorded with the county recorder’s office where the property is located. This ensures that the deed is legally recognized.

- Revocation: You can revoke the Transfer-on-Death Deed at any time before your death. This is done by filing a revocation form with the county recorder.

- Beneficiary Rights: Beneficiaries do not have any rights to the property until the owner passes away. This means they cannot sell or use the property during the owner’s lifetime.

- Tax Implications: Be aware of potential tax implications for your beneficiaries. It is advisable to consult with a tax professional to understand any consequences.

- Legal Assistance: Consider seeking legal assistance if you have questions or concerns about the process. A qualified attorney can provide guidance tailored to your situation.

Understanding these key points will help ensure that you fill out and use the Illinois Transfer-on-Death Deed form correctly and effectively. Taking the time to do this right can provide peace of mind for both you and your loved ones.

File Overview

| Fact Name | Details |

|---|---|

| Definition | An Illinois Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by the Illinois Compiled Statutes, specifically 755 ILCS 27. |

| Eligibility | Any individual who owns real estate in Illinois can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property upon their death. |

| Revocability | The deed can be revoked at any time before the owner's death, allowing for flexibility in estate planning. |

| Execution Requirements | The deed must be signed by the owner and witnessed by two individuals or notarized to be valid. |

| Filing Requirement | The Transfer-on-Death Deed must be recorded with the county recorder’s office where the property is located. |

| Effect on Creditors | Property transferred via a Transfer-on-Death Deed is still subject to the owner's creditors until the owner's death. |

| Tax Implications | Beneficiaries may receive a step-up in basis for tax purposes, which can reduce capital gains taxes when they sell the property. |

| Limitations | The Transfer-on-Death Deed cannot be used for transferring property held in a trust or for certain types of jointly owned property. |