Free Quitclaim Deed Template for Illinois

Create Other Popular Quitclaim Deed Forms for Different States

Quick Claim Deed Ohio - Reduces the complexity of estate and property planning.

For individuals seeking to understand risk management, the Hold Harmless Agreement is an important document that can provide essential protection during various activities. To learn more about its implications, you can visit this resource: comprehensive Hold Harmless Agreement insights.

How to Gift a House to a Family Member - Quitclaim Deeds can assist in property transfers due to marriage or civil union agreements.

Similar forms

The Warranty Deed is one of the most common documents used in real estate transactions. Unlike a Quitclaim Deed, which offers no guarantees about the title, a Warranty Deed provides a guarantee that the seller holds clear title to the property. This means that if any issues arise regarding ownership, the seller is responsible for resolving them. Buyers often prefer Warranty Deeds for their added security, as they assure that the property is free from any liens or claims from other parties.

Understanding various deed types is essential for anyone involved in real estate transactions. Each document serves a specific purpose, providing different levels of protection and assurances to the parties involved. For those seeking support and security in their personal lives, resources like the Fill PDF Forms can provide essential assistance for acquiring an emotional support animal, enhancing overall well-being amidst the complexities of property management and ownership.

The Special Warranty Deed is another document that shares similarities with the Quitclaim Deed. While it also transfers ownership of property, it differs in that it guarantees that the seller has not done anything to harm the title during their ownership. However, it does not protect against issues that may have existed before the seller acquired the property. This type of deed is often used in commercial real estate transactions and offers a middle ground between the Quitclaim and Warranty Deeds.

The Bargain and Sale Deed is a document that conveys property but does not provide any warranties about the title. Similar to a Quitclaim Deed, it transfers ownership without guaranteeing that the seller has clear title. However, it implies that the seller has some interest in the property. This type of deed is often used in foreclosure sales or tax lien sales, where the seller may not be able to provide a full warranty on the title.

A Deed of Trust is somewhat different but still related to property transactions. It is used to secure a loan by transferring the title of the property to a trustee until the loan is paid off. Although it does not transfer ownership in the same way as a Quitclaim Deed, it involves a similar legal process of transferring property rights. In this case, the Quitclaim Deed could be used to release the property from the trust once the loan is satisfied.

The Grant Deed is another document that shares some characteristics with the Quitclaim Deed. It transfers ownership of property and provides a limited guarantee that the seller has not previously transferred the title to anyone else. While it does not offer the same level of protection as a Warranty Deed, it does provide more assurance than a Quitclaim Deed. Grant Deeds are commonly used in residential real estate transactions in various states.

Lastly, the Affidavit of Title is a document that, while not a deed, serves a similar purpose in confirming ownership. It is often used in conjunction with a Quitclaim Deed to provide additional assurance to the buyer about the seller's ownership rights. The seller declares under oath that they own the property and that there are no liens or claims against it. This affidavit can help buyers feel more secure, even when using a Quitclaim Deed, which lacks the same level of guarantees.

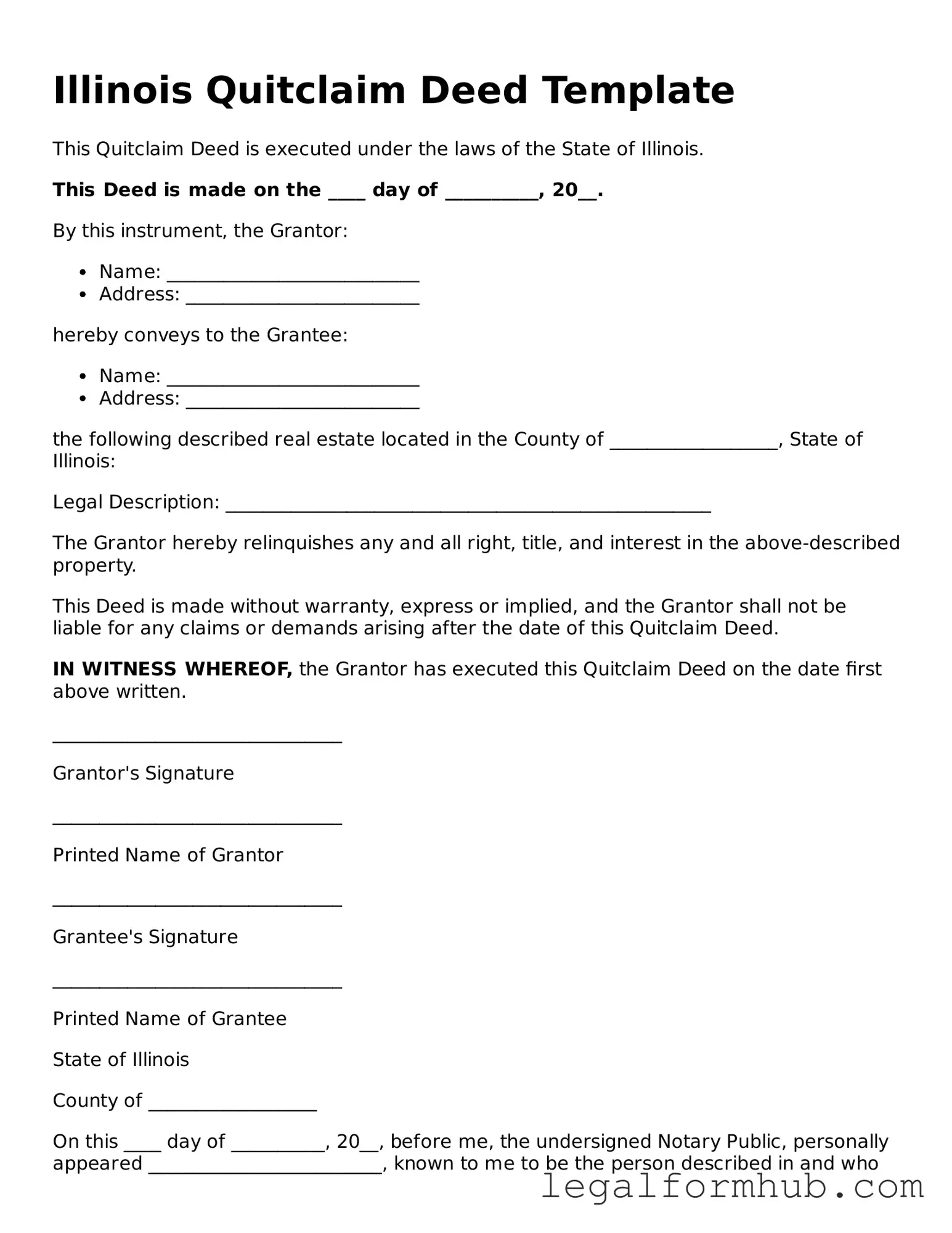

Instructions on Writing Illinois Quitclaim Deed

After you have gathered the necessary information and documents, you can begin filling out the Illinois Quitclaim Deed form. Follow these steps carefully to ensure the form is completed accurately.

- Obtain the Illinois Quitclaim Deed form. You can find it online or at your local county clerk's office.

- In the top section, enter the name of the person or entity transferring the property (the "Grantor"). Include their address.

- Next, provide the name of the person or entity receiving the property (the "Grantee"). Include their address as well.

- Fill in the legal description of the property. This can usually be found on the property’s deed or tax documents. Ensure it is accurate.

- Indicate the date of the transfer. This is the date you are completing the form.

- Sign the form in the presence of a notary public. The Grantor must sign, and the notary will also sign and stamp the document.

- Check if any additional signatures are required, such as for multiple Grantors or Grantees.

- Make copies of the completed and notarized Quitclaim Deed for your records.

- File the original Quitclaim Deed with the county recorder’s office where the property is located. There may be a filing fee.

Once you have completed these steps, the Quitclaim Deed will be officially recorded. This process ensures that the transfer of property is legally recognized. Keep a copy for your records and confirm the filing with the county recorder’s office.

Misconceptions

Misconceptions about the Illinois Quitclaim Deed can lead to confusion and potential legal issues. Here are ten common misunderstandings, along with clarifications to help you navigate this important legal document.

- Quitclaim Deeds Transfer Ownership Completely. Many believe that a quitclaim deed transfers full ownership of a property. In reality, it transfers whatever interest the grantor has, which may be none at all.

- Quitclaim Deeds Are Only for Family Transfers. While often used among family members, quitclaim deeds can be used in various situations, including sales and transfers between unrelated parties.

- Quitclaim Deeds Are Always Quick and Easy. Although they can simplify the transfer process, issues such as unclear title or existing liens may complicate the transaction.

- A Quitclaim Deed Removes Liens. This is a common myth. A quitclaim deed does not eliminate any existing liens on the property; it merely transfers the ownership interest.

- All Quitclaim Deeds Must Be Notarized. While notarization is generally recommended for validity, it is not strictly required in Illinois for the deed to be effective.

- Quitclaim Deeds Are Irrevocable. Some think that once a quitclaim deed is executed, it cannot be undone. However, it can be challenged or revoked under certain circumstances.

- Quitclaim Deeds Are Only for Real Estate. This is misleading. Quitclaim deeds can also be used to transfer other types of property interests, such as personal property or rights.

- Using a Quitclaim Deed Guarantees Clear Title. A quitclaim deed does not guarantee that the title is free of defects. Buyers should always conduct a title search before purchasing property.

- Quitclaim Deeds Are Only Useful for Transfers. They can also be used to clear up title issues or to add or remove a name from the title without transferring ownership.

- You Don’t Need Legal Help for a Quitclaim Deed. While it’s possible to complete a quitclaim deed without an attorney, seeking legal advice can prevent mistakes and ensure that the transfer is valid.

Understanding these misconceptions can help individuals make informed decisions when dealing with quitclaim deeds in Illinois.

Key takeaways

When dealing with the Illinois Quitclaim Deed form, it is essential to understand its purpose and the implications of its use. Below are key takeaways to consider:

- Purpose: A Quitclaim Deed is primarily used to transfer ownership of property without any warranties. It simply conveys whatever interest the grantor has in the property.

- No Guarantees: Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor holds clear title to the property. This means the recipient assumes some risk.

- Filling Out the Form: Ensure all required fields are filled out accurately, including the names of the grantor and grantee, property description, and the date of transfer.

- Notarization: The Quitclaim Deed must be signed in front of a notary public. This step is crucial for the document's validity.

- Recording the Deed: After completion, the Quitclaim Deed should be recorded with the county clerk or recorder's office to make the transfer public and official.

- Potential Tax Implications: Transferring property through a Quitclaim Deed may have tax consequences. It’s advisable to consult a tax professional to understand any liabilities.

- Legal Advice Recommended: Before executing a Quitclaim Deed, consider seeking legal advice, especially if there are disputes or complications regarding the property title.

- Use Cases: Common scenarios for using a Quitclaim Deed include transferring property between family members, settling an estate, or removing a former spouse from the title after a divorce.

- State-Specific Requirements: Be aware that each state may have specific laws governing Quitclaim Deeds. In Illinois, ensure compliance with local regulations.

Understanding these key aspects can help ensure a smoother property transfer process and minimize potential legal issues down the line.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real property without any warranties. |

| Governing Law | The Illinois Quitclaim Deed is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Parties Involved | The parties involved are the grantor (seller) and the grantee (buyer). |

| Use Cases | Commonly used in situations like transferring property between family members or clearing up title issues. |

| Consideration | Consideration is not required, but it is common to include a nominal amount, such as $1. |

| Recording | It is advisable to record the quitclaim deed with the local county recorder's office to ensure public notice. |

| Form Requirements | The form must be signed by the grantor and should be notarized to be valid. |

| Limitations | A quitclaim deed does not guarantee that the grantor has clear title to the property. |