Free Promissory Note Template for Illinois

Create Other Popular Promissory Note Forms for Different States

Simple Promissory Note Template California - A maturity date is typically specified in the note, indicating when the debt must be repaid.

To facilitate the hiring process, it's important for employers to utilize the California Employment Verification form, which serves as a key resource in confirming an individual's work eligibility. This form includes vital details related to the employee's qualifications and ensures adherence to both state and federal requirements. For those who need assistance with filling out this important document, access the tool at Fill PDF Forms.

Michigan Promissory Note - A Promissory Note does not need to be filed with a government office to be valid.

Similar forms

A loan agreement is a document that outlines the terms between a borrower and a lender. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement often includes additional clauses that address collateral, default conditions, and the responsibilities of both parties. This makes it more comprehensive than a standard promissory note, which primarily focuses on the borrower's promise to repay the loan.

A mortgage is another document that shares similarities with a promissory note. Both involve a promise to repay borrowed money, but a mortgage specifically secures the loan with real property. In essence, when a borrower takes out a mortgage, they sign a promissory note as well as a mortgage document. The mortgage gives the lender the right to take possession of the property if the borrower fails to meet their repayment obligations.

For families considering the education route of homeschooling, it is vital to understand the process of formalizing their choice, which involves submitting the https://arizonapdfs.com/homeschool-letter-of-intent-template to the state. This letter serves not just as a notification, but as a commitment to provide an education that meets the outlined legal requirements, ensuring clarity and structure in this educational journey.

A personal guarantee is a document that one party signs to take personal responsibility for another party’s debt. Similar to a promissory note, it involves a commitment to repay a loan. However, a personal guarantee often comes into play when a business borrows money and the lender requires a personal assurance from an individual, typically an owner or executive, that the debt will be repaid. This adds a layer of security for the lender beyond the borrower's promise.

A security agreement is akin to a promissory note in that it establishes the terms under which a borrower can secure a loan with collateral. While a promissory note is a promise to repay, a security agreement details the collateral that the lender can claim if the borrower defaults. This document is crucial for lenders because it provides them with a legal claim to the assets used as security, ensuring they have a way to recover their funds.

An IOU, or informal acknowledgment of a debt, is a simpler form of a promissory note. It records that one party owes money to another but typically lacks the detailed terms found in a formal promissory note. While an IOU may not be legally enforceable in the same way, it still serves as a written acknowledgment of a debt, similar to how a promissory note confirms the borrower's obligation to repay.

A conditional sales agreement is another document that bears resemblance to a promissory note. In this agreement, the buyer promises to pay for an item over time while the seller retains ownership until the full payment is made. Like a promissory note, it involves a promise to pay, but it also includes specific conditions related to the sale and ownership of the item, making it a hybrid between a loan agreement and a purchase contract.

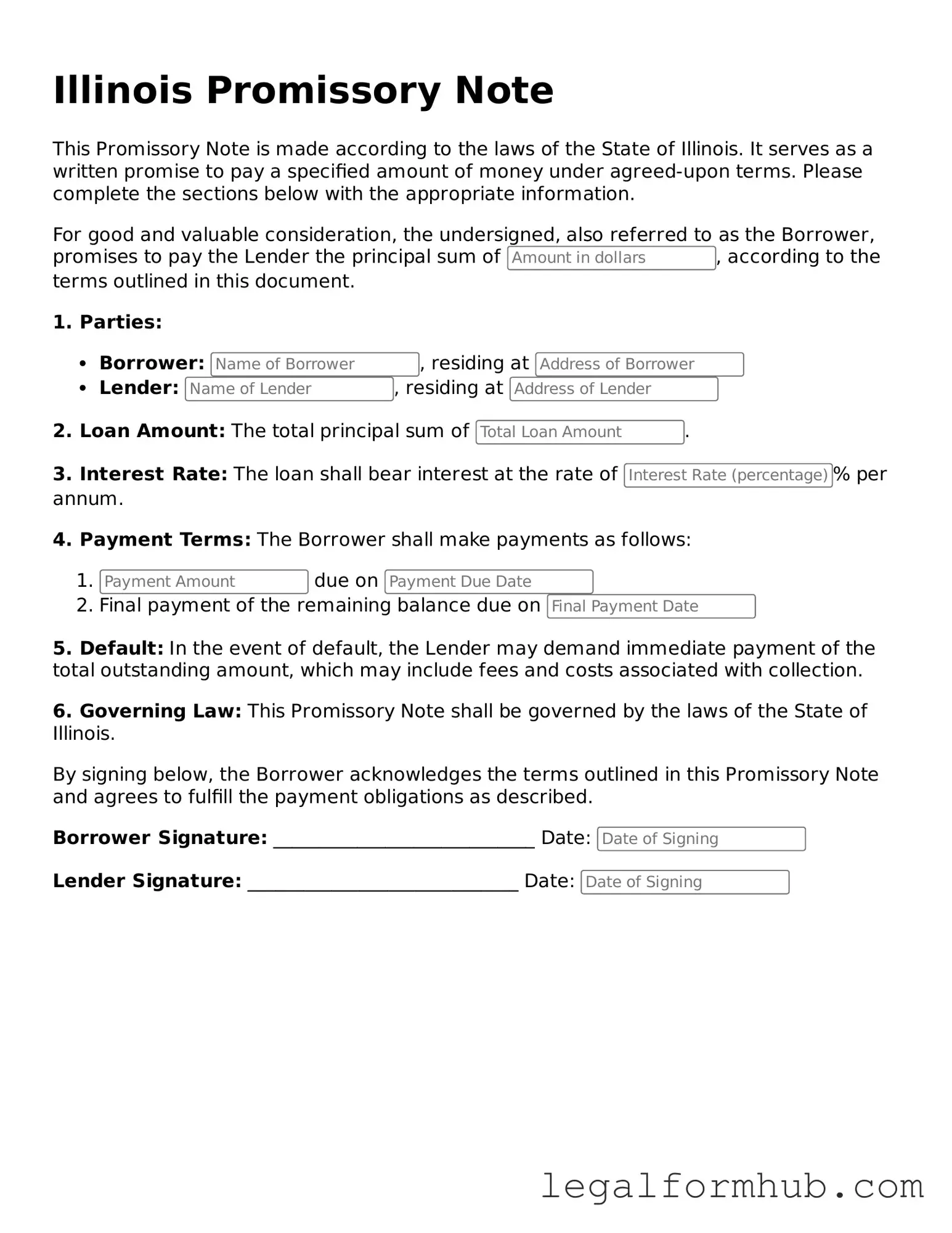

Instructions on Writing Illinois Promissory Note

Once you have the Illinois Promissory Note form in front of you, the next step is to fill it out accurately. Ensure you have all necessary information at hand, such as the names of the parties involved, the amount of money being loaned, and the repayment terms. This form will serve as a legal document outlining the agreement between the lender and the borrower.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Next, fill in the name and address of the borrower. This identifies the individual or entity responsible for repaying the loan.

- Enter the name and address of the lender. This is the person or organization providing the loan.

- Specify the principal amount of the loan. This is the total amount borrowed, without interest.

- Detail the interest rate, if applicable. Indicate whether it is fixed or variable.

- Outline the repayment schedule. Include the frequency of payments (e.g., monthly, quarterly) and the due date for each payment.

- Include any late fees or penalties for missed payments. Clearly state the terms to avoid confusion later.

- Sign and date the form. Both the borrower and lender should sign to make the agreement binding.

- Consider having the signatures notarized for added legal protection.

Misconceptions

Understanding the Illinois Promissory Note form can be challenging, especially with the various misconceptions that exist. Here are ten common misunderstandings, clarified for better comprehension.

- All Promissory Notes Are the Same: Many believe that all promissory notes are identical. In reality, the terms and conditions can vary significantly based on the agreement between the parties involved.

- A Promissory Note Must Be Notarized: Some think that notarization is mandatory for a promissory note to be valid. While notarization can add an extra layer of authenticity, it is not a legal requirement in Illinois.

- Only Banks Can Issue Promissory Notes: A common misconception is that only financial institutions can create promissory notes. In truth, any individual or business can issue one as long as it outlines the terms clearly.

- Promissory Notes Are Only for Loans: Many people assume that these notes are exclusively for loans. However, they can also be used for other types of financial agreements where repayment is expected.

- Verbal Agreements Are Sufficient: Some believe that a verbal agreement is enough for a promissory note. While oral agreements can be valid, having a written document is always advisable to avoid misunderstandings.

- Interest Rates Must Be Specified: There is a misconception that every promissory note must include an interest rate. While it is common to specify one, it is not a requirement; a note can be interest-free.

- Promissory Notes Are Non-Binding: Some individuals think that a promissory note does not hold legal weight. This is incorrect; a properly executed promissory note is a legally binding document.

- They Are Only for Personal Loans: Many people associate promissory notes solely with personal loans. In fact, they can be used in business transactions as well, providing flexibility in various financial dealings.

- Once Signed, They Cannot Be Changed: There is a belief that a promissory note is set in stone once signed. Modifications can be made, but both parties must agree to any changes and document them properly.

- They Are Only Useful in Illinois: Some think that promissory notes are only relevant within the state of Illinois. However, they can be used in other jurisdictions, though the specific laws may vary.

By understanding these misconceptions, individuals can navigate the complexities of promissory notes with greater confidence and clarity.

Key takeaways

Understand the purpose of a promissory note. It is a written promise to pay a specific amount of money at a designated time.

Clearly state the loan amount. This should be the exact figure being borrowed, without ambiguity.

Include the names of both the borrower and the lender. Make sure to use full legal names to avoid confusion.

Specify the repayment terms. Indicate when payments are due and how they should be made, whether in installments or as a lump sum.

Detail any interest rates. If applicable, include the interest rate and how it will be calculated.

Consider including late fees. This can help encourage timely payments and protect the lender's interests.

Both parties should sign the note. This confirms that everyone agrees to the terms laid out in the document.

Keep a copy of the signed note. This serves as a record of the agreement and can be important for future reference.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Illinois Uniform Commercial Code (UCC) governs promissory notes in Illinois. |

| Parties Involved | The note typically involves two parties: the maker (borrower) and the payee (lender). |

| Essential Elements | Key elements include the amount owed, interest rate, payment schedule, and maturity date. |

| Interest Rate | Illinois law allows for the inclusion of an interest rate, which must comply with state usury laws. |

| Signature Requirement | The maker must sign the note for it to be legally binding. |

| Transferability | Promissory notes can be transferred to another party, making them negotiable instruments. |

| Default Consequences | If the maker defaults, the payee has the right to pursue legal remedies, including collection actions. |

| Modification | Changes to the terms of the note must be agreed upon by both parties and documented in writing. |

| Record Keeping | It is advisable for both parties to keep a copy of the signed note for their records. |