Free Prenuptial Agreement Template for Illinois

Create Other Popular Prenuptial Agreement Forms for Different States

North Carolina Premarital Agreement - This agreement is a tool for ensuring both partners are working as a team financially, rather than as individuals.

To ensure a smooth transition of boat ownership, it is important to understand the significance of a reliable document. By utilizing the necessary Boat Bill of Sale form, you can simplify the process and maintain clear records of your transaction.

Michigan Premarital Agreement - This form helps couples manage expectations regarding financial roles in their marriage.

Georgia Premarital Agreement - The agreement can be a tool to ensure fairness in financial matters.

Similar forms

The Illinois Prenuptial Agreement is similar to a Cohabitation Agreement. Both documents outline the rights and responsibilities of individuals who are living together, whether married or not. A Cohabitation Agreement can specify how assets will be divided if the relationship ends, similar to how a Prenuptial Agreement addresses asset division in the event of a divorce. Both agreements serve to protect individual interests and provide clarity in financial matters, helping to avoid disputes in the future.

An Estate Plan is another document that shares similarities with a Prenuptial Agreement. While a Prenuptial Agreement focuses on the division of assets during marriage or divorce, an Estate Plan deals with the distribution of assets after death. Both documents require careful consideration of assets and beneficiaries. They aim to ensure that individual wishes are respected, whether during life or after passing, and can prevent conflicts among heirs or spouses.

A Postnuptial Agreement is also comparable to a Prenuptial Agreement. Like a Prenuptial Agreement, a Postnuptial Agreement details how assets will be managed and divided. The key difference lies in timing; a Postnuptial Agreement is created after the marriage has taken place. Both documents are designed to protect individual interests and can address changes in circumstances, such as income changes or the acquisition of new assets, ensuring that both parties are on the same page regarding financial matters.

To further protect your interests during a vehicle transaction, it's important to utilize appropriate legal documents. One helpful resource is the Fill PDF Forms which can assist you in preparing the necessary agreements to ensure a smooth and compliant purchase process.

A Separation Agreement bears resemblance to a Prenuptial Agreement in that it outlines the terms under which a couple will separate. This document typically addresses issues such as property division, child custody, and support obligations. Both agreements are proactive measures that help clarify expectations and responsibilities, aiming to reduce conflict and provide a clear framework for the future, whether during a separation or after a divorce.

Lastly, a Financial Disclosure Statement is similar to a Prenuptial Agreement in that it requires both parties to disclose their financial situations. This document is often used in conjunction with a Prenuptial Agreement to ensure transparency about assets and debts. Both emphasize the importance of informed decision-making in financial matters, helping to build trust and understanding between partners. By ensuring that both parties are aware of each other's financial circumstances, these documents can help prevent misunderstandings and disputes down the line.

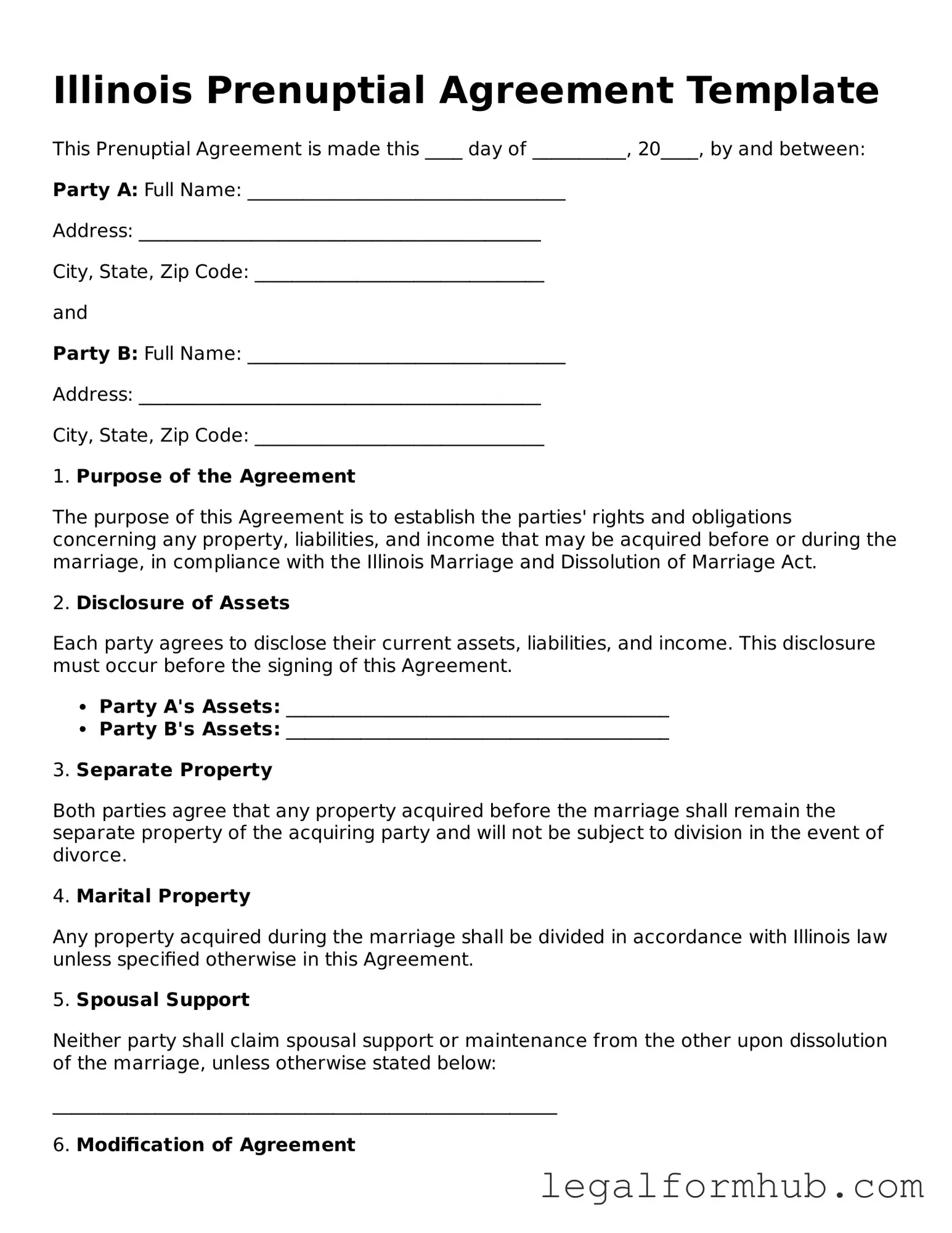

Instructions on Writing Illinois Prenuptial Agreement

Completing the Illinois Prenuptial Agreement form is an important step for couples considering a legal arrangement regarding their assets and responsibilities. Following these steps will help ensure that the form is filled out correctly and meets the necessary requirements.

- Begin by obtaining the Illinois Prenuptial Agreement form. This can usually be found online or through legal stationery stores.

- Read the form carefully to understand the sections that need to be completed.

- In the first section, provide the full names of both parties involved in the agreement.

- Next, include the current addresses of both individuals. Make sure the addresses are accurate and up-to-date.

- In the designated area, outline the assets and liabilities of each party. Be thorough and honest about all financial matters.

- Discuss and agree on the terms of the agreement with your partner. This may include how property will be divided in the event of a divorce.

- Once both parties agree on the terms, sign the form in the presence of a notary public to make it legally binding.

- Keep copies of the signed agreement for both parties. It is important to have a record of the agreement for future reference.

Misconceptions

Many people have misunderstandings about prenuptial agreements in Illinois. Here are nine common misconceptions:

-

Prenuptial agreements are only for the wealthy.

This is not true. Anyone can benefit from a prenuptial agreement, regardless of their financial situation. It can help clarify financial responsibilities and protect assets.

-

Prenuptial agreements are only necessary if one partner has significant assets.

Even couples with modest assets can find value in a prenuptial agreement. It can address debts, future earnings, and other financial matters.

-

Prenuptial agreements are only for divorce.

While they do outline terms in case of divorce, they can also clarify financial expectations during the marriage, which can prevent conflicts.

-

Prenuptial agreements are not enforceable in court.

This is a misconception. When properly drafted and executed, prenuptial agreements are legally binding and can be enforced in court.

-

Prenuptial agreements must be signed months before the wedding.

While it’s best to finalize them well in advance, there is no strict timeline. However, both parties should have enough time to review and understand the agreement.

-

Prenuptial agreements can cover anything.

There are limitations. For instance, they cannot include child custody or support terms. Courts typically focus on the best interests of the child in those matters.

-

Only one lawyer is needed for a prenuptial agreement.

Each party should have their own legal representation. This ensures that both individuals understand their rights and that the agreement is fair.

-

Prenuptial agreements are a sign of distrust.

Many view them as a proactive way to communicate about finances. They can actually strengthen a relationship by encouraging open discussions.

-

Prenuptial agreements are permanent and cannot be changed.

They can be modified or revoked if both parties agree. Regularly reviewing the agreement can ensure it remains relevant to changing circumstances.

Key takeaways

Filling out and using the Illinois Prenuptial Agreement form can be an important step for couples planning to marry. Here are some key takeaways to consider:

- Open Communication is Essential: Discussing financial matters openly with your partner can help ensure that both parties feel comfortable and understood throughout the process.

- Full Disclosure is Required: Both partners must provide a complete and honest account of their financial situations. This includes assets, debts, and income to ensure fairness and transparency.

- Legal Review is Recommended: It is advisable for both parties to have their own legal counsel review the agreement. This helps to ensure that everyone understands their rights and obligations under the agreement.

- Changes Must be Documented: If either party wishes to make changes to the agreement after it has been signed, those changes must be documented in writing and agreed upon by both parties.

File Overview

| Fact Name | Description |

|---|---|

| Definition | An Illinois prenuptial agreement is a contract between two people who plan to marry, outlining how their assets and debts will be handled in case of divorce or death. |

| Governing Law | The Illinois Uniform Premarital Agreement Act governs prenuptial agreements in Illinois. |

| Requirements | Both parties must voluntarily sign the agreement. It should be in writing and ideally notarized. |

| Disclosure | Full financial disclosure is recommended. Each party should provide a complete picture of their assets and liabilities. |

| Enforceability | A prenuptial agreement can be challenged in court if it is found to be unconscionable or if one party did not understand the terms. |

| Modification | Agreements can be modified after marriage, but changes must also be in writing and signed by both parties. |