Free Loan Agreement Template for Illinois

Create Other Popular Loan Agreement Forms for Different States

Georgia Promissory Note Template - Each loan agreement is unique, tailored to the specifics of the loan.

To understand the fundamental requirements for establishing a corporation, it is crucial to explore the process involved in completing the relevant state-specific Articles of Incorporation form, which serves as the foundational document for your business entity.

California Promissory Note Template - May provide for joint borrowers in a multi-signature scenario.

Similar forms

The Illinois Loan Agreement form shares similarities with a Promissory Note. Both documents outline the terms of a loan, including the principal amount, interest rate, and repayment schedule. A Promissory Note serves as a written promise from the borrower to repay the loan, often including details about default consequences. While the Loan Agreement may cover broader terms, the Promissory Note is typically more concise and focused solely on the borrower's commitment to repay the borrowed amount.

Another document comparable to the Illinois Loan Agreement is the Security Agreement. This document is used when a loan is secured by collateral. Similar to the Loan Agreement, it specifies the terms of the loan but also includes details about the collateral being pledged. In both cases, the lender has rights to the collateral in the event of a default, providing a level of security for the loan.

The Illinois Loan Agreement also resembles a Credit Agreement. This document is often used in commercial lending and outlines the terms under which credit is extended. Like the Loan Agreement, it details the amount, interest rates, and repayment terms. However, a Credit Agreement may involve multiple parties and can include additional terms related to the borrower's financial covenants and obligations.

In the realm of financial agreements, careful documentation is essential, and understanding these types of contracts can simplify the process. For instance, if you're in need of a specific document, you might find yourself looking to Fill PDF Forms for assistance, ensuring that all necessary details are accurately conveyed.

A Lease Agreement is another document that shares commonalities with the Illinois Loan Agreement. While a Lease Agreement pertains to the rental of property, it similarly outlines terms regarding payment schedules and obligations. Both agreements require the parties to adhere to specific terms, and failure to comply can result in penalties or legal action.

The Illinois Loan Agreement is also similar to a Forbearance Agreement. This document is used when a borrower is struggling to meet payment obligations. It outlines a temporary modification of the loan terms, similar to how the Loan Agreement establishes the original terms. Both documents require the borrower to adhere to specific conditions to avoid further legal repercussions.

A Guaranty Agreement is another document that parallels the Illinois Loan Agreement. This agreement involves a third party who agrees to take responsibility for the loan if the borrower defaults. Like the Loan Agreement, it specifies the terms of the loan and the obligations of all parties involved, ensuring that the lender has recourse if the borrower fails to meet their obligations.

The Illinois Loan Agreement is also akin to a Loan Modification Agreement. This document is used to change the terms of an existing loan, often due to the borrower's financial difficulties. Both agreements require clear terms regarding payment schedules and obligations, but the Loan Modification Agreement specifically addresses changes to the original Loan Agreement.

Lastly, a Mortgage Agreement bears similarities to the Illinois Loan Agreement. This document is specifically used when real estate is involved as collateral for the loan. Like the Loan Agreement, it outlines the terms of the loan, including repayment schedules and interest rates. However, the Mortgage Agreement includes specific provisions regarding the property itself and the lender's rights in case of default.

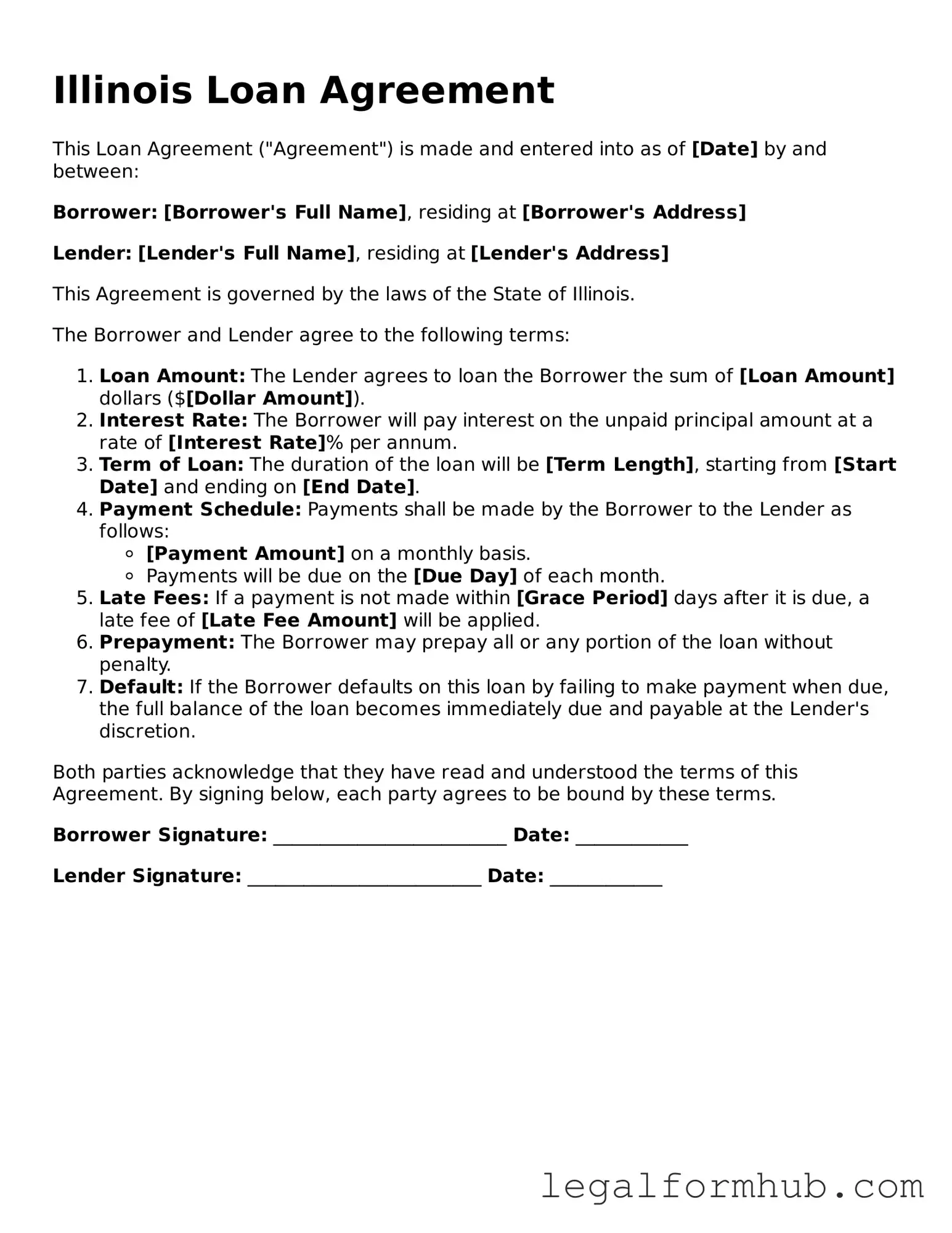

Instructions on Writing Illinois Loan Agreement

Completing the Illinois Loan Agreement form is an important step in securing a loan. Following these steps will help ensure that you fill out the form correctly and thoroughly, making the process smoother for all parties involved.

- Begin by carefully reading the instructions provided with the form.

- Write your full legal name in the designated field.

- Provide your current address, including street number, city, state, and zip code.

- Fill in your contact information, including phone number and email address.

- Indicate the loan amount you are requesting.

- Specify the purpose of the loan in the appropriate section.

- Detail the repayment terms, including the interest rate and payment schedule.

- Provide any necessary co-signer information, if applicable.

- Sign and date the form at the bottom where indicated.

- Review the completed form for accuracy before submitting it.

After filling out the form, ensure that you keep a copy for your records. This will be useful for future reference and communication with the lender.

Misconceptions

Understanding the Illinois Loan Agreement form can be challenging, especially with the many misconceptions that surround it. Here are eight common myths and the truths that debunk them:

-

All loan agreements are the same.

Each loan agreement is unique. The Illinois Loan Agreement form is tailored to comply with state laws and specific borrower-lender relationships. Variations can exist based on the type of loan and the terms negotiated.

-

Only banks can issue loan agreements.

While banks are common lenders, many individuals and organizations can issue loan agreements. Private lenders, family members, and businesses may also use the Illinois Loan Agreement form to formalize loans.

-

Loan agreements are not legally binding.

When properly executed, loan agreements are legally binding contracts. They create enforceable obligations for both the borrower and the lender, providing legal recourse if either party fails to uphold their end of the agreement.

-

Verbal agreements are sufficient.

While verbal agreements can be made, they are often difficult to enforce. The Illinois Loan Agreement form provides a written record that clarifies the terms and protects both parties, reducing misunderstandings.

-

Only the borrower needs to sign the agreement.

Both parties must sign the loan agreement to make it valid. This ensures that all parties acknowledge and agree to the terms laid out in the document.

-

Loan agreements do not need to be notarized.

Although notarization is not always required, having the agreement notarized can add an extra layer of protection. It verifies the identities of the signers and can help prevent disputes about authenticity.

-

All loan agreements have the same interest rates.

Interest rates can vary widely depending on numerous factors, including the lender, the borrower's creditworthiness, and the type of loan. The Illinois Loan Agreement form allows for flexibility in setting these rates.

-

Once signed, the terms cannot be changed.

While the terms of a loan agreement are generally fixed once signed, they can be modified if both parties agree to the changes. It's essential to document any amendments in writing to maintain clarity and legal standing.

By understanding these misconceptions, borrowers and lenders can navigate the Illinois Loan Agreement form with greater confidence and clarity.

Key takeaways

When filling out and using the Illinois Loan Agreement form, it is essential to consider several important factors. Here are key takeaways to keep in mind:

- Identify the Parties: Clearly state the names and addresses of both the lender and the borrower. Accurate identification helps prevent confusion later on.

- Loan Amount: Specify the exact amount being loaned. This figure should be clear and unambiguous to avoid disputes.

- Interest Rate: Include the interest rate applicable to the loan. Make sure it complies with Illinois state regulations to ensure legality.

- Repayment Terms: Outline how and when the borrower will repay the loan. This section should detail the payment schedule, including due dates and amounts.

- Default Conditions: Clearly define what constitutes a default on the loan. This information is crucial for both parties to understand their rights and obligations.

- Governing Law: Specify that the agreement is governed by Illinois law. This helps in determining the legal framework for any disputes that may arise.

- Signatures: Both parties must sign and date the agreement. This step is essential for making the document legally binding.

- Witness or Notary: Consider having the agreement witnessed or notarized. While not always required, this can add an extra layer of authenticity.

- Keep Copies: After signing, both parties should retain copies of the agreement. This ensures that each party has access to the terms agreed upon.

By following these key points, you can create a comprehensive and effective Illinois Loan Agreement that protects the interests of both the lender and the borrower.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The Illinois Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Illinois, specifically under the Illinois Compiled Statutes. |

| Parties Involved | The form requires the identification of both the lender and the borrower, including their legal names and contact information. |

| Repayment Terms | It specifies the repayment schedule, interest rate, and any fees associated with the loan. |