Free Last Will and Testament Template for Illinois

Create Other Popular Last Will and Testament Forms for Different States

Free Ohio Last Will and Testament Form Pdf - A crucial legal tool to ensure your assets are distributed according to your wishes.

Last Will and Testament North Carolina - Addresses how to handle potential disputes among beneficiaries.

The Arizona Notice to Quit form is a legal document that a landlord uses to inform a tenant that they must vacate the rental property. This notice outlines the reasons for eviction and provides a timeline for the tenant to leave. Understanding this form is essential for both landlords and tenants navigating the eviction process in Arizona. For more detailed information, landlords can refer to the resources available at arizonapdfs.com/notice-to-quit-template/.

Last Will and Testament Michigan - Establishes a clear plan for your estate, providing peace of mind for you and your family.

Last Will and Testament Template Georgia - Can be amended with codicils to reflect changes without drafting a new will.

Similar forms

The Illinois Last Will and Testament form is similar to a Living Will. A Living Will outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes. Both documents express personal desires, but while a Last Will manages the distribution of assets after death, a Living Will addresses healthcare decisions during life.

Another document akin to the Illinois Last Will and Testament is the Trust. A Trust can hold assets for beneficiaries, often allowing for more control over how and when those assets are distributed. While a Last Will takes effect after death, a Trust can be active during a person's lifetime, providing flexibility in asset management.

Understanding various legal documents is essential for effective estate planning and personal management. For instance, individuals may find themselves needing to claim disability benefits, and the Fill PDF Forms provides an accessible solution for filling out necessary forms like the EDD DE 2501, which enables proper communication of one's medical condition and enables access to financial support when needed. Just like a Living Will or Last Will ensures that an individual's choices are respected, filling out these forms with care ensures that rights and benefits are effectively managed.

The Power of Attorney is also comparable. This document designates an individual to make financial or healthcare decisions on someone else's behalf. Both a Power of Attorney and a Last Will ensure that a person's wishes are respected, though they operate in different contexts—one during life and the other after death.

A Codicil is a document that modifies an existing Last Will and Testament. It allows individuals to make changes without drafting an entirely new will. This is similar in purpose to the Last Will, as both serve to express a person's final wishes regarding their estate.

The Illinois Declaration of Guardian form shares similarities with a Last Will in that both documents can address the care of dependents. A Declaration of Guardian specifies who should take care of minor children if both parents pass away, while a Last Will designates how assets should be distributed after death.

The Revocable Living Trust is another document that bears resemblance. Like a Last Will, it can dictate how assets are distributed upon death. However, a Revocable Living Trust can be altered during the grantor's lifetime and can help avoid probate, offering a different approach to estate planning.

A Bill of Sale is somewhat similar in that it documents the transfer of ownership of personal property. While a Last Will deals with the distribution of assets after death, a Bill of Sale facilitates the sale or transfer of property during a person's lifetime, ensuring clear ownership records.

The Advance Healthcare Directive is related as it combines elements of both a Living Will and a Power of Attorney. It provides guidance on medical decisions and appoints someone to make those decisions if the individual is unable to do so. Both documents reflect a person's wishes regarding health and care.

The Affidavit of Heirship is another document that can be compared to a Last Will. It serves to establish the heirs of a deceased person when no will exists. While a Last Will clearly outlines the distribution of assets, an Affidavit of Heirship can help settle estates without a formal will, ensuring that heirs are recognized.

Lastly, the Estate Plan is a broader document that encompasses various legal instruments, including a Last Will. An Estate Plan outlines how a person's assets will be managed and distributed, addressing not only the distribution of property but also tax considerations and other personal wishes, thus encompassing the goals of a Last Will and Testament.

Instructions on Writing Illinois Last Will and Testament

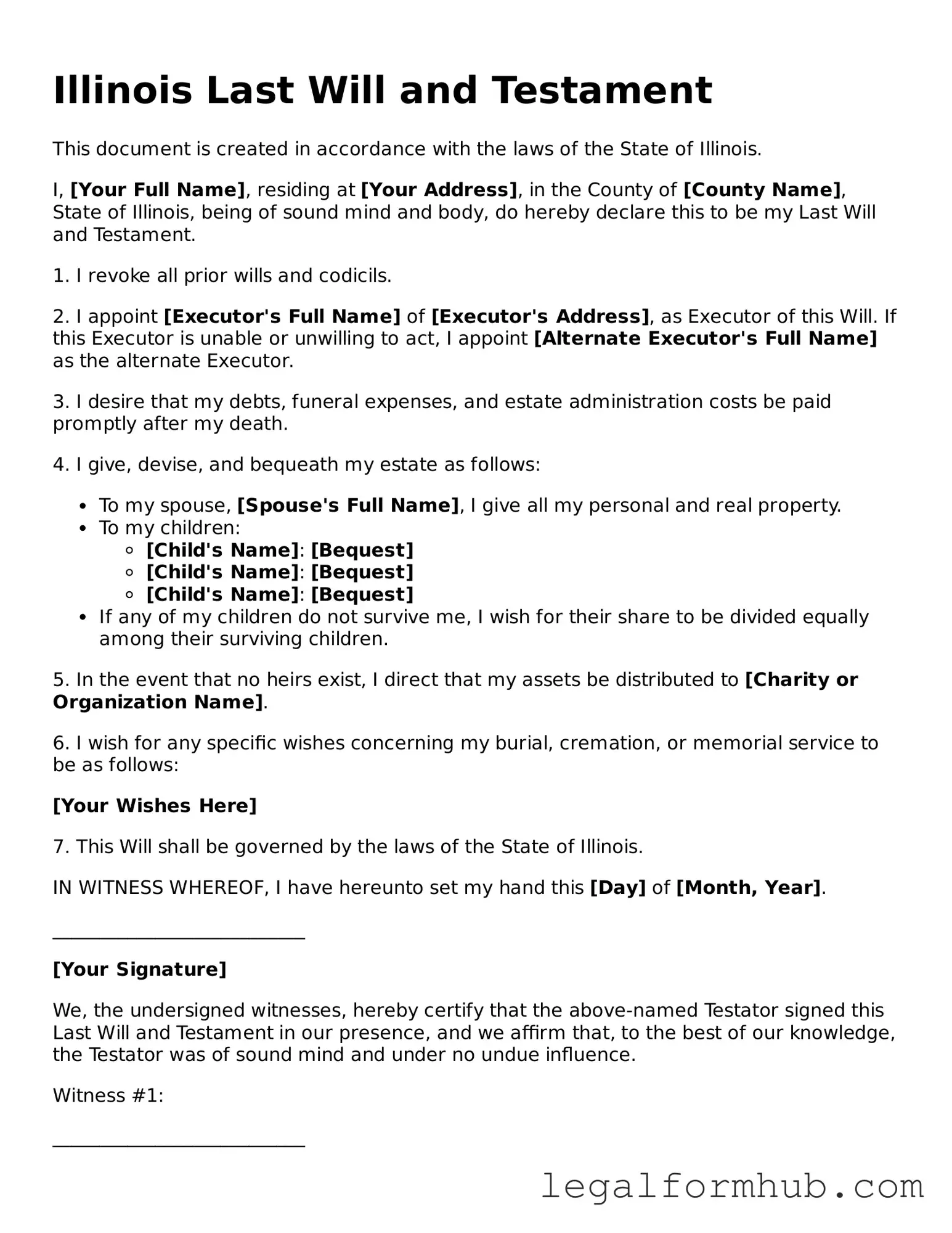

After obtaining the Illinois Last Will and Testament form, it is essential to complete it accurately to ensure your wishes are honored. The next steps involve carefully filling out each section of the form, providing necessary details about your estate and beneficiaries. Following these instructions will guide you through the process.

- Begin by writing your full name at the top of the form. Ensure that it matches the name on your identification documents.

- Next, include your current address. This should be your permanent residence where you live most of the time.

- Designate an executor. This person will carry out the instructions in your will. Write their full name and address clearly.

- List your beneficiaries. These are the individuals or organizations who will inherit your property. Include their names and relationship to you.

- Detail your assets. Specify what you own, such as real estate, bank accounts, and personal property. Be as specific as possible.

- Indicate how you want your assets distributed. Clearly state who receives what. This can help prevent misunderstandings later.

- Include any special requests or instructions. If there are particular wishes regarding your estate, write them down here.

- Sign the form in front of witnesses. Illinois law requires at least two witnesses to observe your signature and sign the document themselves.

- Finally, date the will. This is important for establishing when the document was created.

Misconceptions

Understanding the Illinois Last Will and Testament form can be challenging. Here are five common misconceptions that people have about this important document:

- A will only matters after death. Many believe that a will has no significance until someone passes away. In reality, a will can help clarify a person's wishes and provide guidance while they are still alive, especially in cases of incapacitation.

- Only wealthy individuals need a will. Some think that wills are only for those with significant assets. However, anyone can benefit from having a will, regardless of their financial situation. A will ensures that personal belongings and wishes are respected.

- Verbal agreements are enough. Many people assume that discussing their wishes with family members is sufficient. Unfortunately, verbal agreements can lead to confusion and disputes. A written will provides clear and legally binding instructions.

- Once a will is created, it cannot be changed. There is a misconception that a will is set in stone once it is signed. In fact, individuals can update or revoke their wills at any time, as long as they follow the proper legal procedures.

- All assets automatically go to the spouse. Some believe that if someone is married, their spouse will automatically inherit everything. This is not always the case. A will can specify how assets are distributed, which may differ from state laws.

Understanding these misconceptions can help individuals make informed decisions about their estate planning in Illinois.

Key takeaways

Creating a Last Will and Testament in Illinois is an important step in ensuring your wishes are honored after your passing. Here are some key takeaways to consider when filling out and using this form:

- Understand the Purpose: A Last Will and Testament allows you to dictate how your assets will be distributed, who will care for your children, and how your final wishes will be carried out.

- Eligibility: To create a valid will in Illinois, you must be at least 18 years old and of sound mind.

- Choose an Executor: Select a trustworthy person to manage your estate. This individual will ensure your wishes are followed and handle any necessary legal processes.

- Be Specific: Clearly outline how you want your assets distributed. Ambiguity can lead to disputes among heirs.

- Witness Requirements: Illinois law requires that your will be signed in the presence of at least two witnesses who are not beneficiaries of the will.

- Revocation: You can revoke or change your will at any time, but it’s essential to follow the proper procedures to avoid confusion.

- Consider Legal Advice: While it’s possible to create a will without legal assistance, consulting an attorney can help ensure that your document meets all legal requirements.

- Store Safely: Keep your will in a safe place and inform your executor of its location. This ensures it can be easily accessed when needed.

- Review Regularly: Life changes such as marriage, divorce, or the birth of children may necessitate updates to your will.

By following these guidelines, you can create a comprehensive and effective Last Will and Testament that reflects your wishes and provides peace of mind for you and your loved ones.

File Overview

| Fact Name | Details |

|---|---|

| Governing Law | The Illinois Last Will and Testament is governed by the Illinois Probate Act, specifically 755 ILCS 5/1-1 et seq. |

| Age Requirement | Individuals must be at least 18 years old to create a valid will in Illinois. |

| Signature Requirement | The will must be signed by the testator, the person making the will, at the end of the document. |

| Witness Requirement | Illinois law requires at least two witnesses to sign the will, affirming the testator's signature. |

| Holographic Wills | Holographic wills, which are handwritten and signed by the testator, are recognized in Illinois if certain conditions are met. |

| Revocation | A will can be revoked by a subsequent will or by destroying the original document with the intent to revoke. |

| Testamentary Capacity | The testator must possess testamentary capacity, meaning they understand the nature of making a will and the consequences. |

| Residency | There is no residency requirement for the testator, but the will must comply with Illinois law if it is probated in Illinois. |

| Distribution of Assets | The will outlines how the testator's assets will be distributed upon their death, including specific bequests and general distributions. |

| Executor Appointment | The testator can appoint an executor in the will to manage the estate and ensure the terms are carried out. |