Free Durable Power of Attorney Template for Illinois

Create Other Popular Durable Power of Attorney Forms for Different States

Texas Durable Power of Attorney Free Pdf - This document can be tailored to grant broad or limited powers to the appointed agent.

For a hassle-free transaction, you can find everything you need regarding the complete motorcycle bill of sale form to ensure that the sale is properly documented and recognized.

Ohio Power of Attorney Requirements - This form helps maintain continuity in managing your financial affairs.

Durable Power of Attorney Michigan - Your agent can handle tasks like paying bills, managing investments, and conducting business transactions.

Does Durable Power of Attorney Cover Medical - It can help to clarify your wishes in situations that are often complex.

Similar forms

The Illinois Durable Power of Attorney (DPOA) form shares similarities with the General Power of Attorney (GPOA). Both documents allow individuals to designate an agent to make decisions on their behalf. The key difference lies in the durability of the authority granted. While a GPOA becomes ineffective if the principal becomes incapacitated, a DPOA remains in effect even if the principal is unable to make decisions due to illness or injury. This makes the DPOA particularly useful for long-term planning, ensuring that an agent can manage affairs when the principal cannot.

Another document that resembles the DPOA is the Healthcare Power of Attorney (HCPOA). This form specifically empowers an agent to make medical decisions for the principal if they are incapacitated. Like the DPOA, the HCPOA remains effective during periods of incapacity. However, the HCPOA is limited to healthcare decisions, while the DPOA can cover a broader range of financial and legal matters. Both documents emphasize the importance of appointing a trusted individual to act in the principal's best interests.

The Living Will is another document related to the DPOA. A Living Will outlines an individual's preferences regarding medical treatment in the event of terminal illness or irreversible condition. While the DPOA allows an agent to make healthcare decisions, the Living Will provides specific instructions on the types of treatment the individual wishes to receive or refuse. Together, these documents ensure that a person's healthcare preferences are honored, even when they cannot communicate them directly.

Similar to the DPOA is the Revocable Living Trust. This legal arrangement allows individuals to place their assets into a trust, managed by a trustee for their benefit during their lifetime. If the individual becomes incapacitated, the successor trustee can step in to manage the assets without the need for court intervention. While the DPOA focuses on granting authority to make decisions, a Revocable Living Trust provides a structured way to manage and distribute assets, ensuring a smooth transition of control.

When completing important legal documents, it is essential to ensure accuracy and compliance with state requirements. For those involved in vehicle transactions, the Florida Motor Vehicle Bill of Sale is a vital form that serves as proof of ownership transfer. To facilitate this process, you can utilize online resources, such as Fill PDF Forms, which can help in generating and filling out the necessary documents efficiently.

The Advance Directive is another document that bears resemblance to the DPOA. An Advance Directive encompasses both a Living Will and a Healthcare Power of Attorney, providing a comprehensive approach to healthcare decision-making. It allows individuals to express their wishes regarding medical treatment and designate an agent to make decisions on their behalf. Like the DPOA, it emphasizes the importance of planning for future healthcare needs and ensuring that one's preferences are respected.

The Financial Power of Attorney is closely related to the DPOA but focuses solely on financial matters. This document allows an agent to manage the principal's financial affairs, such as paying bills, managing investments, and handling real estate transactions. While the DPOA can cover both financial and healthcare decisions, the Financial Power of Attorney is specifically tailored to financial management, making it a vital tool for those looking to ensure their financial affairs are handled appropriately during incapacity.

Lastly, the Guardianship Petition is a legal document that can be filed in court to appoint a guardian for an individual who is unable to make decisions due to incapacity. Unlike the DPOA, which allows individuals to choose their agents, a guardianship is determined by the court. This process can be more time-consuming and may not align with the individual's preferences. However, both documents serve the purpose of ensuring that someone is available to make decisions on behalf of an incapacitated person, highlighting the importance of having a plan in place for future needs.

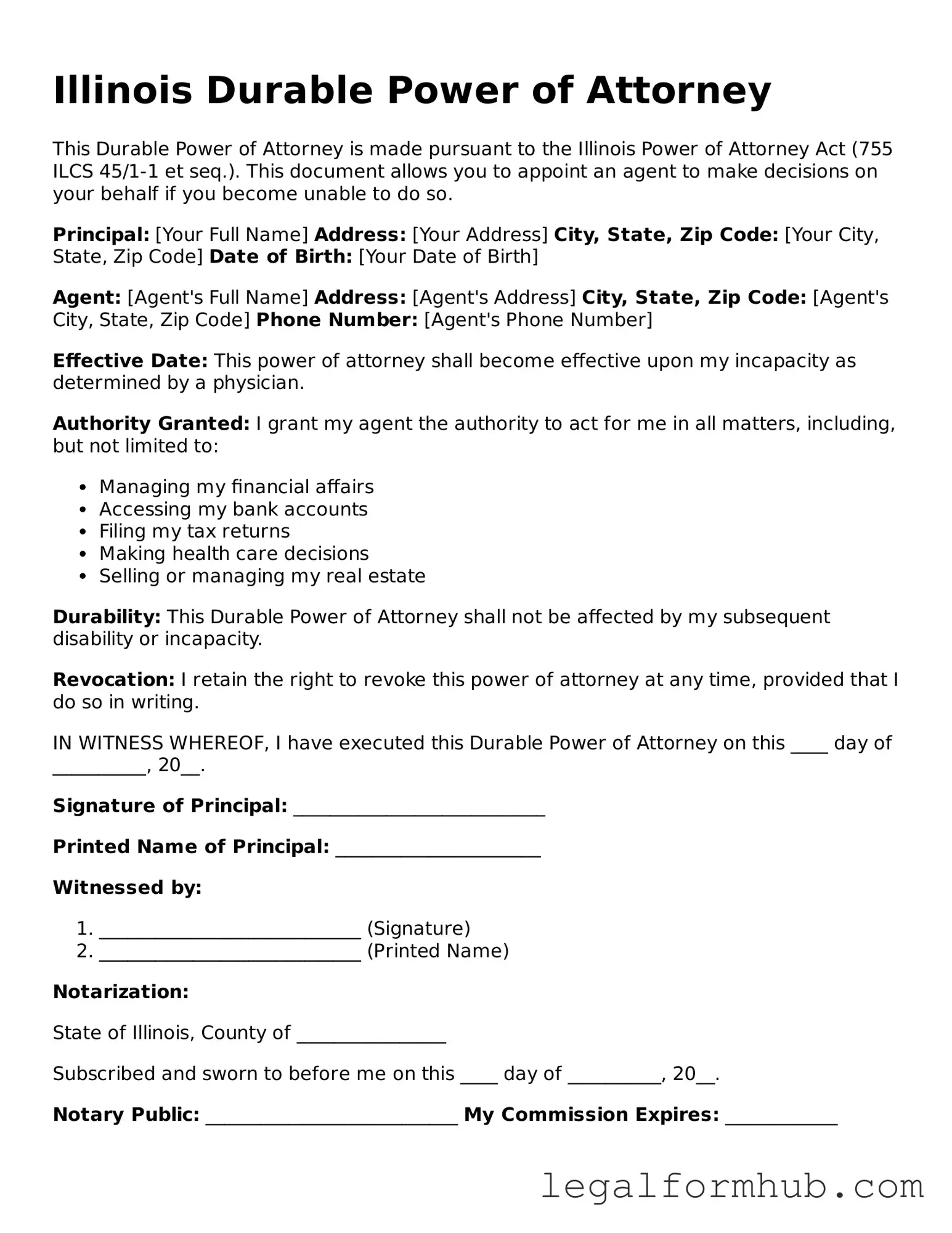

Instructions on Writing Illinois Durable Power of Attorney

Filling out the Illinois Durable Power of Attorney form is an important step in ensuring your wishes are respected regarding your financial and medical decisions. This process may seem daunting, but by following these clear steps, you can complete the form with confidence.

- Begin by obtaining the Illinois Durable Power of Attorney form. You can find it online or at legal offices.

- Carefully read the instructions provided with the form. Understanding the requirements will help you fill it out correctly.

- In the first section, fill in your name and address. This identifies you as the principal.

- Next, designate an agent. This person will make decisions on your behalf. Include their name, address, and relationship to you.

- Decide if you want to name an alternate agent. If so, provide their details as well.

- In the section that follows, specify the powers you wish to grant your agent. You can select general powers or limit them to specific areas.

- Sign and date the form in the designated area. Your signature indicates your consent.

- Have the form witnessed by two individuals or notarized, as required by Illinois law. This adds an extra layer of validity.

Once you have completed the form, store it in a safe place and provide copies to your agent and any relevant parties. This ensures that your wishes can be followed when needed.

Misconceptions

Understanding the Illinois Durable Power of Attorney (DPOA) form is crucial for individuals planning for the future. However, several misconceptions can cloud judgment and lead to confusion. Here are six common misconceptions:

- The DPOA is only for financial matters. Many believe that a Durable Power of Attorney is limited to financial decisions. In reality, it can also cover healthcare decisions, allowing an agent to make medical choices on behalf of the principal if they become incapacitated.

- Once signed, the DPOA cannot be changed. This is not true. Individuals can revoke or modify their Durable Power of Attorney at any time, as long as they are mentally competent. This flexibility allows for changes as life circumstances evolve.

- A DPOA takes away all control from the principal. Some worry that signing a DPOA relinquishes their control. However, the principal retains authority over their decisions as long as they are capable. The agent's role is to act on behalf of the principal when they cannot.

- All agents are required to be attorneys. It is a common belief that only licensed attorneys can serve as agents under a DPOA. In fact, anyone the principal trusts, such as a family member or friend, can be appointed as an agent, as long as they are of legal age.

- A DPOA is only necessary for the elderly. Many assume that only seniors need a Durable Power of Attorney. However, anyone can benefit from having a DPOA, regardless of age. Unexpected events can happen at any time, making it wise for individuals of all ages to consider this legal tool.

- The DPOA is effective immediately upon signing. While some may think that a DPOA becomes effective right away, this is not always the case. A principal can choose to make it effective immediately or only upon their incapacitation. This decision should be clearly stated in the document.

By addressing these misconceptions, individuals can better understand the importance and functionality of the Illinois Durable Power of Attorney form, leading to more informed decisions about their future planning.

Key takeaways

When considering the Illinois Durable Power of Attorney form, it is essential to understand its significance and the proper way to fill it out. Here are nine key takeaways that can guide you through the process.

- Understanding the Purpose: The Durable Power of Attorney allows you to appoint someone to make financial or healthcare decisions on your behalf if you become unable to do so.

- Choosing the Right Agent: Select a trustworthy individual as your agent. This person will have significant authority over your affairs, so choose wisely.

- Specific Powers: You can specify what powers you are granting to your agent. Consider whether you want to give them broad or limited authority.

- Signing Requirements: The form must be signed in front of a notary public. This step ensures that the document is legally recognized.

- Revocation: You can revoke the Durable Power of Attorney at any time, as long as you are mentally competent. This gives you flexibility and control.

- Staying Informed: It’s important to communicate with your agent about your wishes and any changes in your circumstances that might affect their decisions.

- Legal Advice: While you can fill out the form on your own, consulting with a legal professional can provide clarity and ensure that your document meets all legal requirements.

- Storage and Accessibility: Keep the completed form in a safe place, but also ensure that your agent and family members know where to find it when needed.

- Regular Updates: Review your Durable Power of Attorney regularly, especially after major life changes such as marriage, divorce, or the birth of a child.

By keeping these takeaways in mind, you can navigate the process of filling out and using the Illinois Durable Power of Attorney form with greater confidence and understanding.

File Overview

| Fact Name | Details |

|---|---|

| Definition | The Illinois Durable Power of Attorney allows a person to designate another individual to make decisions on their behalf if they become incapacitated. |

| Governing Law | This form is governed by the Illinois Power of Attorney Act, specifically 755 ILCS 45/2-1 et seq. |

| Durability | The term "durable" means that the power of attorney remains effective even if the principal becomes incapacitated. |

| Agent's Authority | The agent can be granted broad or limited powers, depending on the principal's preferences outlined in the document. |

| Signing Requirements | The form must be signed by the principal and witnessed by at least one person or notarized to be valid. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time as long as they are mentally competent. |

| Limitations | The agent cannot make decisions about the principal's healthcare unless specifically authorized in a separate healthcare power of attorney. |

| Legal Age | Both the principal and the agent must be at least 18 years old to execute the Durable Power of Attorney in Illinois. |