Free Deed in Lieu of Foreclosure Template for Illinois

Create Other Popular Deed in Lieu of Foreclosure Forms for Different States

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Lenders may require the borrower to provide financial documentation during the process.

California Property Transfer Deed - The borrower should make sure all terms are clearly stated.

The proper submission of the Arizona Homeschool Letter of Intent is crucial for parents wishing to homeschool, as it formally notifies the state of their educational choice. To aid families in this process and avoid any possible ambiguities, resources are available, such as the template found at https://arizonapdfs.com/homeschool-letter-of-intent-template, which can help ensure that all requirements are met effectively.

Deed in Lieu of Foreclosure Ohio - A helpful solution tailored for individuals facing overwhelming housing costs and seeking redemption.

Foreclosure in Georgia - A deed in lieu can help borrowers avoid the stress of foreclosure sales or auctions.

Similar forms

The Illinois Deed in Lieu of Foreclosure is similar to a mortgage release document. A mortgage release is a legal document that signifies the lender's agreement to release the borrower from the mortgage obligation. In both cases, the borrower transfers the property back to the lender to avoid foreclosure. This process can help borrowers escape the financial burden of an underwater mortgage while providing lenders with a quicker way to reclaim the property without going through the lengthy foreclosure process.

Another document that shares similarities is a short sale agreement. In a short sale, the lender agrees to accept less than the full amount owed on the mortgage when the borrower sells the property. Like a deed in lieu, a short sale allows the borrower to avoid foreclosure, but it involves selling the property rather than transferring ownership directly to the lender. Both options can be beneficial for borrowers looking to mitigate the negative impact of foreclosure on their credit scores.

The loan modification agreement also bears resemblance to the deed in lieu of foreclosure. This document outlines new terms for an existing mortgage, often including lower monthly payments or extended repayment periods. While a deed in lieu involves giving up the property, a loan modification allows the borrower to keep their home. However, both documents aim to provide a solution to financial distress and help borrowers avoid the consequences of foreclosure.

A forbearance agreement is another document that can be compared to the deed in lieu of foreclosure. In a forbearance agreement, the lender temporarily suspends or reduces mortgage payments due to the borrower's financial hardship. This allows the borrower to catch up on payments without losing their home. Both documents serve as tools to help borrowers manage their financial difficulties, but they differ in that a deed in lieu results in the borrower relinquishing the property.

The bankruptcy filing is also relevant in this context. When individuals file for bankruptcy, they can halt foreclosure proceedings temporarily while they reorganize their debts. Like a deed in lieu, bankruptcy provides a way for borrowers to deal with overwhelming financial obligations. However, bankruptcy can have long-lasting effects on a person's credit, while a deed in lieu may be seen as a more proactive approach to resolving mortgage issues.

A quitclaim deed is another document that resembles the deed in lieu of foreclosure. A quitclaim deed allows one party to transfer their interest in a property to another party without making any guarantees about the title. While this is often used in situations like divorce or gifting property, it can also be utilized in a deed in lieu situation. Both documents involve the transfer of property rights, but a quitclaim deed does not specifically address the mortgage obligations tied to the property.

Understanding the complexities of various legal documents can significantly impact the decisions homeowners make during distressing financial times. For instance, when facing foreclosure, it's crucial to consider alternatives such as a Deed in Lieu of Foreclosure or exploring options to verify employment. The California Employment Verification form is an important tool that employers use to validate an employee's work status, ensuring compliance with regulations. If you're looking to manage your hiring process effectively, you can find the necessary resources by visiting Fill PDF Forms.

Lastly, a property settlement agreement can be compared to a deed in lieu of foreclosure, especially in divorce cases. This agreement outlines how marital property will be divided between spouses, which may include the transfer of a home. In situations where one spouse can no longer afford the mortgage, a deed in lieu may be used as a way to relinquish the property to the lender. Both documents facilitate the transfer of property ownership, but a property settlement focuses on the division of assets rather than addressing mortgage obligations directly.

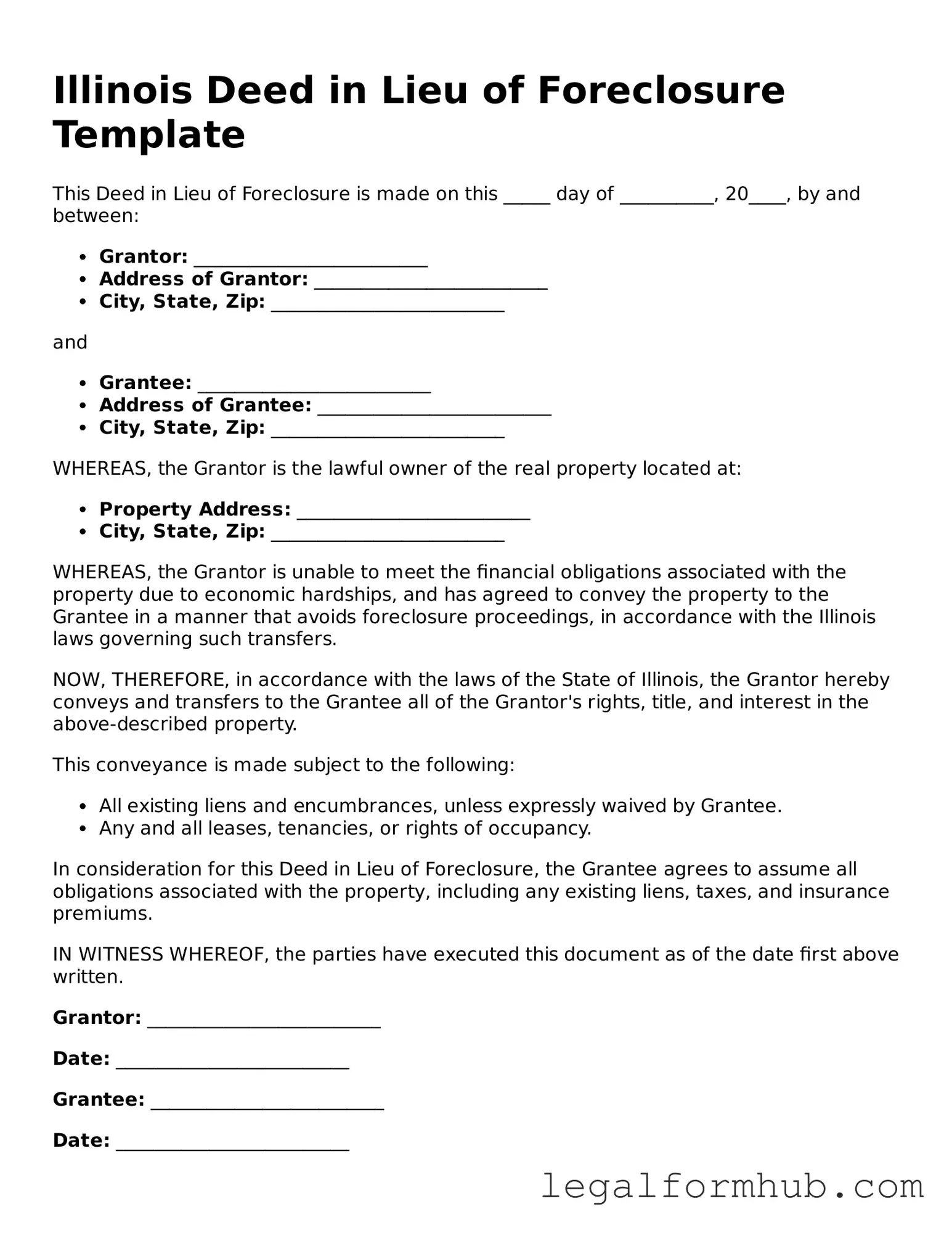

Instructions on Writing Illinois Deed in Lieu of Foreclosure

After completing the Illinois Deed in Lieu of Foreclosure form, the next step is to ensure that it is properly executed and submitted to the appropriate parties. This typically involves signing the document in front of a notary public and delivering it to the lender. Make sure to keep a copy for your records.

- Obtain the Illinois Deed in Lieu of Foreclosure form from a reliable source or the lender.

- Fill in the name of the property owner(s) in the designated section.

- Provide the current address of the property being transferred.

- Enter the legal description of the property. This information can usually be found on the property deed or tax documents.

- Include the name of the lender receiving the deed.

- Specify the date of the transfer.

- Sign the form in the presence of a notary public to ensure it is legally valid.

- Make copies of the signed document for your records.

- Submit the completed form to the lender, following any specific submission guidelines they may have.

Misconceptions

Understanding the Illinois Deed in Lieu of Foreclosure form is essential for homeowners facing financial difficulties. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- It eliminates all debt associated with the mortgage. Many believe that signing a deed in lieu automatically cancels any remaining debt. In reality, while it may relieve the homeowner of the property, there could still be other financial obligations or liabilities that remain.

- It is a quick and easy solution. Some homeowners think that a deed in lieu is a fast way to exit a mortgage. However, the process often involves negotiations with the lender, paperwork, and potential delays. It is not always as straightforward as it seems.

- It has no impact on credit scores. A common belief is that a deed in lieu does not affect credit scores. In truth, it can have a significant negative impact, similar to a foreclosure, which can hinder future borrowing opportunities.

- It is available to all homeowners. Many assume that anyone can use a deed in lieu of foreclosure. However, lenders typically require specific criteria to be met, such as demonstrating financial hardship and having a property that is not encumbered by other liens.

Being informed about these misconceptions can help homeowners make better decisions regarding their financial situations.

Key takeaways

Filling out and using the Illinois Deed in Lieu of Foreclosure form can be a significant step for homeowners facing foreclosure. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to transfer their property back to the lender voluntarily, helping to avoid the lengthy foreclosure process.

- Eligibility Requirements: Not all homeowners qualify. Lenders typically require that the borrower is experiencing financial hardship and has exhausted other options.

- Consult with Professionals: It’s advisable to speak with a real estate attorney or housing counselor to understand the implications and ensure the process is handled correctly.

- Complete the Form Accurately: The form must be filled out completely and accurately. Any errors or omissions can delay the process or lead to rejection.

- Consider Tax Implications: There may be tax consequences associated with a Deed in Lieu of Foreclosure. Homeowners should consult a tax professional to understand potential liabilities.

- Get Lender Approval: Before submitting the form, obtain written approval from the lender. This ensures that the lender is willing to accept the deed in lieu.

- Document Everything: Keep copies of all correspondence and documents related to the Deed in Lieu of Foreclosure. This documentation can be crucial for future reference.

By keeping these key points in mind, homeowners can navigate the Deed in Lieu of Foreclosure process more effectively.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | This process is governed by Illinois law, specifically under the Illinois Mortgage Foreclosure Law. |

| Eligibility | Homeowners facing financial difficulties may qualify for a deed in lieu if they are unable to keep up with mortgage payments. |

| Benefits | This option can help borrowers avoid the lengthy and stressful foreclosure process, allowing for a smoother transition. |

| Considerations | It is crucial for borrowers to understand the potential impact on their credit score and to consult with a legal or financial advisor before proceeding. |