Free Deed Template for Illinois

Create Other Popular Deed Forms for Different States

Contract for Deed Texas Template - Updating a Deed is necessary if there are changes in ownership status.

Employers in California must utilize the Employment Verification form to ensure they are hiring individuals who are legally eligible to work in the state. This form is not only imperative for confirming employment eligibility but also plays a vital role in adhering to regulatory requirements. For anyone navigating the hiring process in California, understanding and properly completing this form is essential, so click the button below to Fill PDF Forms.

Michigan Property Transfer Affidavit - Records the change of ownership from one party to another.

How to Get a Copy of My House Deed - Different types of deeds serve different ownership purposes.

Georgia Deed Transfer Forms - Establishes a legal record of property transfer.

Similar forms

The Illinois Deed form shares similarities with the Warranty Deed. Both documents serve the purpose of transferring ownership of real estate. A Warranty Deed guarantees that the seller holds clear title to the property and has the right to sell it. This document also provides assurances to the buyer against any future claims to the property, making it a secure option for real estate transactions.

Another document akin to the Illinois Deed form is the Quitclaim Deed. While both are used to transfer property, a Quitclaim Deed offers no guarantees about the title. This means that the seller relinquishes any interest they may have in the property, but does not assure the buyer of clear title. It is often used among family members or in situations where the seller may not have a clear title to the property.

The Special Warranty Deed is also comparable to the Illinois Deed form. This document provides a limited warranty to the buyer, covering only the time the seller owned the property. Unlike a Warranty Deed, which covers the entire history of the title, a Special Warranty Deed protects the buyer only from issues that arose during the seller's ownership. This makes it a more limited option for buyers seeking assurance about their property title.

A Bargain and Sale Deed is similar in that it transfers ownership of real estate. However, it typically does not provide any warranties regarding the title. This type of deed implies that the seller has the right to sell the property but does not guarantee that the title is clear. Buyers should exercise caution when using this type of deed, as it may expose them to potential claims against the property.

The Grant Deed is another document that resembles the Illinois Deed form. A Grant Deed conveys property from one party to another and includes certain guarantees. It assures the buyer that the property has not been sold to anyone else and that the seller has not encumbered the property with any undisclosed liens. This makes the Grant Deed a reliable option for buyers seeking some level of protection.

The Deed of Trust is also related to the Illinois Deed form, but it serves a different purpose. This document is used to secure a loan on real estate. It involves three parties: the borrower, the lender, and a trustee. The borrower conveys the property to the trustee, who holds it as security for the loan. If the borrower defaults, the trustee can sell the property to repay the lender, making this document crucial in real estate financing.

The Title Transfer Document is another similar document. This form is used to officially transfer ownership of a property from one party to another. While it may not carry the same legal weight as a deed, it serves as a record of the transfer. It is often used in conjunction with other documents to ensure that the transfer is properly documented and recognized.

The Affidavit of Title is also relevant when discussing property ownership. This document is a sworn statement by the seller, affirming that they hold clear title to the property and disclosing any potential issues. While it does not transfer ownership, it complements the Illinois Deed form by providing additional assurances to the buyer regarding the title.

To ensure a smooth incorporation process, it is important to understand the requirements for filing the necessary documents. For detailed guidance, refer to this essential resource on the key aspects of Articles of Incorporation.

The Bill of Sale is similar in that it serves to transfer ownership, but it is typically used for personal property rather than real estate. This document outlines the sale of items such as vehicles or equipment. While it does not involve the complexities of real estate transactions, it shares the fundamental purpose of transferring ownership from one party to another.

Finally, the Lease Agreement, while primarily used for rental situations, can also bear similarities to the Illinois Deed form. A lease grants a tenant the right to occupy a property for a specified period. While it does not transfer ownership, it establishes a legal relationship between the landlord and tenant, similar to how a deed establishes ownership rights between a seller and buyer.

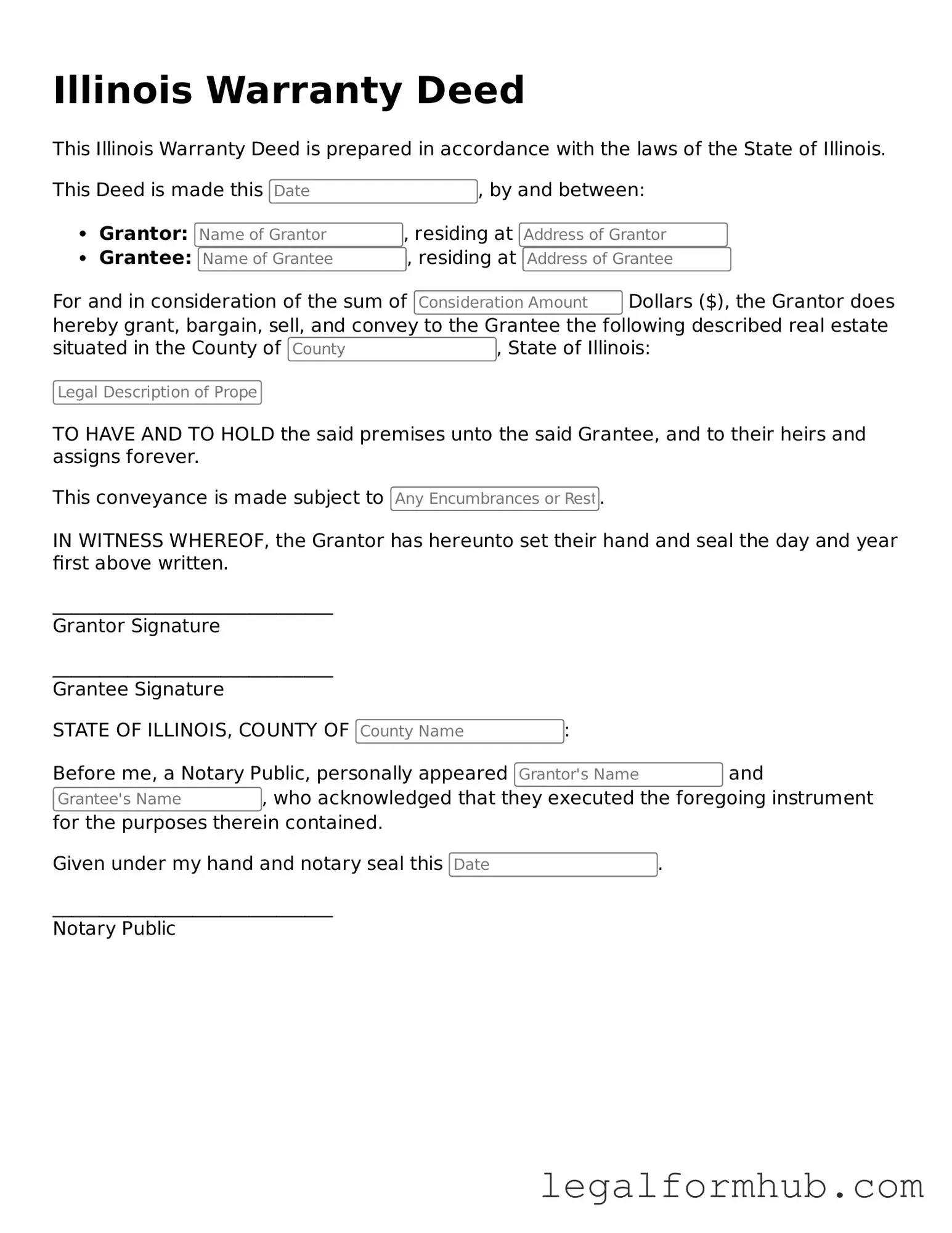

Instructions on Writing Illinois Deed

After you complete the Illinois Deed form, you will need to have it signed and notarized before filing it with the appropriate county office. This ensures that the transfer of property is legally recognized.

- Obtain the Illinois Deed form from a reliable source or the county clerk's office.

- Fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide the address of the property being transferred.

- Include a legal description of the property. This can often be found in previous deed documents or tax records.

- Specify the consideration (the amount paid for the property) in the appropriate section.

- Check the box indicating the type of deed you are using (e.g., warranty deed, quitclaim deed).

- Sign the document in the presence of a notary public.

- Have the notary public complete their section, including their signature and seal.

- Make copies of the completed deed for your records.

- File the original deed with the county recorder’s office where the property is located.

Misconceptions

Understanding the Illinois Deed form can be challenging, especially with the many misconceptions that exist. Here are ten common misunderstandings, along with clarifications to help you navigate the process more easily.

- All deeds are the same. Many people think that all deed forms are identical. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each serving specific purposes.

- You don’t need a lawyer to complete a deed. While it is possible to fill out a deed without legal assistance, having a lawyer review it can help avoid mistakes that may cause issues later.

- Only the seller needs to sign the deed. Some believe that only the seller's signature is required. However, both the seller and the buyer typically need to sign the deed for it to be valid.

- The deed must be notarized. Although notarization is often recommended, it is not always required for the deed to be legally valid in Illinois. However, it can help prevent disputes.

- Deeds are only for transferring ownership. While the primary purpose of a deed is to transfer ownership, it can also serve other purposes, such as establishing easements or rights of way.

- You can use a handwritten deed. Some believe that a handwritten deed is sufficient. However, using a standard form is advisable to ensure all necessary legal language is included.

- Once a deed is recorded, it cannot be changed. Many think that a recorded deed is set in stone. In fact, it can be amended or corrected if errors are discovered, but the process must be followed correctly.

- All deeds need to be filed with the county. While most deeds should be recorded to protect the buyer's interest, there are exceptions, such as certain transfers between family members.

- Property taxes are not affected by the deed. Some people assume that changing ownership through a deed does not impact property taxes. However, new ownership may trigger reassessment of property taxes.

- You can complete a deed at any time. While it may seem convenient to create a deed whenever you want, timing can be crucial. It’s best to complete the deed before any legal issues arise related to the property.

By clarifying these misconceptions, individuals can approach the Illinois Deed form with greater confidence and understanding. Always consider seeking professional advice when dealing with property transactions.

Key takeaways

Filling out and using the Illinois Deed form is an important step in transferring property ownership. Here are some key takeaways to keep in mind:

- Understand the Types of Deeds: Familiarize yourself with different types of deeds, such as warranty deeds and quitclaim deeds, as each serves a different purpose in property transfer.

- Provide Accurate Information: Ensure that all names, addresses, and legal descriptions of the property are correct. Mistakes can lead to complications later.

- Signatures Matter: The deed must be signed by the grantor (the person transferring the property). In some cases, notarization is required for the deed to be legally valid.

- Consider Recording the Deed: After filling out the deed, it’s advisable to record it with the county recorder’s office. This step provides public notice of the property transfer.

- Check for Liens: Before transferring property, check for any outstanding liens or encumbrances. These can affect ownership rights and future transactions.

- Consult a Professional: If you have any doubts or questions, consider consulting a real estate attorney or a qualified professional. They can provide guidance tailored to your situation.

File Overview

| Fact Name | Description |

|---|---|

| Type of Deed | The Illinois Deed form is primarily used for transferring real property ownership. |

| Governing Law | Illinois law governs the execution and validity of deed forms, specifically the Illinois Compiled Statutes, Chapter 765. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property). |

| Witness Requirement | While not mandatory, having a witness sign the deed can provide additional verification. |

| Notarization | Notarization is required for the deed to be recorded with the county recorder's office. |

| Property Description | A legal description of the property must be included to ensure clarity in the transfer. |

| Recording | To protect the interests of the new owner, the deed should be recorded in the county where the property is located. |