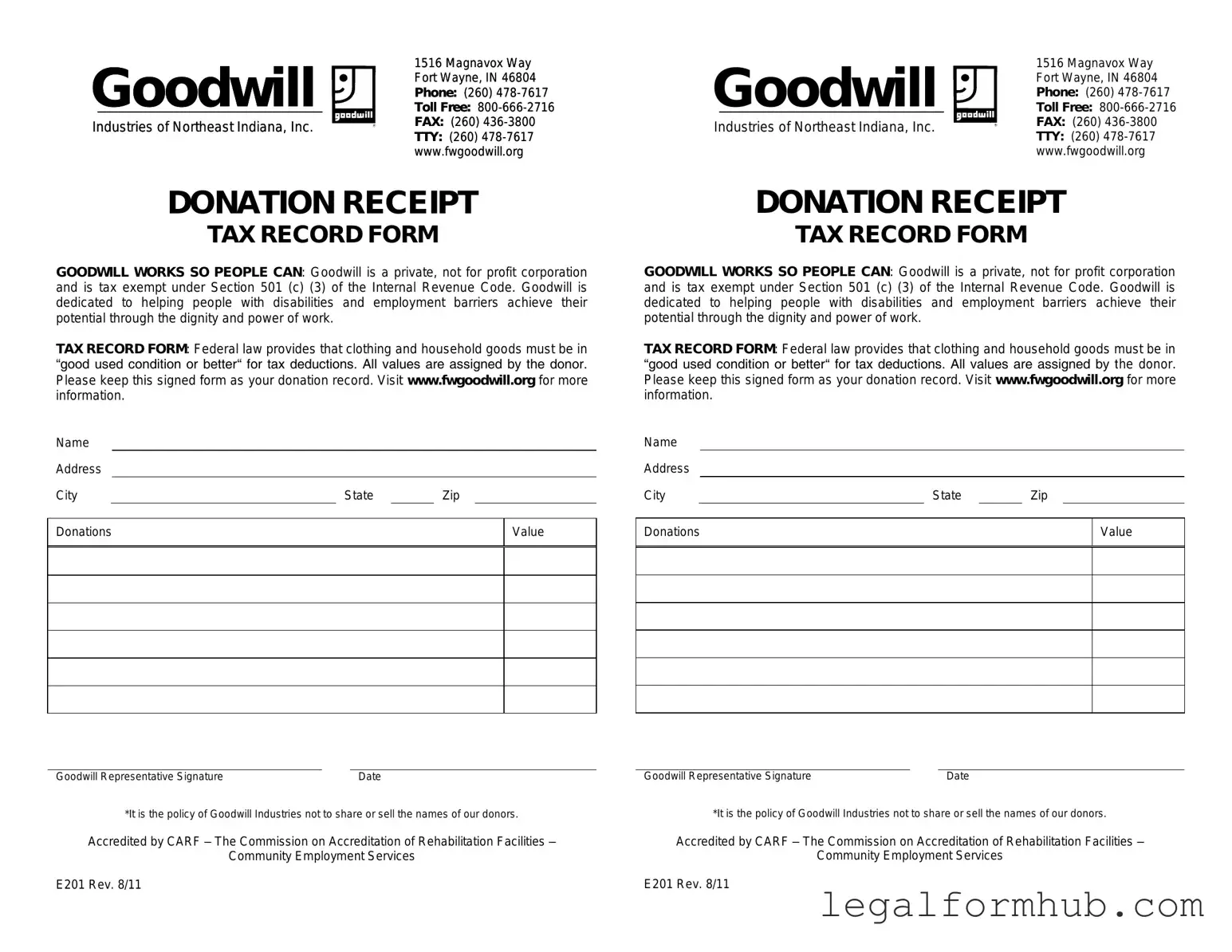

Fill Your Goodwill donation receipt Form

Different PDF Templates

Dl 933 Form California Dmv - A parent or guardian’s signature is necessary on the DL 44 for applicants under 18.

To ensure a smooth transaction when transferring ownership of a motorcycle, it's important to complete the necessary documentation, including the Motorcycle Bill of Sale. For your convenience, you can easily access and use the legal form by visiting Fill PDF Forms to get started on the process.

Batting Lineup Strategy - List your first three players in the batting lineup.

Similar forms

The Goodwill donation receipt form is similar to a tax deduction receipt. Both documents serve as proof of a charitable contribution, which can be used to claim deductions on income tax returns. A tax deduction receipt typically includes details such as the date of the donation, the amount contributed, and the organization’s information. This information is essential for taxpayers looking to reduce their taxable income while supporting charitable causes.

Another document comparable to the Goodwill donation receipt is a charitable contribution acknowledgment letter. This letter is issued by the charity to confirm the receipt of a donation. It often includes similar details, such as the donor's name, the date of the contribution, and a description of the donated items. This acknowledgment is crucial for donors, as it provides a formal record of their generosity for tax purposes.

A third document that shares similarities is the itemized donation list. This list is typically created by the donor and details each item donated, along with its estimated value. While the Goodwill receipt serves as a summary of the overall donation, the itemized list provides a breakdown. Both documents are important for tax reporting and help ensure that donors accurately report their contributions.

The Arizona Motor Vehicle Bill of Sale form serves as a crucial document for vehicle transactions, ensuring that both parties have a clear record of the sale. It outlines important details such as the vehicle identification number (VIN), the sale price, and the signatures of the buyer and seller, thereby providing legal protection in case of disputes. For those looking to create or obtain this form easily, resources such as arizonapdfs.com/motor-vehicle-bill-of-sale-template can be invaluable.

Lastly, the cash donation receipt is another document that parallels the Goodwill donation receipt. This type of receipt is issued when a donor makes a monetary contribution to a charitable organization. Like the Goodwill receipt, it includes the date, amount, and organization’s information. Both receipts validate the donor's contribution and are necessary for tax deduction claims, reinforcing the importance of keeping thorough records of charitable donations.

Instructions on Writing Goodwill donation receipt

Once you have gathered your items for donation to Goodwill, it's time to complete the donation receipt form. This form serves as a record of your charitable contribution, which may be useful for tax purposes. Follow these steps to accurately fill out the form.

- Begin by entering the date of the donation at the top of the form. Use the format MM/DD/YYYY for clarity.

- Next, provide your name in the designated field. Ensure that you write your full name as it appears on your identification.

- Fill in your address, including street, city, state, and ZIP code. This information is essential for record-keeping.

- In the section for items donated, list each item you are donating. Be specific about the condition of each item, such as "gently used" or "new."

- Next, estimate the fair market value of each item. This is the price you believe someone would pay for the item in its current condition.

- If applicable, indicate whether you received any goods or services in exchange for your donation. If not, leave this section blank.

- Finally, sign and date the form at the bottom. This signature confirms that the information provided is accurate and complete.

After completing the form, keep a copy for your records. This will help you when filing your taxes and can serve as proof of your charitable donation.

Misconceptions

Many people have questions and misunderstandings about the Goodwill donation receipt form. Here are ten common misconceptions, along with clarifications to help you navigate the donation process more effectively.

-

Donations must be in perfect condition.

While Goodwill appreciates items in good condition, they also accept donations that may need some repair or cleaning. The key is that the items should be usable.

-

You can’t deduct items without a receipt.

While it’s true that a receipt is important for tax deductions, you can still estimate the value of items donated without one. However, having a receipt provides better documentation for your records.

-

All donated items are sold immediately.

Goodwill may hold items for a while before selling them. Some items may even be sent to specialty stores or auctions, depending on their value.

-

Goodwill determines the value of your donations.

As the donor, you are responsible for determining the fair market value of your items. Goodwill can provide general guidelines, but the final value is up to you.

-

Only clothing and household items can be donated.

Goodwill accepts a wide range of items, including electronics, furniture, and vehicles. Always check with your local Goodwill for specific guidelines.

-

Donations are not tax-deductible.

In most cases, donations to Goodwill are tax-deductible. However, it’s important to keep records and follow IRS guidelines for charitable contributions.

-

You must donate a minimum amount to receive a receipt.

Goodwill provides receipts for any donation, regardless of the size. Every contribution counts, and you should always ask for a receipt.

-

Goodwill only accepts donations from individuals.

Businesses can also donate items to Goodwill. Companies often donate surplus inventory or equipment, and they can benefit from tax deductions as well.

-

The receipt must be filled out by Goodwill staff.

While Goodwill staff can assist, you can fill out the receipt yourself. Just make sure to accurately list the items and their estimated values.

-

All donations go to local programs.

While many donations support local programs, Goodwill operates on a larger scale. Some proceeds may support national initiatives or other locations.

Understanding these misconceptions can help you make informed decisions about your donations and ensure that you take full advantage of the benefits they offer.

Key takeaways

When donating items to Goodwill, it is important to understand how to properly fill out and use the donation receipt form. Here are some key takeaways to keep in mind:

- Obtain a Receipt: Always request a receipt when you make a donation. This serves as proof of your contribution for tax purposes.

- Itemize Your Donations: Clearly list each item you are donating. This helps in assessing the value of your contributions.

- Estimate Fair Market Value: Assign a reasonable value to each item based on its condition and current market prices.

- Keep a Copy: Retain a copy of the receipt for your records. This is essential for tax deductions.

- Check for Specific Instructions: Some Goodwill locations may have specific guidelines for filling out the receipt, so be sure to follow them.

- Understand Tax Implications: Donations to Goodwill may be tax-deductible, but it’s wise to consult a tax professional for guidance.

- Be Honest: Provide accurate descriptions and values for your donations. Misrepresenting items can lead to issues with tax deductions.

- Consider the Condition: Items should be in good condition. Goodwill accepts gently used items that can be resold.

- Use the Receipt for Record-Keeping: The receipt can help you keep track of your charitable contributions throughout the year.

- Ask Questions: If you are unsure about how to fill out the form or what items are acceptable, do not hesitate to ask Goodwill staff for assistance.

Following these guidelines will ensure that your donation experience is smooth and beneficial for both you and Goodwill.

File Information

| Fact Name | Description |

|---|---|

| Purpose of the Receipt | The Goodwill donation receipt serves as proof of your charitable contribution for tax purposes. |

| Tax Deduction | Donors can claim a tax deduction for the fair market value of the donated items. |

| Itemization Requirement | Donors must list the items donated and their estimated values on the receipt. |

| Goodwill's Role | Goodwill provides the receipt upon donation, but it is the donor's responsibility to keep it for their records. |

| State-Specific Forms | Some states may have specific requirements for donation receipts. For example, California requires a written acknowledgment for donations over $250. |

| IRS Guidelines | The IRS requires that donations over $500 be reported on Form 8283, which must be attached to your tax return. |

| Value Determination | Donors should determine the fair market value based on the condition and age of the items donated. |

| Non-Cash Donations | Goodwill receipts are typically used for non-cash donations, such as clothing, furniture, and electronics. |

| Record Keeping | It is advisable to keep a copy of the receipt along with photos of the donated items for your records. |