Printable Gift Deed Document

Common Gift Deed Documents:

Corrective Deed California - A Corrective Deed is vital when transferring property among family members.

To facilitate the ownership transfer, it is advisable to accurately complete the required documentation, including the California Dog Bill of Sale form, which can be conveniently accessed through Fill PDF Forms. This ensures that all pertinent details are recorded and that the transaction adheres to legal standards.

Gift Deed - Tailored for Each State

Similar forms

A Gift Deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. It is similar to a Will, which also facilitates the transfer of property. However, a Will takes effect only upon the death of the testator, while a Gift Deed is effective immediately. Both documents require clear identification of the parties involved and the property being transferred, but a Gift Deed is executed during the lifetime of the donor, allowing for an immediate transfer of ownership.

Another document that shares similarities with a Gift Deed is a Quitclaim Deed. A Quitclaim Deed transfers any interest the grantor has in a property to the grantee without making any promises about the quality of that interest. Like a Gift Deed, a Quitclaim Deed does not involve monetary compensation. Both documents require the consent of the parties involved and must be executed in writing, but a Quitclaim Deed may be used in situations where the grantor is unsure of their ownership rights.

A Trust Agreement also resembles a Gift Deed in that it can facilitate the transfer of property to beneficiaries. In a Trust Agreement, the grantor places assets into a trust managed by a trustee for the benefit of the beneficiaries. While a Gift Deed transfers ownership outright, a Trust Agreement allows for more control over how and when the assets are distributed. Both documents require careful drafting to ensure that the intentions of the grantor are clearly expressed.

A Deed of Gift is closely related to a Gift Deed. It serves a similar purpose in transferring property without monetary exchange. The key difference lies in the terminology and the specific legal requirements that may vary by jurisdiction. Both documents must clearly identify the donor and the recipient, as well as the property being transferred, ensuring that the transaction is legally binding.

In the realm of property transactions, understanding the various types of deeds is crucial for ensuring clear ownership transfer and mitigating risks. One important aspect to consider is the legal protection offered through agreements like the Hold Harmless Agreement, which can be found at arizonapdfs.com/hold-harmless-agreement-template/. This agreement safeguards parties involved in real estate dealings from potential liabilities, complementing the use of deeds such as Gift Deeds and Quitclaim Deeds to promote secure and efficient property transfers.

A Sale Deed, while primarily used for transactions involving payment, also shares some characteristics with a Gift Deed. Both documents involve the transfer of property rights from one party to another. However, a Sale Deed includes a purchase price and often requires additional legal formalities, such as the payment of transfer taxes. In contrast, a Gift Deed is executed without any financial consideration, focusing solely on the intent to give.

A Lease Agreement can be compared to a Gift Deed in terms of property rights transfer, albeit temporarily. A Lease Agreement allows one party to use another's property for a specified period in exchange for rent. While a Gift Deed transfers ownership permanently, a Lease Agreement establishes a temporary arrangement. Both documents must detail the rights and responsibilities of the parties involved to avoid disputes.

An Assignment Agreement is another document that shares some similarities with a Gift Deed. An Assignment Agreement transfers rights or interests in a contract from one party to another. While it may involve compensation, it can also be executed without payment. Both documents require clear identification of the parties and the subject matter, ensuring that the transfer is legally recognized.

A Power of Attorney can also be seen as related to a Gift Deed. It allows one person to act on behalf of another in legal matters, including the transfer of property. While a Gift Deed requires the direct involvement of the donor, a Power of Attorney enables someone else to execute a Gift Deed on behalf of the donor. Both documents necessitate clear communication of the donor's wishes and intentions.

Lastly, a Bill of Sale is similar to a Gift Deed in that it transfers ownership of personal property. A Bill of Sale is typically used for tangible items, such as vehicles or equipment, and may involve monetary consideration. However, it can also be executed as a gift. Both documents require the identification of the parties and the property being transferred, ensuring clarity in the transaction.

Instructions on Writing Gift Deed

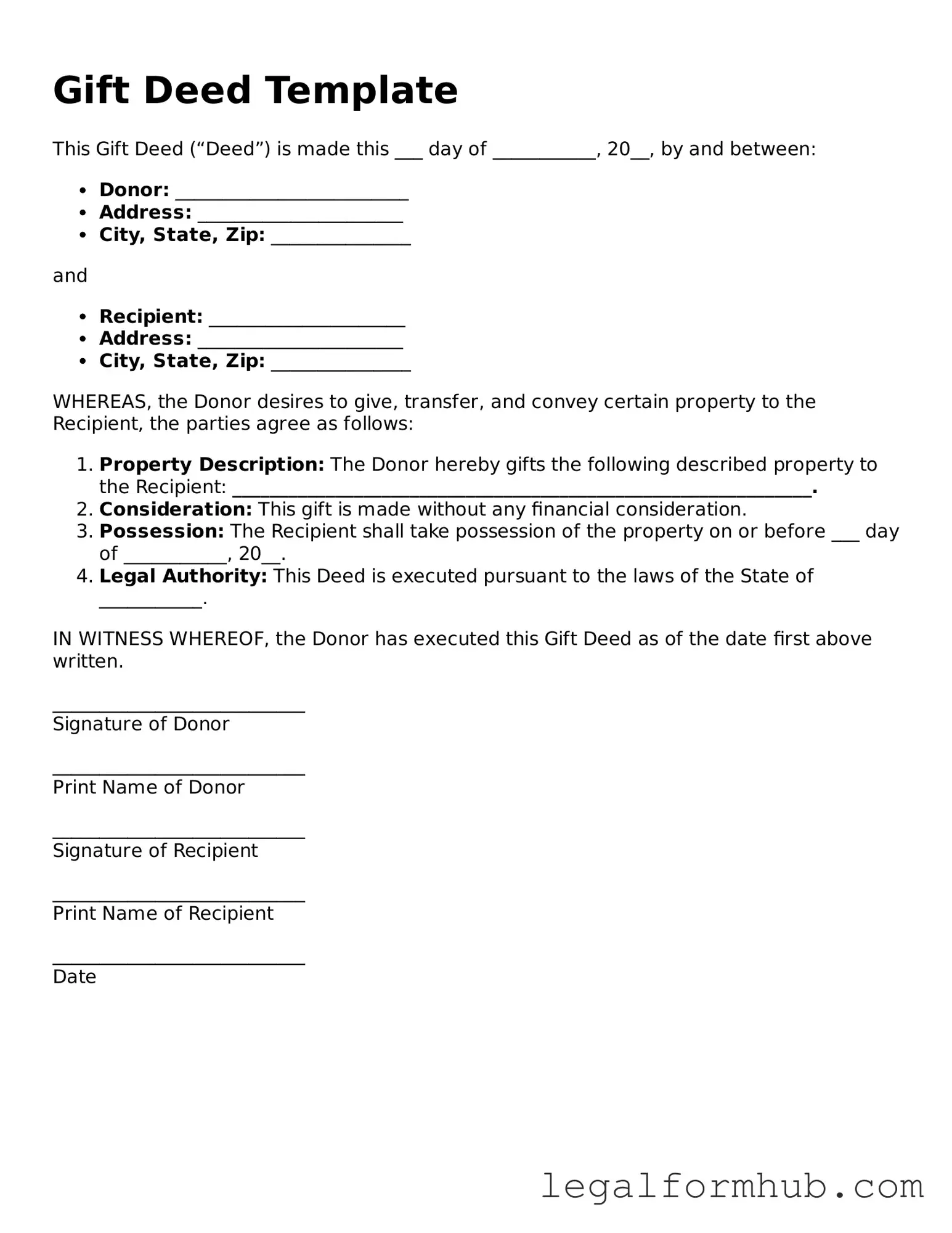

After gathering the necessary information, you are ready to fill out the Gift Deed form. This form requires specific details about the donor and the recipient, as well as a description of the gift being transferred. Follow these steps to ensure accurate completion.

- Begin by entering the full name of the donor in the designated space.

- Next, provide the donor's address, including street, city, state, and zip code.

- Fill in the full name of the recipient in the appropriate field.

- Enter the recipient's address, ensuring all details are correct.

- Clearly describe the gift being transferred, including any relevant details such as serial numbers or distinguishing features.

- Include the date of the gift transfer.

- Both the donor and recipient should sign and date the form at the bottom.

- If applicable, have a witness sign the form to validate the transaction.

Once completed, review the form for accuracy. Make sure all signatures are present before submitting it as required.

Misconceptions

Understanding gift deeds can be confusing. Here are nine common misconceptions about them, along with clarifications to help you navigate this important legal document.

-

Gift deeds are only for real estate.

This is not true. Gift deeds can be used for various types of property, including personal belongings, vehicles, and financial assets.

-

You don’t need a lawyer for a gift deed.

While it’s possible to create a gift deed without legal help, consulting a lawyer can ensure that the document meets all legal requirements and protects your interests.

-

A verbal gift is just as valid as a written gift deed.

Verbal agreements can lead to misunderstandings and disputes. A written gift deed provides clear evidence of the gift and its terms.

-

You can change your mind after signing a gift deed.

Once a gift deed is executed and delivered, it typically cannot be revoked. It’s crucial to be certain before finalizing the document.

-

Gift deeds are only for family members.

This is a misconception. You can gift property to anyone, including friends or charitable organizations, as long as the deed is properly executed.

-

Gifts are tax-free, so no reporting is necessary.

While some gifts may not incur taxes, large gifts can trigger tax obligations. It’s important to understand the tax implications and report them accordingly.

-

All gifts require a notarized gift deed.

Notarization is not always necessary, but it can add an extra layer of authenticity and protection. Check your local laws for specific requirements.

-

Gift deeds are the same as wills.

This is incorrect. A gift deed transfers ownership immediately, while a will only distributes property after death.

-

You can’t include conditions in a gift deed.

In fact, you can include conditions in a gift deed. However, these conditions must be clearly stated to avoid confusion later on.

Being informed about these misconceptions can help you make better decisions regarding gift deeds. Always consider seeking professional advice to ensure your intentions are clearly documented and legally sound.

Key takeaways

When considering a Gift Deed, it's important to understand its implications and the process involved. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Gift Deed is a legal document that allows one person to transfer ownership of property or assets to another without any exchange of money. This can include real estate, personal property, or financial assets.

- Ensure Clarity: Clearly describe the property being gifted. Include details such as the address for real estate or specific identifiers for personal property. Ambiguities can lead to disputes later.

- Include Necessary Details: The Gift Deed should include the names and addresses of both the donor (the person giving the gift) and the recipient (the person receiving the gift). This information is crucial for legal validity.

- Consider Tax Implications: Gifting can have tax consequences. Depending on the value of the gift, the donor may need to file a gift tax return. It's wise to consult a tax professional to understand any potential liabilities.

- Legal Formalities: Depending on the type of property, certain formalities may need to be followed, such as notarization or witnessing. Ensuring these steps are completed can help avoid legal issues in the future.

By keeping these points in mind, you can navigate the process of filling out and using a Gift Deed more effectively.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A gift deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. |

| Legal Requirement | Most states require that a gift deed be in writing and signed by the donor (the person giving the gift). |

| Consideration | Unlike a sale, a gift deed does not involve consideration, meaning the recipient does not pay for the property. |

| State-Specific Laws | In California, for example, the gift deed must comply with the California Civil Code Section 11911. |

| Tax Implications | Gifts may have tax implications. The donor might need to file a gift tax return if the value exceeds the annual exclusion limit. |

| Revocation | A gift deed can typically be revoked by the donor before it is executed, but once executed, it is generally irrevocable. |

| Recording | To protect the rights of the recipient, it is advisable to record the gift deed with the local property records office. |