Free Quitclaim Deed Template for Georgia

Create Other Popular Quitclaim Deed Forms for Different States

Quick Claim Deed Ohio - Encourages transparency in informal property dealings.

To ensure a smooth transaction, it's vital to understand the key elements of the Mobile Home Bill of Sale documentation. For more insights, refer to a comprehensive guide on the Mobile Home Bill of Sale process by visiting this link.

How to Gift a House to a Family Member - This deed type minimizes the need for extensive documentation or proof of property history.

Similar forms

A Warranty Deed is similar to a Quitclaim Deed in that both are used to transfer property ownership. However, a Warranty Deed offers a guarantee from the seller regarding the title’s validity. The seller assures the buyer that they have clear title to the property and the right to sell it. This added layer of protection can provide peace of mind for the buyer, as it includes warranties against future claims. In contrast, a Quitclaim Deed does not provide any such guarantees, making it a more straightforward, but riskier, option for transferring ownership.

A Bargain and Sale Deed also resembles a Quitclaim Deed in its function of transferring property. This type of deed implies that the seller has ownership and the right to sell the property, but it does not guarantee that the title is free of defects. Unlike a Quitclaim Deed, a Bargain and Sale Deed may offer some assurances about the seller’s ownership but lacks the full warranties found in a Warranty Deed. Buyers should be aware of the potential risks associated with this type of deed, as it does not protect against future claims on the property.

A Special Purpose Deed is another document that shares similarities with a Quitclaim Deed. This type of deed is often used for specific transactions, such as transferring property between family members or in divorce settlements. Like a Quitclaim Deed, a Special Purpose Deed does not provide warranties regarding the title. Its primary function is to facilitate the transfer of ownership without the complexities of a traditional sale. Parties involved should ensure they understand the implications of using this type of deed, as it carries similar risks as a Quitclaim Deed.

Understanding the nuances of property transfer documents is crucial for both buyers and sellers. Each type of deed, such as the Warranty Deed, Quitclaim Deed, and Grant Deed, serves a specific purpose and offers different levels of protection. For those involved in employment verification, similar attention to documentation is paramount. To learn more about essential forms used in this regard, including the Employment Verification form, you can visit Fill PDF Forms to begin the process.

An Executor’s Deed is used in the context of estate administration and shares some characteristics with a Quitclaim Deed. When a property is transferred by an executor of an estate, this deed serves to convey the property to the heirs or beneficiaries. Like a Quitclaim Deed, an Executor’s Deed does not provide any warranties about the title. It simply transfers whatever interest the deceased had in the property. This lack of guarantees can leave beneficiaries exposed to potential title issues, making it essential for them to conduct thorough due diligence.

A Deed in Lieu of Foreclosure is another document that functions similarly to a Quitclaim Deed. This type of deed is used when a homeowner voluntarily transfers the property to the lender to avoid foreclosure. Like a Quitclaim Deed, it does not offer warranties about the title. The lender accepts the property in exchange for forgiving the remaining mortgage debt. While this can be a beneficial option for homeowners facing financial difficulties, it is crucial to understand the implications and potential risks involved, especially regarding any existing liens or claims against the property.

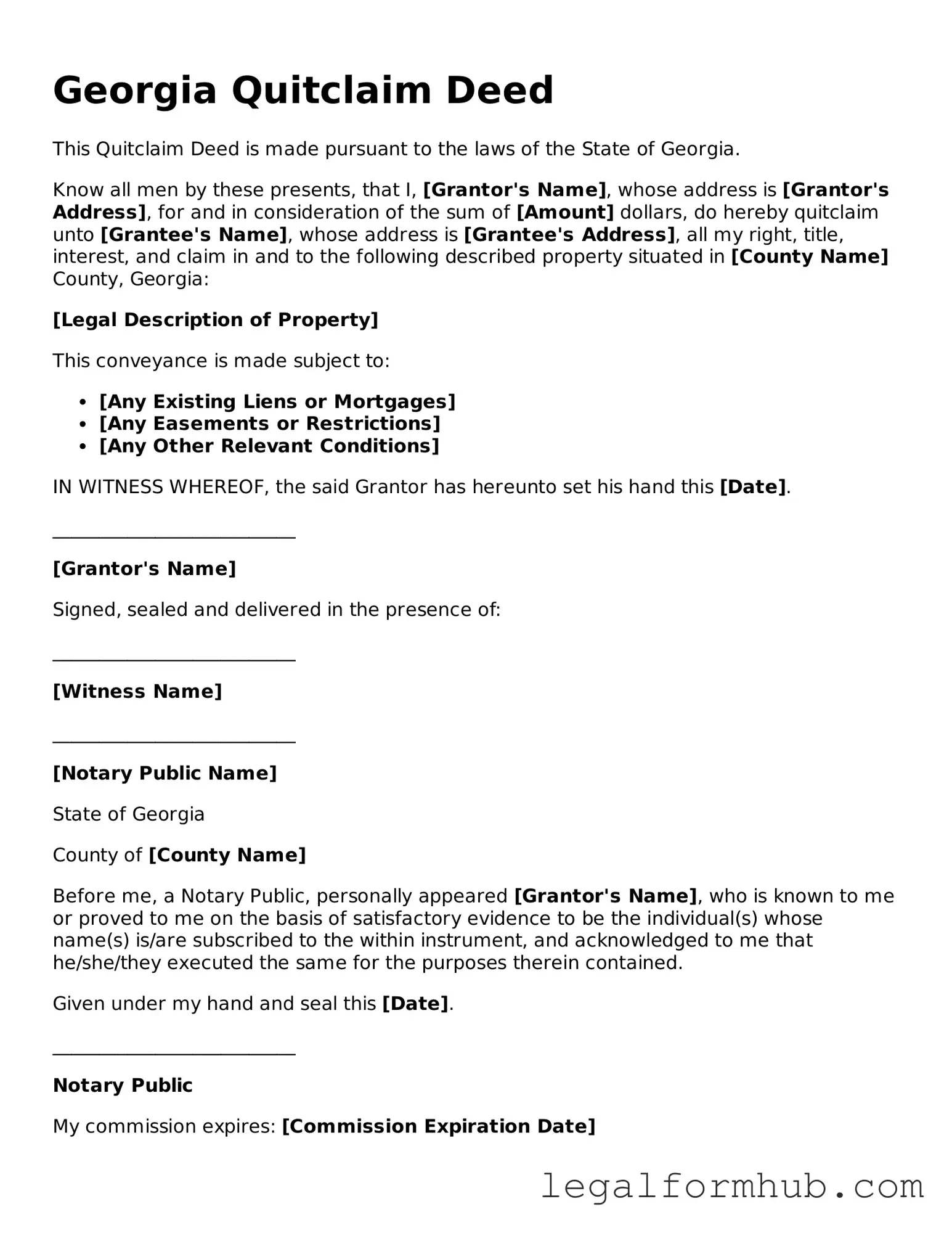

Instructions on Writing Georgia Quitclaim Deed

Once you have your Georgia Quitclaim Deed form ready, it's time to fill it out carefully. Each section of the form requires specific information, so take your time to ensure everything is accurate. After completing the form, you will need to sign it in the presence of a notary public, then file it with your local county clerk's office.

- Obtain the Form: Download or pick up a Georgia Quitclaim Deed form from a reliable source.

- Identify the Grantor: In the first section, write the full name and address of the person transferring the property.

- Identify the Grantee: Next, fill in the full name and address of the person receiving the property.

- Describe the Property: Provide a detailed description of the property being transferred. This may include the address, lot number, and any other relevant details.

- Consideration: Enter the amount of consideration (if any) being exchanged for the property. This could be a dollar amount or simply state "for love and affection" if it's a gift.

- Sign the Document: The grantor must sign the form in the designated area. Ensure that the signature matches the name listed as the grantor.

- Notarization: Take the signed form to a notary public. The notary will verify the identity of the grantor and witness the signature.

- File the Deed: Submit the completed and notarized Quitclaim Deed to the county clerk's office in the county where the property is located.

Misconceptions

Misconceptions about the Georgia Quitclaim Deed form can lead to confusion and potential issues in property transactions. Below are four common misunderstandings:

- It transfers ownership completely. Many believe that a quitclaim deed transfers full ownership of the property. In reality, it only conveys whatever interest the grantor has in the property, which may not be complete or even valid.

- It guarantees a clear title. Some individuals think that using a quitclaim deed guarantees a clear title. However, this type of deed does not provide any warranties regarding the title. If there are existing liens or claims, they may still affect the new owner.

- It is only used between family members. While quitclaim deeds are often used in family transactions, they are not limited to such situations. They can be used in various contexts, including transfers between unrelated parties or in divorce settlements.

- It requires a lawyer to complete. Many assume that legal representation is necessary to execute a quitclaim deed. Although having a lawyer can be beneficial, individuals can prepare and file the deed themselves, provided they follow the proper procedures.

Key takeaways

When filling out and using the Georgia Quitclaim Deed form, there are several important considerations to keep in mind. The following key takeaways can help ensure a smooth process.

- Understand the Purpose: A Quitclaim Deed is primarily used to transfer ownership of property without guaranteeing that the title is clear. This means that the grantor does not promise that they own the property free and clear of any liens or claims.

- Complete All Required Information: Ensure that all necessary fields on the form are filled out accurately. This includes the names of the grantor and grantee, the legal description of the property, and the date of the transfer.

- Signatures Are Essential: The Quitclaim Deed must be signed by the grantor in the presence of a notary public. This step is crucial for the deed to be legally valid.

- File with the County: After completing and signing the form, it is important to file the Quitclaim Deed with the appropriate county office. This action ensures that the property records reflect the change in ownership.

By following these guidelines, individuals can effectively navigate the process of using a Quitclaim Deed in Georgia.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any warranties. |

| Purpose | It allows the grantor to relinquish any claim to the property, making it useful for transferring property between family members or resolving title issues. |

| Governing Law | The Georgia Quitclaim Deed is governed by Georgia law, specifically O.C.G.A. § 44-5-30. |

| Consideration | The deed may be executed without monetary consideration, although it is common to include a nominal amount. |

| Requirements | In Georgia, the quitclaim deed must be in writing, signed by the grantor, and notarized. |

| Recording | It is advisable to record the quitclaim deed with the county clerk to provide public notice of the ownership transfer. |

| Limitations | This type of deed does not guarantee that the grantor has clear title to the property, which can lead to potential disputes. |

| Tax Implications | Transfer taxes may apply when recording the deed, and it is important to check local regulations for specifics. |

| Usage Scenarios | Common scenarios include transferring property between relatives, clearing up title defects, or adding/removing a spouse from the title. |