Free Promissory Note Template for Georgia

Create Other Popular Promissory Note Forms for Different States

Michigan Promissory Note - A Promissory Note is a written promise to pay a specific amount of money to another party.

The California Articles of Incorporation form is a crucial document that establishes a corporation in California. This legal form outlines essential details about the business, such as its name, purpose, and management structure. To facilitate the incorporation process, you can access valuable resources, including Free Business Forms, which help in preparing the necessary documentation. Filing this document with the California Secretary of State is the first step in creating a legally recognized entity.

Create Promissory Note - They can also specify what happens in case the borrower wants to pay off the loan early.

Ohio Promissory Note Requirements - The simplicity of the form makes it accessible for various financial relationships.

Similar forms

A promissory note is a financial instrument that serves as a written promise to pay a specified amount of money to a designated party at a defined time. It shares similarities with various other documents that also involve promises or obligations. One such document is the loan agreement. Like a promissory note, a loan agreement outlines the terms of borrowing, including the amount, interest rate, and repayment schedule. However, a loan agreement often includes more detailed terms and conditions, covering aspects like collateral and default consequences.

Another related document is a mortgage. A mortgage is a specific type of promissory note that is secured by real property. While a standard promissory note may not require collateral, a mortgage ties the obligation to repay directly to the property being financed. This means that if the borrower defaults, the lender can take possession of the property through foreclosure.

Then there’s a personal guarantee. This document involves a third party agreeing to take responsibility for the debt if the primary borrower defaults. While a promissory note focuses on the borrower’s commitment, a personal guarantee adds an extra layer of security for the lender by involving another individual’s assets and creditworthiness.

Next, we have an IOU. An IOU is a simpler, less formal version of a promissory note. It acknowledges a debt but usually lacks the detailed terms found in a promissory note. While an IOU serves as evidence of a debt, it may not provide the same legal enforceability or clarity regarding repayment terms.

Another similar document is a loan modification agreement. This document alters the terms of an existing promissory note, often to make payments more manageable for the borrower. Loan modifications can include changes to the interest rate, payment schedule, or even the principal amount, all of which aim to prevent default and keep the borrower in good standing.

Understanding the different types of financial agreements is crucial for borrowers and lenders alike, as they provide a framework for transactions. Among these, the California Employment Verification form serves as an important tool for employers in confirming work eligibility. For those looking to properly fill out this essential document, visit Fill PDF Forms to ensure compliance with state regulations.

A credit agreement is also comparable. This document outlines the terms under which credit is extended to a borrower. Like a promissory note, it specifies the amount to be borrowed and the repayment terms. However, credit agreements often cover revolving credit lines, such as credit cards, and may include provisions about fees and penalties for late payments.

Another related document is a security agreement. This document is used when a borrower pledges collateral to secure a loan. While a promissory note states the promise to pay, a security agreement details what assets are at risk if the borrower fails to meet their obligations, providing additional protection for the lender.

In addition, there is a settlement agreement. This document is used to resolve disputes and may involve a promise to pay a certain amount to settle a claim. Like a promissory note, it creates a binding obligation, but it typically arises from negotiations to resolve a legal issue rather than a straightforward borrowing scenario.

Lastly, a lease agreement can also be considered similar. While it primarily pertains to the rental of property, it often includes a payment obligation similar to a promissory note. Renters promise to pay a specified amount for the use of property, and the lease outlines the terms of that payment, including due dates and penalties for late payment.

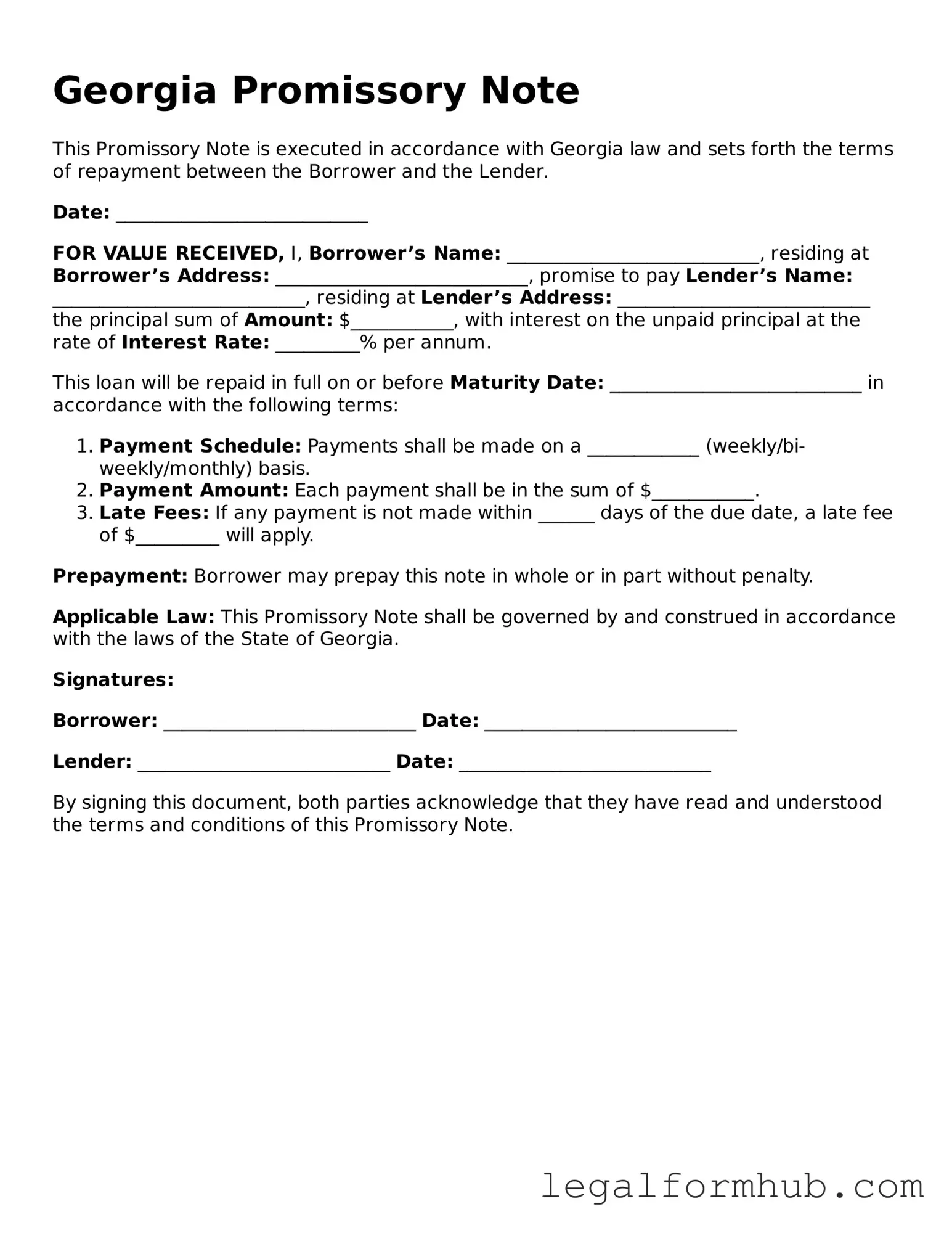

Instructions on Writing Georgia Promissory Note

After obtaining the Georgia Promissory Note form, you will need to complete it accurately to ensure it serves its intended purpose. Once filled out, the note may need to be signed and possibly notarized, depending on your situation. Follow the steps below to complete the form correctly.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Next, write the name and address of the borrower. This should include the full legal name and current address.

- Then, provide the name and address of the lender. Include the lender's full legal name and current address as well.

- Specify the principal amount being borrowed. This is the total amount of money the borrower agrees to repay.

- Indicate the interest rate, if applicable. Clearly state whether it is a fixed or variable rate.

- Detail the repayment schedule. Include how often payments will be made (e.g., monthly, quarterly) and the due date for the first payment.

- Outline any late fees or penalties for missed payments. Be specific about the amounts and conditions.

- Include any additional terms or conditions that apply to the loan. This may cover aspects like prepayment penalties or collateral.

- At the bottom of the form, both the borrower and lender must sign and date the document. Ensure that all signatures are legible.

Misconceptions

Understanding the Georgia Promissory Note form is crucial for anyone involved in lending or borrowing money. However, many misconceptions surround this document. Here are ten common misunderstandings:

- It must be notarized. Many people think a promissory note needs a notary's signature to be valid. In Georgia, notarization is not required for the note to be enforceable.

- It can only be used for personal loans. Some believe promissory notes are only for personal loans. In reality, they are used in business transactions and real estate deals as well.

- All promissory notes are the same. Not all promissory notes are identical. Each note can be tailored to fit the specific terms agreed upon by the parties involved.

- Verbal agreements are sufficient. Relying on a verbal agreement is risky. A written promissory note provides clear evidence of the terms and conditions, making it easier to enforce.

- Interest rates are fixed. Many assume the interest rate on a promissory note cannot change. However, the parties can agree to variable rates, as long as they are clearly stated in the document.

- They are only for large sums of money. People often think promissory notes are only for significant amounts. However, they can be used for any amount, big or small.

- Default means immediate loss. A common belief is that defaulting on a promissory note results in immediate loss of the loaned amount. In many cases, lenders may offer a grace period or alternative solutions.

- They are not legally binding. Some think that a promissory note is just a casual agreement. In fact, when properly executed, it is a legally binding contract.

- Only banks can issue them. Many believe that only financial institutions can create promissory notes. Individuals can issue them as well, provided they meet legal requirements.

- They are difficult to enforce. There is a misconception that enforcing a promissory note is complicated. While it may require legal action, the process is straightforward if the terms are clear.

Addressing these misconceptions can help both lenders and borrowers navigate the lending process more effectively. Always consult with a legal expert if you have questions about your specific situation.

Key takeaways

When dealing with the Georgia Promissory Note form, it's essential to understand a few key aspects to ensure everything is filled out correctly and used effectively. Here are some important takeaways:

- Clearly Define the Loan Terms: Specify the amount borrowed, interest rate, and repayment schedule. This clarity helps avoid misunderstandings later.

- Include Borrower and Lender Information: Make sure to provide full names and addresses for both parties. Accurate identification is crucial for legal purposes.

- Signatures Matter: Both the borrower and lender must sign the note. Without signatures, the document may not hold up in court.

- Keep Copies: After completing the form, both parties should retain copies. This ensures everyone has access to the same information and terms.

By keeping these points in mind, you can navigate the process of using a Georgia Promissory Note with confidence.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A promissory note in Georgia is a written promise to pay a specified amount of money to a designated party at a specified time. |

| Governing Law | The Georgia Promissory Note is governed by the Georgia Uniform Commercial Code (UCC), specifically O.C.G.A. § 11-3-101 et seq. |

| Parties Involved | Typically, there are two main parties: the maker (borrower) who promises to pay and the payee (lender) who receives the payment. |

| Interest Rate | The note may specify an interest rate, which can be fixed or variable, depending on the agreement between the parties. |

| Payment Terms | Payment terms should clearly outline when and how payments will be made, including any grace periods or late fees. |

| Enforceability | For a promissory note to be enforceable, it must be signed by the maker and include essential terms like amount, interest rate, and payment schedule. |

| Default Consequences | If the maker defaults on the note, the payee has the right to take legal action to recover the owed amount, including interest and fees. |