Free Gift Deed Template for Georgia

Create Other Popular Gift Deed Forms for Different States

Texas Gift Deed - This form outlines the details of the property being gifted and the donor's intent.

The Arizona Medical Power of Attorney form is a legal document that allows individuals to designate someone they trust to make healthcare decisions on their behalf if they become unable to do so. This form empowers the appointed agent to communicate with medical professionals and make choices regarding treatment options, ensuring that the individual's wishes are honored. Understanding the nuances of this form is essential for anyone looking to secure their healthcare preferences in advance. For more information, you can refer to the template available at https://arizonapdfs.com/medical-power-of-attorney-template.

How Much Does It Cost to Transfer Property Deeds? - It provides clear documentation of the gift for future reference.

Similar forms

The Warranty Deed is similar to a Gift Deed in that both documents transfer ownership of property. In a Warranty Deed, the seller guarantees that they hold clear title to the property and have the right to sell it. This assurance provides the buyer with confidence that no one else can claim ownership. In contrast, a Gift Deed does not involve a sale; it simply conveys property as a gift, often without the same level of guarantee regarding the title. However, both documents require signatures and must be recorded to be effective.

A Quitclaim Deed is another document that shares similarities with a Gift Deed. Both are used to transfer property, but a Quitclaim Deed does so without any warranties. This means that the person transferring the property does not guarantee they have any ownership rights. While a Gift Deed conveys property as a gift with the intent of transferring ownership, a Quitclaim Deed may be used to relinquish any claim to a property, making it less secure for the recipient.

An Affidavit of Heirship is also comparable to a Gift Deed, particularly in situations where property is transferred after someone's death. This document establishes the heirs of a deceased person and their rights to the property. While a Gift Deed involves a living donor and a clear intent to gift property, an Affidavit of Heirship serves to clarify ownership among heirs, often when no formal will exists. Both documents aim to clarify ownership but in different contexts.

A Bill of Sale, while primarily used for personal property rather than real estate, shares the concept of transferring ownership. A Bill of Sale documents the sale of items like vehicles or equipment, similar to how a Gift Deed documents the transfer of real property. Both documents require signatures and serve as proof of the transaction. However, a Bill of Sale involves a monetary exchange, whereas a Gift Deed does not.

When navigating the complexities of property agreements, it's crucial to understand various documents, including lease agreements. A Lease Agreement allows one party to use another’s property for a specified duration in exchange for rent. For those who need a structured lease template to simplify the rental process, Fill PDF Forms can provide the necessary resources to facilitate clear and legally binding agreements.

Finally, a Real Estate Purchase Agreement outlines the terms of a sale between a buyer and a seller. This document is similar to a Gift Deed in that it involves the transfer of property. However, a Purchase Agreement includes details about the sale price and conditions of the sale, which are absent in a Gift Deed. Both documents require signatures and must be executed properly to be legally binding, but they serve different transactional purposes.

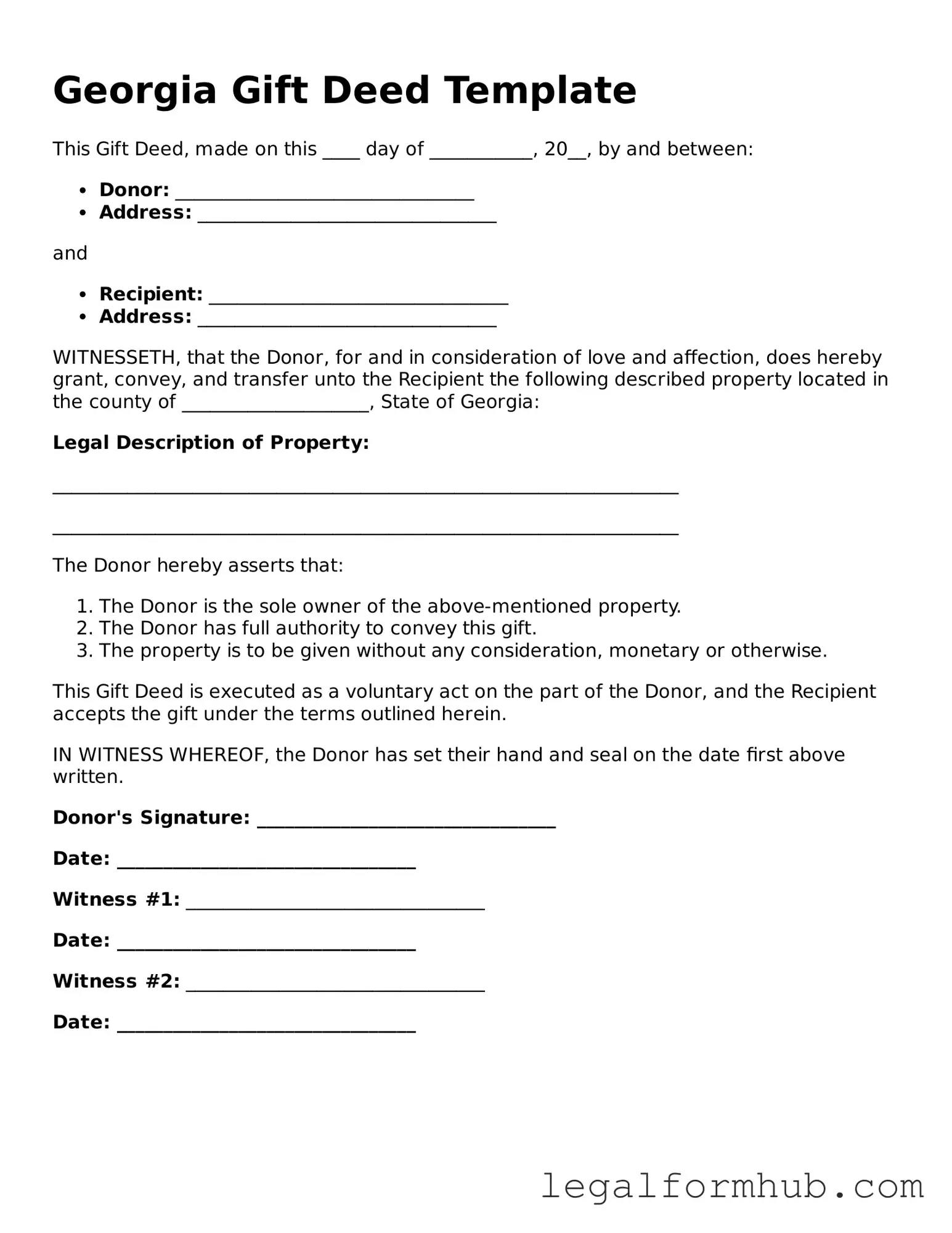

Instructions on Writing Georgia Gift Deed

After obtaining the Georgia Gift Deed form, you will need to complete it accurately to ensure a smooth transfer of property. This process involves providing specific information about the property and the parties involved. Follow these steps carefully to fill out the form correctly.

- Gather necessary information: Collect details about the property, including its legal description, the names of the giver (grantor) and the receiver (grantee), and any other relevant information.

- Fill in the grantor's information: Write the full name and address of the person giving the gift.

- Provide the grantee's information: Enter the full name and address of the person receiving the gift.

- Describe the property: Clearly state the legal description of the property being transferred. This may include the lot number, subdivision name, and county.

- Indicate the consideration: Write "love and affection" or any other consideration you wish to state, as this is a gift deed.

- Sign the form: The grantor must sign the deed in the presence of a notary public.

- Notarize the document: A notary public will need to witness the signature and affix their seal to the document.

- File the deed: Submit the completed and notarized deed to the appropriate county office for recording.

Completing these steps will help ensure that the gift deed is properly executed and recorded. Once filed, the transfer of property will be official, and both parties will have documentation of the transaction.

Misconceptions

Understanding the Georgia Gift Deed form is crucial for anyone considering transferring property as a gift. However, several misconceptions can lead to confusion. Here are five common misconceptions:

- Gift Deeds are only for family members. Many believe that a gift deed can only be used to transfer property between family members. In reality, anyone can gift property to another person, regardless of their relationship.

- A Gift Deed does not require legal documentation. Some think that a verbal agreement is sufficient for a gift deed. However, a written document is necessary to legally transfer ownership and protect both parties involved.

- Gift Deeds are not subject to taxes. There is a misconception that gifting property is tax-free. While the recipient may not pay taxes at the time of the gift, the donor may be subject to gift tax if the value exceeds certain limits set by the IRS.

- Once a Gift Deed is signed, it cannot be revoked. Many assume that a gift deed is final and cannot be changed. However, the donor may revoke the deed under certain conditions before the transfer is complete.

- Gift Deeds are the same as a Will. Some people confuse gift deeds with wills. A gift deed transfers ownership immediately, while a will only takes effect upon the death of the testator.

By clarifying these misconceptions, individuals can make informed decisions about property transfers in Georgia.

Key takeaways

When dealing with the Georgia Gift Deed form, it's essential to understand its key components and requirements. Here are nine important takeaways to consider:

- Purpose: A Gift Deed is used to transfer property ownership without any exchange of money.

- Eligibility: Anyone can give a gift of property, but the recipient must be a legal person or entity.

- Property Description: Clearly describe the property being transferred, including its address and legal description.

- Donor and Recipient Information: Include full names and addresses of both the person giving the gift and the person receiving it.

- Signatures: The Gift Deed must be signed by the donor. In some cases, notarization may be required for validity.

- Delivery: The deed must be delivered to the recipient to complete the transfer of ownership.

- Filing: Although not always necessary, filing the Gift Deed with the county clerk can provide public notice of the transfer.

- Tax Implications: Be aware of potential gift tax implications; consult a tax professional if needed.

- Revocation: A Gift Deed cannot be revoked once executed unless specific legal conditions are met.

Understanding these key points can help ensure a smooth process when using the Georgia Gift Deed form.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Georgia Gift Deed is a legal document used to transfer property ownership as a gift without any payment involved. |

| Governing Law | The Georgia Gift Deed is governed by the Official Code of Georgia Annotated (O.C.G.A.) § 44-5-30. |

| Parties Involved | The deed involves a donor (the person giving the gift) and a donee (the person receiving the gift). |

| Consideration | No monetary consideration is required for a gift deed; the transfer is made voluntarily. |

| Witness Requirement | The deed must be signed in the presence of at least two witnesses to be valid. |

| Notarization | Notarization of the deed is recommended to ensure authenticity and facilitate recording. |

| Tax Implications | Gift deeds may have tax implications for both the donor and donee, including potential gift tax considerations. |

| Recording | The completed gift deed should be recorded with the county clerk’s office where the property is located to provide public notice. |