Free Durable Power of Attorney Template for Georgia

Create Other Popular Durable Power of Attorney Forms for Different States

Ohio Power of Attorney Requirements - Discussions about your Durable Power of Attorney may prevent family disputes later.

Understanding the importance of the Missouri Operating Agreement is essential for any LLC, as it not only defines the management structure but also clarifies the responsibilities and operational procedures among members. To ease the process of creating this pivotal document, you can access the Operating Agreement form and begin tailoring it to your specific needs.

Texas Durable Power of Attorney Free Pdf - Having a Durable Power of Attorney can simplify the process of managing financial matters in challenging times.

Similar forms

The Georgia Durable Power of Attorney form is similar to a General Power of Attorney. Both documents allow one person to appoint another to act on their behalf in financial and legal matters. However, the key difference lies in durability. A General Power of Attorney becomes invalid if the principal becomes incapacitated, while the Durable Power of Attorney remains effective even if the principal is unable to make decisions due to illness or injury. This makes the Durable Power of Attorney a more robust option for long-term planning.

To ensure a smooth transition in your mobile home sale, it is important to utilize the right documentation. For a reliable resource, refer to this comprehensive guide on the Mobile Home Bill of Sale requirements.

Another document that shares similarities is the Healthcare Power of Attorney. This form specifically grants someone the authority to make medical decisions for another person when they are unable to do so. Like the Durable Power of Attorney, it allows for the designation of a trusted individual to act on behalf of the principal. The focus here is on healthcare decisions, ensuring that the principal's medical preferences are honored when they cannot communicate them.

The Living Will is also comparable to the Georgia Durable Power of Attorney, particularly in the context of healthcare decisions. A Living Will outlines a person's wishes regarding medical treatment in situations where they cannot express their preferences. While the Durable Power of Attorney appoints someone to make decisions, the Living Will provides specific instructions. Both documents work together to ensure that an individual's desires are respected, particularly in critical situations.

Lastly, the Revocable Trust shares some characteristics with the Durable Power of Attorney. A Revocable Trust allows a person to manage their assets during their lifetime and designates a successor trustee to take over after their death or incapacitation. While the Durable Power of Attorney focuses on decision-making authority, the Revocable Trust is about asset management. Both documents provide a way to plan for the future and ensure that personal wishes are followed, but they operate in different areas of estate planning.

Instructions on Writing Georgia Durable Power of Attorney

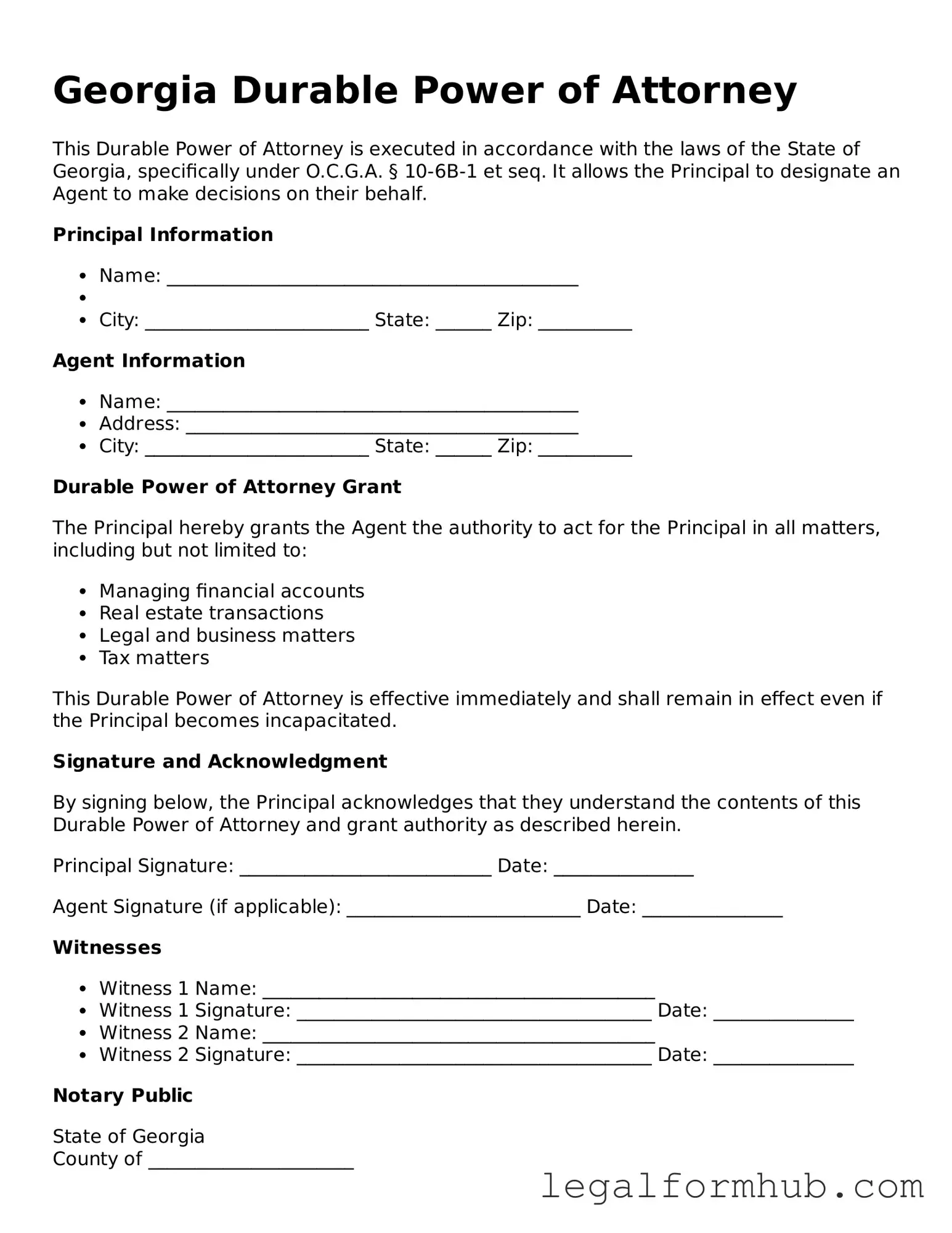

Filling out the Georgia Durable Power of Attorney form is a straightforward process. This document allows you to designate someone to act on your behalf in financial and legal matters. Follow these steps carefully to ensure that the form is completed correctly.

- Obtain the Georgia Durable Power of Attorney form. You can find it online or at legal stationery stores.

- Read the entire form to understand the sections you need to complete.

- In the first section, provide your full name and address as the principal.

- Designate your agent by writing their full name and address in the specified section.

- If you wish to name an alternate agent, fill in their information in the designated area.

- Review the powers you want to grant your agent. Check the appropriate boxes to indicate which powers apply.

- Sign and date the form in the presence of a notary public. Ensure that the notary public also signs and stamps the document.

- Provide copies of the completed form to your agent and any relevant institutions or individuals.

Once the form is filled out and notarized, it becomes effective as per your instructions. Make sure to keep a copy for your records and communicate your wishes clearly to your agent.

Misconceptions

When it comes to the Georgia Durable Power of Attorney form, there are several misconceptions that can lead to confusion. Understanding these can help individuals make informed decisions about their legal documents. Here are six common misconceptions:

- It only takes effect when I become incapacitated. Many people believe that a Durable Power of Attorney is only activated when they are unable to make decisions. However, it can take effect immediately upon signing, depending on how it is drafted.

- My agent can do anything they want with my assets. While the agent does have significant authority, their powers are limited to what you specify in the document. You can outline what decisions they can make and what actions they cannot take.

- Once I sign it, I can’t change it. This is not true. You have the right to revoke or change your Durable Power of Attorney at any time, as long as you are mentally competent to do so.

- It’s the same as a standard Power of Attorney. A Durable Power of Attorney is different from a standard Power of Attorney. The durable version remains effective even if you become incapacitated, while a standard one typically does not.

- I don’t need a Durable Power of Attorney if I have a will. A will only takes effect after your death. A Durable Power of Attorney is crucial for making decisions on your behalf while you are still alive, particularly if you become incapacitated.

- My family can automatically make decisions for me if I can’t. Without a Durable Power of Attorney, family members may face legal challenges when trying to make decisions on your behalf. This document can help avoid potential conflicts and ensure your wishes are honored.

By dispelling these misconceptions, individuals can better understand the importance of having a Durable Power of Attorney in place. It’s a proactive step towards ensuring that your preferences are respected, even when you may not be able to voice them yourself.

Key takeaways

When considering a Georgia Durable Power of Attorney, it’s important to understand several key aspects. Here are some essential takeaways:

- Designation of Agent: You must clearly identify the person you trust to act on your behalf. This individual is referred to as your agent or attorney-in-fact.

- Durability: The document remains effective even if you become incapacitated. This ensures that your financial and legal matters can be managed without interruption.

- Specific Powers: Be explicit about the powers you grant. You can choose to allow your agent to handle a wide range of financial transactions or limit their authority to specific tasks.

- Revocation: You have the right to revoke the Durable Power of Attorney at any time, as long as you are mentally competent. Make sure to notify your agent and any institutions that may have a copy of the document.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A Georgia Durable Power of Attorney allows an individual to designate another person to make financial and legal decisions on their behalf. |

| Durability | This type of power of attorney remains effective even if the principal becomes incapacitated. |

| Governing Law | The form is governed by the Georgia Uniform Power of Attorney Act, found in O.C.G.A. § 10-6B-1 et seq. |

| Principal | The person granting the power is referred to as the principal. |

| Agent | The individual designated to act on behalf of the principal is known as the agent or attorney-in-fact. |

| Execution Requirements | The form must be signed by the principal in the presence of a notary public and, in some cases, witnesses. |

| Revocation | The principal can revoke the durable power of attorney at any time, as long as they are competent. |

| Limitations | Some powers, such as those related to health care decisions, may require a separate document. |

| Importance | This document is crucial for ensuring that financial and legal matters are managed according to the principal's wishes when they cannot do so themselves. |