Free Deed in Lieu of Foreclosure Template for Georgia

Create Other Popular Deed in Lieu of Foreclosure Forms for Different States

Deed in Lieu of Foreclosure Ohio - Encourages borrowers to make informed decisions regarding their financial futures with lender collaboration.

The California Bill of Sale form serves as a legal document that records the transfer of ownership of personal property from one individual to another. This form is crucial for providing evidence of the transaction and outlining the details of the sale, such as the buyer, seller, and item description. To ensure your transaction is documented properly, consider filling out the form by clicking the button below or visiting Fill PDF Forms.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - It may be possible to negotiate terms that allow the borrower to remain in the home temporarily.

Similar forms

A short sale agreement is a document where a homeowner sells their property for less than the amount owed on the mortgage, with the lender's approval. Like a deed in lieu of foreclosure, a short sale aims to avoid the lengthy foreclosure process. Both options allow homeowners to relieve themselves of mortgage debt and mitigate the financial impact of foreclosure. However, in a short sale, the property is sold to a third party, while a deed in lieu transfers ownership directly to the lender.

If you are looking for the right documentation to handle your trailer transaction, understanding the process behind the Illinois Trailer Bill of Sale preparation is essential. This document ensures that all necessary details are included to complete the ownership transfer smoothly.

A mortgage modification agreement involves changing the terms of an existing mortgage to make it more manageable for the homeowner. This document can lower monthly payments, reduce interest rates, or extend the loan term. Similar to a deed in lieu of foreclosure, a mortgage modification seeks to help homeowners avoid foreclosure. However, while a deed in lieu relinquishes ownership to the lender, a mortgage modification allows the homeowner to retain ownership and continue making payments under revised terms.

A forbearance agreement is another document that provides temporary relief to homeowners facing financial difficulties. In this arrangement, the lender agrees to pause or reduce mortgage payments for a specified period. Both forbearance agreements and deeds in lieu of foreclosure aim to prevent foreclosure, but they do so in different ways. A forbearance allows homeowners to keep their property while they work on their financial situation, whereas a deed in lieu results in the homeowner giving up their property to the lender.

A bankruptcy filing can also be similar to a deed in lieu of foreclosure in that both can provide relief from overwhelming debt. Filing for bankruptcy can halt foreclosure proceedings and allow homeowners to reorganize or eliminate debts. While a deed in lieu directly transfers property ownership to the lender, bankruptcy can lead to a variety of outcomes, including the possibility of retaining the home under certain circumstances. Both options can impact credit scores, but the consequences and processes differ significantly.

An assumption agreement allows a buyer to take over the existing mortgage of a seller, often seen in real estate transactions. This document can benefit sellers who need to exit a mortgage without going through foreclosure. Like a deed in lieu of foreclosure, an assumption agreement can provide a way to relieve the seller from mortgage obligations. However, in an assumption, the buyer takes on the responsibility of the mortgage, while a deed in lieu transfers that responsibility to the lender, effectively removing the homeowner from the equation.

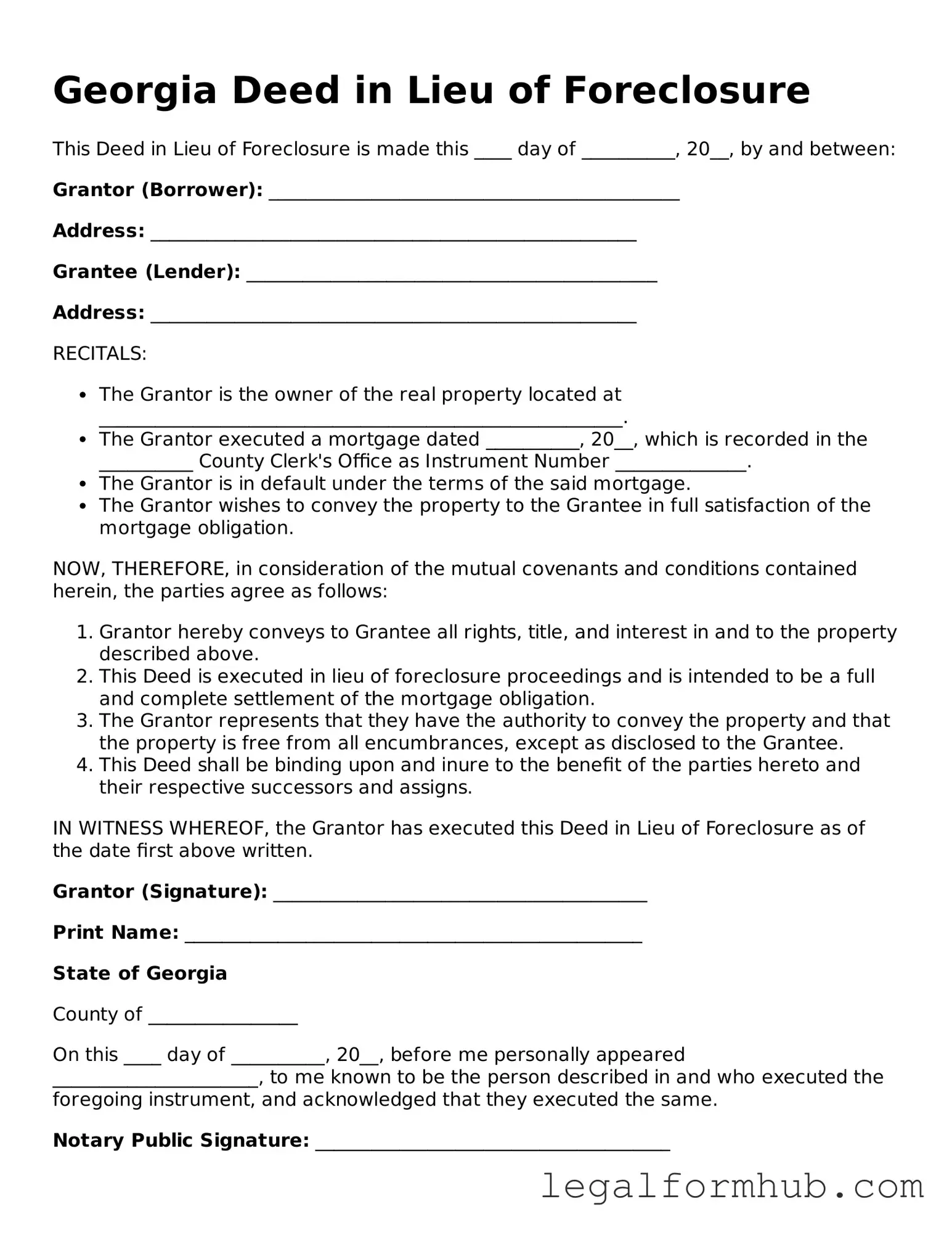

Instructions on Writing Georgia Deed in Lieu of Foreclosure

Once you have the Georgia Deed in Lieu of Foreclosure form, you will need to fill it out accurately to ensure it is valid. After completing the form, you will need to submit it to the appropriate parties involved in the foreclosure process.

- Obtain the Georgia Deed in Lieu of Foreclosure form from a reliable source or your lender.

- Fill in the date at the top of the form.

- Provide the names of the grantor(s) (the person(s) transferring the property) and the grantee (the lender or bank). Ensure all names are spelled correctly.

- Include the property address, including the city, county, and state.

- Clearly describe the property by including the legal description. This can usually be found in your mortgage documents or property deed.

- State the reason for the deed in lieu of foreclosure in the designated section.

- Sign the form in the presence of a notary public. Ensure all grantors sign where required.

- Have the notary public complete their section, including their signature and seal.

- Make copies of the completed form for your records.

- Submit the original signed form to the lender or bank as instructed.

Misconceptions

The Georgia Deed in Lieu of Foreclosure is often misunderstood. Here are ten common misconceptions about this legal process.

- A Deed in Lieu is the same as foreclosure. Many people believe that a deed in lieu of foreclosure is just another form of foreclosure. In reality, it is a voluntary transfer of property to the lender to avoid the foreclosure process.

- It eliminates all debts. Some homeowners think that signing a deed in lieu will wipe out all their debts. However, this is not always the case. If there is a deficiency balance after the property is sold, the lender may still pursue the borrower for that amount.

- It does not affect credit scores. A common belief is that a deed in lieu of foreclosure has no impact on credit scores. In truth, it can significantly affect credit ratings, similar to a foreclosure.

- It is a quick process. Many assume that a deed in lieu is a fast solution to avoid foreclosure. While it can be quicker than traditional foreclosure, the process still requires negotiation and approval from the lender.

- All lenders accept deeds in lieu. Some people think that all mortgage lenders will accept a deed in lieu. However, this is not guaranteed. Lenders have their own policies and may not agree to this option.

- It releases all liability. A misconception exists that signing a deed in lieu releases the borrower from all liability. This is not always true, especially if the lender includes a recourse provision.

- It is only for homeowners in extreme financial distress. Some believe that only those in dire financial situations can pursue a deed in lieu. In fact, homeowners facing various financial challenges may consider this option.

- It is a simple form to fill out. Many think that the deed in lieu form is straightforward and easy to complete. However, it often requires careful consideration and sometimes legal advice to ensure all terms are understood.

- It guarantees forgiveness of the mortgage. There is a belief that a deed in lieu guarantees forgiveness of the mortgage debt. While it may lead to forgiveness, it is not a certainty without specific agreements in place.

- It is the best option for everyone. Some homeowners think that a deed in lieu is the best solution for avoiding foreclosure. However, each situation is unique, and alternatives such as loan modifications or short sales may be more suitable.

Understanding these misconceptions can help homeowners make informed decisions regarding their mortgage options in Georgia.

Key takeaways

Filling out and using the Georgia Deed in Lieu of Foreclosure form is an important step for homeowners facing financial difficulties. Here are some key takeaways to consider:

- Understanding the Purpose: The Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer ownership of their property to the lender. This can help avoid the lengthy and costly foreclosure process.

- Eligibility Requirements: Not all homeowners will qualify for this option. Lenders typically require that the borrower is experiencing financial hardship and that the property is not subject to any other liens.

- Document Preparation: When filling out the form, ensure that all information is accurate and complete. This includes details about the property, the borrower, and the lender. Mistakes can delay the process.

- Legal Implications: It is crucial to understand the legal consequences of signing a Deed in Lieu of Foreclosure. This action may impact credit scores and future borrowing opportunities.

- Consultation with Professionals: Before proceeding, it is wise to consult with a real estate attorney or a financial advisor. They can provide guidance tailored to individual circumstances and help navigate the complexities involved.

By keeping these key points in mind, homeowners can make informed decisions regarding their financial situation and the use of the Deed in Lieu of Foreclosure form in Georgia.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure proceedings. |

| Governing Law | The process is governed by Georgia law, specifically under O.C.G.A. § 44-14-162. |

| Eligibility | Borrowers must be facing financial hardship and unable to continue making mortgage payments to qualify for this option. |

| Benefits | This option can help borrowers avoid the lengthy foreclosure process and may result in less damage to their credit score. |

| Process | To initiate a deed in lieu of foreclosure, borrowers should contact their lender to discuss the situation and request the necessary forms. |

| Documentation | Borrowers may need to provide financial statements, hardship letters, and other relevant documents to support their request. |

| Considerations | It is essential to understand the potential tax implications and the impact on credit before proceeding with a deed in lieu of foreclosure. |