Fill Your Generic Direct Deposit Form

Different PDF Templates

Puppy Missed 3rd Round of Shots - Make sure to update this form as vaccinations are administered.

A Power of Attorney (POA) form in Arizona is a legal document that allows one person to appoint another to make decisions on their behalf. This form can cover a wide range of matters, from financial transactions to healthcare decisions. Understanding the nuances of this document is crucial for anyone looking to ensure their wishes are honored when they can no longer speak for themselves. For more information and to obtain a template, visit https://arizonapdfs.com/power-of-attorney-template.

262 Form - Section 2 details the financial aspects of the sale or transfer.

Similar forms

The Generic Direct Deposit form shares similarities with a W-4 form, which is used for tax withholding purposes. Both documents require personal information, such as name and Social Security number, to ensure accurate processing. Just as the W-4 allows employees to specify their withholding preferences, the Direct Deposit form enables individuals to designate where their payments will be deposited. Each form requires a signature to authorize the respective actions, ensuring that the employee's choices are formally recognized by their employer or financial institution.

Another document that resembles the Generic Direct Deposit form is the ACH Authorization form. This form is used to authorize automatic payments or deposits through the Automated Clearing House network. Like the Direct Deposit form, it requires detailed banking information, including account and routing numbers. Both forms serve to facilitate electronic transactions, ensuring that funds are transferred securely and efficiently. The ACH Authorization form also includes a section for the individual's signature, confirming their consent to the specified transactions.

The Payroll Deduction Authorization form is yet another document that has a similar function. This form allows employees to authorize deductions from their paychecks for various purposes, such as retirement contributions or health insurance premiums. Both the Payroll Deduction and Direct Deposit forms require the employee's consent and specify the financial institution involved. They both play crucial roles in managing an employee's compensation and benefits, ensuring that the correct amounts are allocated as per the employee's requests.

Understanding the importance of various financial forms is crucial for maintaining smooth transactions within an organization. One such essential document is the Employment Verification Form, which plays a significant role in confirming employment history and job details. To assist in this process, you can easily access and complete the verification necessities by using the provided Fill PDF Forms to ensure all requisite information is readily available for prospective employers.

The Bank Account Verification form also bears resemblance to the Generic Direct Deposit form. This document is often required by employers to confirm that the banking information provided by an employee is accurate. Similar to the Direct Deposit form, it collects essential banking details, including account and routing numbers. Both forms aim to prevent errors in financial transactions, ensuring that funds are deposited or withdrawn from the correct accounts. A signature is typically required on both forms to validate the information provided.

The Authorization for Release of Information form is another document that shares some characteristics with the Generic Direct Deposit form. This form allows individuals to grant permission for the release of their personal information to third parties, often for financial or employment verification purposes. Like the Direct Deposit form, it requires the individual's signature and personal details. Both documents emphasize the importance of consent when handling sensitive information, ensuring that the individual's rights are respected.

Lastly, the Employment Application form is similar in that it collects personal information from applicants. While its primary purpose is to assess qualifications for a job, it often requires details like name, address, and Social Security number. Both forms serve as gateways for financial transactions or employment opportunities, emphasizing the importance of accurate and complete information. Each form also necessitates a signature to confirm that the information provided is truthful and authorized.

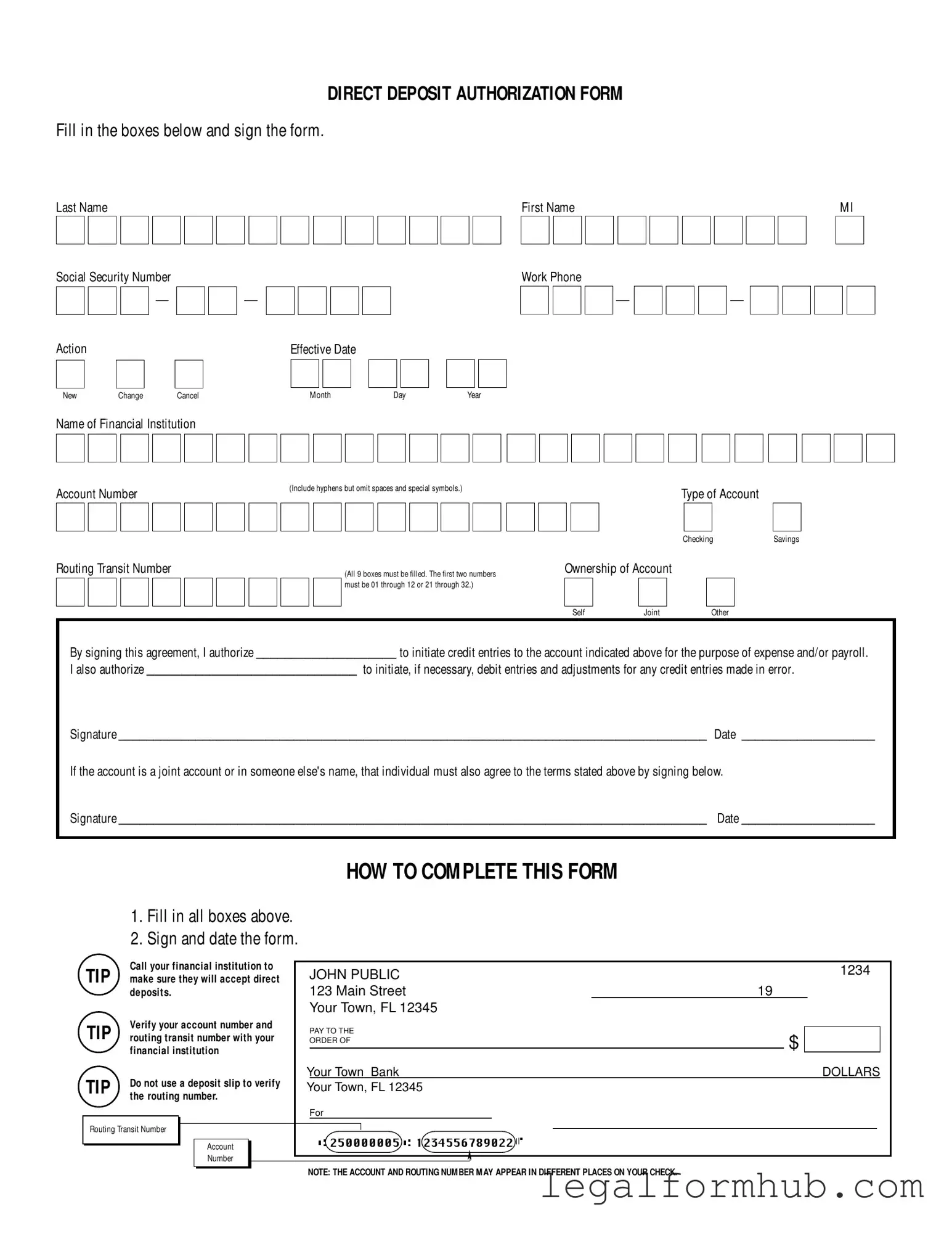

Instructions on Writing Generic Direct Deposit

After completing the Generic Direct Deposit form, it will be submitted to your employer or financial institution for processing. This enables your payments to be directly deposited into your chosen bank account. Follow these steps to ensure the form is filled out correctly.

- Fill in your Last Name, First Name, and M.I. in the designated boxes.

- Enter your Social Security Number in the format of XXX-XX-XXXX.

- Select the Action you wish to take: New, Change, or Cancel.

- Provide the Effective Date in the format of Month, Day, Year.

- Fill in your Work Phone number in the format of XXX-XXX-XXXX.

- Write the Name of Financial Institution where you want the deposits made.

- Enter your Account Number, including hyphens but omitting spaces and special symbols.

- Select the Type of Account (Savings or Checking).

- Fill in the Routing Transit Number (All 9 boxes must be filled). Ensure the first two numbers are 01 through 12 or 21 through 32.

- Indicate the Ownership of Account: Self, Joint, or Other.

- Sign the form to authorize your employer or financial institution to initiate credit entries to your account.

- Write the Date of signing.

- If applicable, have the joint account holder sign and date the form as well.

Double-check your entries for accuracy before submitting the form. This will help avoid any delays in processing your direct deposit.

Misconceptions

Here are some common misconceptions about the Generic Direct Deposit form:

- It's only for payroll deposits. Many believe direct deposit is limited to payroll. In reality, it can also be used for other types of payments, such as government benefits or refunds.

- All banks accept the form. Some think any bank will accept a direct deposit form. It's important to check with your financial institution to ensure they accept direct deposits.

- You don't need to verify your account details. Some people skip verifying their account and routing numbers. This can lead to errors, so it's wise to double-check with your bank.

- Only one signature is needed. If the account is joint, both parties must sign the form. This is often overlooked, leading to delays in processing.

- Changes can be made easily at any time. Many assume changes to direct deposit can be made instantly. However, it may take a few pay cycles for changes to take effect.

- You can use a deposit slip for routing numbers. Some people think a deposit slip is a valid way to verify routing numbers. In fact, it’s better to confirm directly with your bank.

- It doesn't matter if all boxes aren't filled. Some believe incomplete forms will still be processed. All boxes must be filled to avoid delays or rejections.

- Direct deposit is not secure. Many worry about the security of direct deposits. However, they are generally safer than paper checks, which can be lost or stolen.

- You can't cancel a direct deposit once it's set up. Some think once a direct deposit is established, it can't be canceled. In reality, you can cancel or change it at any time by submitting a new form.

Key takeaways

When filling out the Generic Direct Deposit form, there are several important points to keep in mind:

- Complete All Fields: Ensure that every box on the form is filled out completely. Incomplete forms may delay processing.

- Sign and Date: After filling out the form, sign and date it to validate your authorization.

- Contact Your Bank: It is advisable to call your financial institution to confirm that they accept direct deposits.

- Verify Account Information: Double-check your account number and routing transit number with your bank to avoid errors.

- Avoid Deposit Slips: Do not use a deposit slip to verify the routing number, as this may lead to inaccuracies.

- Understand Routing Numbers: The routing transit number must consist of 9 digits, with the first two numbers ranging from 01 to 12 or 21 to 32.

- Joint Accounts: If the account is joint or in someone else's name, that individual must also sign the form to agree to the terms.

- Authorization: By signing the form, you authorize the initiation of credit entries to your account for payroll or expenses.

- Adjustments for Errors: The form also allows for adjustments to be made for any credit entries that were processed in error.

Following these guidelines will help ensure a smooth and efficient setup for direct deposit.

File Information

| Fact Name | Details |

|---|---|

| Purpose | The Generic Direct Deposit form authorizes the transfer of funds into a bank account for payroll or expense reimbursements. |

| Account Information | It requires the account number and routing transit number, which must be verified with the financial institution. |

| Types of Accounts | The form allows for deposits into either a savings or checking account. |

| Ownership | Account ownership can be self, joint, or other. If it's a joint account, both parties must sign. |

| Legal Authority | In many states, this form is governed by the Uniform Commercial Code (UCC) which regulates bank deposits and collections. |

| Signature Requirement | A signature is mandatory to authorize the initiation of credit and, if needed, debit entries. |

| Effective Date | The form allows the user to specify an effective date for when the direct deposit should start. |

| Completion Tips | Users are advised to fill in all fields, verify account details with their bank, and avoid using deposit slips for routing numbers. |