Fill Your Florida Commercial Contract Form

Different PDF Templates

Youth Basketball Evaluation Form - Assess the ability to recover to a man after switching or helping on defense.

To facilitate the transfer of ownership, it is essential to complete the necessary documentation, and you can easily do so by utilizing the resources available at Fill PDF Forms, which offers a straightforward way to prepare the California Dog Bill of Sale form.

Free Broker Price Opinion Template - Understand the implications of property upgrades or downgrades in value.

Roof Condition Report - Encourages homeowner engagement in maintaining an effective roofing system.

Similar forms

The Florida Commercial Contract form shares similarities with the Residential Purchase Agreement. Both documents outline the essential terms of a real estate transaction, including the parties involved, property description, purchase price, and conditions for closing. However, the Residential Purchase Agreement is tailored for residential properties, while the Florida Commercial Contract is specifically designed for commercial transactions. This distinction is crucial, as commercial properties often involve different regulations and considerations, such as zoning laws and business operations.

Another similar document is the Lease Agreement. Like the Florida Commercial Contract, a Lease Agreement details the terms of a property transaction, focusing on the rights and responsibilities of the landlord and tenant. Both documents specify rental amounts, duration of the agreement, and conditions for termination. However, the Lease Agreement primarily pertains to rental arrangements rather than outright purchases, making it a key tool for those engaging in long-term property use without ownership.

The Option to Purchase Agreement is also comparable. This document grants a buyer the right, but not the obligation, to purchase a property at a predetermined price within a specified timeframe. Similar to the Florida Commercial Contract, it requires clear terms regarding the purchase price and conditions. The primary difference lies in the nature of the agreement; the Option to Purchase Agreement offers flexibility and time for the buyer to evaluate the property before committing to a full purchase.

The Commercial Lease Agreement is another related document. It outlines the terms for leasing commercial property, similar to how the Florida Commercial Contract details a purchase. Both documents include provisions for rent, maintenance responsibilities, and duration of the agreement. The key difference is that a lease does not transfer ownership, while the Florida Commercial Contract does, making it essential for buyers who wish to acquire property outright.

The Purchase and Sale Agreement is also quite similar. This document serves as a binding contract between a buyer and seller, outlining the terms of the sale. Like the Florida Commercial Contract, it includes details about the purchase price, property description, and closing conditions. However, the Purchase and Sale Agreement can apply to both residential and commercial properties, making it a more general document compared to the Florida Commercial Contract, which is specifically tailored for commercial transactions.

In real estate transactions, having robust legal protections is essential, and a vital tool in this context is the Hold Harmless Agreement. This agreement serves to protect one party from liability for damages or injuries incurred by another party. Specifically, the arizonapdfs.com/hold-harmless-agreement-template provides a template to ensure both parties are well-informed about their rights and responsibilities, particularly in situations like real estate dealings or events where potential risks are present. By utilizing such a document, parties can safeguard themselves from unforeseen legal claims, fostering a more secure transaction environment.

Lastly, the Real Estate Investment Agreement has similarities with the Florida Commercial Contract. Both documents address the terms of an investment in real estate, including purchase price and responsibilities of the parties involved. However, the Real Estate Investment Agreement often focuses on the partnership or investment aspect, detailing how profits and responsibilities are shared among investors. In contrast, the Florida Commercial Contract is more focused on the direct sale and purchase of a property.

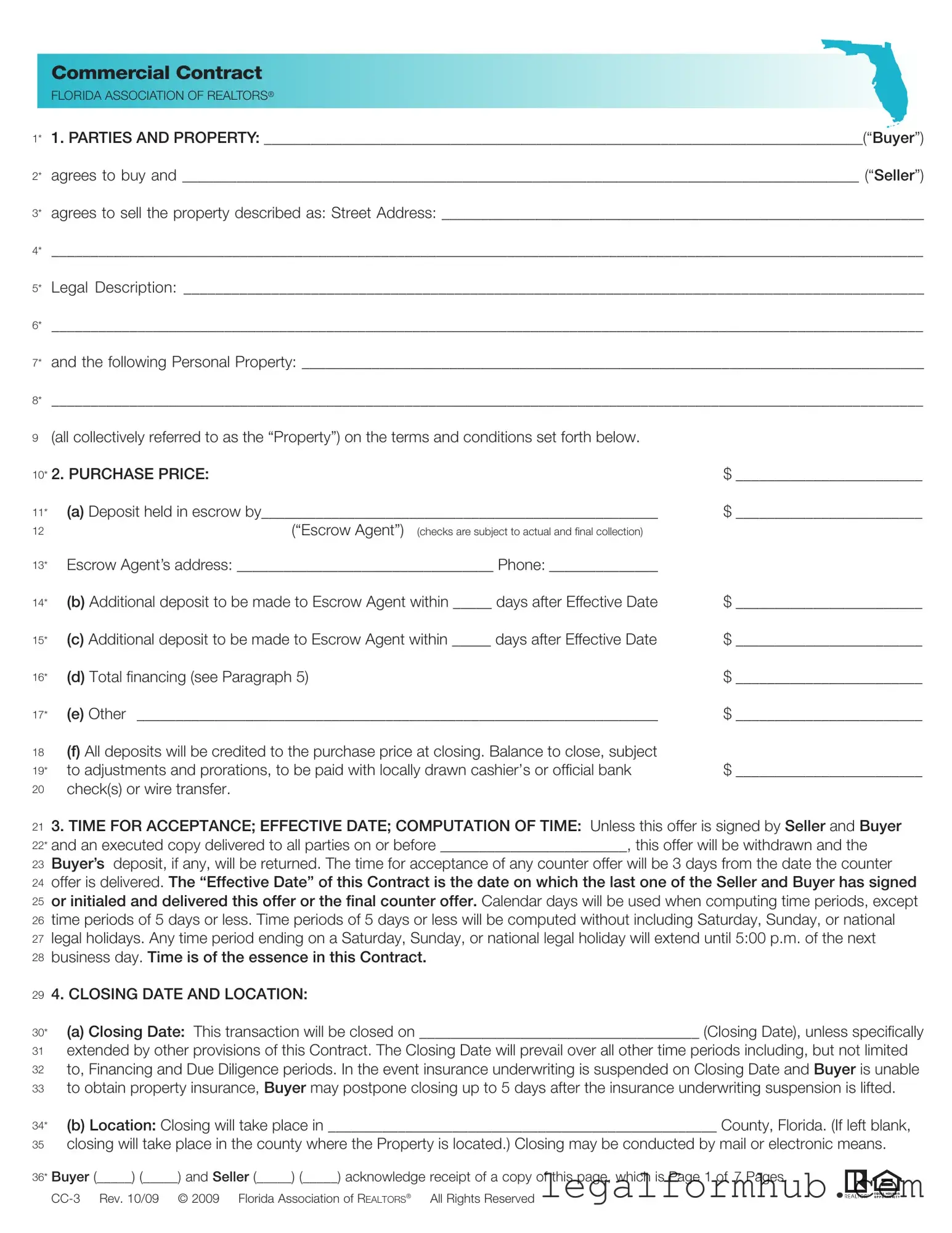

Instructions on Writing Florida Commercial Contract

Completing the Florida Commercial Contract form requires careful attention to detail. Each section must be filled out accurately to ensure that all parties involved understand the terms of the agreement. Follow these steps to properly fill out the form.

- Identify the Parties: In the first section, write the names of the Buyer and Seller, along with their respective addresses.

- Property Description: Provide the street address and legal description of the property being sold. Ensure this information is complete and accurate.

- Personal Property: List any personal property included in the sale, if applicable.

- Purchase Price: Enter the total purchase price, including details about the deposit and any additional deposits to be made to the escrow agent.

- Effective Date: Specify the date by which the offer must be accepted. If the offer is not signed by this date, it will be withdrawn.

- Closing Date and Location: Indicate the expected closing date and location. If left blank, the closing will occur in the county where the property is located.

- Financing Information: Fill in the details regarding third-party financing, including the amount, interest rate, and terms.

- Title Information: Specify how the title will be conveyed and any conditions related to the title, including any liens or encumbrances.

- Property Condition: Indicate whether the property will be accepted "as is" or if there will be a due diligence period for inspections.

- Closing Procedure: Outline the responsibilities of both parties during the closing process, including the provision of necessary documents and payment of fees.

- Signatures: Ensure that both the Buyer and Seller sign and date the contract at the end of the form.

After completing these steps, review the entire form for accuracy. It is crucial that all information is correct to avoid any potential disputes later. Once verified, the form can be submitted to the appropriate parties for further processing.

Misconceptions

- Misconception 1: The Florida Commercial Contract form is only for large businesses.

- Misconception 2: The contract is too complex for average users.

- Misconception 3: All terms are set in stone once the contract is signed.

- Misconception 4: The contract guarantees financing.

- Misconception 5: The seller is responsible for all repairs before closing.

- Misconception 6: Once signed, the contract cannot be canceled.

- Misconception 7: The contract does not protect the buyer's deposit.

This form is suitable for various types of commercial transactions, regardless of the size of the business involved. Small businesses can also use this form to ensure their agreements are legally binding.

While the document contains legal language, it is designed to be user-friendly. Buyers and sellers can work through it with guidance, ensuring that they understand each section before signing.

Many terms can be negotiated before signing. Parties have the option to modify specific clauses to better suit their needs, as long as both parties agree.

The contract does not guarantee financing. Buyers must still apply for and obtain financing as outlined in the contract, using good faith efforts to secure the necessary funds.

Typically, the property is sold "as is," meaning the buyer accepts it in its current condition. Buyers should be aware of this and conduct due diligence before finalizing the agreement.

There are specific conditions under which either party can cancel the contract. For example, if financing is not secured within the agreed timeframe, the buyer may choose to cancel without penalty.

The contract includes provisions to protect the buyer's deposit. If certain conditions are not met, the buyer is entitled to a refund of their deposit, ensuring their financial interests are safeguarded.

Key takeaways

Understand the Parties and Property: Clearly identify the Buyer and Seller, along with the property details. This includes the street address and legal description, ensuring all information is accurate to avoid disputes later.

Purchase Price and Deposits: Specify the purchase price and outline the deposit structure. Ensure that all deposits are documented, as they will be credited toward the purchase price at closing. Be aware of the escrow agent's role in handling these funds.

Time for Acceptance: Pay attention to the timelines outlined in the contract. The offer must be accepted by the Seller within the specified period, or it will be withdrawn. Understanding these timeframes is crucial to ensure the transaction proceeds smoothly.

Property Condition and Inspections: The contract allows for the property to be sold "as is," which means the Buyer accepts it in its current state. However, a Due Diligence Period is available for inspections. Buyers should utilize this time to assess the property thoroughly.

File Information

| Fact Name | Fact Description |

|---|---|

| Parties Involved | The contract identifies the Buyer and Seller by name and outlines their roles in the transaction. |

| Property Description | The contract requires a detailed description of the property, including street address and legal description. |

| Purchase Price | The total purchase price must be specified, along with details about deposits and payment methods. |

| Time for Acceptance | The offer must be signed by both parties and delivered by a specified date to remain valid. |

| Closing Date | The contract sets a specific date for closing the transaction, which can be extended under certain conditions. |

| Third Party Financing | Buyer is obligated to apply for financing within a specified timeframe after the Effective Date. |

| Title Conveyance | Seller must convey marketable title free of encumbrances, except for specified exceptions. |

| Property Condition | The property is sold "as is," meaning the Buyer accepts it in its current condition. |

| Default Provisions | Details the consequences of default by either party, including options for refunds or specific performance. |

| Governing Law | This contract is governed by Florida law, ensuring compliance with state regulations. |