Fill Your Erc Broker Market Analysis Form

Different PDF Templates

Bol Template - An electronic Straight Bill of Lading can expedite processing time significantly.

If you are looking for a reliable document to facilitate the transfer of ownership, consider using this comprehensive Trailer Bill of Sale template to ensure all necessary details are accurately captured. For more information, visit this valuable resource.

High School Transcript - A necessary part of the holistic review process for academic admissions.

Panel Schedule - Identifies circuit breakers and their assigned circuits.

Similar forms

The Comparative Market Analysis (CMA) is a document that real estate professionals use to estimate a property's value. It compares the subject property to similar properties that have recently sold in the area. Like the Erc Broker Market Analysis form, a CMA focuses on the condition and features of the property, as well as the local market trends. Both documents require an analysis of comparable properties, helping sellers set competitive prices and buyers make informed offers.

The Property Inspection Report is another document that shares similarities with the Erc Broker Market Analysis form. This report provides a detailed assessment of a property's physical condition, identifying any issues that could affect its value. While the Broker Market Analysis focuses on marketability and pricing, the Property Inspection Report emphasizes the structural and mechanical aspects of the property. Both documents serve as valuable tools for buyers and sellers in understanding a property’s worth.

The Appraisal Report is a formal evaluation of a property's market value, conducted by a licensed appraiser. Like the Erc Broker Market Analysis, the Appraisal Report considers the property's condition, location, and comparable sales. However, it is a more formal process that adheres to specific guidelines. While the Broker Market Analysis provides a general estimate for marketing purposes, the Appraisal Report is often required for financing and legal purposes.

To ensure a smooth transaction when selling or purchasing a property, it's essential to have all necessary documents prepared, including the California Bill of Sale form. This form not only provides a legal record of ownership transfer but also safeguards both parties involved in the transaction. For ease and accuracy, you may want to Fill PDF Forms to complete this important document.

The Seller's Disclosure Statement is a document that sellers provide to potential buyers, outlining any known issues with the property. Similar to the Erc Broker Market Analysis, this statement aims to inform buyers about the property's condition. Both documents help facilitate transparency in real estate transactions, ensuring that buyers are aware of any potential concerns before making a decision.

The Listing Agreement is a contract between a seller and a real estate agent. It outlines the terms under which the agent will market the property. While the Erc Broker Market Analysis provides a market assessment, the Listing Agreement formalizes the relationship and responsibilities between the seller and agent. Both documents are essential in the selling process, with the analysis helping to set the price and the agreement establishing the terms of sale.

The Rental Market Analysis (RMA) is similar to the Erc Broker Market Analysis in that it evaluates the rental potential of a property. The RMA examines comparable rental properties in the area to determine appropriate rental pricing. Both analyses consider market conditions and property features, helping landlords set competitive rates and providing insights for potential investors.

Instructions on Writing Erc Broker Market Analysis

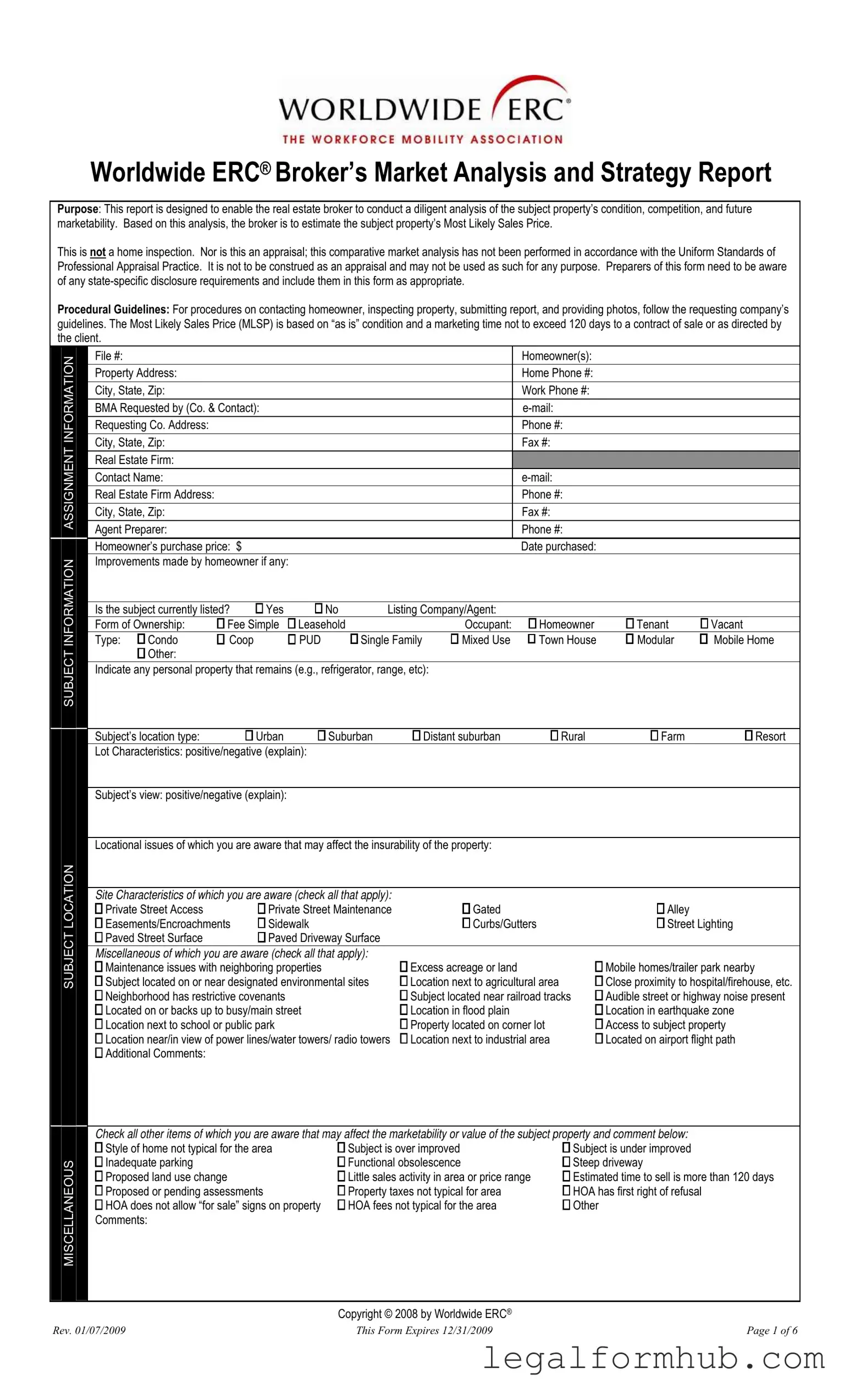

Filling out the ERC Broker Market Analysis form is an essential step for real estate brokers conducting a thorough assessment of a property. This process involves gathering detailed information about the property, its condition, and the surrounding market. Once completed, the form will provide valuable insights that will assist in estimating the property’s Most Likely Sales Price.

- Begin with the INFORMATION section. Fill in the File number, Homeowner(s) name, Property Address, Home Phone number, City, State, Zip, Work Phone number, and the requesting company's details, including the name, contact person, email, address, and phone number.

- Proceed to the ASSIGNMENT section. Enter the Real Estate Firm name, Contact Name, email, and the firm's address and phone number. Also, identify the Agent Preparer and the Homeowner’s purchase price and date.

- In the SUBJECT section, note any improvements made by the homeowner. Indicate if the property is currently listed and provide details about the listing company or agent. Specify the form of ownership and the type of property.

- Document any personal property that remains with the subject, as well as the subject’s location type and lot characteristics. Explain any positive or negative aspects of the subject’s view and any locational issues that may affect insurability.

- In the LOCATION section, check applicable site characteristics and any miscellaneous issues that might affect the property’s marketability. Include any comments in the provided space.

- Move to the SUBJECT CONDITION INSPECTIONS/DISCLOSURES section. Check the boxes for property condition observations and provide additional comments where necessary.

- List the recommended repairs and improvements, including estimated costs and comments for each item.

- In the FINANCING section, identify the most probable means of financing for the subject property. Describe any financing concessions that may be necessary.

- Address any anticipated issues that may affect financing and provide details about the neighborhood, including economic conditions and the broader market area.

- Complete the COMPARABLE SALES section by selecting sales from the last six months that are similar to the subject property. Fill in the details for each comparable sale, including address, MLS number, prices, and any seller concessions.

- Finally, review all sections for accuracy and completeness before submitting the form.

Misconceptions

Here are five common misconceptions about the ERC Broker Market Analysis form:

- This form is an appraisal. Many people mistakenly believe that the ERC Broker Market Analysis serves as an official appraisal. In reality, it is a comparative market analysis and should not be used as an appraisal for any purpose.

- The analysis includes a home inspection. Some assume that the form includes a thorough inspection of the property. However, it does not provide a home inspection; it focuses on assessing market conditions and property value based on various factors.

- The Most Likely Sales Price is guaranteed. There is a misconception that the Most Likely Sales Price (MLSP) is a fixed or guaranteed amount. The MLSP is an estimate based on the property’s condition and market conditions, and it may change as new information arises.

- All state-specific disclosure requirements are automatically included. Some believe that the form automatically covers all state-specific disclosure requirements. It is essential for preparers to be aware of and include any relevant disclosures specific to their state.

- Marketing time is flexible. Many assume that the marketing time for selling the property can be extended indefinitely. In fact, the analysis specifies a marketing time not to exceed 120 days unless directed otherwise by the client.

Key takeaways

- Purpose of the Form: The ERC Broker Market Analysis form assists real estate brokers in evaluating a property’s condition, competition, and marketability to estimate its Most Likely Sales Price (MLSP).

- Not an Appraisal: It is crucial to understand that this form is not an appraisal and should not be used as such. It does not follow the Uniform Standards of Professional Appraisal Practice.

- State-Specific Requirements: Brokers must be aware of and include any state-specific disclosure requirements in the form.

- Procedural Guidelines: Follow the requesting company's guidelines for contacting homeowners, inspecting properties, submitting reports, and providing photos.

- Condition Assessment: Brokers should check for various property conditions, such as water damage or structural issues, and provide detailed comments.

- Financing Considerations: Identify the most probable financing options for the property and any potential issues that may affect securing financing.

- Market Analysis: Analyze the broader market area and current economic conditions that may impact the property’s marketability and pricing strategy.

File Information

| Fact Name | Description |

|---|---|

| Purpose | This report helps real estate brokers analyze property conditions, competition, and marketability. |

| Most Likely Sales Price (MLSP) | The MLSP is based on the property's "as is" condition and a marketing time not exceeding 120 days. |

| Not an Appraisal | This form is a comparative market analysis and should not be used as an appraisal. |

| State-Specific Requirements | Preparers must be aware of and include any state-specific disclosure requirements in the report. |

| Contact Procedures | Follow the requesting company’s guidelines for contacting homeowners and submitting the report. |

| Property Inspection | Inspectors must document any known issues affecting the property, including maintenance and condition. |

| Financing Options | Identifies probable financing types such as FHA, VA, cash, and conventional mortgages. |

| Neighborhood Definition | The subject neighborhood is defined by the preparer and may vary in size and scope. |

| Market Conditions | Current economic conditions and major corporations moving in or out of the area are noted. |

| Expiration Date | This form is valid until December 31, 2009, as per the copyright notice. |