Printable Employee Loan Agreement Document

Similar forms

The Employee Loan Agreement form shares similarities with a Personal Loan Agreement. Both documents outline the terms and conditions under which a loan is provided to an individual. They typically specify the loan amount, interest rate, repayment schedule, and any penalties for late payments. While a Personal Loan Agreement can be between individuals or financial institutions, the Employee Loan Agreement is specifically designed for the employer-employee relationship, ensuring that both parties understand their obligations and rights regarding the loan.

Another document that resembles the Employee Loan Agreement is a Promissory Note. A Promissory Note is a written promise to pay a specified amount of money to a designated party at a defined time or on demand. Like the Employee Loan Agreement, it includes critical details such as the loan amount and repayment terms. However, a Promissory Note is often simpler and may not include as many provisions regarding employment status or additional terms that might be relevant in an employer-employee context.

The Employee Loan Agreement is also akin to a Mortgage Agreement, which is used when an individual borrows money to purchase real estate. Both documents require the borrower to repay the loan under specific conditions. However, a Mortgage Agreement typically involves collateral—in this case, the property itself—while the Employee Loan Agreement usually does not require collateral, focusing instead on the employee’s commitment to repay the loan through payroll deductions or other means.

In order to ensure all parties are well-informed and protected, it is essential to utilize a comprehensive Loan Agreement form that clearly delineates the terms of the agreement. This helps prevent misunderstandings and outlines the expectations from both the lender and the borrower. For a reliable resource, you can access a customizable Loan Agreement form at LegalDocumentsTemplates.com, which can aid in formalizing the lending process efficiently.

Lastly, the Employee Loan Agreement can be compared to a Credit Agreement. A Credit Agreement outlines the terms under which a borrower can access credit from a lender. Similar to the Employee Loan Agreement, it details the amount of credit available, interest rates, and repayment terms. However, a Credit Agreement is often broader and may apply to various types of loans or credit lines, while the Employee Loan Agreement is tailored specifically for loans given to employees by their employers, emphasizing the unique relationship and trust between the two parties.

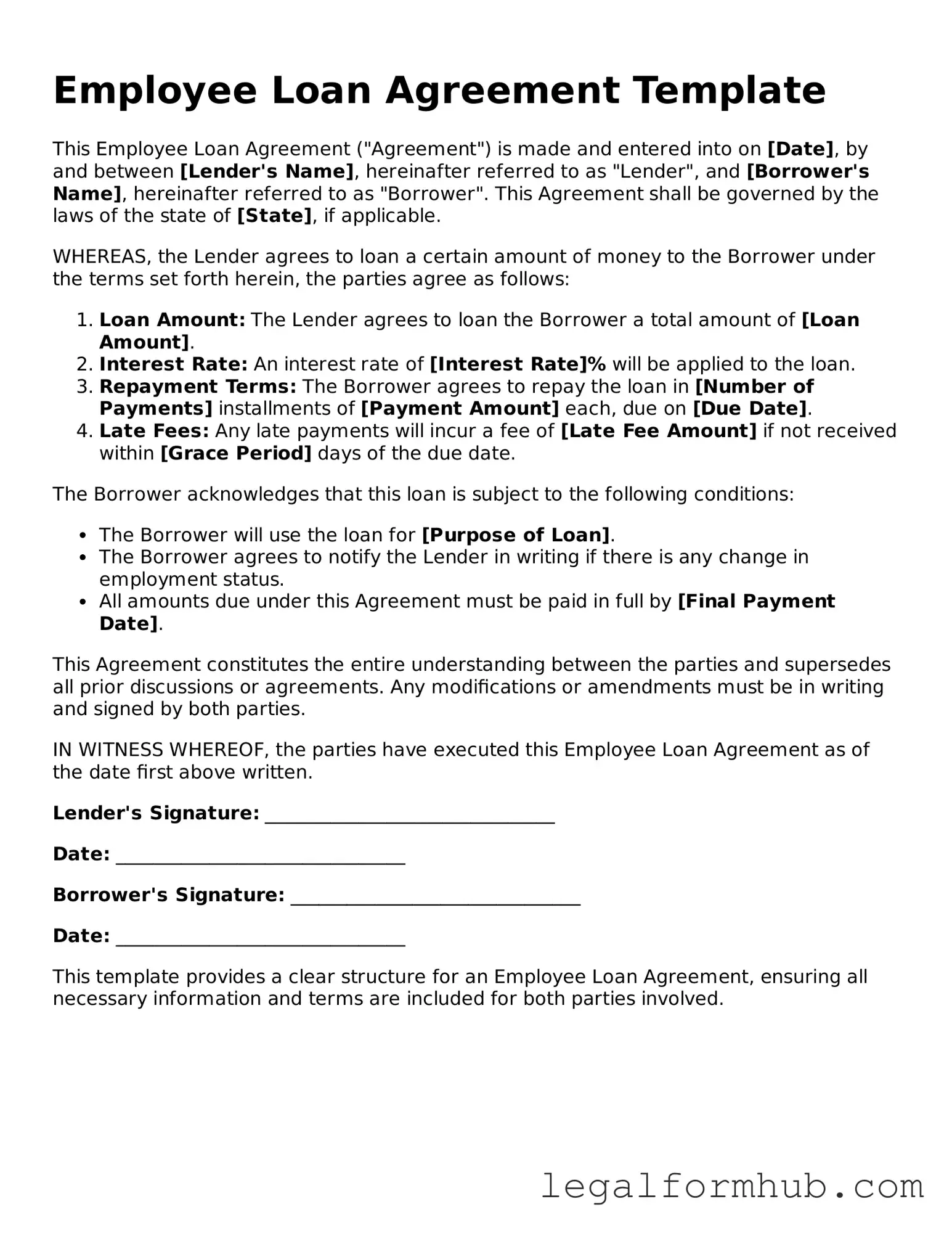

Instructions on Writing Employee Loan Agreement

Filling out the Employee Loan Agreement form is an important step in securing a loan from your employer. This process ensures that both you and your employer have a clear understanding of the terms and conditions associated with the loan. Follow these steps carefully to complete the form accurately.

- Begin by entering your full name in the designated space at the top of the form.

- Next, provide your employee identification number. This helps the employer verify your employment status.

- Fill in the date on which you are completing the agreement.

- Indicate the amount of money you are requesting as a loan. Be precise and clear about the figure.

- Specify the purpose of the loan. This can be for personal use, medical expenses, or any other reason.

- Review the repayment terms provided in the form. Make sure you understand how long you will have to repay the loan and the interest rate, if applicable.

- Sign and date the form at the bottom. Your signature indicates your agreement to the terms outlined.

- Submit the completed form to your HR department or the designated person in your organization.

Once you have submitted the form, it will be reviewed by the appropriate personnel. They may reach out for any additional information or clarification. After approval, you will receive further instructions regarding the disbursement of the loan and repayment schedule.

Misconceptions

When it comes to the Employee Loan Agreement form, several misconceptions can lead to confusion for both employers and employees. Understanding these misconceptions can help clarify the purpose and implications of such agreements.

- Misconception 1: An Employee Loan Agreement is the same as a paycheck advance.

- Misconception 2: The agreement is only beneficial for the employee.

- Misconception 3: There are no legal requirements for an Employee Loan Agreement.

- Misconception 4: Employees can take out loans without any oversight.

- Misconception 5: The loan amount is always fixed and cannot be negotiated.

- Misconception 6: Once the loan is taken, it cannot be altered.

This is not accurate. A paycheck advance typically involves borrowing against future earnings, while an Employee Loan Agreement is a formal arrangement that outlines the terms of a loan provided by the employer, which may be repaid over time.

While employees may see immediate financial relief, employers also benefit. By offering loans, employers can foster loyalty and support their workforce, which can lead to increased productivity and morale.

This is misleading. Employee Loan Agreements must comply with various laws, including those governing interest rates and repayment terms. Failure to adhere to these regulations can lead to legal complications for both parties.

On the contrary, most Employee Loan Agreements require a thorough review process. Employers typically assess the employee's financial situation and ability to repay the loan before finalizing the agreement.

In reality, the loan amount can often be discussed and adjusted based on the employee's needs and the employer's policies. Open communication is essential in determining a fair loan amount.

This is not entirely true. While the original terms of the loan are binding, circumstances may change. Employees and employers can negotiate modifications to the repayment plan if both parties agree.

Key takeaways

When filling out and using the Employee Loan Agreement form, it is crucial to understand several key aspects to ensure clarity and compliance. Here are some important takeaways:

- Clear Terms: Define the loan amount, interest rate, and repayment schedule clearly. This helps prevent misunderstandings between the employer and employee.

- Purpose of the Loan: Specify the purpose of the loan. This adds context and can help in assessing the appropriateness of the request.

- Repayment Process: Outline how repayments will be made. Will they be deducted from paychecks or paid directly? Clarity on this point is essential.

- Default Consequences: Include what happens if the employee defaults on the loan. This can protect both parties and ensure that everyone understands the risks involved.

- Confidentiality: Maintain confidentiality regarding the loan details. This protects the privacy of the employee and fosters a trusting work environment.

- Legal Compliance: Ensure that the agreement complies with federal and state laws. This includes adhering to any regulations regarding interest rates and loan terms.

- Signatures: Both parties should sign the agreement. This formalizes the arrangement and signifies mutual consent to the terms outlined.

- Record Keeping: Keep a copy of the signed agreement for your records. This documentation can be invaluable in case of disputes or misunderstandings in the future.

Understanding these elements will help both employers and employees navigate the loan process effectively and with confidence.

File Overview

| Fact Name | Description |

|---|---|

| Definition | An Employee Loan Agreement is a document that outlines the terms under which an employer lends money to an employee. |

| Purpose | This agreement helps protect both the employer and the employee by clearly defining the loan terms, repayment schedule, and consequences of default. |

| Loan Amount | The agreement specifies the exact amount of money being loaned to the employee. |

| Interest Rate | It may include an interest rate, which can be fixed or variable, depending on the agreement. |

| Repayment Schedule | The repayment schedule outlines when and how the employee will repay the loan, whether through payroll deductions or other means. |

| Governing Law | The agreement is subject to state-specific laws, which can vary. For example, in California, the governing law is the California Civil Code. |

| Default Terms | In case of default, the agreement should specify what actions the employer can take, such as garnishing wages or seeking legal recourse. |

| Confidentiality | Many agreements include confidentiality clauses to protect sensitive financial information. |

| Modification Clause | A modification clause allows for changes to the agreement if both parties agree in writing. |

| Signatures | Both the employer and employee must sign the agreement to make it legally binding. |