Fill Your Employee Advance Form

Different PDF Templates

How to Check How Many College Credits You Have - Use the form solely for personal requests; third parties need authorization.

Roof Inspection Report Template - Obtaining a phone number for the roofing company enhances the ability to reach out with questions or concerns.

Obtaining the Arizona Medical Power of Attorney form is crucial for individuals who want to ensure their healthcare decisions are made according to their preferences. By designating a trusted individual as their agent, they can rest assured that their medical wishes will be communicated effectively. For more information and to access a template for this form, you can visit arizonapdfs.com/medical-power-of-attorney-template/, which provides valuable resources to help guide this important process.

Free Printable Puppy Health Guarantee Template - The Buyer should keep records of daily health and behavioral observations.

Similar forms

The Employee Reimbursement Form is similar to the Employee Advance form in that both documents are used to manage financial transactions related to employee expenses. Employees submit these forms to request funds or reimbursement for expenses incurred while performing their job duties. Both forms require details such as the purpose of the expense, the amount requested, and supporting documentation to ensure transparency and accountability in financial dealings.

The Travel Expense Report serves a similar function as the Employee Advance form, focusing specifically on expenses incurred during business travel. Employees use this report to outline their travel costs, including transportation, lodging, and meals. Like the Employee Advance form, it requires accurate documentation and justification for the expenses claimed, ensuring that the company can track and manage travel-related expenditures effectively.

To further facilitate financial transactions within the organization, a comprehensive understanding of the various forms is essential. For instance, employees looking to acquire the necessary documentation for a vehicle sale can benefit from the Fill PDF Forms, which provide a useful resource for ensuring all details are duly recorded and legal requirements met.

The Purchase Order is another document that shares similarities with the Employee Advance form. While the Employee Advance form requests funds for personal expenses, the Purchase Order is used to authorize the purchase of goods or services on behalf of the company. Both documents require clear descriptions of the requested items and the total amount, facilitating budget management and financial planning.

The Expense Claim Form is akin to the Employee Advance form, as it allows employees to claim reimbursement for out-of-pocket expenses. Both forms require employees to provide details of the expenses incurred, including dates, amounts, and the nature of the expense. The primary difference lies in the timing of the request, with the Expense Claim Form being used after the expenses have been incurred, while the Employee Advance form is used to request funds in advance.

The Vendor Invoice is also similar to the Employee Advance form in that it involves a request for payment. Vendors submit invoices to request payment for goods or services provided to the company. Both documents require clear details about the amounts owed and the nature of the transaction, ensuring that financial records are accurate and up to date.

The Budget Request Form bears similarities to the Employee Advance form as well. Employees can use this form to request funding for specific projects or initiatives. Both documents require justification for the requested amounts and a clear outline of how the funds will be utilized. This ensures that financial resources are allocated effectively and align with the company's goals.

The Payroll Advance Request Form is closely related to the Employee Advance form, as both involve requests for financial assistance. Employees may use the Payroll Advance Request Form to request an advance on their upcoming paycheck. Similar to the Employee Advance form, this document requires the employee to specify the amount requested and the reason for the advance, promoting responsible financial management.

Lastly, the Grant Application Form shares similarities with the Employee Advance form in that both documents request funding for specific purposes. Employees or departments may use the Grant Application Form to seek financial support for projects or initiatives. Both forms require detailed descriptions of the intended use of funds and justification for the request, ensuring that resources are allocated to projects that align with the organization's objectives.

Instructions on Writing Employee Advance

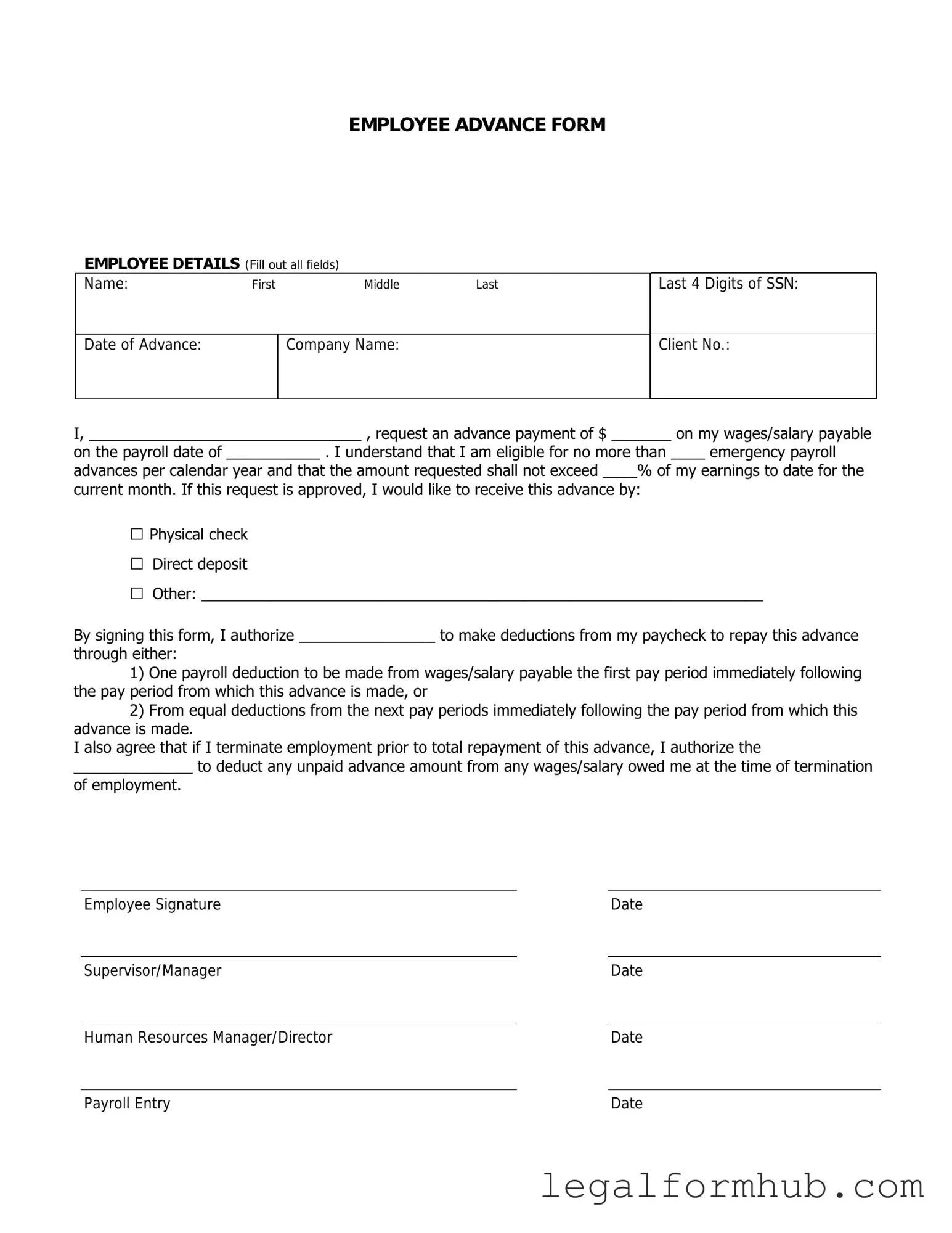

After you have gathered the necessary information, you are ready to complete the Employee Advance form. This process involves entering specific details accurately to ensure a smooth approval process. Follow the steps outlined below to fill out the form correctly.

- Begin by entering your full name in the designated field at the top of the form.

- Provide your employee ID number. This can usually be found on your company ID badge or in your employee profile.

- Next, fill in the date of the request. Use the format MM/DD/YYYY.

- Indicate the amount of advance you are requesting. Ensure this amount aligns with company policy.

- In the next section, briefly describe the purpose of the advance. Be clear and concise.

- Provide any necessary documentation that supports your request. This may include receipts or estimates.

- Sign and date the form at the bottom to confirm that all information provided is accurate.

- Finally, submit the completed form to your supervisor or the appropriate department for processing.

Misconceptions

Understanding the Employee Advance form is crucial for both employees and employers. However, several misconceptions can lead to confusion. Here are seven common misunderstandings:

- Only high-level employees can request advances. This is not true. Any employee, regardless of their position, can apply for an advance if it aligns with company policy.

- Employee advances are loans that must be paid back immediately. While advances do need to be repaid, the repayment terms can vary. Employees often have a set period to repay the advance, which is usually deducted from future paychecks.

- All expenses qualify for an employee advance. This is a misconception. Advances are typically limited to specific types of expenses, such as travel or work-related purchases, as outlined in company guidelines.

- Submitting an Employee Advance form guarantees approval. Approval is not guaranteed. Each request is evaluated based on the company’s policies and the employee’s history.

- Once an advance is approved, it cannot be changed. In many cases, adjustments can be made if circumstances change. Employees should communicate with their HR department for any necessary modifications.

- There is no need to provide documentation for an advance. Most companies require some form of documentation or justification for the requested advance. This helps ensure that funds are used appropriately.

- Employee advances negatively impact credit scores. Advances are not reported to credit agencies. They are internal transactions between the employee and employer, so they do not affect personal credit ratings.

Being aware of these misconceptions can help employees navigate the process more effectively and ensure that they understand their rights and responsibilities when it comes to requesting an advance.

Key takeaways

Filling out the Employee Advance form correctly is essential for ensuring timely processing of your request. Here are some key takeaways to keep in mind:

- Complete All Required Fields: Ensure that you fill in every necessary section of the form. Missing information can delay the approval process.

- Provide a Detailed Description: Clearly explain the purpose of the advance. A detailed description helps the approvers understand your needs better.

- Submit in a Timely Manner: Turn in your form well in advance of when you need the funds. This allows for any potential issues to be resolved before the deadline.

- Keep Copies for Your Records: Always retain a copy of the submitted form. This is important for tracking your request and for future reference.

By following these guidelines, you can help ensure a smooth process for obtaining your employee advance.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Employee Advance form is used to request an advance on wages or expenses incurred by an employee. |

| Eligibility | Typically, only employees who have completed a probationary period can request an advance. |

| Repayment Terms | Repayment terms should be clearly outlined, specifying how and when the advance will be paid back. |

| Documentation Required | Employees may need to provide receipts or documentation for the expenses related to the advance. |

| State-Specific Forms | Some states may have specific forms or requirements; for example, California requires adherence to Labor Code Section 224. |

| Approval Process | The form typically requires approval from a supervisor or HR before the advance is granted. |

| Tax Implications | Advances may have tax implications; employees should consult with a tax professional if unsure. |

| Impact on Payroll | Advances may be deducted from the employee's next paycheck, affecting their overall payroll for that period. |

| Confidentiality | Details of the advance should be kept confidential to protect the employee's financial privacy. |

| Company Policy | Each company should have a clear policy regarding employee advances, outlining eligibility, limits, and procedures. |