Printable Durable Power of Attorney Document

Common Durable Power of Attorney Documents:

Revocation of Power of Attorney Template - Affirms the importance of the principal’s wishes being honored.

Example of Power of Attorney - The document can include stipulations on how the agent should perform their duties related to the property.

For an efficient process in transferring ownership, consider utilizing this vital document known as the Mobile Home Bill of Sale form that ensures all necessary details are accurately recorded.

Power of Attorney Letter for Car - This document can enhance transparency in transactions by clearly outlining authorized actions.

Durable Power of Attorney - Tailored for Each State

Similar forms

The Durable Power of Attorney (DPOA) is often compared to a standard Power of Attorney (POA). Both documents allow an individual, known as the principal, to designate someone else, referred to as the agent or attorney-in-fact, to make decisions on their behalf. However, the key distinction lies in durability. A standard POA may become ineffective if the principal becomes incapacitated, while a DPOA remains valid even in such circumstances, ensuring that the agent can continue to act without interruption.

Another document similar to the DPOA is the Healthcare Power of Attorney. This specific type of power of attorney grants an agent the authority to make medical decisions for the principal when they are unable to do so themselves. While the DPOA generally covers financial and legal matters, the Healthcare Power of Attorney focuses solely on health-related issues, ensuring that the principal’s medical preferences are honored during critical times.

The Living Will is also closely related to the DPOA. A Living Will is a legal document that outlines an individual's preferences regarding medical treatment and life-sustaining measures in situations where they are unable to communicate their wishes. Unlike the DPOA, which appoints an agent to make decisions, the Living Will serves as a direct expression of the principal's desires, guiding healthcare providers and loved ones in making decisions aligned with those wishes.

A Revocable Trust shares similarities with the DPOA in that both can help manage assets and ensure that the principal’s wishes are carried out. A Revocable Trust allows individuals to transfer their assets into a trust during their lifetime, which can then be managed by a trustee. This arrangement can provide a seamless transition of asset management in the event of incapacity or death, similar to how a DPOA allows an agent to handle financial matters on behalf of the principal.

The Advance Healthcare Directive combines elements of both the Healthcare Power of Attorney and the Living Will. This document provides instructions for medical treatment preferences while also designating an agent to make healthcare decisions. It ensures that both the principal's wishes are clearly articulated and that someone is appointed to advocate for those wishes, similar to the DPOA’s role in financial matters.

The Guardianship document is another related form. While a DPOA allows individuals to designate someone to make decisions on their behalf, a Guardianship is a court-appointed arrangement. If an individual becomes incapacitated without a DPOA in place, the court may appoint a guardian to make decisions for them. This process can be lengthy and may not align with the individual's wishes, highlighting the importance of having a DPOA in place.

The Conservatorship is similar to Guardianship, but it specifically pertains to financial matters. When a court determines that an individual is unable to manage their financial affairs, it may appoint a conservator to handle those responsibilities. This process, like Guardianship, can be time-consuming and may not reflect the individual's preferences, making a DPOA a more efficient option for managing financial decisions.

The Authorization for Release of Information is another document that shares some similarities with the DPOA. This form allows individuals to permit specific individuals or organizations to access their personal information, often for medical or financial purposes. While the DPOA grants broader decision-making authority, the Authorization for Release of Information is more limited in scope, focusing specifically on the sharing of information rather than decision-making.

Understanding the importance of establishing clear agreements is crucial for any business entity, especially limited liability companies (LLCs) in Missouri. This becomes evident when considering the Missouri Operating Agreement form, which outlines the management structure, responsibilities, and operational procedures essential for the LLC's function. To facilitate this process and ensure that all members are on the same page, it’s vital to utilize the Operating Agreement form. By filling out this document, LLC members can clarify their roles and expectations, paving the way for smoother operations and dispute resolutions.

Finally, the Bill of Rights for Residents of Long-Term Care Facilities can be viewed as a complementary document to the DPOA. This set of rights ensures that individuals in long-term care settings maintain their dignity and autonomy. While a DPOA allows someone to make decisions on behalf of a principal, the Bill of Rights safeguards the principal's rights and preferences in care settings, ensuring that their needs and wishes are prioritized.

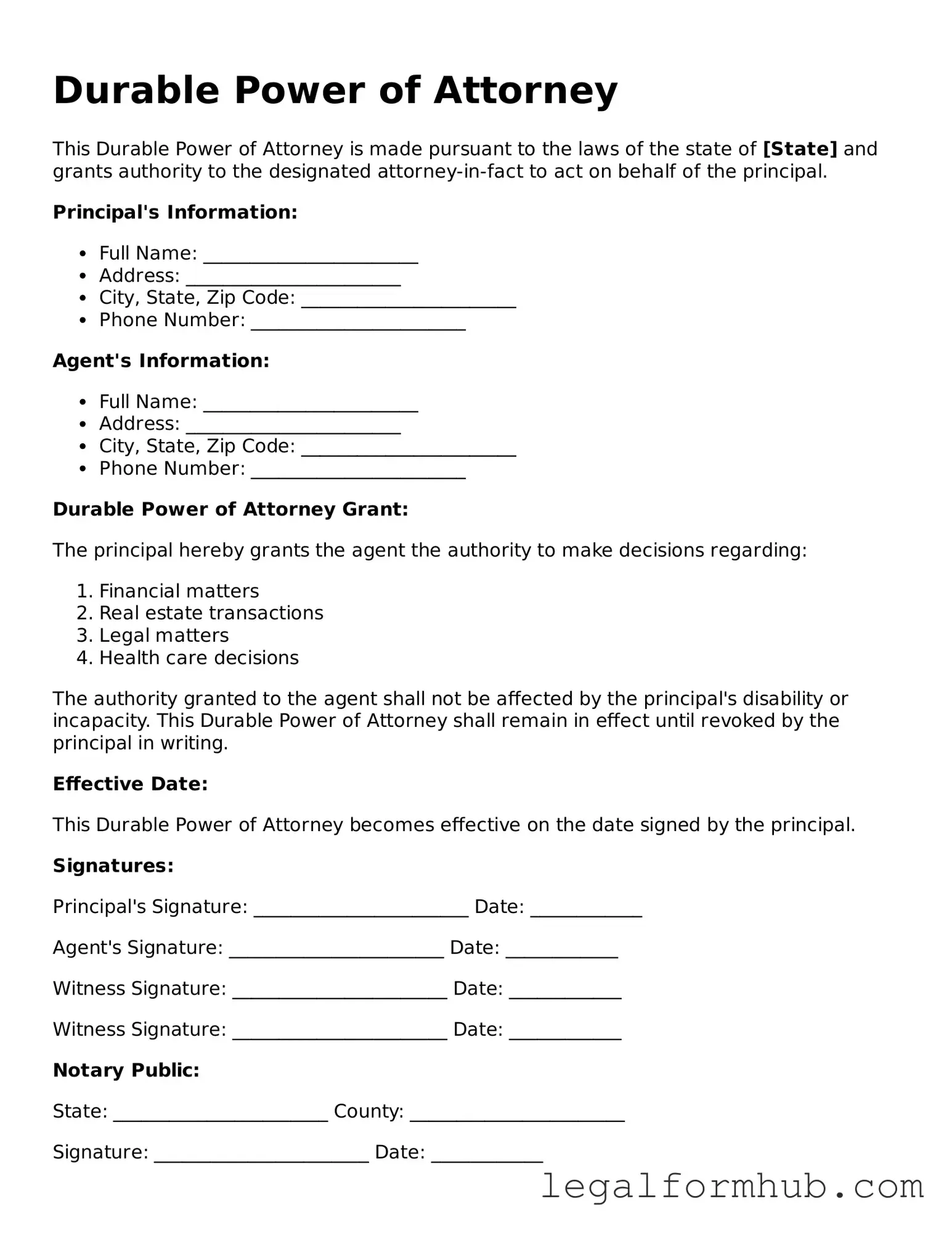

Instructions on Writing Durable Power of Attorney

Filling out a Durable Power of Attorney form is an important step in planning for future needs. This document allows you to appoint someone you trust to make decisions on your behalf when you are unable to do so. It’s essential to complete this form carefully to ensure it reflects your wishes accurately.

- Obtain the Durable Power of Attorney form. You can find it online or request a copy from a legal professional.

- Begin by entering your full name and address at the top of the form. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. Ensure this individual is trustworthy and understands your preferences.

- Specify the powers you wish to grant your agent. You may choose to give them broad authority or limit their powers to specific areas, such as financial or medical decisions.

- Include the date on which the powers will begin. You can choose to have them take effect immediately or only if you become incapacitated.

- Sign and date the form in the designated area. Your signature is crucial, as it validates the document.

- Consider having the form witnessed or notarized, depending on your state’s requirements. This step can add an extra layer of authenticity.

- Make copies of the completed form. Distribute these copies to your agent and any relevant institutions, such as banks or healthcare providers.

Misconceptions

Understanding the Durable Power of Attorney (DPOA) is essential for effective estate planning. However, several misconceptions can lead to confusion about its purpose and function. Here are six common misconceptions:

- A Durable Power of Attorney is only for financial matters. Many people believe that a DPOA only handles financial decisions. In reality, it can also cover healthcare decisions if specified, allowing an agent to make medical choices on behalf of the principal.

- Once a Durable Power of Attorney is signed, it cannot be changed. This is incorrect. The principal can revoke or modify the DPOA at any time as long as they are competent to do so. It’s important to communicate any changes clearly to all involved parties.

- A Durable Power of Attorney takes effect immediately. Some assume that a DPOA becomes effective as soon as it is signed. However, it can be drafted to take effect only upon the principal's incapacitation, which is known as a springing DPOA.

- Only lawyers can create a Durable Power of Attorney. While it is advisable to consult a lawyer for legal documents, individuals can create a DPOA themselves using templates, provided they meet state requirements.

- A Durable Power of Attorney grants unlimited power to the agent. This misconception can be misleading. The authority granted can be limited to specific tasks or decisions, as defined by the principal in the document.

- A Durable Power of Attorney is the same as a living will. Many confuse these two documents. A DPOA allows someone to make decisions on behalf of another, while a living will specifically outlines a person's wishes regarding medical treatment in end-of-life situations.

Clarifying these misconceptions can help individuals make informed decisions about their estate planning and ensure that their wishes are respected.

Key takeaways

Filling out and using a Durable Power of Attorney (DPOA) form is an important step in planning for future health and financial decisions. Here are some key takeaways to consider:

- The DPOA allows you to designate someone you trust to make decisions on your behalf if you become unable to do so.

- It is essential to choose an agent who is reliable and understands your values and wishes.

- Ensure the form is completed accurately and in accordance with your state's requirements to avoid any legal issues.

- Review and update your DPOA regularly, especially after major life events, to ensure it reflects your current situation.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to appoint someone else to make decisions on their behalf, even if they become incapacitated. |

| Durability | This type of power of attorney remains effective until the principal's death or revocation, regardless of mental capacity. |

| Legal Requirements | Most states require the principal to be of sound mind when signing the document. Witnesses or notarization may also be necessary. |

| State-Specific Forms | Each state has its own Durable Power of Attorney form. It’s crucial to use the correct form for your state to ensure validity. |

| Governing Laws | In the United States, the Uniform Power of Attorney Act provides a framework, but individual states have their own laws governing these documents. |

| Types of Authority | The principal can grant broad or limited authority, allowing the agent to handle financial, legal, or health-related matters. |

| Agent's Responsibilities | The agent must act in the best interest of the principal, maintaining transparency and accountability in their actions. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

| Potential Risks | Choosing an untrustworthy agent can lead to misuse of authority. It’s essential to select someone reliable and trustworthy. |

| Healthcare Decisions | A Durable Power of Attorney can include provisions for healthcare decisions, but a separate healthcare proxy may also be advisable. |