Printable Deed in Lieu of Foreclosure Document

Common Deed in Lieu of Foreclosure Documents:

Quit Claim Deed Form Iowa - A Quitclaim Deed transfers ownership rights in a property from one party to another without any warranties.

When purchasing or selling a motorcycle, it is vital to complete an Arizona Motorcycle Bill of Sale to formalize the transaction and protect both parties involved. This document not only includes essential information about the motorcycle but also specifies the terms of the sale, making it an indispensable part of the process. For a comprehensive template to assist you in creating this document, you can refer to https://arizonapdfs.com/motorcycle-bill-of-sale-template/.

Deed in Lieu of Foreclosure - Tailored for Each State

Similar forms

The first document similar to the Deed in Lieu of Foreclosure is the Short Sale Agreement. In a short sale, the homeowner sells the property for less than the amount owed on the mortgage. The lender must agree to accept this reduced amount. Both documents aim to prevent foreclosure, but while a deed in lieu transfers ownership directly to the lender, a short sale involves a third-party buyer. Homeowners may find a short sale less damaging to their credit score compared to a deed in lieu.

Another related document is the Mortgage Modification Agreement. This agreement allows homeowners to change the terms of their existing mortgage, making it more manageable. By altering the interest rate, extending the loan term, or reducing the principal, the lender helps the borrower avoid foreclosure. Unlike a deed in lieu, which relinquishes ownership, a mortgage modification keeps the homeowner in possession of the property while making it easier to meet payment obligations.

Understanding the various financial documents available for homeowners in distress is crucial in navigating challenging situations. For those examining vehicle purchases alongside home matters, the Fill PDF Forms provides a valuable resource to ensure all aspects of purchasing are legally documented and clear, similar in importance to other agreements that help in financial stability.

The Forebearance Agreement is also similar. This document allows a borrower to temporarily pause or reduce mortgage payments due to financial hardship. The lender agrees not to initiate foreclosure during this period. While a deed in lieu involves surrendering the property, a forbearance agreement provides the homeowner with a chance to recover financially and retain ownership, thus offering a different approach to addressing mortgage difficulties.

Lastly, the Bankruptcy Filing can be compared to the Deed in Lieu of Foreclosure. Filing for bankruptcy can halt foreclosure proceedings and provide the homeowner with a fresh start. It may allow the borrower to reorganize debts or liquidate assets. However, unlike a deed in lieu, which directly transfers property to the lender, bankruptcy is a legal process that can affect all debts and assets, not just the mortgage. Both options serve as potential remedies for financial distress, but they operate under different legal frameworks.

Instructions on Writing Deed in Lieu of Foreclosure

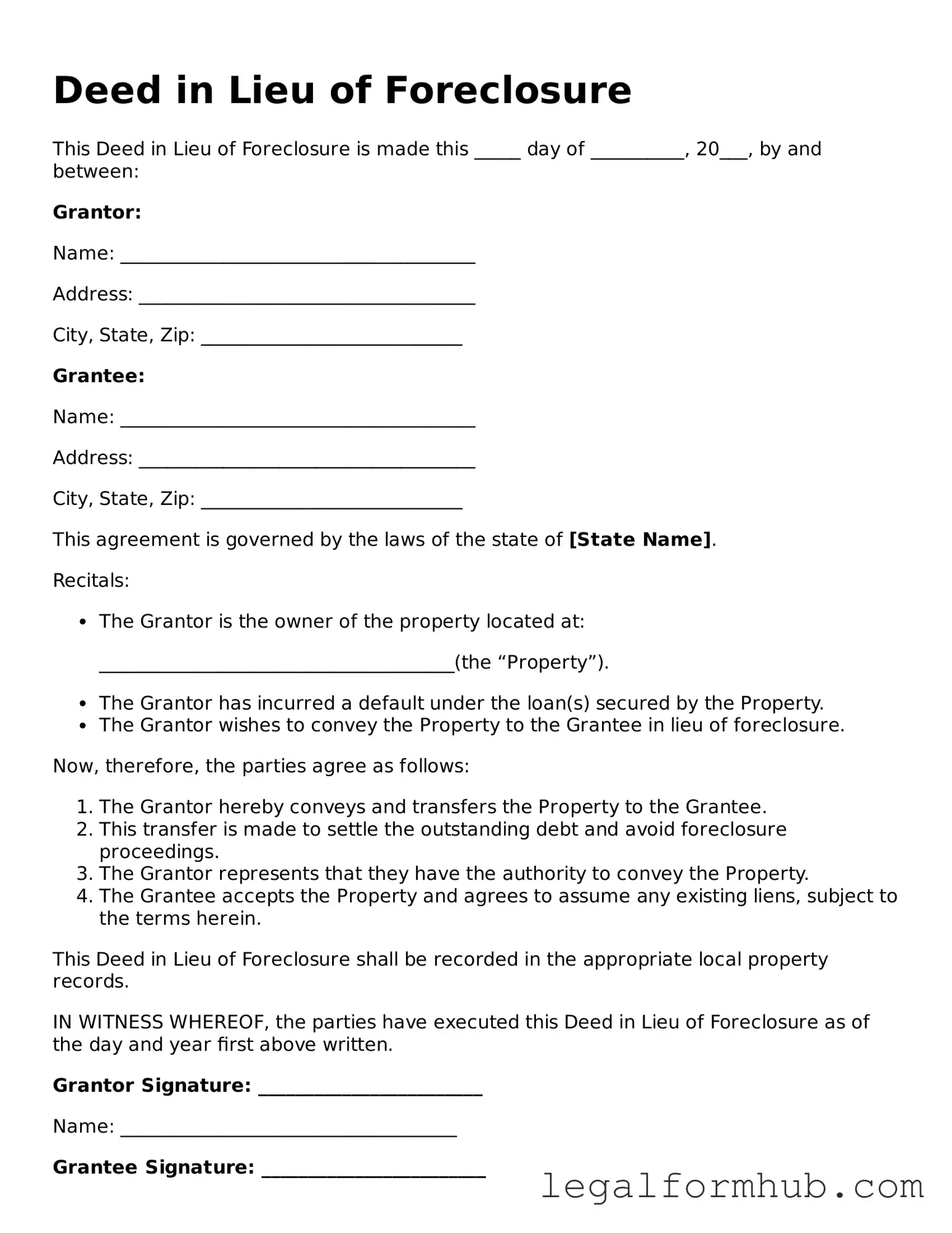

Once you have the Deed in Lieu of Foreclosure form ready, it is crucial to complete it accurately. This ensures that the process moves forward without unnecessary delays. Follow these steps to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide the name of the property owner. Ensure the name is spelled correctly.

- List the address of the property in question, including the city, state, and ZIP code.

- Fill in the name of the lender or mortgage company. Double-check for accuracy.

- Include the loan number associated with the property.

- Indicate the current balance of the mortgage. This should reflect the most recent statement.

- Sign and date the form where indicated. Ensure that the signature matches the name provided.

- Have the form notarized, if required. This adds an extra layer of verification.

- Make copies of the completed form for your records.

- Submit the original form to the lender. Follow any specific submission instructions they provide.

After submitting the form, monitor for any communication from the lender. They may reach out for additional information or confirmation. Stay proactive to ensure a smooth transition.

Misconceptions

The Deed in Lieu of Foreclosure is often misunderstood. Here are seven common misconceptions about this process, clarified for better understanding.

-

It completely eliminates all debt.

Many believe that signing a Deed in Lieu of Foreclosure wipes out all financial obligations. However, this is not always the case. While it may relieve you of the mortgage debt, there could be other liabilities, such as second mortgages or liens, that remain.

-

It is a quick fix to avoid foreclosure.

Some homeowners think that a Deed in Lieu is a fast solution. In reality, the process can take time, as lenders must review and approve the request. It’s not an instant escape from foreclosure.

-

It has no impact on credit scores.

Another misconception is that a Deed in Lieu of Foreclosure doesn’t affect credit ratings. In truth, it can have a negative impact, similar to a foreclosure, potentially affecting your ability to secure future loans.

-

It is the same as a short sale.

People often confuse a Deed in Lieu with a short sale. While both involve transferring property to the lender, a short sale requires selling the home for less than the mortgage balance, whereas a Deed in Lieu involves voluntarily giving the property back to the lender.

-

It absolves all legal responsibilities.

Some homeowners think that once they sign the Deed in Lieu, they are free from any legal obligations. However, lenders may still pursue deficiencies or other legal actions related to the loan.

-

It is available to everyone.

Not every homeowner qualifies for a Deed in Lieu of Foreclosure. Lenders have specific criteria, and they may require proof of financial hardship or other documentation before considering the option.

-

It is a permanent solution.

Lastly, some believe that a Deed in Lieu of Foreclosure permanently resolves their financial issues. While it may relieve immediate pressure, it does not address underlying financial problems that could persist.

Understanding these misconceptions can help homeowners make informed decisions about their options when facing financial difficulties.

Key takeaways

Filling out and using the Deed in Lieu of Foreclosure form involves several important considerations. Here are key takeaways to keep in mind:

- The Deed in Lieu of Foreclosure is a legal document that allows a borrower to transfer ownership of their property to the lender to avoid foreclosure.

- It is essential to ensure that all information on the form is accurate and complete to prevent delays in processing.

- Consulting with a real estate attorney or a housing counselor can provide guidance on the implications of signing the deed.

- Borrowers should be aware that this option may affect their credit score, similar to a foreclosure.

- After submitting the form, it is important to follow up with the lender to confirm receipt and discuss any next steps.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure. |

| Purpose | This process helps homeowners avoid the lengthy and damaging foreclosure process, allowing for a smoother transition. |

| Eligibility | Homeowners must typically be facing financial hardship and unable to keep up with mortgage payments. |

| State-Specific Laws | Each state has its own laws governing Deeds in Lieu of Foreclosure. For example, in California, it is governed by California Civil Code § 2943. |

| Impact on Credit | While a Deed in Lieu of Foreclosure is less damaging than a foreclosure, it can still negatively affect credit scores. |

| Tax Implications | Homeowners may face tax consequences if the lender forgives any portion of the mortgage debt. Consulting a tax professional is advisable. |