Fill Your DD 2656 Form

Different PDF Templates

Building Project Proposal - Provides a reference point for project performance assessments.

Applying for Asylum in the Us - Asylum is often a pathway to permanent residency for successful applicants.

For those looking to complete their transaction, the California Motor Vehicle Bill of Sale can be easily accessed online, and you can find the necessary template at https://pdftemplates.info/ to ensure a smooth and legal vehicle sale.

Youth Basketball Evaluation Form - Examine the player’s ability to handle the ball with both hands under pressure.

Similar forms

The DD Form 214 is a critical document for military personnel. It serves as a certificate of release or discharge from active duty. Similar to the DD 2656, which deals with retirement benefits, the DD 214 provides essential information about a service member's time in the military, including their discharge status and any awards received. This form is often required when veterans apply for benefits, making it a vital component of their post-service life.

When dealing with transactions, having a proper document is essential, such as a Bill of Sale form that officially records the sale of an item from a seller to a buyer. This document serves as proof of purchase and outlines the agreement details, protecting the rights of both parties. In New York, understanding the importance of this form helps in preventing disputes and verifying ownership changes. To simplify the process of obtaining this vital document, individuals can get the form easily online.

The SF 50, or Notification of Personnel Action, is another important document. This form is used to record significant employment actions, such as promotions, transfers, or separations in federal employment. Like the DD 2656, the SF 50 is essential for establishing eligibility for certain benefits. Both documents require accurate personal information and employment history, ensuring that individuals receive the benefits they have earned.

The VA Form 21-526EZ is specifically designed for veterans applying for disability compensation and related benefits. This form is similar to the DD 2656 in that it requires detailed personal information and documentation of service. Both forms aim to ensure that veterans receive the benefits they are entitled to, though the VA Form 21-526EZ focuses more on disability claims rather than retirement benefits.

The Form W-4 is a tax document used by employees to determine the amount of federal income tax withholding from their paychecks. While it may seem unrelated at first, both the W-4 and DD 2656 require individuals to provide personal information and financial details. The information gathered in both forms helps ensure that individuals are correctly accounted for in financial matters, whether it be for retirement benefits or tax withholdings.

The Form I-9, Employment Eligibility Verification, is another document that shares similarities with the DD 2656. This form verifies an employee's identity and authorization to work in the United States. Like the DD 2656, the I-9 requires personal details and supporting documentation. Both forms are essential for ensuring compliance with federal regulations, although they serve different purposes in the context of employment and benefits.

Lastly, the Form 1099 is used to report various types of income other than wages, salaries, and tips. This document is similar to the DD 2656 in that it involves financial information and reporting for tax purposes. Both forms require accurate data to ensure that individuals receive the benefits or income they are entitled to, helping to maintain transparency and compliance with tax laws.

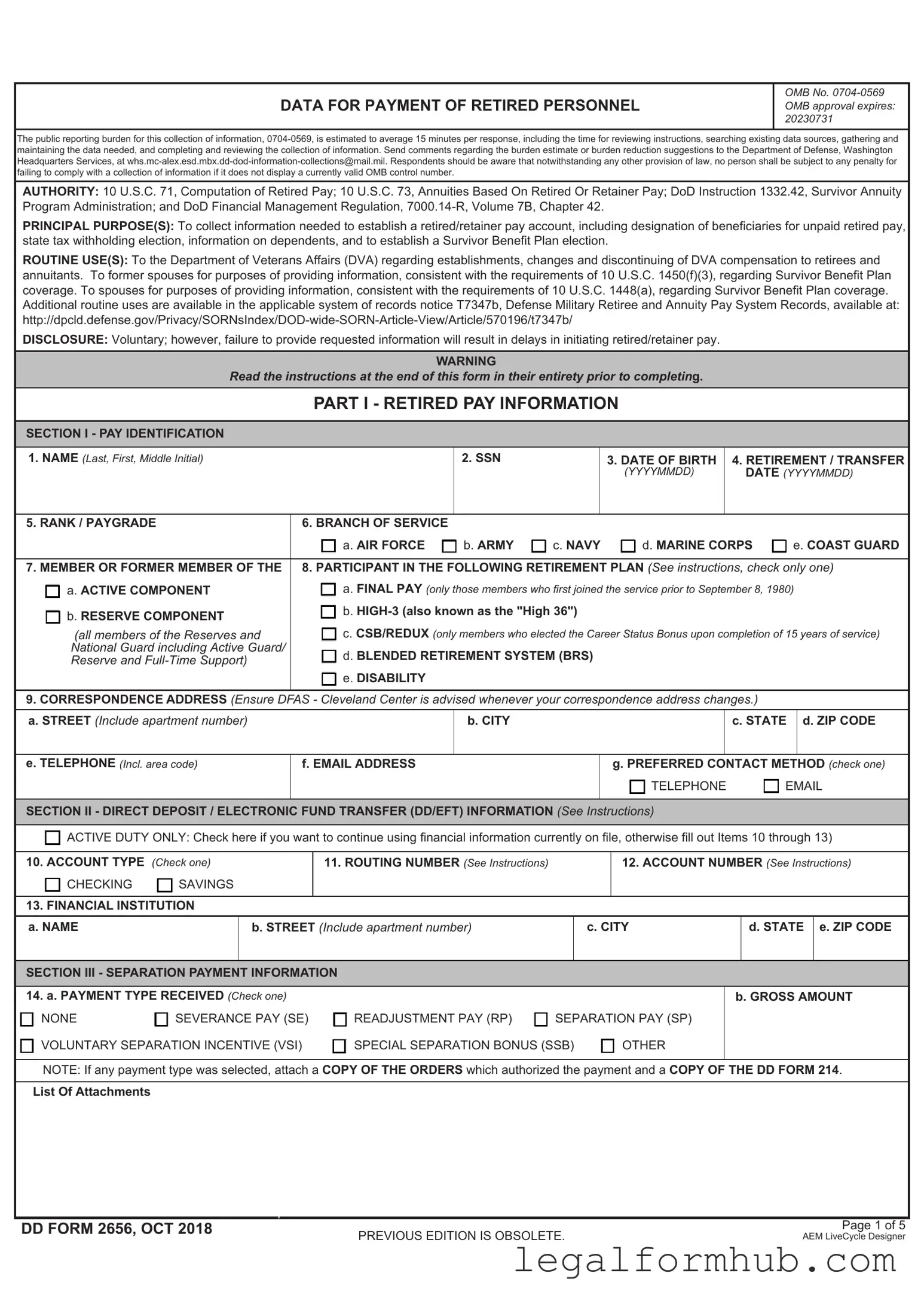

Instructions on Writing DD 2656

Filling out the DD 2656 form is a straightforward process that requires careful attention to detail. This form is essential for providing necessary information related to your benefits. Follow these steps to complete the form accurately.

- Begin by obtaining a copy of the DD 2656 form. You can find it online or request a hard copy from your local military office.

- Read the instructions carefully. Understanding the requirements will help you fill out the form correctly.

- Start with Section I. Enter your personal information, including your full name, Social Security number, and date of birth.

- Proceed to Section II. Provide your address, including city, state, and zip code.

- In Section III, indicate your marital status. If applicable, include your spouse's information.

- Move to Section IV. Fill in details about your children, if any. Include their names and dates of birth.

- Section V requires you to provide information about your service. Include your branch of service and the dates of service.

- Next, review Section VI. This section asks for your designated beneficiaries. List their names and relationships to you.

- Finally, sign and date the form at the bottom. Ensure your signature is clear and matches the name provided at the top.

After completing the form, double-check all entries for accuracy. Once verified, submit it according to the instructions provided, either online or by mailing it to the appropriate office.

Misconceptions

The DD 2656 form, also known as the Data for Payment of Retired Personnel, is often misunderstood. Here are seven common misconceptions about this form:

- It is only for military retirees. Many believe that the DD 2656 form is exclusively for those who have retired from military service. However, it can also apply to certain eligible family members and survivors.

- Filling out the form is optional. Some think that completing the DD 2656 is not mandatory. In reality, it is a crucial document that ensures proper payment and benefits for retirees.

- The form only needs to be submitted once. A misconception exists that the DD 2656 is a one-time submission. In fact, updates may be necessary if there are changes in personal information or payment preferences.

- All sections of the form are required. Some individuals assume that every section must be filled out. While it is important to provide accurate information, not all sections are mandatory for every applicant.

- It can be submitted online. Many believe that the DD 2656 can be completed and submitted online. Currently, the form must be printed, signed, and mailed or delivered to the appropriate office.

- There is no deadline for submission. Some think they can submit the form at any time. However, there are specific deadlines that must be adhered to in order to avoid delays in benefits.

- Assistance is not available for filling out the form. It is a common belief that individuals must complete the form on their own. In reality, there are resources and personnel available to provide guidance and assistance.

Understanding these misconceptions can help ensure that the DD 2656 form is completed accurately and submitted in a timely manner.

Key takeaways

When filling out and using the DD 2656 form, there are several important points to consider. This form is crucial for service members and their families regarding benefits and entitlements. Here are key takeaways to keep in mind:

- Purpose of the Form: The DD 2656 form is used to apply for retired pay and benefits. It ensures that the correct information is provided to facilitate the processing of retirement benefits.

- Accurate Information: Ensure all personal information, including Social Security numbers and dates of birth, is accurate. Errors can lead to delays in processing.

- Submission Deadlines: Be aware of any deadlines for submitting the form. Timely submission can impact the start date of retirement benefits.

- Supporting Documents: Gather and attach any necessary supporting documents. This may include marriage certificates, divorce decrees, or birth certificates for dependents.

- Review and Confirmation: After completing the form, review it carefully. Confirm that all sections are filled out correctly before submission to avoid complications.

By following these guidelines, you can help ensure a smoother process when dealing with the DD 2656 form and related retirement benefits.

File Information

| Fact Name | Details |

|---|---|

| Purpose | The DD 2656 form is used to designate beneficiaries for military retirement pay and other benefits. |

| Who Uses It | This form is primarily used by members of the U.S. Armed Forces and their eligible dependents. |

| Filing Requirement | Service members must complete this form to ensure their benefits are distributed according to their wishes. |

| Submission Process | The completed form is submitted to the appropriate military finance office or personnel office. |

| State-Specific Considerations | Some states may have additional requirements for beneficiary designations under state law. |

| Updates | Service members should update the DD 2656 form whenever there are changes in personal circumstances, such as marriage or divorce. |

| Legal Authority | The form is governed by Title 10 of the U.S. Code, which outlines military benefits and entitlements. |

| Importance of Accuracy | Providing accurate information is crucial to avoid delays or issues in benefit distribution. |