Printable Corrective Deed Document

Common Corrective Deed Documents:

Quit Claim Deed Form Iowa - This form serves as a simple method to change a property title when there is a transfer of ownership.

A Georgia Quitclaim Deed form is a legal document used to transfer ownership of real estate from one individual to another without making any guarantees about the title's status. This type of deed is often used among family members or in situations where the seller is not concerned about the title's history. For those looking to obtain a reliable template, you can find one at Legal PDF Documents. If you're ready to fill out this form, click the button below.

Similar forms

The Corrective Deed is similar to a Quitclaim Deed. A Quitclaim Deed transfers whatever interest a person has in a property without making any guarantees about the title. This means that if there are any issues with the title, the grantee (the person receiving the property) has no recourse against the grantor (the person giving the property). Like a Corrective Deed, a Quitclaim Deed is often used to clear up any confusion about property ownership or to transfer property between family members.

Another document similar to the Corrective Deed is the Warranty Deed. A Warranty Deed provides a guarantee from the seller that they hold clear title to the property and have the right to sell it. This means the buyer is protected against any future claims to the property. While both deeds serve to transfer ownership, the Warranty Deed offers more security for the buyer compared to the Corrective Deed, which mainly addresses errors in previous documents.

The Special Warranty Deed is also comparable to the Corrective Deed. This type of deed guarantees that the seller has not caused any issues with the title during their ownership. However, it does not cover any problems that may have existed before the seller acquired the property. The Corrective Deed, on the other hand, focuses on fixing specific errors in existing deeds, making it a useful tool for addressing title discrepancies.

Understanding property transfer documents is crucial for anyone involved in real estate transactions. The Quitclaim Deed, for instance, plays a significant role in clarifying ownership without the complexities of warranties. For those looking to explore deeper into the types of deeds available, resources like https://pdftemplates.info can provide essential templates and guidance, ensuring that the process remains smooth and legally sound.

A Deed of Trust is another document that shares some similarities with the Corrective Deed. While a Corrective Deed is used to amend or clarify ownership issues, a Deed of Trust secures a loan by transferring the property title to a trustee until the loan is repaid. Both documents involve property titles, but their purposes differ significantly. A Deed of Trust is primarily a financial instrument, while a Corrective Deed aims to rectify mistakes in property records.

The Affidavit of Title is also relevant when discussing the Corrective Deed. This document is a sworn statement by the seller confirming their ownership and the status of the title. It helps assure the buyer that there are no outstanding claims against the property. While the Corrective Deed fixes specific errors in property documents, the Affidavit of Title provides a broader assurance about the title's condition at the time of sale.

Lastly, a Title Insurance Policy is similar in purpose to the Corrective Deed, as both aim to protect property owners from title issues. A Title Insurance Policy provides financial protection against losses due to defects in the title, such as undiscovered liens or claims. While the Corrective Deed addresses specific errors in the title, Title Insurance offers a safety net for property owners against future title disputes. Both documents play important roles in ensuring smooth property transactions.

Instructions on Writing Corrective Deed

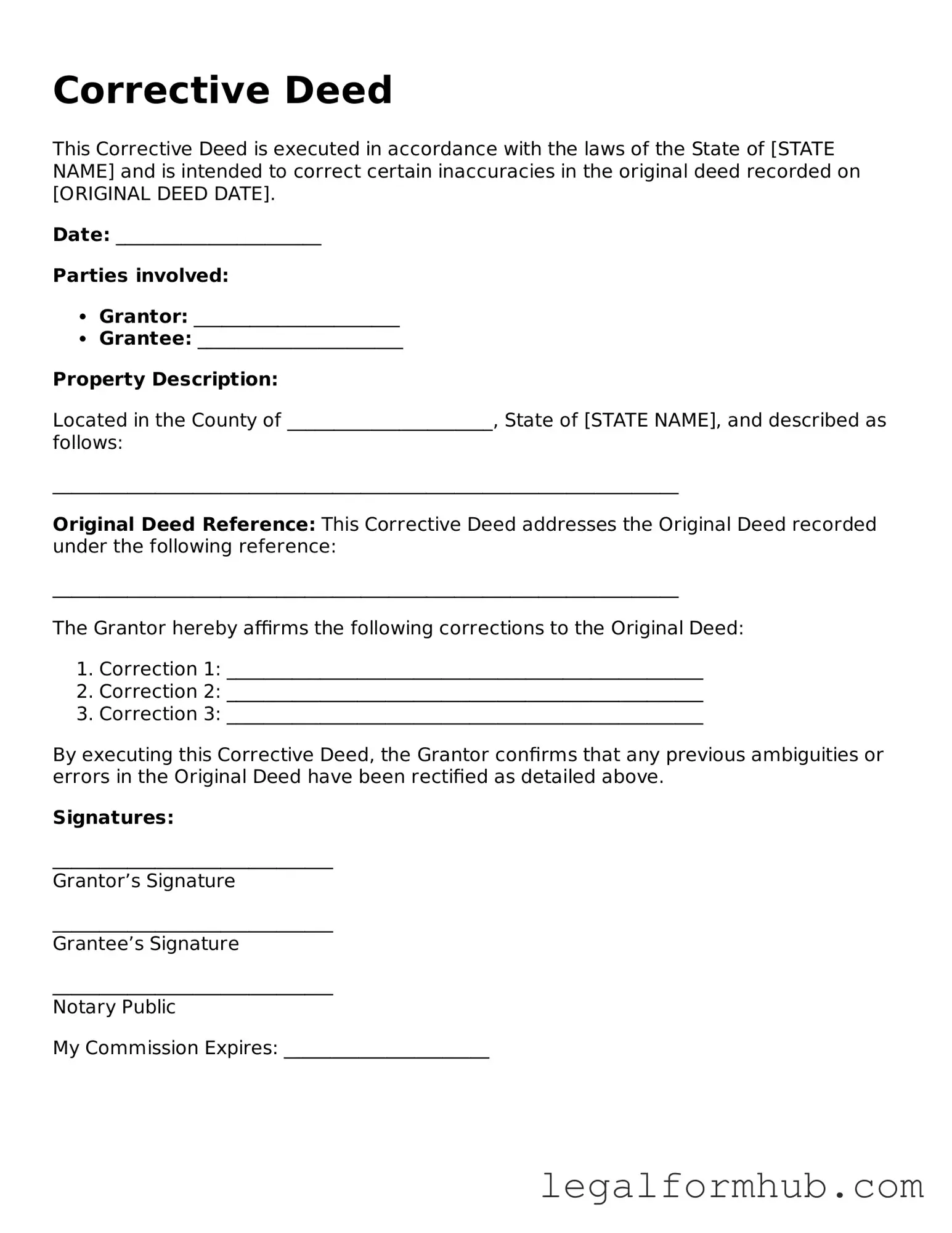

Once you have the Corrective Deed form in hand, it’s important to fill it out accurately to ensure that any necessary corrections are properly documented. This process will involve providing specific information regarding the property and the parties involved. Follow these steps to complete the form correctly.

- Gather Necessary Information: Collect details about the property, including the legal description, parcel number, and the names of all parties involved.

- Fill Out the Form: Start by entering the current owner's name and address in the designated fields.

- Specify the Corrective Changes: Clearly state what corrections need to be made. This could include changes to the property description or the names of the parties.

- Provide Additional Details: If applicable, include any relevant information that supports the need for the corrective deed, such as previous deed references or dates.

- Sign the Document: Ensure that all parties involved sign the form. If there are multiple owners, all must provide their signatures.

- Notarization: Have the document notarized to verify the identities of the signers and ensure the form is legally binding.

- Submit the Form: File the completed form with the appropriate county office or recorder’s office where the property is located.

After completing these steps, keep a copy of the Corrective Deed for your records. This will serve as proof of the corrections made and can be useful for future reference or transactions involving the property.

Misconceptions

When dealing with the Corrective Deed form, several misconceptions can arise. Understanding these misconceptions can help clarify its purpose and proper use.

- Misconception 1: A Corrective Deed is only for fixing typos.

- Misconception 2: A Corrective Deed requires a new title search.

- Misconception 3: Anyone can create a Corrective Deed without legal guidance.

- Misconception 4: A Corrective Deed is the same as a Quitclaim Deed.

- Misconception 5: A Corrective Deed can change the ownership of the property.

- Misconception 6: Filing a Corrective Deed is a lengthy process.

This is not entirely accurate. While it can correct typographical errors, it also addresses more significant issues, such as clarifying property descriptions or correcting names.

In most cases, a new title search is not necessary. The Corrective Deed serves to amend the existing deed, which usually does not affect the title status.

Although some individuals may attempt to draft a Corrective Deed on their own, it is advisable to seek legal assistance to ensure all necessary details are correctly addressed.

These two forms serve different purposes. A Quitclaim Deed transfers ownership rights, while a Corrective Deed modifies an existing deed without changing ownership.

This is incorrect. The purpose of a Corrective Deed is to correct errors in the existing deed, not to alter ownership rights.

The process is generally straightforward. Once completed and signed, it can be filed with the appropriate local office, often requiring minimal time for processing.

Key takeaways

Filling out and using the Corrective Deed form is an important process for ensuring property records accurately reflect ownership and other relevant details. Below are key takeaways regarding this form:

- The Corrective Deed is used to correct errors in a previously recorded deed.

- Common errors include misspellings of names, incorrect legal descriptions, or omitted information.

- All parties involved in the original deed must typically sign the Corrective Deed.

- The Corrective Deed must be notarized to ensure its validity.

- It is important to clearly state the specific error being corrected.

- Include the date of the original deed and the recording information for reference.

- File the Corrective Deed with the appropriate county recorder’s office.

- Keep a copy of the Corrective Deed for personal records after filing.

- Consulting with a real estate attorney can help clarify any complex issues.

- Ensure that the Corrective Deed complies with state-specific requirements to avoid rejection.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | A Corrective Deed is used to correct errors in a previously recorded deed, ensuring that the property records accurately reflect ownership. |

| Governing Law | The use and requirements of a Corrective Deed vary by state. In many states, it is governed by property law, specifically the Uniform Real Property Electronic Recording Act (URPERA). |

| Required Information | Typically, a Corrective Deed must include the original deed's details, the specific errors being corrected, and the correct information. |

| Execution | To be valid, the Corrective Deed must be signed by the parties involved, notarized, and recorded with the appropriate local government office. |