Fill Your Citibank Direct Deposit Form

Different PDF Templates

Dekalb County Water New Service Application - This document allows for the cancellation of an existing water service account.

Warranty on Roof - Annual check-ins and upkeep can enhance your roof's performance and warranty life.

The Employment Verification Form is a document used to confirm an individual's employment history, job title, and salary from previous employers. This form serves as a vital tool for prospective employers, providing them with credible information to help in their hiring decisions. To ensure a smooth hiring process, consider filling out the verification form by clicking the button below or by visiting Fill PDF Forms.

Editable Dnd Character Sheet - Equipment and items the character carries, essential for their journey.

Similar forms

The W-4 form is similar to the Citibank Direct Deposit form in that both documents require personal information from the individual. The W-4 form is used for tax withholding purposes, allowing employees to specify how much federal income tax should be withheld from their paychecks. Just like the Direct Deposit form, the W-4 requires details such as the individual's name, address, and Social Security number. Both forms aim to ensure that payments are processed accurately and efficiently, reflecting the individual's financial preferences.

For a smooth transaction, consider utilizing our comprehensive guide to the Mobile Home Bill of Sale form. This document plays a crucial role in officially transferring ownership and ensures that all necessary details are accurately documented, giving both parties peace of mind during the sale.

The Payroll Authorization form also shares similarities with the Citibank Direct Deposit form. This document allows employees to authorize their employer to deposit their wages directly into their bank account. Like the Direct Deposit form, it requires bank account information, including the account number and routing number. Both forms serve to streamline payment processes and ensure timely access to funds, minimizing the need for paper checks.

The 1099 form is another document that relates to direct deposits, particularly for independent contractors and freelancers. It reports income paid to individuals who are not classified as employees. While the 1099 does not directly facilitate payment like the Direct Deposit form, it is essential for tracking income that may be deposited directly into a bank account. Both documents involve financial transactions and require accurate reporting of personal and banking information.

The ACH Authorization form is closely aligned with the Citibank Direct Deposit form as it allows individuals to authorize automatic payments or deposits through the Automated Clearing House (ACH) network. This form requires similar information, such as banking details and personal identification. Both documents aim to facilitate electronic transfers, making it easier for individuals to manage their finances without relying on physical checks.

Lastly, the Bank Account Verification form is akin to the Citibank Direct Deposit form because it confirms the accuracy of an individual's banking information. This form is often required by employers or financial institutions to ensure that the account details provided for direct deposits are correct. Like the Direct Deposit form, it collects essential information, including the account holder's name and account number, to prevent errors in payment processing.

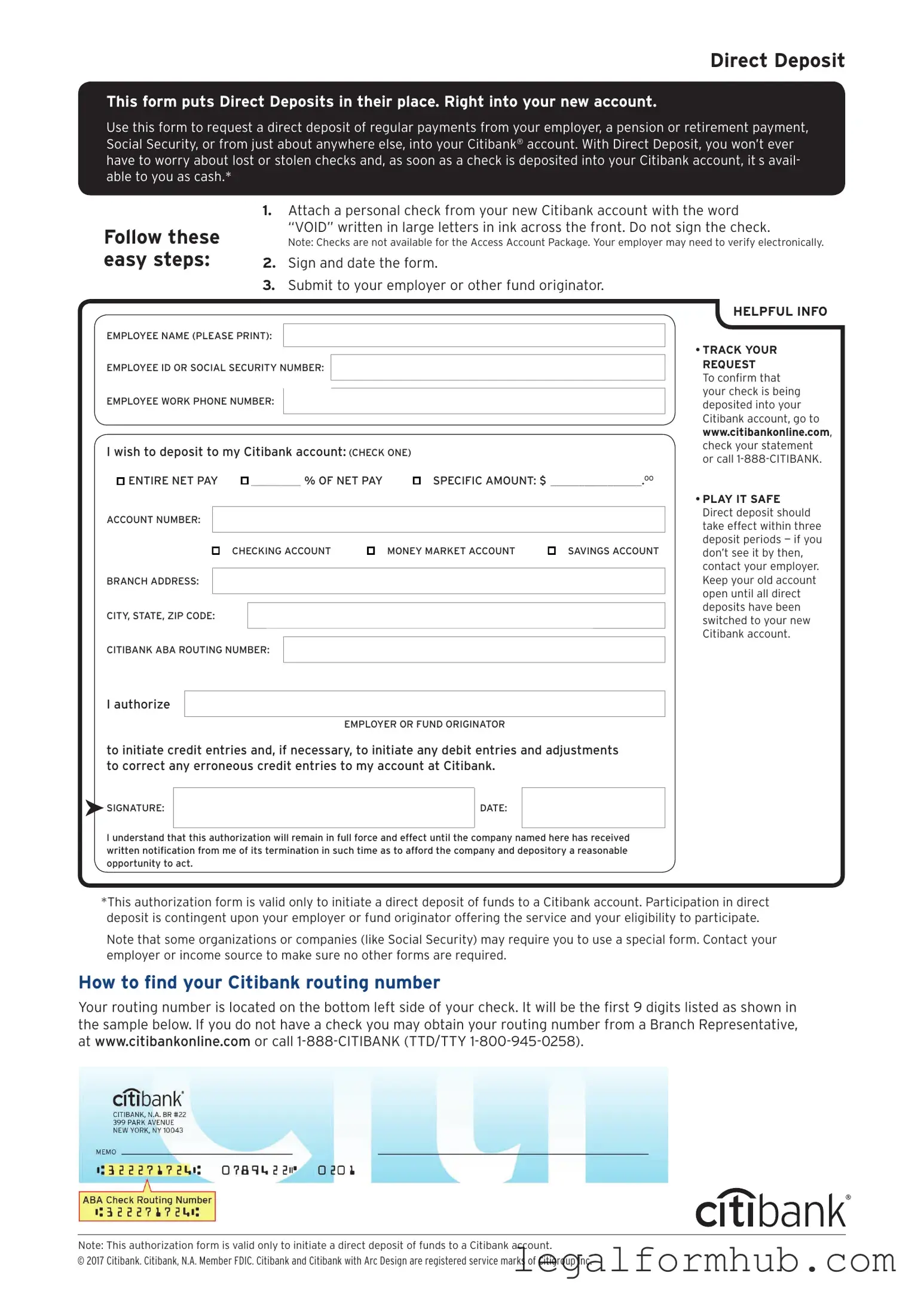

Instructions on Writing Citibank Direct Deposit

Filling out the Citibank Direct Deposit form is a straightforward process that ensures your paycheck or other payments are deposited directly into your bank account. Once you have completed the form, it will be submitted to your employer or the relevant organization for processing.

- Begin by downloading the Citibank Direct Deposit form from the official Citibank website or obtain a hard copy from your employer.

- Fill in your personal information at the top of the form. This typically includes your full name, address, and Social Security number.

- Provide your bank account details. Enter your Citibank account number and the routing number for Citibank. These numbers can be found on your checks or through your online banking account.

- Indicate the type of account you are using. Check the box for either "Checking" or "Savings" to specify your account type.

- Decide if you want to deposit your entire paycheck or a specific amount. If you choose a specific amount, write that figure in the designated space.

- Sign and date the form at the bottom. Your signature authorizes the direct deposit and confirms that the information provided is accurate.

- Submit the completed form to your employer or the organization that will be processing your direct deposit.

Misconceptions

Understanding the Citibank Direct Deposit form is essential for anyone looking to streamline their payment processes. However, several misconceptions can lead to confusion. Here are seven common misunderstandings:

-

Direct deposit is only for payroll.

This is not true. While many people associate direct deposit primarily with their salaries, it can also be used for other types of payments, such as government benefits, tax refunds, and even some types of vendor payments.

-

Setting up direct deposit is complicated.

Many believe that the process is overly complex, but in reality, it is often straightforward. Most employers or payment providers will provide a simple form to fill out, requiring basic information like your bank account number and routing number.

-

Direct deposit is not secure.

Some individuals worry about the security of direct deposit. However, direct deposit is generally considered safer than receiving physical checks, which can be lost or stolen. Banks use encryption and other security measures to protect your information.

-

You can only have one direct deposit account.

This misconception is incorrect. Many institutions allow you to split your direct deposit among multiple accounts. This means you can allocate a portion of your paycheck to savings and another to checking, for example.

-

Direct deposit is immediate.

While direct deposits are usually processed quickly, they are not always instantaneous. Depending on the bank and the timing of the transaction, it may take one or two business days for the funds to appear in your account.

-

Direct deposit forms are the same for all banks.

This is a common misconception. Each bank may have its own specific form and requirements for setting up direct deposit. It is important to use the correct form provided by your bank to ensure a smooth setup.

-

Once set up, direct deposit cannot be changed.

This is not accurate. You can change your direct deposit information whenever necessary. If you switch banks or want to alter the amount deposited into different accounts, simply fill out a new form and submit it to your employer or payment provider.

By clarifying these misconceptions, individuals can feel more confident in using the Citibank Direct Deposit form and enjoy the benefits of this convenient payment method.

Key takeaways

When filling out and using the Citibank Direct Deposit form, it's important to keep a few key points in mind. Here are some essential takeaways:

- Provide Accurate Information: Ensure that all personal details, including your name, address, and account number, are correct. Mistakes can lead to delays or issues with your deposits.

- Choose the Right Account: Specify whether you want your deposit to go into a checking or savings account. This choice impacts how you manage your funds.

- Attach Necessary Documentation: Include any required documents, such as a voided check or bank statement, to verify your account details.

- Check for Employer Requirements: Some employers may have specific guidelines for submitting the form. Make sure to follow their instructions closely.

- Monitor Your Deposits: After submitting the form, keep an eye on your bank account. Confirm that your direct deposits are arriving as expected.

By following these tips, you can ensure a smooth experience with your Citibank Direct Deposit form.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Citibank Direct Deposit form is used to authorize the automatic deposit of funds into a Citibank account. |

| Eligibility | Individuals must have a Citibank account to utilize the direct deposit feature. |

| Information Required | The form typically requires personal information, such as the account holder's name, account number, and routing number. |

| Governing Laws | Direct deposit practices are governed by the Electronic Funds Transfer Act and applicable state laws regarding electronic payments. |